Enlarge image

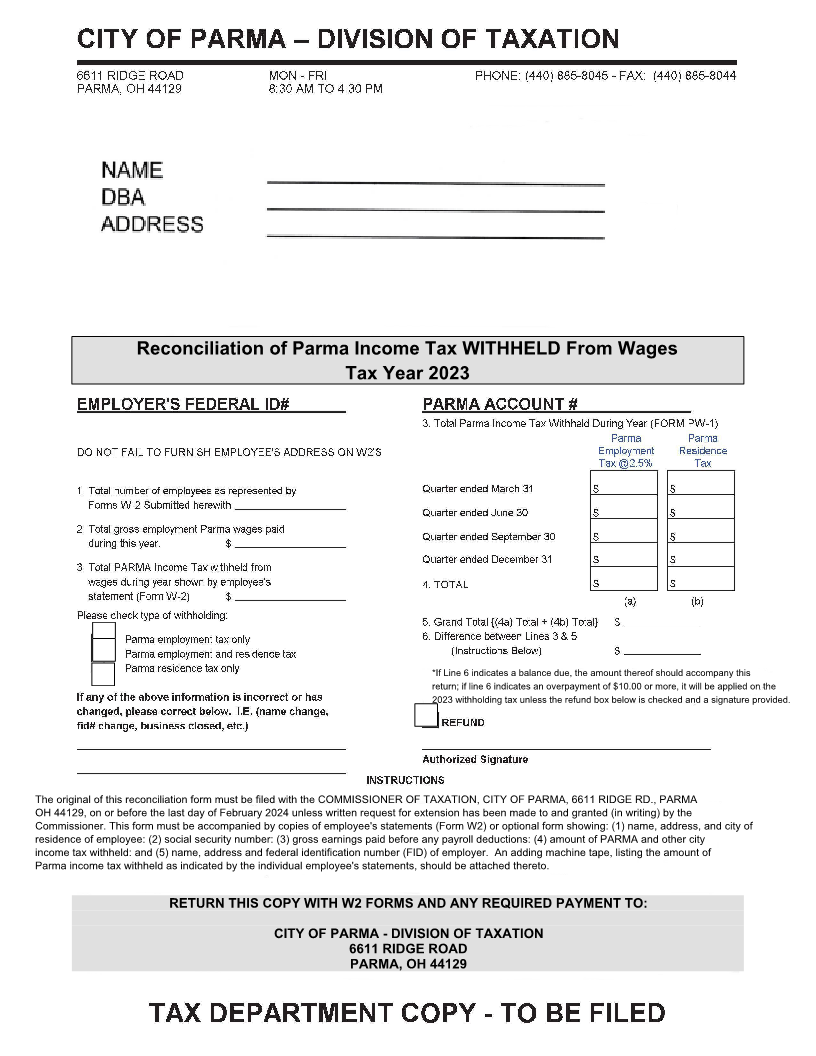

Reconciliation of Parma Income Tax WITHHELD From Wages

Tax Year 2023

*If Line 6 indicates a balance due, the amount thereof should accompany this

return; if line 6 indicates an overpayment of $10.00 or more, it will be applied on the

2023 withholding tax unless the refund box below is checked and a signature provided.

The original of this reconciliation form must be filed with the COMMISSIONER OF TAXATION, CITY OF PARMA, 6611 RIDGE RD., PARMA

OH 44129, on or before the last day of February 202 4unless written request for extension has been made to and granted (in writing) by the

Commissioner. This form must be accompanied by copies of employee's statements (Form W2) or optional form showing: (1) name, address, and city of

residence of employee: (2) social security number: (3) gross earnings paid before any payroll deductions: (4) amount of PARMA and other city

income tax withheld: and (5) name, address and federal identification number (FID) of employer. An adding machine tape, listing the amount of

Parma income tax withheld as indicated by the individual employee's statements, should be attached thereto.

RETURN THIS COPY WITH W2 FORMS AND ANY REQUIRED PAYMENT TO:

CITY OF PARMA - DIVISION OF TAXATION

6611 RIDGE ROAD

PARMA, OH 44129