Enlarge image

DRAFT

Do not file draft forms. Although we do not expect this draft to change

significantly before we publish the final version, we will not post the final

version until after year-end.

Enlarge image |

DRAFT

Do not file draft forms. Although we do not expect this draft to change

significantly before we publish the final version, we will not post the final

version until after year-end.

|

Enlarge image |

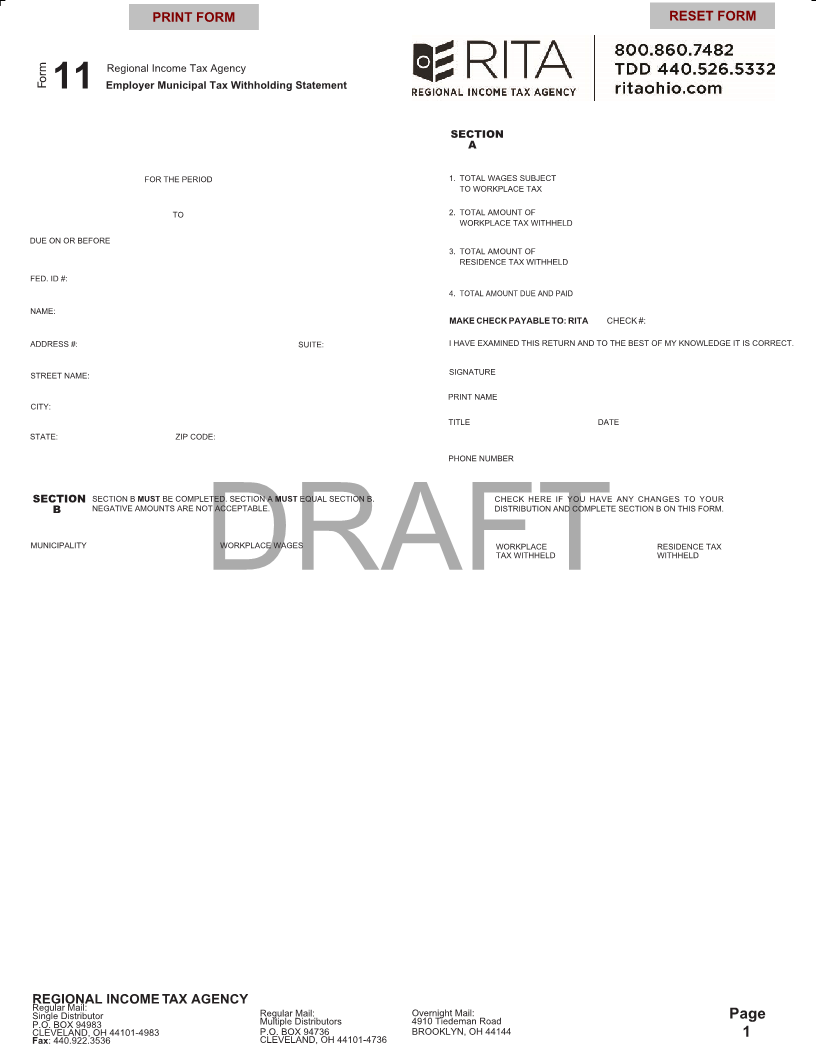

PRINT FORM RESET FORM

Regional Income Tax Agency

Form Employer Municipal Tax Withholding Statement

11

SECTION

A

FOR THE PERIOD 1. TOTAL WAGES SUBJECT

TO WORKPLACE TAX

11LF05A

TO 2. TOTAL AMOUNT OF

WORKPLACE TAX WITHHELD

DUE ON OR BEFORE

3. TOTAL AMOUNT OF

RESIDENCE TAX WITHHELD

FED. ID #:

4. TOTAL AMOUNT DUE AND PAID

NAME:

MAKE CHECK PAYABLE TO: RITA CHECK #:

ADDRESS #: SUITE: I HAVE EXAMINED THIS RETURN AND TO THE BEST OF MY KNOWLEDGE IT IS CORRECT.

STREET NAME: SIGNATURE

PRINT NAME

CITY:

TITLE DATE

STATE: ZIP CODE:

PHONE NUMBER

SECTION SECTION B MUST BE COMPLETED. SECTION A MUST EQUAL SECTION B. CHECK HERE IF YOU HAVE ANY CHANGES TO YOUR

B NEGATIVE AMOUNTS ARE NOT ACCEPTABLE. DISTRIBUTION AND COMPLETE SECTION B ON THIS FORM.

MUNICIPALITY WORKPLACE WAGES WORKPLACE RESIDENCE TAX

TAX WITHHELD WITHHELD

DRAFT

RegularREGIONALMail: INCOME TAX AGENCY

Single Distributor Regular Mail: Overnight Mail: Page

P.O. BOX 94983 Multiple Distributors 4910 Tiedeman Road

CLEVELAND, OH 44101-4983 P.O. BOX 94736 BROOKLYN, OH 44144 1

Fax: 440.922.3536 CLEVELAND, OH 44101-4736

|

Enlarge image |

SECTION

B 11LF05B

MUNICIPALITY WORKPLACE WAGES WORKPLACE RESIDENCE TAX

TAX WITHHELD WITHHELD

DRAFT

Page

2

11LF24

|