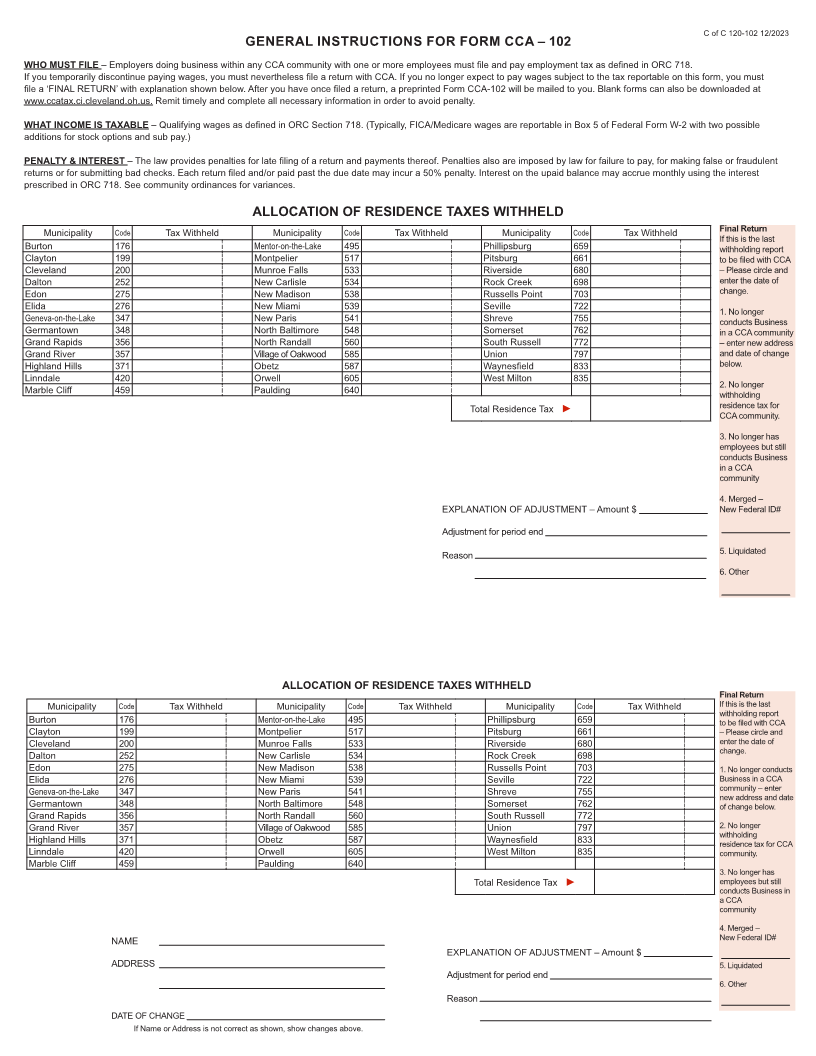

Enlarge image

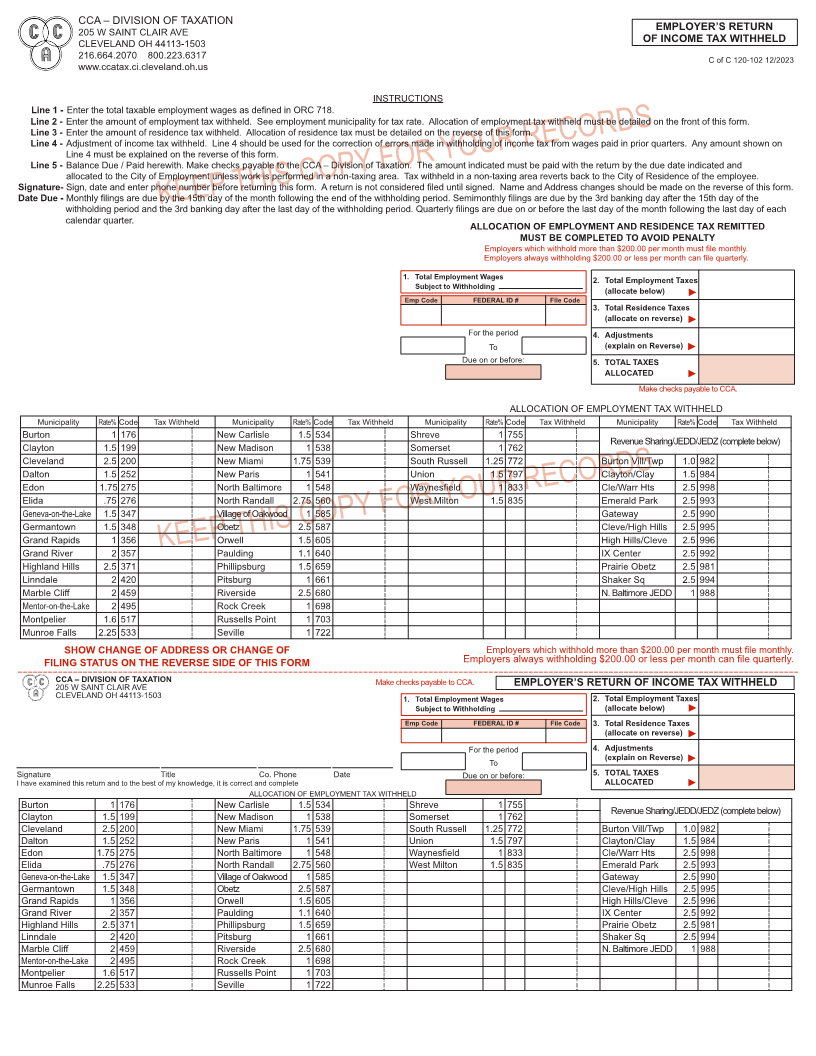

CCA – DIVISION OF TAXATION EMPLOYER’S RETURN

205 W SAINT CLAIR AVE

CLEVELAND OH 44113-1503 OF INCOME TAX WITHHELD

216.664.2070 800.223.6317 C of C 120-102 12/2023

www.ccatax.ci.cleveland.oh.us

INSTRUCTIONS

Line 1 - Enter the total taxable employment wages as defined in ORC 718.

Line 2 - Enter the amount of employment tax withheld. See employment municipality for tax rate. Allocation of employment tax withheld must be detailed on the front of this form.

Line 3 - Enter the amount of residence tax withheld. Allocation of residence tax must be detailed on the reverse of this form.

Line 4 - Adjustment of income tax withheld. Line 4 should be used for the correction of errors made in withholding of income tax from wages paid in prior quarters. Any amount shown on

Line 4 must be explained on the reverse of this form.

Line 5 - Balance Due / Paid herewith. Make checks payable to the CCA – Division of Taxation. The amount indicated must be paid with the return by the due date indicated and

allocated to the City of Employment unless work is performed in a non-taxing area. Tax withheld in a non-taxing area reverts back to the City of Residence of the employee.

Signature- Sign, date and enter phone number before returning this form. A return is not considered filed until signed. Name and Address changes should be made on the reverse of this form.

Date Due - Monthly filings are due by the 15th day of the month following the end of the withholding period. Semimonthly filings are due by the 3rd banking day after the 15th day of the

withholding period andKEEPthe 3rd banking dayTHISafter the last dayCOPYof the withholdingFORperiod. QuarterlyYOURfilings are due onRECORDSor before the last day of the month following the last day of each

calendar quarter. ALLOCATION OF EMPLOYMENT AND RESIDENCE TAX REMITTED

MUST BE COMPLETED TO AVOID PENALTY

Employers which withhold more than $200.00 per month must file monthly.

Employers always withholding $200.00 or less per month can file quarterly.

1. Total Employment Wages 2. Total Employment Taxes

Subject to Withholding (allocate below)

Emp Code FEDERAL ID # File Code ►

3. Total Residence Taxes

(allocate on reverse) ►

For the period 4. Adjustments

To (explain on Reverse) ►

Due on or before: 5. TOTAL TAXES

ALLOCATED ►

Make checks payable to CCA.

ALLOCATION OF EMPLOYMENT TAX WITHHELD

Municipality Rate% Code Tax Withheld Municipality Rate% Code Tax Withheld Municipality Rate% Code Tax Withheld Municipality Rate% Code Tax Withheld

BurtonClayton 1.5 1991 176 New CarlisleNew Madison 1.5 5341 538 ShreveSomerset 1 7551 762 Revenue Sharing/JEDD/JEDZ (complete below)

Cleveland 2.5 200 New Miami 1.75 539 South Russell 1.25 772 Burton Vill/Twp 1.0 982

Dalton 1.5 252 New Paris 1 541 Union 1.5 797 Clayton/Clay 1.5 984

Edon 1.75 275 North Baltimore 1 548 Waynesfield 1 833 Cle/Warr Hts 2.5 998

Elida .75 276 North Randall 2.75 560 West Milton 1.5 835 Emerald Park 2.5 993

Geneva-on-the-Lake 1.5 347 Village of Oakwood 1 585 Gateway 2.5 990

Germantown 1.5 348 Obetz 2.5 587 Cleve/High Hills 2.5 995

Grand Rapids 1 356 Orwell 1.5 605 High Hills/Cleve 2.5 996

Grand River 2 357 KEEPPauldingTHIS1.1COPY640 FOR YOUR RECORDSIX Center 2.5 992

Highland Hills 2.5 371 Phillipsburg 1.5 659 Prairie Obetz 2.5 981

Linndale 2 420 Pitsburg 1 661 Shaker Sq 2.5 994

Marble Cliff 2 459 Riverside 2.5 680 N. Baltimore JEDD 1 988

Mentor-on-the-Lake 2 495 Rock Creek 1 698

Montpelier 1.6 517 Russells Point 1 703

Munroe Falls 2.25 533 Seville 1 722

SHOW CHANGE OF ADDRESS OR CHANGE OF Employers which withhold more than $200.00 per month must file monthly.

FILING STATUS ON THE REVERSE SIDE OF THIS FORM Employers always withholding $200.00 or less per month can file quarterly.

CCA – DIVISION OF TAXATION Make checks payable to CCA. EMPLOYER’S RETURN OF INCOME TAX WITHHELD

205 W SAINT CLAIR AVE

CLEVELAND OH 44113-1503 1. Total Employment Wages 2. Total Employment Taxes

Subject to Withholding (allocate below) ►

Emp Code FEDERAL ID # File Code 3. Total Residence Taxes

(allocate on reverse) ►

For the period 4. Adjustments

To (explain on Reverse) ►

Signature Title Co. Phone Date Due on or before: 5. TOTAL TAXES

I have examined this return and to the best of my knowledge, it is correct and complete ALLOCATED ►

ALLOCATION OF EMPLOYMENT TAX WITHHELD

BurtonClayton 1.5 1991 176 New CarlisleNew Madison 1.5 5341 538 ShreveSomerset 1 7551 762 Revenue Sharing/JEDD/JEDZ (complete below)

Cleveland 2.5 200 New Miami 1.75 539 South Russell 1.25 772 Burton Vill/Twp 1.0 982

Dalton 1.5 252 New Paris 1 541 Union 1.5 797 Clayton/Clay 1.5 984

Edon 1.75 275 North Baltimore 1 548 Waynesfield 1 833 Cle/Warr Hts 2.5 998

Elida .75 276 North Randall 2.75 560 West Milton 1.5 835 Emerald Park 2.5 993

Geneva-on-the-Lake 1.5 347 Village of Oakwood 1 585 Gateway 2.5 990

Germantown 1.5 348 Obetz 2.5 587 Cleve/High Hills 2.5 995

Grand Rapids 1 356 Orwell 1.5 605 High Hills/Cleve 2.5 996

Grand River 2 357 Paulding 1.1 640 IX Center 2.5 992

Highland Hills 2.5 371 Phillipsburg 1.5 659 Prairie Obetz 2.5 981

Linndale 2 420 Pitsburg 1 661 Shaker Sq 2.5 994

Marble Cliff 2 459 Riverside 2.5 680 N. Baltimore JEDD 1 988

Mentor-on-the-Lake 2 495 Rock Creek 1 698

Montpelier 1.6 517 Russells Point 1 703

Munroe Falls 2.25 533 Seville 1 722