Enlarge image

17 or 18 or 19 (whichever is applicable)

$25.00 per filing year for returns filed after

or the IRS due date.

Visit City website for rates.

Overpayments of $10.00 or less will not be refunded.

$25.00 per filing year. If the return is not filed or

Amounts of $10.00 or less are not

payable.

to MANDATORY DECLARATION OF ESTIMATED TAX

www.cityofashtabula.com.

TOTAL AMOUNT DUE – Line 7 + Line 10. Submit payment in full with the return.

applicable

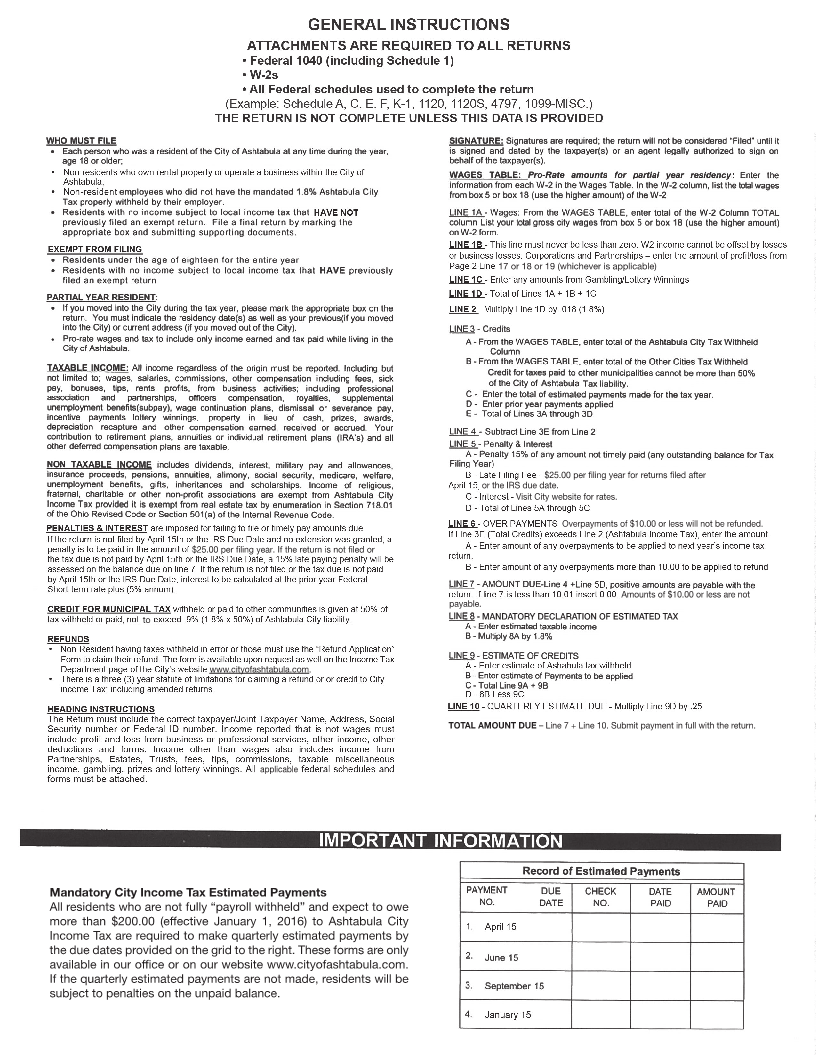

Mandatory City Income Tax Estimated Payments

All residents who are not fully “payroll withheld” and expect to owe

TVYL [OHU LɈLJ[P]L 1HU\HY` [V (ZO[HI\SH *P[`

0UJVTL ;H_ HYL YLX\PYLK [V THRL X\HY[LYS` LZ[PTH[LK WH`TLU[Z I`

[OL K\L KH[LZ WYV]PKLK VU [OL NYPK [V [OL YPNO[ ;OLZL MVYTZ HYL VUS`

H]HPSHISL PU V\Y VɉJL VY VU V\Y ^LIZP[L ^^^ JP[`VMHZO[HI\SH JVT

0M [OL X\HY[LYS` LZ[PTH[LK WH`TLU[Z HYL UV[ THKL YLZPKLU[Z ^PSS IL

Z\IQLJ[ [V WLUHS[PLZ VU [OL \UWHPK IHSHUJL