Enlarge image

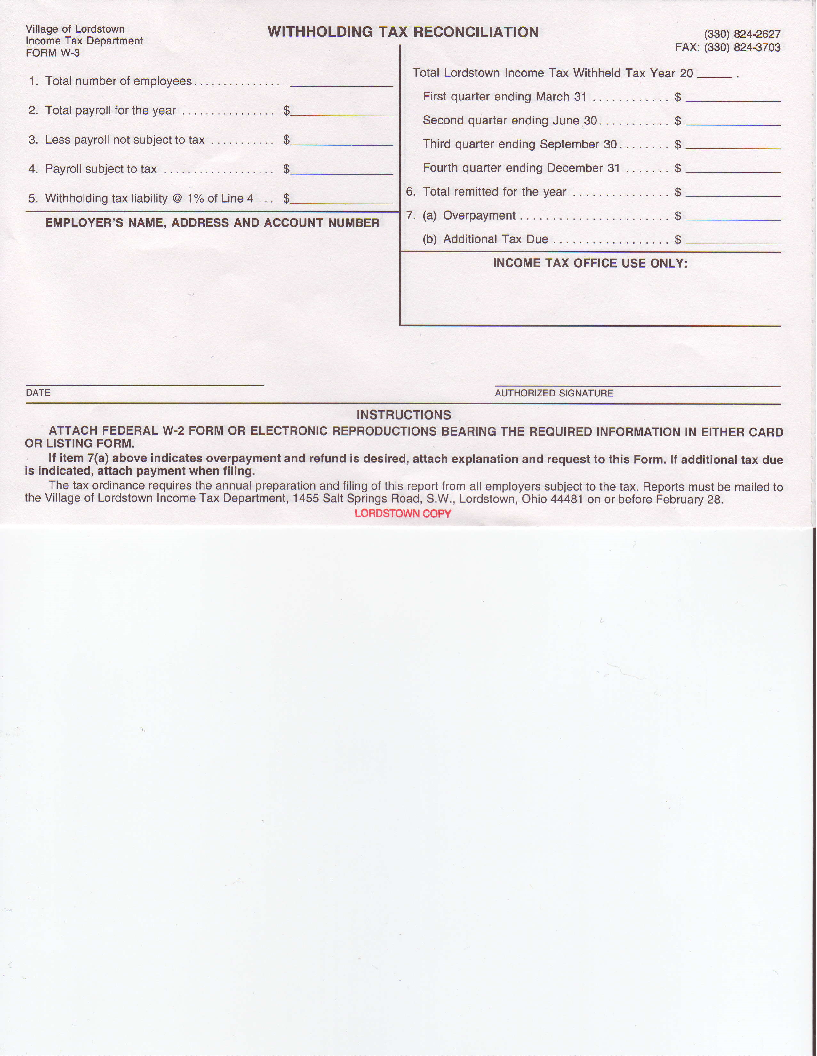

Village of Lordstown WITHHOLDING TAX RECONCILIATION (330) 824-2627 lncome Tax DeDartment FAX: (330) 824-3709 FORM W.3 Total Lordstown Income Tax Withheld Tax Year 20 _. 1. Total number of employees. Firstquarter ending March 31 ...... $ 2. Totalpayrollfortheyear.. ....... $ Second quarter ending June 30 . . .. . $ 3. Less payroll not subject to tax . .. .. .. .. . . $ Third quarter ending September 30. . . . 4. Payrollsubjecttotax. .... $ Fourth quarter ending December 31 . . .. $ Total remitted for the year . . 5.Withho|dingtax|iabi|ity@1"/"o|Line4'..$- (a) Overpayment... ........ $ EMPLOYER'S NAME, ADDRESS AND ACCOUNT NUMBER (b) AdditionalTaxDue ...... $ INCOME TAX OFFICE USE ONLY: DATE AUTHORIZED SIGNATURE INSTRUCTIONS ATTACH FEDERAL W.2 FORM OR ELECTRONIC REPRODUCTIONS BEARING THE REQUIRED INFORMATION IN EITHER CARD OR LISTING FORM. lf item 7(a) above indicates overpayment and refund is desired, attach explanation and request to this Form. lf additional tax due is indicated, attach payment when filing. The tax ordinance requires the annual preparation and filing of this report from all employers subject to the tax. Reports must be mailed to the Village of Lordstown Income Tax Department, 1455 Salt Springs Road, S.W., Lordstown, Ohio 44481 on or before February 28. LORDSTOWN COPY