Enlarge image

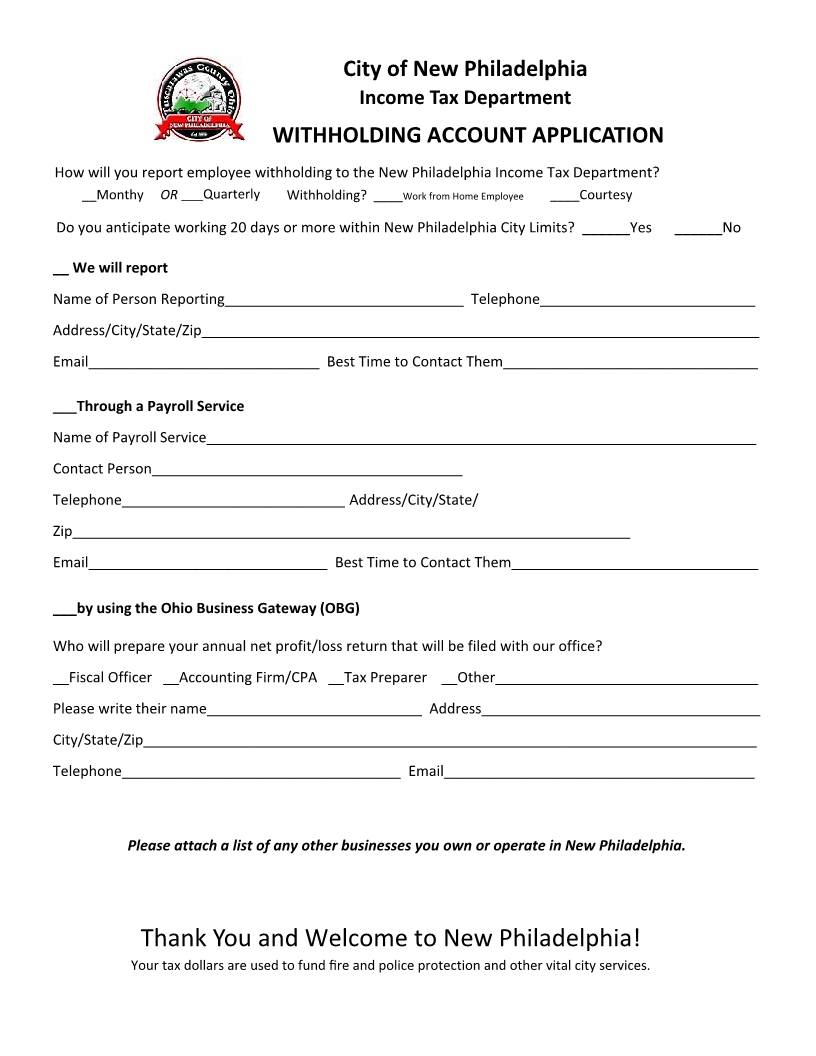

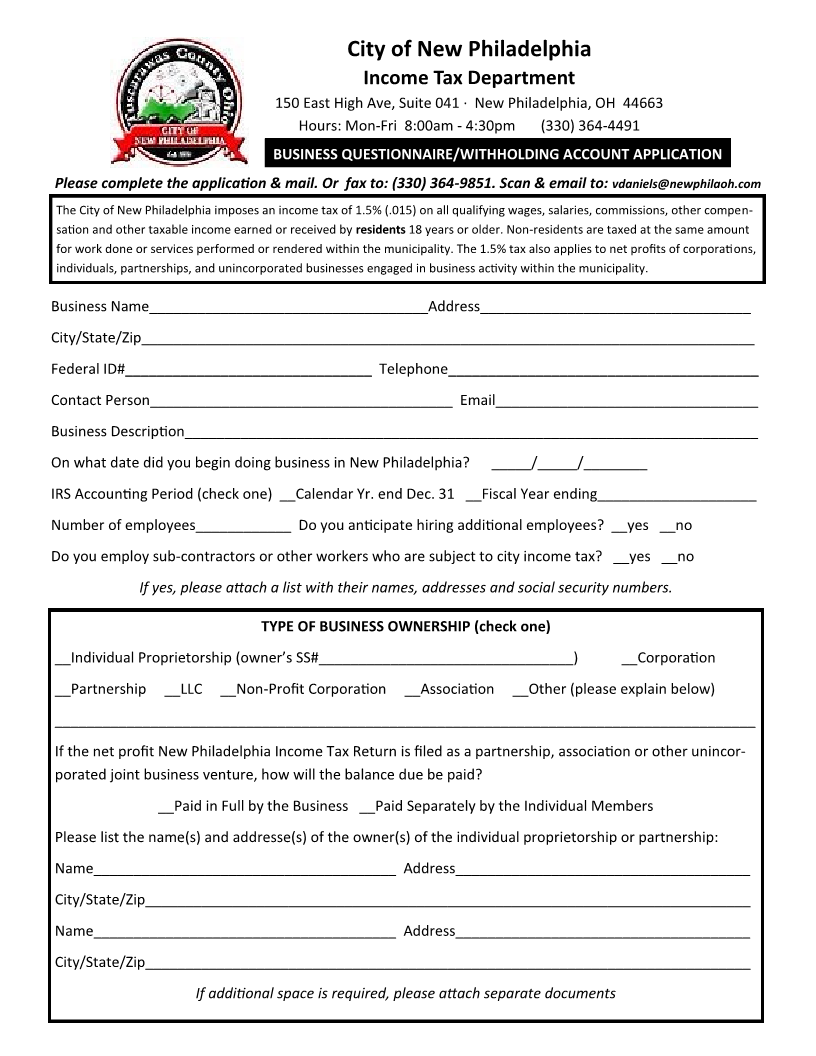

City of New Philadelphia

Income Tax Department

150 East High Ave, Suite 041 · New Philadelphia, OH 44663

Hours: Mon-Fri 8:00am - 4:30pm (330) 364-4491

BUSINESS QUESTIONNAIRE/WITHHOLDING ACCOUNT APPLICATION

Please complete the application & mail. Or fax to: (330) 364-9851. Scan & email to: vdaniels@newphilaoh.com

The City of New Philadelphia imposes an income tax of 1.5% (.015) on all qualifying wages, salaries, commissions, other compen-

sation and other taxable income earned or received by residents 18 years or older. Non-residents are taxed at the same amount

for work done or services performed or rendered within the municipality. The 1.5% tax also applies to net profits of corporations,

individuals, partnerships, and unincorporated businesses engaged in business activity within the municipality.

Business Name___________________________________Address__________________________________

City/State/Zip_____________________________________________________________________________

Federal ID#_______________________________ Telephone_______________________________________

Contact Person______________________________________ Email_________________________________

Business Description________________________________________________________________________

On what date did you begin doing business in New Philadelphia? _____/_____/________

IRS Accounting Period (check one) __Calendar Yr. end Dec. 31 __Fiscal Year ending____________________

Number of employees____________ Do you anticipate hiring additional employees? __yes __no

Do you employ sub-contractors or other workers who are subject to city income tax? __yes __no

If yes, please attach a list with their names, addresses and social security numbers.

TYPE OF BUSINESS OWNERSHIP (check one)

__Individual Proprietorship (owner’s SS#________________________________) __Corporation

__Partnership __LLC __Non-Profit Corporation __Association __Other (please explain below)

________________________________________________________________________________________

If the net profit New Philadelphia Income Tax Return is filed as a partnership, association or other unincor-

porated joint business venture, how will the balance due be paid?

__Paid in Full by the Business __Paid Separately by the Individual Members

Please list the name(s) and addresse(s) of the owner(s) of the individual proprietorship or partnership:

Name______________________________________ Address_____________________________________

City/State/Zip____________________________________________________________________________

Name______________________________________ Address_____________________________________

City/State/Zip____________________________________________________________________________

If additional space is required, please attach separate documents