Enlarge image

Click on the fields below and type in your

information. Then print the form and mail

it to our office.

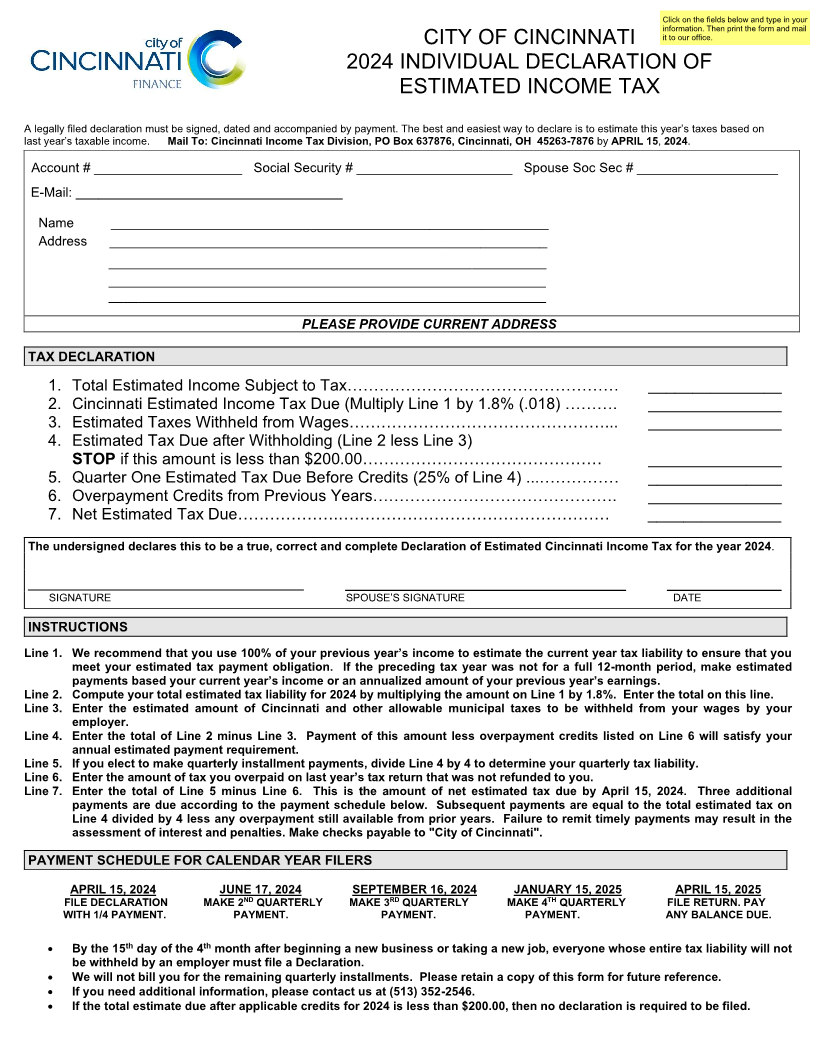

CITY OF CINCINNATI

2024 INDIVIDUAL DECLARATION OF

ESTIMATED INCOME TAX

A legally filed declaration must be signed, dated and accompanied by payment. The best and easiest way to declare is to estimate this year’s taxes based on

last year’s taxable income. Mail To: Cincinnati Income Tax Division, PO Box 637876, Cincinnati, OH 45263-7876by APRIL 15 ,2024 .

Account # ____________________ Social Security # _____________________ Spouse Soc Sec # ___________________

E-Mail: ____________________________________ Email____________________________________________

Name ___________________________________________________________

Address ___________________________________________________________

___________________________________________________________

___________________________________________________________

___________________________________________________________

PLEASE PROVIDE CURRENT ADDRESS

TAX DECLARATION

1. Total Estimated Income Subject to Tax…………………………………………… _______________

2. Cincinnati Estimated Income Tax Due (Multiply Line 1 by 1.8% (.018) ………. _______________

3. Estimated Taxes Withheld from Wages…………………………………………... _______________

4. Estimated Tax Due after Withholding (Line 2 less Line 3)

STOP if this amount is less than $200.00……………………………………… _______________

5. Quarter One Estimated Tax Due Before Credits (25% of Line 4) ...…………… _______________

6. Overpayment Credits from Previous Years………………………………………. _______________

7. Net Estimated Tax Due ……………….…………………………………………… _______________

The undersigned declares this to be a true, correct and complete Declaration of Estimated Cincinnati Income Tax for the year 2024.

_______________________________ ___________________________ ___________

SIGNATURE SPOUSE’S SIGNATURE DATE

INSTRUCTIONS

Line 1. We recommend that you use 100% of your previous year’s income to estimate the current year tax liability to ensure that you

meet your estimated tax payment obligation. If the preceding tax year was not for a full 12-month period, make estimated

payments based your current year’s income or an annualized amount of your previous year’s earnings.

Line 2. Compute your total estimated tax liability for 2024 by multiplying the amount on Line 1 by 1.8%. Enter the total on this line.

Line 3. Enter the estimated amount of Cincinnati and other allowable municipal taxes to be withheld from your wages by your

employer.

Line 4. Enter the total of Line 2 minus Line 3. Payment of this amount less overpayment credits listed on Line 6 will satisfy your

annual estimated payment requirement.

Line 5. If you elect to make quarterly installment payments, divide Line 4 by 4 to determine your quarterly tax liability.

Line 6. Enter the amount of tax you overpaid on last year’s tax return that was not refunded to you.

Line 7. Enter the total of Line 5 minus Line 6. This is the amount of net estimated tax due by April 15, 2024. Three additional

payments are due according to the payment schedule below. Subsequent payments are equal to the total estimated tax on

Line 4 divided by 4 less any overpayment still available from prior years. Failure to remit timely payments may result in the

assessment of interest and penalties. Make checks payable to "City of Cincinnati".

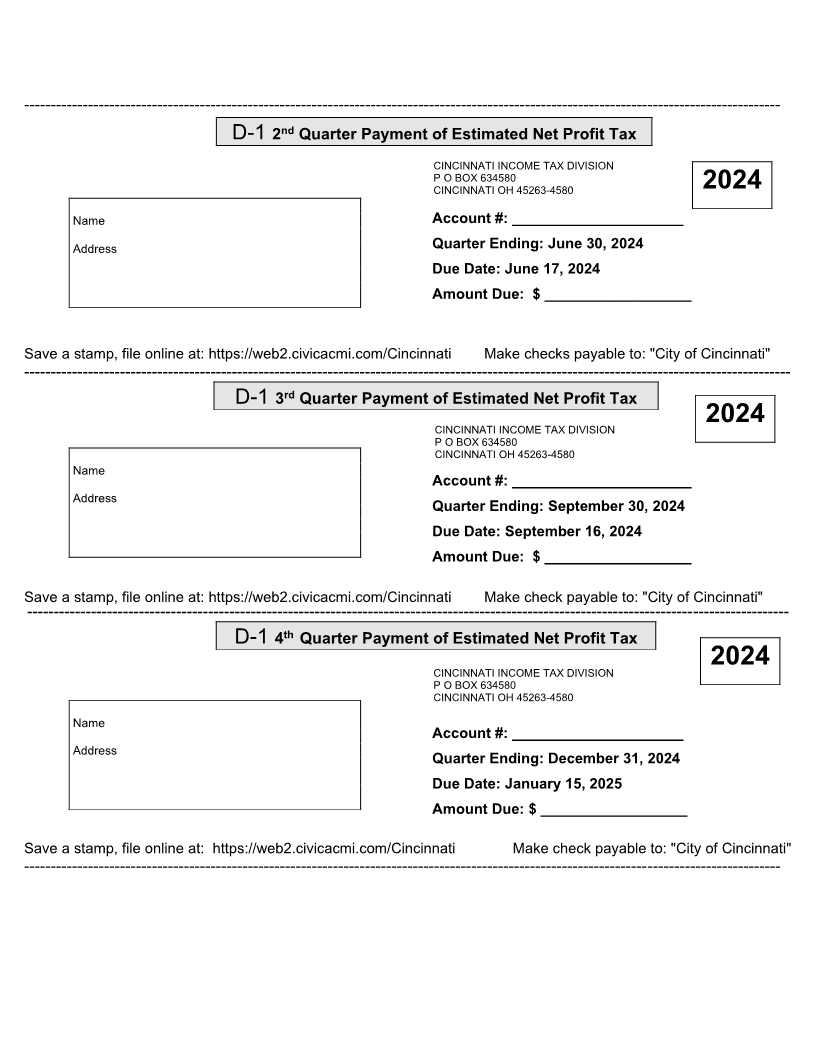

PAYMENT SCHEDULE FOR CALENDAR YEAR FILERS

APRIL 15, 2024 JUNE 17, 2024 SEPTEMBER 16, 2024 JANUARY 15, 2025 APRIL 15, 2025

FILE DECLARATION MAKE 2 QUARTERLY ND MAKE 3 QUARTERLY MAKE 4 QUARTERLY RD FILE RETURN. PAYTH

WITH 1/4 PAYMENT. PAYMENT. PAYMENT. PAYMENT. ANY BALANCE DUE.

• By the 15 dayth of the 4 monthth after beginning a new business or taking a new job, everyone whose entire tax liability will not

be withheld by an employer must file a Declaration.

• We will not bill you for the remaining quarterly installments. Please retain a copy of this form for future reference.

• If you need additional information, please contact us at (513) 352-2546.

• If the total estimate due after applicable credits for 2024 is less than $200.00, then no declaration is required to be filed.