Enlarge image

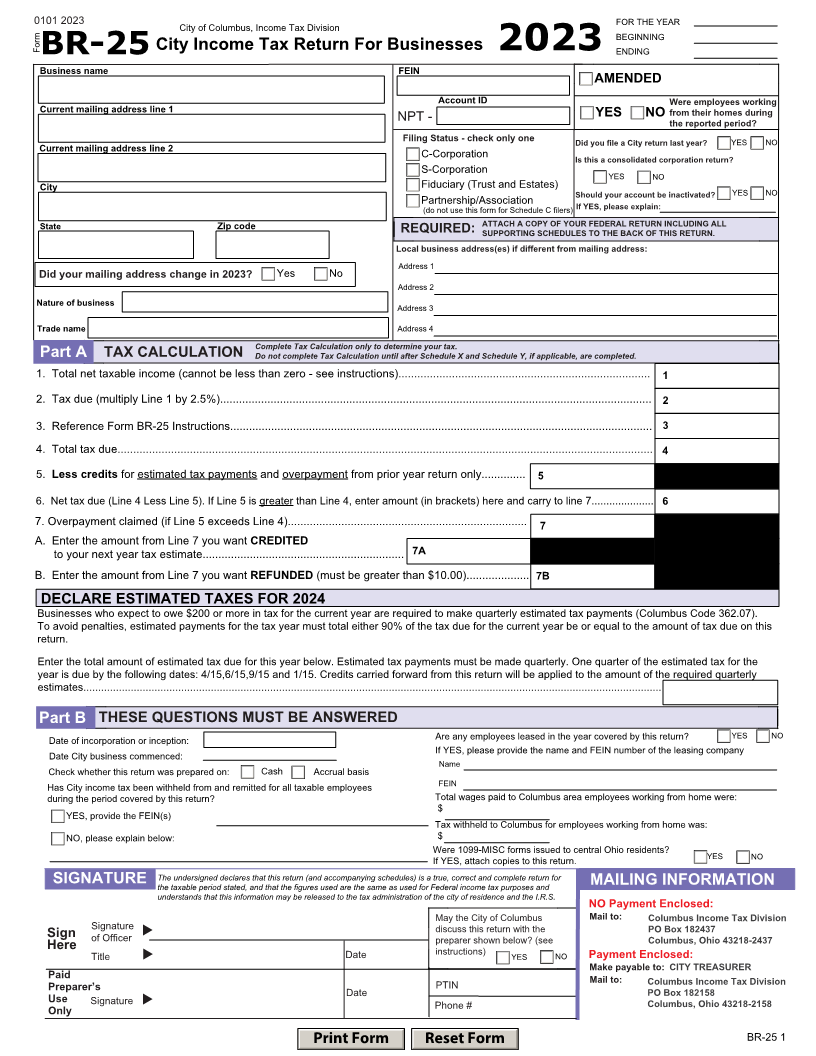

0101 2023 City of Columbus, Income Tax Division FOR THE YEAR

BEGINNING

Form City Income Tax Return For Businesses

BR-25 2023 ENDING

Business name FEIN

AMENDED

Account ID Were employees working

Current mailing address line 1 NPT - YES NO from their homes during

the reported period?

Filing Status - check only one Did you file a City return last year? YES NO

Current mailing address line 2 C-Corporation Is this a consolidated corporation return?

S-Corporation YES NO

City Fiduciary (Trust and Estates) YES NO

Partnership/Association Should your account be inactivated?

(do not use this form for Schedule C filers) If YES, please explain:

State Zip code ATTACH A COPY OF YOUR FEDERAL RETURN INCLUDING ALL

REQUIRED: SUPPORTING SCHEDULES TO THE BACK OF THIS RETURN.

Local business address(es) if different from mailing address:

Address 1

Did your mailing address change in 2023? Yes No

Address 2

Nature of business Address 3

Trade name Address 4

Complete Tax Calculation only to determine your tax.

Part A TAX CALCULATION Do not complete Tax Calculation until after Schedule X and Schedule Y, if applicable, are completed.

1. Total net taxable income (cannot be less than zero - see instructions)................................................................................ 1

2. Tax due (multiply Line 1 by 2.5%)......................................................................................................................................... 2

3. Reference Form BR-25 Instructions...................................................................................................................................... 3

4. Total tax due.......................................................................................................................................................................... 4

5. Less credits for estimated tax payments and overpayment from prior year return only.............. 5

6. Net tax due (Line 4 Less Line 5). If Line 5 is greater than Line 4, enter amount (in brackets) here and carry to line 7..................... 6

7. Overpayment claimed (if Line 5 exceeds Line 4)............................................................................ 7

A. Enter the amount from Line 7 you want CREDITED

to your next year tax estimate................................................................ 7A

B. Enter the amount from Line 7 you want REFUNDED (must be greater than $10.00).................... 7B

DECLARE ESTIMATED TAXES FOR 2024

Businesses who expect to owe $200 or more in tax for the current year are required to make quarterly estimated tax payments (Columbus Code 362.07).

To avoid penalties, estimated payments for the tax year must total either 90% of the tax due for the current year be or equal to the amount of tax due on this

return.

Enter the total amount of estimated tax due for this year below. Estimated tax payments must be made quarterly. One quarter of the estimated tax for the

year is due by the following dates: 4/15,6/15,9/15 and 1/15. Credits carried forward from this return will be applied to the amount of the required quarterly

estimates...................................................................................................................................................................................................

Part B THESE QUESTIONS MUST BE ANSWERED

Date of incorporation or inception: Are any employees leased in the year covered by this return? YES NO

Date City business commenced: If YES, please provide the name and FEIN number of the leasing company

Name

Check whether this return was prepared on: Cash Accrual basis

Has City income tax been withheld from and remitted for all taxable employees FEIN

during the period covered by this return? Total wages paid to Columbus area employees working from home were:

$

YES, provide the FEIN(s)

Tax withheld to Columbus for employees working from home was:

NO, please explain below: $

Were 1099-MISC forms issued to central Ohio residents? YES NO

If YES, attach copies to this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for

SIGNATURE the taxable period stated, and that the figures used are the same as used for Federal income tax purposes and MAILING INFORMATION

understands that this information may be released to the tax administration of the city of residence and the I.R.S.

NO Payment Enclosed:

May the City of Columbus Mail to: Columbus Income Tax Division

Sign Signature discuss this return with the PO Box 182437

of Officer preparer shown below? (see Columbus, Ohio 43218-2437

Date

Here Title instructions) YES NO Payment Enclosed:

Make payable to: CITY TREASURER

Paid Mail to: Columbus Income Tax Division

Preparer’s PTIN

Date PO Box 182158

Use Signature Phone # Columbus, Ohio 43218-2158

Only

Print Form Reset Form BR-25 1