Enlarge image

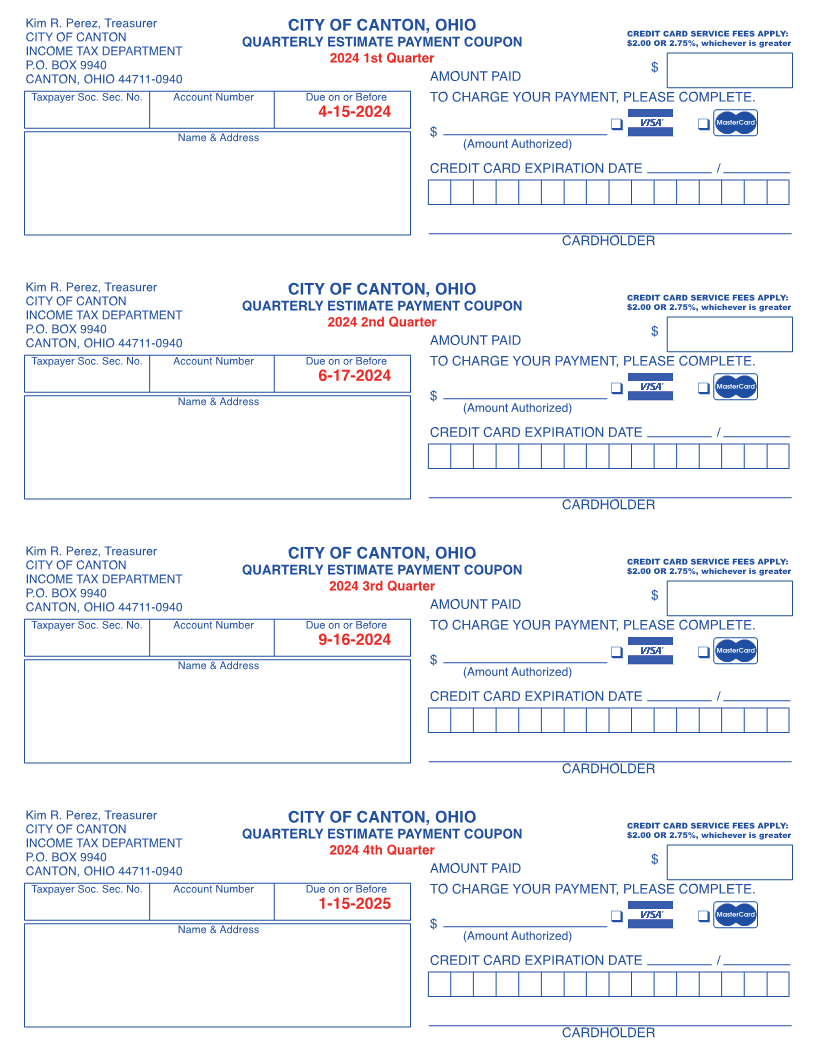

Kim R. Perez, Treasurer CITY OF CANTON, OHIO CREDIT CARD SERVICE FEES APPLY:

CITY OF CANTON QUARTERLY ESTIMATE PAYMENT COUPON $2.00 OR 2.75%, whichever is greater

INCOME TAX DEPARTMENT

P.O. BOX 9940 2024 1st Quarter $

CANTON, OHIO 44711-0940 AMOUNT PAID

Taxpayer Soc. Sec. No. Account Number Due on or Before TO CHARGE YOUR PAYMENT, PLEASE COMPLETE.

4-15-2024 MasterCard

q q

Name & Address $

(Amount Authorized)

CREDIT CARD EXPIRATION DATE /

CARDHOLDER

Kim R. Perez, Treasurer CITY OF CANTON, OHIO CREDIT CARD SERVICE FEES APPLY:

CITY OF CANTON QUARTERLY ESTIMATE PAYMENT COUPON $2.00 OR 2.75%, whichever is greater

INCOME TAX DEPARTMENT

P.O. BOX 9940 2024 2nd Quarter $

CANTON, OHIO 44711-0940 AMOUNT PAID

Taxpayer Soc. Sec. No. Account Number Due on or Before TO CHARGE YOUR PAYMENT, PLEASE COMPLETE.

6-17-2024 MasterCard

q q

Name & Address $

(Amount Authorized)

CREDIT CARD EXPIRATION DATE /

CARDHOLDER

Kim R. Perez, Treasurer CITY OF CANTON, OHIO CREDIT CARD SERVICE FEES APPLY:

CITY OF CANTON QUARTERLY ESTIMATE PAYMENT COUPON $2.00 OR 2.75%, whichever is greater

INCOME TAX DEPARTMENT

P.O. BOX 9940 2024 3rd Quarter $

CANTON, OHIO 44711-0940 AMOUNT PAID

Taxpayer Soc. Sec. No. Account Number Due on or Before TO CHARGE YOUR PAYMENT, PLEASE COMPLETE.

9-16-2024 MasterCard

q q

Name & Address $

(Amount Authorized)

CREDIT CARD EXPIRATION DATE /

CARDHOLDER

Kim R. Perez, Treasurer CITY OF CANTON, OHIO CREDIT CARD SERVICE FEES APPLY:

CITY OF CANTON QUARTERLY ESTIMATE PAYMENT COUPON $2.00 OR 2.75%, whichever is greater

INCOME TAX DEPARTMENT

P.O. BOX 9940 2024 4th Quarter $

CANTON, OHIO 44711-0940 AMOUNT PAID

Taxpayer Soc. Sec. No. Account Number Due on or Before TO CHARGE YOUR PAYMENT, PLEASE COMPLETE.

1-15-2025 MasterCard

q q

Name & Address $

(Amount Authorized)

CREDIT CARD EXPIRATION DATE /

CARDHOLDER