Enlarge image

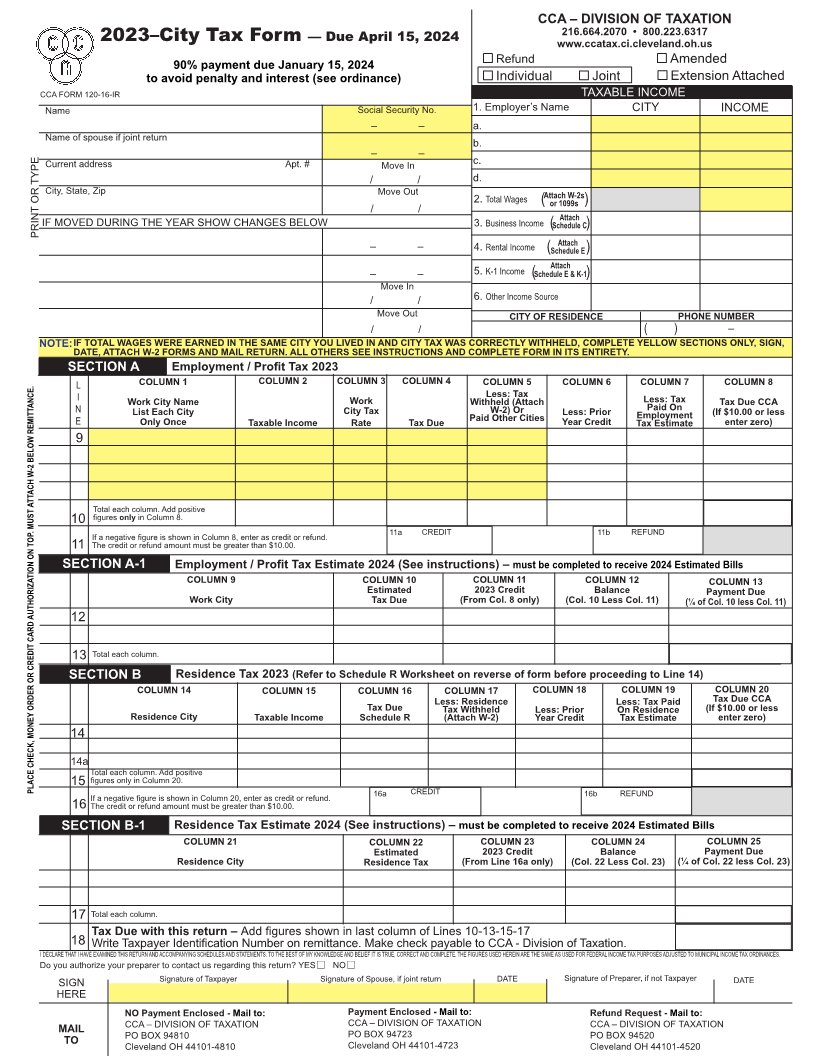

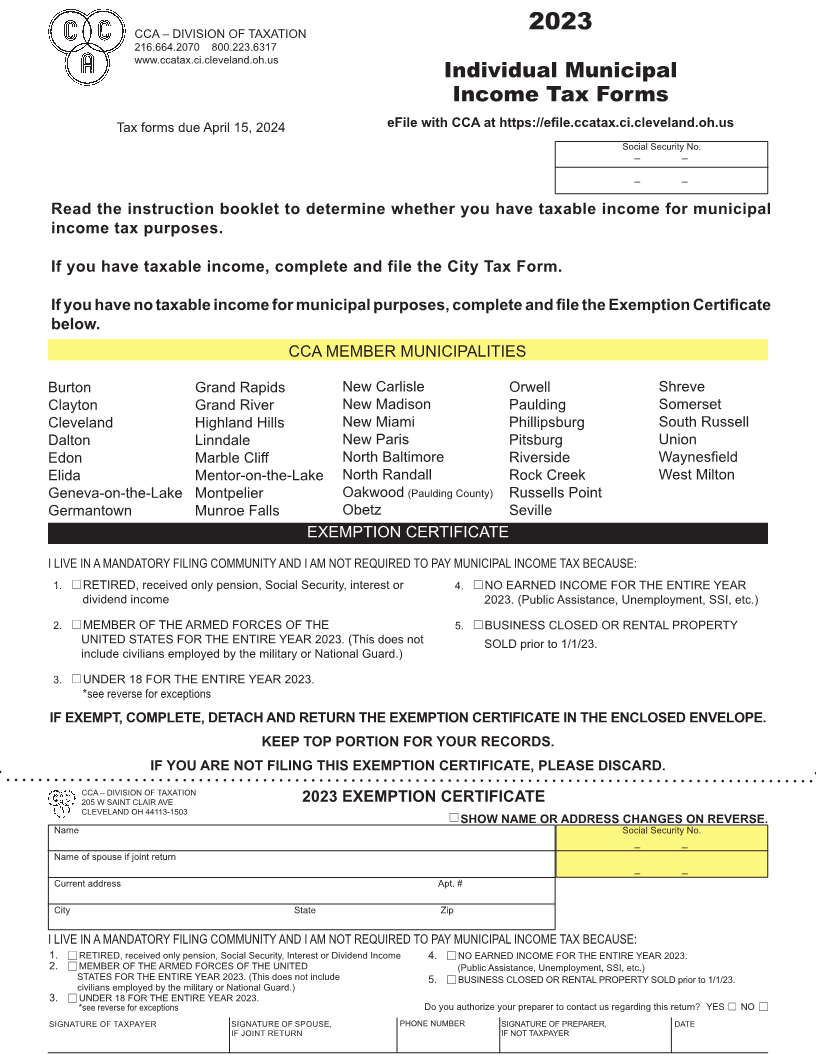

CCA – DIVISION OF TAXATION 2023

216.664.2070 800.223.6317

www.ccatax.ci.cleveland.oh.us

Individual Municipal

Income Tax Forms

Tax forms due April 15, 2024 eFile with CCA at https://efile.ccatax.ci.cleveland.oh.us

Social Security No.

– –

– –

Read the instruction booklet to determine whether you have taxable income for municipal

income tax purposes.

If you have taxable income, complete and file the City Tax Form.

If you have no taxable income for municipal purposes, complete and file the Exemption Certificate

below.

CCA MEMBER MUNICIPALITIES

Burton Grand Rapids New Carlisle Orwell Shreve

Clayton Grand River New Madison Paulding Somerset

Cleveland Highland Hills New Miami Phillipsburg South Russell

Dalton Linndale New Paris Pitsburg Union

Edon Marble Cliff North Baltimore Riverside Waynesfield

Elida Mentor-on-the-Lake North Randall Rock Creek West Milton

Geneva-on-the-Lake Montpelier Oakwood (Paulding County) Russells Point

Germantown Munroe Falls Obetz Seville

EXEMPTION CERTIFICATE

I LIVE IN A MANDATORY FILING COMMUNITY AND I AM NOT REQUIRED TO PAY MUNICIPAL INCOME TAX BECAUSE:

1. RETIRED, received only pension, Social Security, interest or 4. NO EARNED INCOME FOR THE ENTIRE YEAR

@ dividend income @2023. (Public Assistance, Unemployment, SSI, etc.)

2. MEMBER OF THE ARMED FORCES OF THE 5. BUSINESS CLOSED OR RENTAL PROPERTY

@UNITED STATES FOR THE ENTIRE YEAR 2023. (This does not @

SOLD prior to 1/1/23.

include civilians employed by the military or National Guard.)

3. UNDER 18 FOR THE ENTIRE YEAR 2023.

*@ see reverse for exceptions

IF EXEMPT, COMPLETE, DETACH AND RETURN THE EXEMPTION CERTIFICATE IN THE ENCLOSED ENVELOPE.

KEEP TOP PORTION FOR YOUR RECORDS.

IF YOU ARE NOT FILING THIS EXEMPTION CERTIFICATE, PLEASE DISCARD.

CCA – DIVISION OF TAXATION

205 W SAINT CLAIR AVE 2023 EXEMPTION CERTIFICATE

CLEVELAND OH 44113-1503

SHOW NAME OR ADDRESS CHANGES ON REVERSE.

Name @ Social Security No.

– –

Name of spouse if joint return

– –

Current address Apt. #

City State Zip

I LIVE IN A MANDATORY FILING COMMUNITY AND I AM NOT REQUIRED TO PAY MUNICIPAL INCOME TAX BECAUSE:

1. RETIRED, received only pension, Social Security, Interest or Dividend Income 4. NO EARNED INCOME FOR THE ENTIRE YEAR 2023.

2. @ MEMBER OF THE ARMED FORCES OF THE UNITED @ (Public Assistance, Unemployment, SSI, etc.)

@STATES FOR THE ENTIRE YEAR 2023. (This does not include 5. BUSINESS CLOSED OR RENTAL PROPERTY SOLD prior to 1/1/23.

civilians employed by the military or National Guard.) @

3. UNDER 18 FOR THE ENTIRE YEAR 2023.

@ *see reverse for exceptions Do you authorize your preparer to contact us regarding this return? YES NO

SIGNATURE OF TAXPAYER SIGNATURE OF SPOUSE, PHONE NUMBER SIGNATURE OF PREPARER, DATE @ @

IF JOINT RETURN IF NOT TAXPAYER