Enlarge image

GENERAL INSTRUCTIONS

Based on Alliance Codified Ordinance, Section 182 et seq.

Tax Forms and Ordinance available at: www.cityofalliance.com

Online filing available at: www.municonnect.com/alliance

WHO MUST FILE A TAX RETURN ADJUSTMENTS TO INCOME

(1) Residents of the City of Alliance who have not filed an exemption Allowable Deductions:

certificate with the Income Tax Office. A return must be filed even if you (a) Unreimbursed Employees Business Expenses (Federal Form

received no income or owe no tax. 2106). When used in actual performance of employment (See Federal

Form 2106 for instructions and latest information). Federal Schedule 1

(2) Residents of the City of Alliance age 16 or over who receive sala- must be attached for verification. See instructions on back page of tax form.

ries, wages, commissions, and other earned income for work done or Not Allowable Deductions:

services performed or rendered from all sources of income. (a) Deferred compensation such as 401 K, IRA, Keogh and pension

plans.

(3) Resident S corporations, corporations, partnerships and unincor- (b) Business or rental loss cannot offset W-2 wages.

porated businesses.

ATTACHMENTS ARE REQUIRED TO ALL RETURNS

(4) NON-RESIDENTS of the City of Alliance, who receive salaries, W-2’s - No exceptions

wages, commissions, and other earned income for work done or services Federal Schedules of income included with return (Includes 1040,

performed or rendered within the City of Alliance, IF NOT COVERED 2106, Schedule 1, etc.). The return is not complete and cannot be

BY A WITHHOLDING PLAN. filed unless this source data is provided.

(5) Employers Within the City - On the portion attributable to the City

of Alliance of the net profits earned during the effective period of this TIME AND PLACE FOR FILING

ordinance of all resident corporations, unincorporated businesses, (A) Calendar year taxpayer - file between January 1 and April 15 of

professions or other entities, derived from sales made, work done, this year.

services performed or rendered and business or other activities conducted (B) Fiscal year taxpayer - file on or before 105 days after the fiscal year

in the City of Alliance. end.

(C) Where to file- INCOME TAX DEPARTMENT

(6) Non-Resident Employers - On the portion attributable to the City 504 East Main Street

of Alliance of the net profits earned during the effective period of this P.O. Box 2025

ordinance of all non-resident corporations, unincorporated businesses, Alliance, Ohio 44601

professions or other entities, derived from sales made, work done or Phone # 330-821-9190

services performed or rendered and business or other activities conducted EXTENSION OF TIME TO FILE

in the city of Alliance whether or not such corporations or unincorporated If you wish to have an extension of time to file, you may do either of

business entities have an office or place of business in the City of the following by April 15, 2024.

Alliance. (A) Send in a copy of the extension request that was filed with the

(7) The credit for tax paid to other municipalities by Alliance residents Internal Revenue Service.

is limited to 1.75% for each location. (B) Send in a written request to this office. If you wish confirmation,

enclose a self-addressed stamped envelope with the request.

RENTAL INCOME NOTE: An extension grants additional time to file a tax return; it

(1) Residents having Rental Property located in or outside the City of does not extend the time to pay any tax that is due. Payment of

Alliance must file a tax return. However, the tax is computed on the such tax should be included with the extension request to ensure

net income only, after allowance for Depreciation, Real Estate Taxes, approval of such request.

Repairs, Insurance, etc.

(2) Non-Residents having Rental Property situated within the City of DECLARATION OF ESTIMATED TAX

Alliance must file a tax return. However, the tax is computed on the A declaration of estimated tax must be filed if a local tax of at least 2.0%

net income only after allowance for Depreciation, Real Estate Taxes, is not withheld by your employer and/or the tax due exceeds $200.00.

Repairs, Insurance, etc. Failure to pay estimated taxes will result in penalty charges.

Filing a Declaration of Estimated Tax is not required for those taxpayers

GAMBLING, WAGERING AND LOTTERIES whose sole taxable income is local and Alliance City tax is withheld.

Income derived from gambling, wagering, lotteries, including the Ohio

State Lottery and Multi-state lotteries and games or schemes of chance

earned or received by the residents of the City is subject to city income RECORDS TO BE MAINTAINED

tax. All taxpayers subject to the Alliance Income Tax shall keep and maintain

an accurate record of all information pertinent to their city tax liability.

EXEMPT INCOME This information shall be kept for five (5) years from the date this return

Pensions, Social Security, Unemployment, Interest, Dividends, Capital is filed or the withholding taxes are paid.

Gains, Military Pay, Welfare, Insurance Benefits, Alimony, Child Support,

Earnings to those under age 16, are not subject to the tax.

IMPORTANT INFORMATION

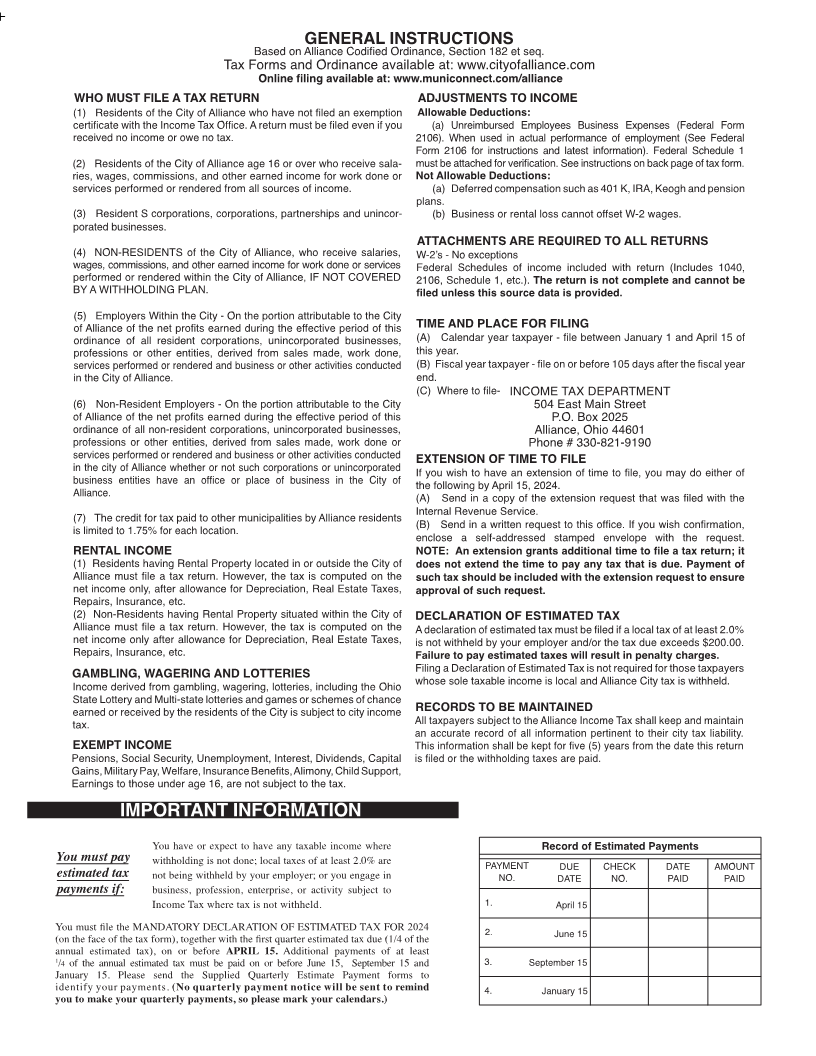

You have or expect to have any taxable income where Record of Estimated Payments

You must pay withholding is not done; local taxes of at least 2.0% are PAYMENT DUE CHECK DATE AMOUNT

estimated tax not being withheld by your employer; or you engage in NO. DATE NO. PAID PAID

payments if: business, profession, enterprise, or activity subject to

Income Tax where tax is not withheld. 1. April 15

You must file the MANDATORY DECLARATION OF ESTIMATED TAX FOR 20162024 2. June 15

(on the face of the tax form), together with the first quarter estimated tax due (1/4 of the

annual estimated tax), on or before APRIL 15. Additional payments of at least

1/ 4of the annual estimated tax must be paid on or before June 15, September 15 and 3. September 15

January 15. Please send the Supplied Quarterly Estimate Payment forms to

identify your payments. (No quarterly payment notice will be sent to remind 4. January 15

you to make your quarterly payments, so please mark your calendars.)