Enlarge image

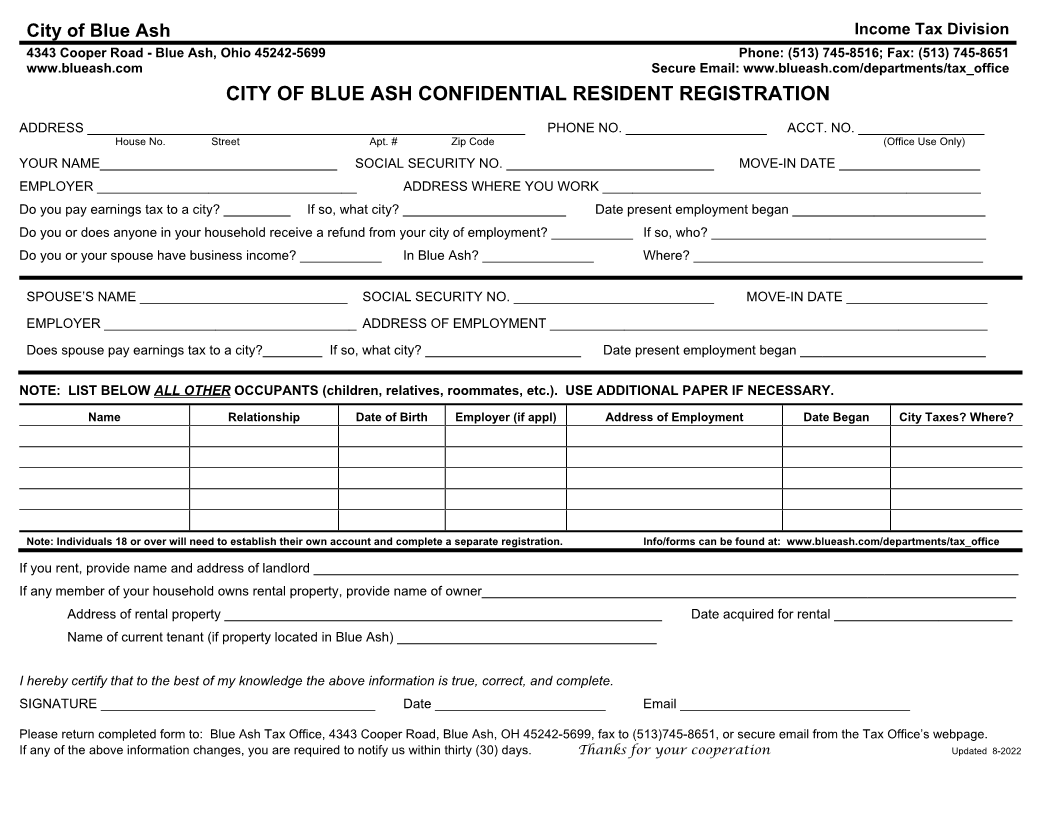

Dear Blue Ash Resident: Welcome, and thank you for choosing the City of Blue Ash as your new home. Blue Ash provides many outstanding services and amenities to its residents and businesses including the Blue Ash Recreation Center, Summit Park, Police and Fire protection, brush and leaf collection, snow/ice removal, and much more. A large percentage of the funding for these top-notch services come from the City’s income tax. This tax is levied on those who reside and work in the City. Below, you’ll find some useful information about the City’s income tax as it relates to our residents: The tax rate in the City of Blue Ash is 1.25% (as a comparison, Cincinnati’s rate is 1.8%). If you pay city income tax to another city, likely deducted on your paycheck, Blue Ash offers 100% credit towards the Blue Ash income tax up to the 1.25% tax rate. Filing is mandatory for all individuals over the age of 18, even if your employer fully withheld your Blue Ash income taxes. The City of Blue Ash Tax Department will complete your yearly returns for free if you provide your relevant tax information. In order to establish or update your account, we need some basic information. Please complete the attached registration form and be sure to fill in all areas that pertain to you. If you have any questions regarding the form, or any other city income tax questions, please feel free to contact the Blue Ash Tax Department. We are available Monday through Friday, 8:00 AM to 4:30 PM. Additionally, information and forms can be found at www.blueash.com/departments/tax_office. Please return the completed registration within thirty (30) days. A return envelope has been included for your convenience. We also have Secure Mail as an option to quickly and securely send the registration form back to us, look for the red button on the Tax Office’s website. Please note that your information will remain confidential as required by Ohio law. Thank you in advance for your cooperation. Sincerely, Blue Ash Income Tax Division