Enlarge image

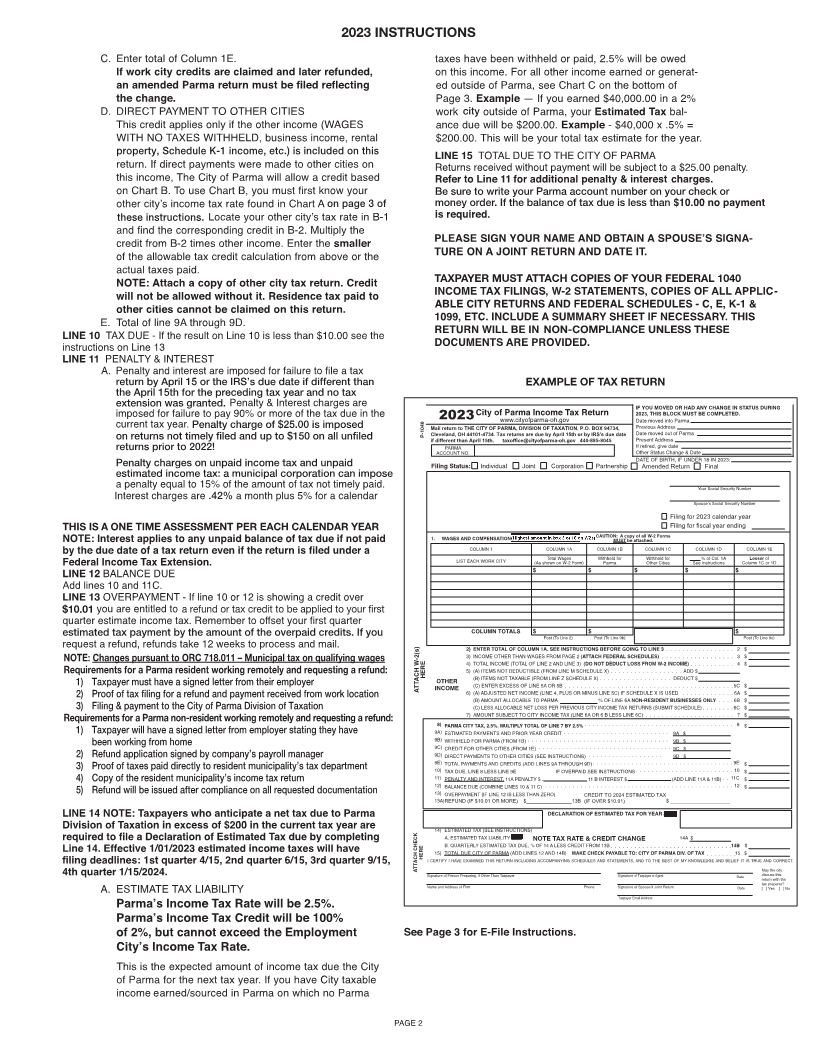

2023

2024.

GENERAL INSTRUCTIONS

CITY OF PARMA HAS A MANDATORY FILING ORDINANCE COLUMN 1B

WHO MUST FILE: Every resident 18 years or older with earned Enter the amount of taxes withheld for the City of Parma

in this column.

All such earnings wherever earned are considered taxable.

The location of the places from which payment is made or where payment

is received is immaterial. Every business entity - (individual, proprietorship,

partnership, corporation, S - Corporations “Parma Businesses Only”, for

returns.

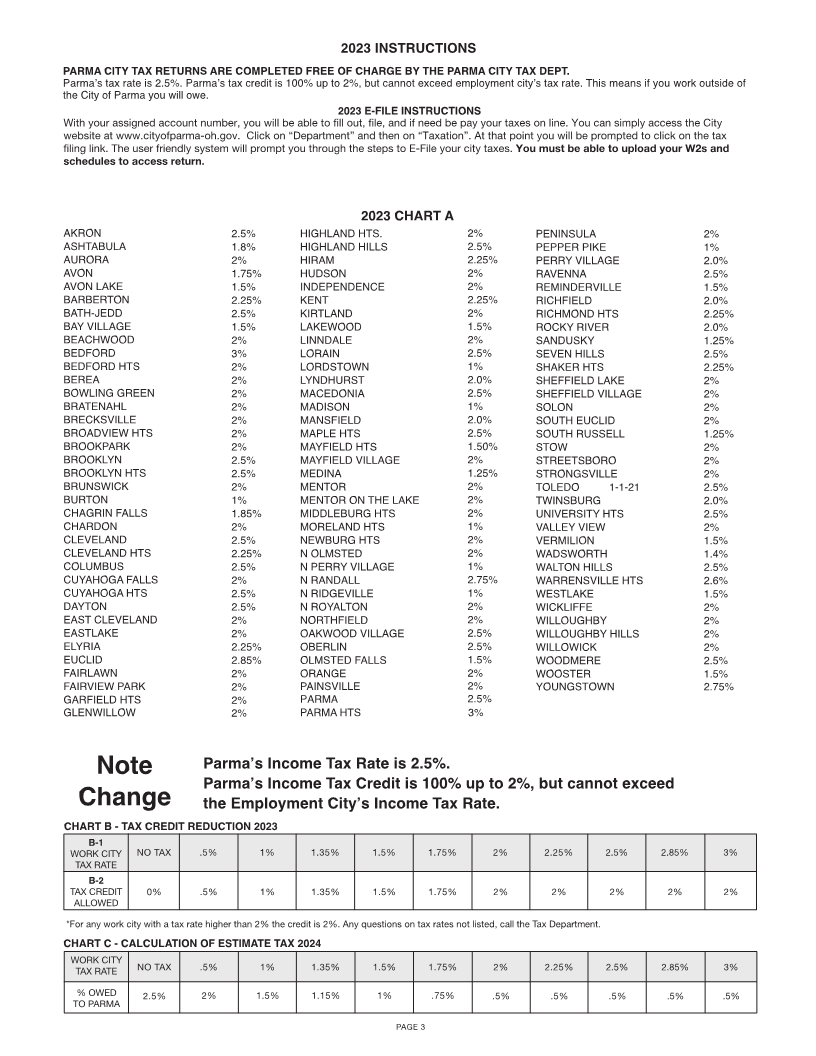

SPECIAL NOTE: A on page 3 of these instructions. .

for a business not located within this municipality are not required to

SPECIAL NOTE: All non-resident businesses must comply with Ohio

the Taxation Division upon request.

EARNED INCOME is defined as salaries, wages, commissions,

income from gaming, wagering and lotteries, including Ohio State

lottery winnings over the amount of $600.00, and other compensation

and would include but not be limited to: bonuses, incentive

payments, directors fees, property in lieu of cash, tips, dismissal or

severance pay, and awards, tax shelter plans, vacation and short

term disability, wage continuation plans, supplemental unemployment

benefits, deferred compensation i.e. (401K, 403B, etc.) depreciation

recapture and other compensation earned, received, or accrued.

FILE on or before the IRS’s due date following the close of the

calendar year. If the return is for a fiscal year or any period less than a

year, the return should be filed by the 15th day of the fourth month

from the end of the fiscal year or other period. Tax returns from

individuals or joint accounts are due by April 15 or the IRS’s due date

if different than April 15 for the preceding tax year.

EXTENSIONS OF TIME TO FILE: A

Extension must be attached to the Parma Return. An extension grants

All taxes due must be paid in full no later

than the IRS’s filing due date. Returns on a Federal Extension must

be filed by the 15th of the month which the Federal Extension ends.

PENALTIES AND INTEREST:

estimated taxes.

EXEMPTIONS AND ITEMIZED DEDUCTIONS as available on

individual federal income tax returns are not allowed. The munici-

pal income tax is based on gross earnings.

COLUMN 1

This column is to list each work city separately. Continue across

each column as listed below.

COLUMN 1A

Using Box 5 of Medicare Wage or Box 18 Local Wage, whichever is

the highest wage on the W-2.

Cities tax gross wages before any deduc-

deferred retirement plans ARE taxed by the City in the year which

you earn the income.)