Enlarge image

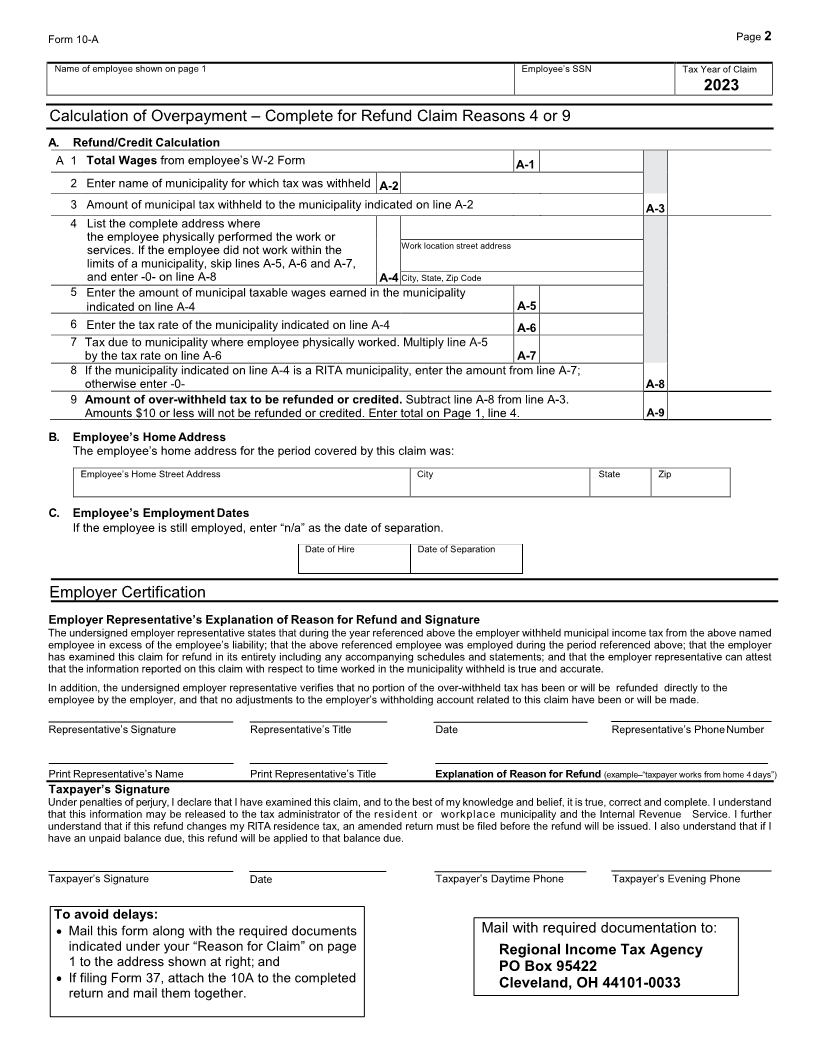

Regional Income Tax Agency

Application for Municipal Income Tax Refund

Form PO Box 95422

10A Cleveland, OH 44101-0033

Your social security number Tax year of claim To avoid delays in your refund request, please review the

2023 instruction page for guidelines and claim specifics.

Your first name and middle initial Last name If filing a Form 37 and 10A, attach 10A to your completed

return and mail them together to the Form 10A address.

Current home address (number and street) Apt # Frequently asked questions regarding Refunds can be

found on ritaohio.com under FAQs/Individual FAQ/Refunds.

City, state, and ZIP code

Contact phone number: ___________________________________

Reason for Claim

Check the Box below that applies.

• A separate 10 Ais required if you have multiple W-2 forms, or for each municipality from which a refund is requested.

• No refunds will be issued without the proper documentation indicated by reason for claim.

(MM/DD/YYYY)

1. Age Exemption. Date of Birth________________ Attach a copy of your W-2 form and proof of birthdate (birth certificate, driver’s

license, etc.). If you were under age for only part of the year, you must either: (1) have your employer sign the completed Employer

Certification on page 2; or (2) attach a copy of your pay stub for the pay period in which your birthday fell. Exceptions to the

under 18 years of age exemption exist. For age exemption qualifications, visit ritaohio.com, select the RITA municipality in which

you worked and review the Special Notes section that relates to the appropriate tax year.

2. Days Worked From Home. Days worked outside of municipality for which the employer withheld tax, and instead you

worked from home (remote). Attach a copy of your W-2 Form, a completed Log of Days Out Worksheet on page 3, and a

completed Calculation ofDays Worked Out of RITA on page 3. Your employer must sign the Employer Certification on page 2.

3. Other Days Worked Outside of municipality for which the employer withheld tax (other than days worked at home). Attach a

copy of your W-2 Form, a completed Log of Days Out Worksheet on page 3, and a completed Calculation ofDays Worked Out of

RITA on page 3. In addition, your employer must sign the Employer Certification on page 2.

4. Employer withheld at a rate higher than the employment municipality’s tax rate. Attach a copy of your W-2 Form and a

completed Calculation of Overpayment on page 2. Your employer must sign the Employer Certification on page 2. Do Not Use fo9.

5. Employer withheld too much (over-withheld) residence municipality tax. Attach a copy of your W-2 Form. Your employer

must sign the Employer Certification on page 2.

6. Withheld by mistake for the municipality of ________________________ when I actually worked in the municipality of

________________________. Attach a copy of your W-2 Form. Your employer must sign the Employer Certification on page 2.

Indicate the address where you actually worked in the box below.

Work Location Street Address City State Zip

7. Over-the-road truck driver. The wages of an interstate truck driver regularly assigned to drive in more than one state are

only taxable by the driver’s municipality of residence. Intrastate truck drivers may be eligible to receive up to a 90% refund

from their principal place of work. (A logging of your work locations, to support a refund of the tax withheld from your principal place

of work is required). Attach a copy of your W-2. In addition, your employer must sign the Employer Certification (pg. 2).

8. Military Spouse Residency Relief Act. Attach copies of W-2 Form, Form DD 2058, valid military spouse ID card and

service member’s most recent LES. Only the completion of the Claim Summary below is required.

9. Other (Indicate Reason). Attach W-2 Form and other applicable documentation, and a completed Calculation of Overpayment

on page 2. Your employer must sign the Employer Certification on page 2.

________________________________________________________________________________________________________

10. Refund of overpayment on account if you have already filed Form 37 or you are not required to file. Employer certification is not

required. This reason should not be selected if requesting a refund for taxes withheld by your employer. Use

applicable reasons 1-9 for requests for taxes withheld by your employer.

Claim Summary – Submit one claim per form. Please complete a separate 10A if multiple employers/municipalities exist.

1 Employer Federal ID # Employer Name

1

2 RITA Municipality for which tax was withheld (from W-2, Box 20). RITA

cannot refund tax withheld to a Non-RITA municipality 2

3 Amount of income not taxable. Enter -0- for reasons 4 and 5. For all other reasons enter the

amount of wages you are claiming are nottaxable 3

4 Amount of over withholding claimed (Box A-9 on page 2 or Line 10 on page 3) 4

5 Amount of over withholding you want applied as a payment to your individual or joint account

instead of being refunded to you. Enter -0- if you want all of your refund sent to you 5

Provide the social security number of the account to which you want the SSN of account to be credited

amount on line 5 to be credited

6 Net amount to be refunded. Subtract line 5 from line 4. Amounts $10 or less will not be refunded. 6