Enlarge image

1

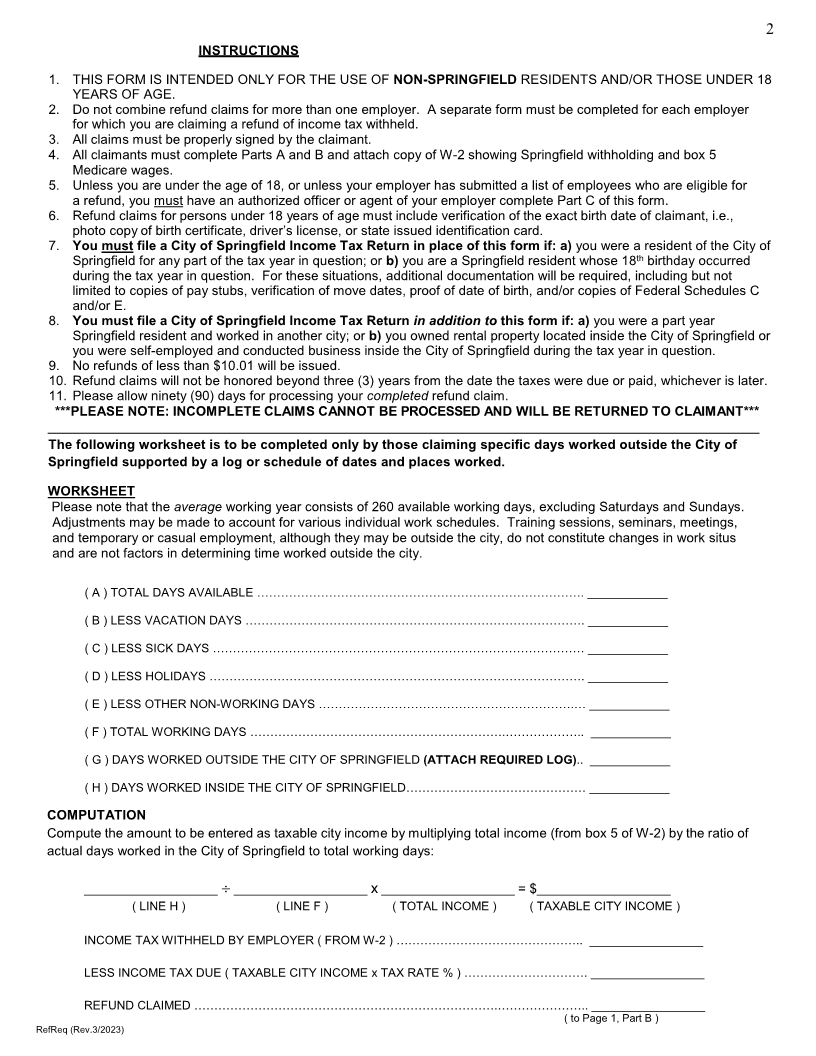

www.springfieldohio.gov INCOME TAX REFUND REQUEST

CITY OF SPRINGFIELD, INCOME TAX DIVISION

76 EAST HIGH STREET Account #_______________

SPRINGFIELD, OHIO 45502 (FOR OFFICE USE ONLY)

PHONE (937) 324-7357

TaxFilingHelp@springfieldohio.gov

PLEASE REVIEW INSTRUCTIONS ON PAGE 2 BEFORE COMPLETING FORM

PART A

Name Social Security # __________________

( print first name, middle initial, last name )

Present Address Phone # ________________________

( street, apt # )

Email __________________________

( city, state and zip code )

SPRINGFIELD INCOME TAX RATE: 2.40% JEDD INCOME TAX RATE: 1.00%

REFUND CLAIMS OLDER THAN THREE (3) YEARS AFTER THE TAX WAS DUE OR PAID WILL NOT BE PROCESSED.

TAX YEAR __________ REFUND AMOUNT CLAIMED $____________

PART B

Employer Name Location Worked Taxable Tax Due Less Amount = Refund

Income Withheld Amount

________________ _______________ _________ _________ _________ ___________

Please provide a clear and concise explanation of reason for refund:

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EMPLOYEE AFFIDAVIT: The undersigned states that all facts and figures given on this form are true and complete to the best of

his/her knowledge and belief; that no such refund has previously been claimed or received by him/her; and understands that this

information may be released to the Internal Revenue Service and the municipality of residence.

Employee Signature ____________________________________________ Date ______________________

___________________________________________________________________________________________ _

PART C

EMPLOYER VERIFICATION AND AFFIDAVIT: I hereby certify that __________________(employee name) was

employed by the undersigned during the period for which said employee makes claim for refund and that ______% or

the amount of $_____________ was withheld in excess of his/her liability based on the above stated facts and

calculations; and that no portion of said tax withheld has been or will be refunded directly to the employee, and no

adjustment in withholding remittance has been or will be made. I further declare that the information contained herein

is true and correct to the best of my knowledge and belief and that I am authorized to provide this information.

Authorized Name _____________________________________ Title ______________________________________

(Print first name, middle initial, last name)

Authorized Signature __________________________________ Date _____________________________________

Name of Employer ____________________________________ Phone ____________________________________