Enlarge image

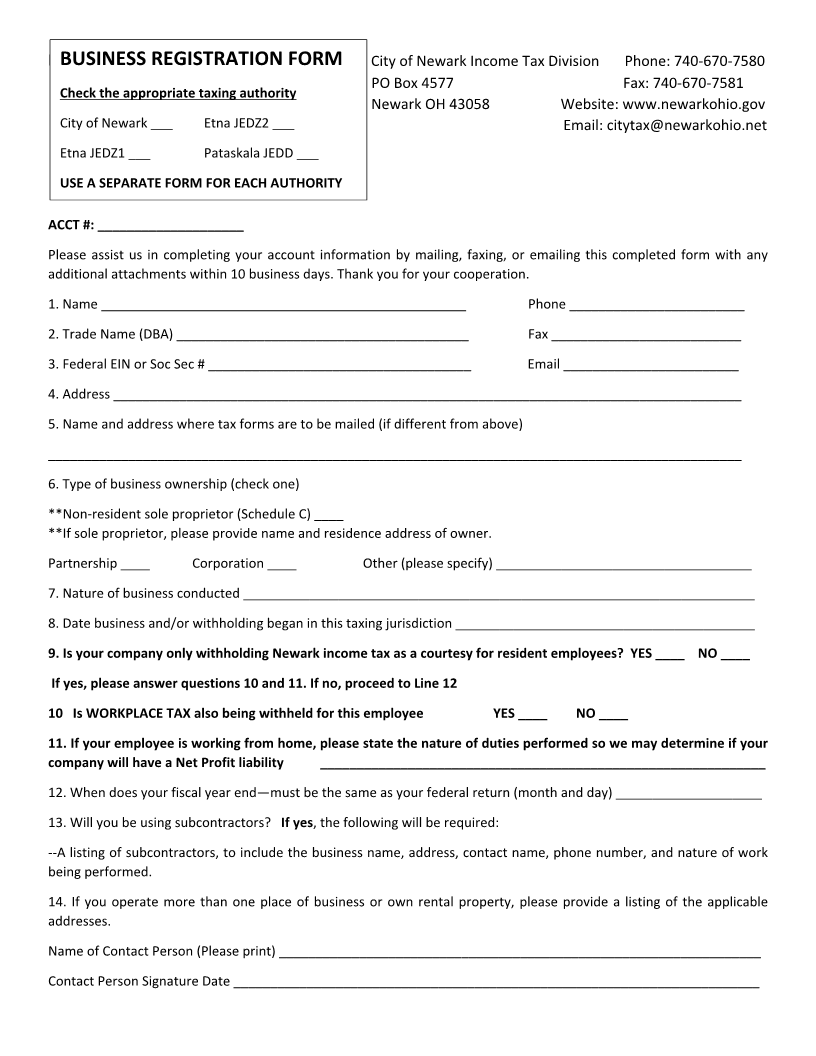

Business Registration FormBUSINESS REGISTRATION FORM City of Newark Income Tax Division Phone: 740‐670‐7580

PO Box 4577 Fax: 740‐670‐7581

Check the appropriate taxing authority

Newark OH 43058 Website: www.newarkohio.gov

City of Newark ___ Etna JEDZ2 ___ Email: citytax@newarkohio.net

Etna JEDZ1 ___ Pataskala JEDD ___

USE A SEPARATE FORM FOR EACH AUTHORITY

ACCT #: ____________________

Please assist us in completing your account information by mailing, faxing, or emailing this completed form with any

additional attachments within 10 business days. Thank you for your cooperation.

1. Name Phone ________________________

2. Trade Name (DBA) ________________________________________ Fax __________________________

3. Federal EIN or Soc Sec # ____________________________________ Email ________________________

4. Address ______________________________________________________________________________________

5. Name and address where tax forms are to be mailed (if different from above)

_______________________________________________________________________________________________

6. Type of business ownership (check one)

**Non‐resident sole proprietor (Schedule C) ____

**If sole proprietor, please provide name and residence address of owner.

Partnership ____ Corporation ____ Other (please specify) ___________________________________

7. Nature of business conducted ______________________________________________________________________

8. Date business and/or withholding began in this taxing jurisdiction _________________________________________

9. Is your company only withholding Newark income tax as a courtesy for resident employees? YES ____ NO ____

If yes, please answer questions 10 and 11. If no, proceed to Line 12

10 Is WORKPLACE TAX also being withheld for this employee YES ____ NO ____

11. If your employee is working from home, please state the nature of duties performed so we may determine if your

company will have a Net Profit liability _____________________________________________________________

12. When does your fiscal year end—must be the same as your federal return (month and day) ____________________

13. Will you be using subcontractors? If yes, the following will be required:

‐‐A listing of subcontractors, to include the business name, address, contact name, phone number, and nature of work

being performed.

14. If you operate more than one place of business or own rental property, please provide a listing of the applicable

addresses.

Name of Contact Person (Please print) __________________________________________________________________

Contact Person Signature Date ________________________________________________________________________