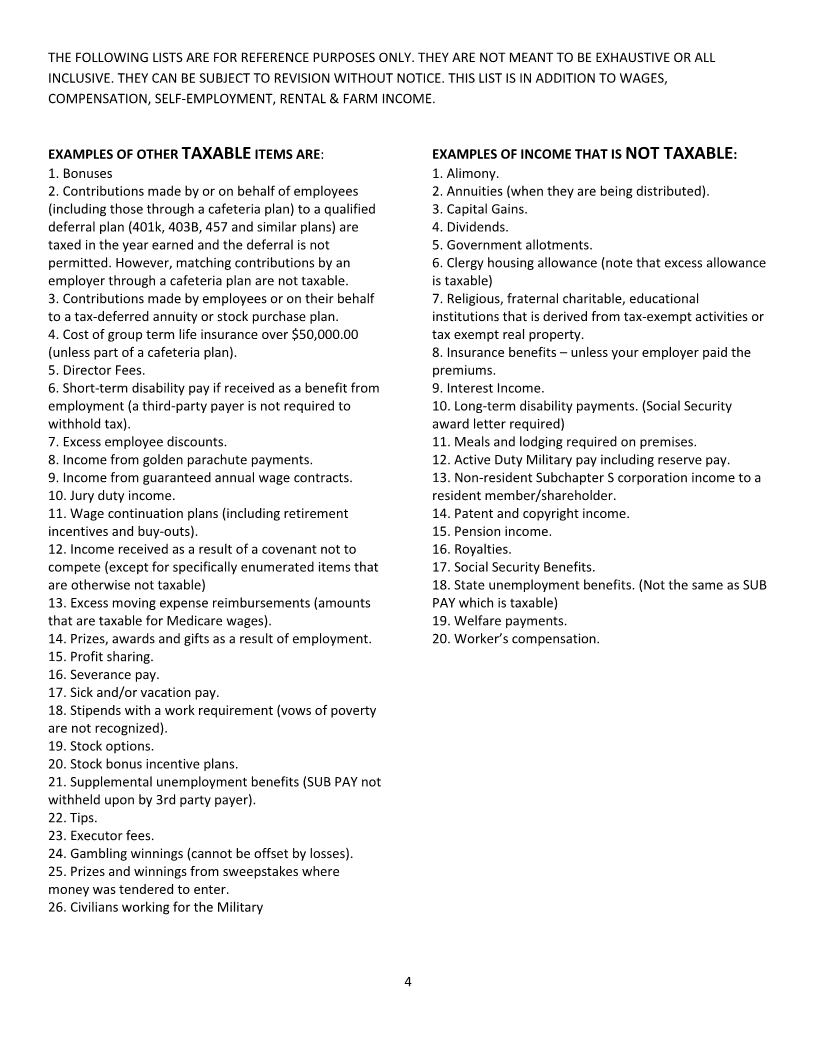

Enlarge image

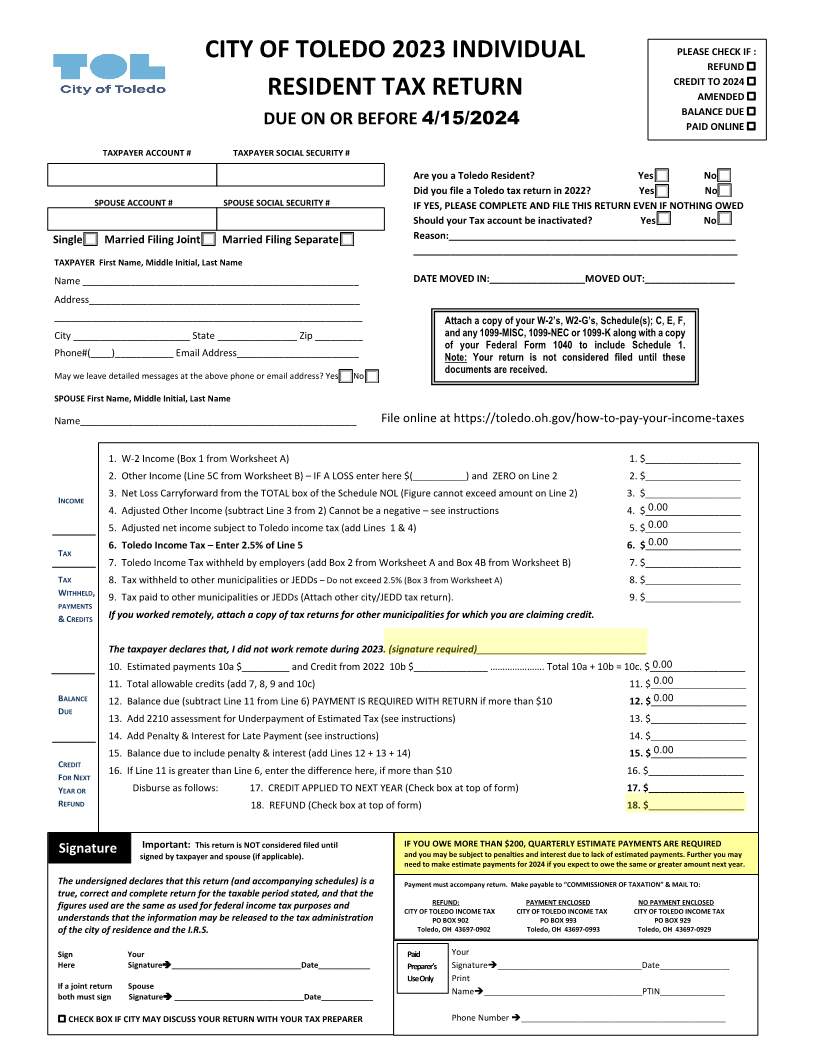

PLEASE CHECK IF :

CITY OF TOLEDO 2023 INDIVIDUAL REFUND

CREDIT TO 2024

RESIDENT TAX RETURN AMENDED

BALANCE DUE

DUE ON OR BEFORE4/15/2024 PAID ONLINE

TAXPAYER ACCOUNT # TAXPAYER SOCIAL SECURITY #

Are you a Toledo Resident? Yes No

Did you file a Toledo tax return in 2022? Yes No

SPOUSE ACCOUNT # SPOUSE SOCIAL SECURITY # IF YES, PLEASE COMPLETE AND FILE THIS RETURN EVEN IF NOTHING OWED

Should your Tax account be inactivated? Yes No

Single Married Filing Joint Married Filing Separate Reason:______________________________________________________

_____________________________________________________________

TAXPAYER First Name, Middle Initial, Last Name

Name ____________________________________________________ DATE MOVED IN:__________________MOVED OUT:_________________

Address___________________________________________________

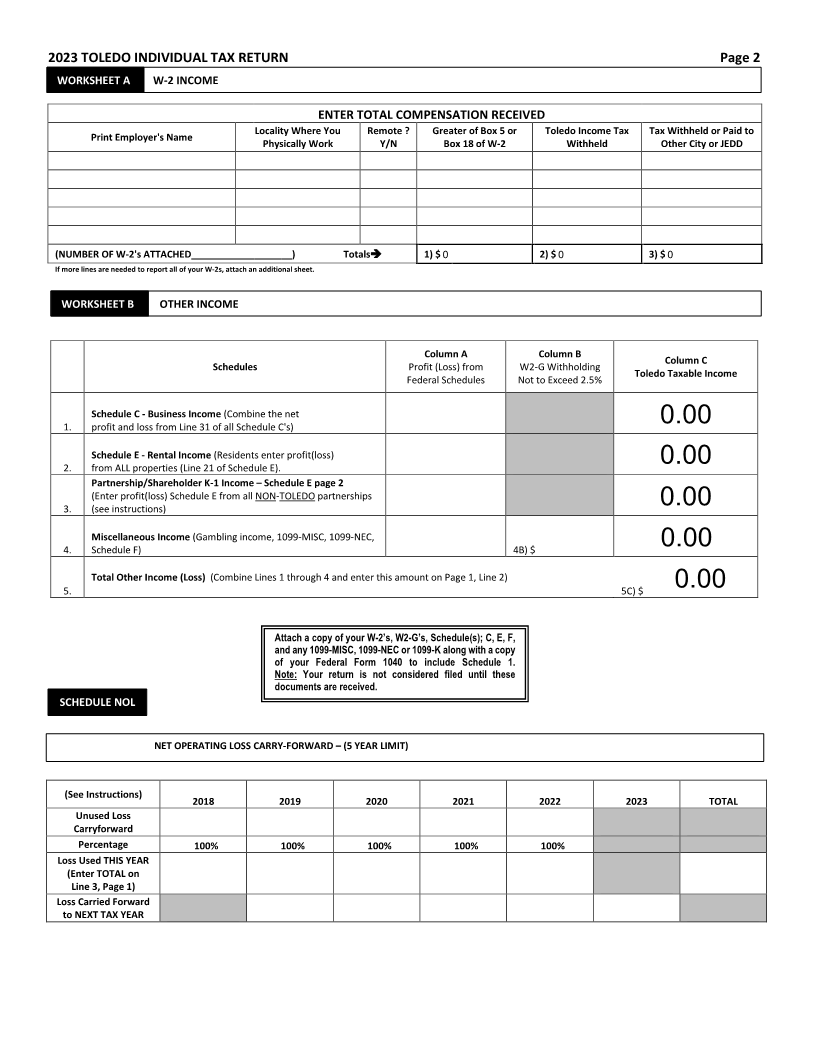

__________________________________________________________ Attach a copy of your W-2’s, W2-G’s, Schedule(s); C, E, F,

City ______________________ State _______________ Zip _________ and any 1099-MISC, 1099-NEC or 1099-K along with a copy

of your Federal Form 1040 to include Schedule 1.

Phone#(____)___________ Email Address_______________________ Note: Your return is not considered filed until these

May we leave detailed messages at the above phone or email address? Yes No documents are received.

SPOUSE First Name, Middle Initial, Last Name

Name____________________________________________________ File online at https://toledo.oh.gov/how-to-pay-your-income-taxes

1. W-2 Income (Box 1 from Worksheet A) 1. $__________________

2. Other Income (Line 5C from Worksheet B) – IF A LOSS enter here $(__________) and ZERO on Line 2 2. $__________________

I

NCOME 3. Net Loss Carryforward from the TOTAL box of the Schedule NOL (Figure cannot exceed amount on Line 2) 3. $__________________0.00

4. Adjusted Other Income (subtract Line 3 from 2) Cannot be a negative – see instructions 4. $__________________

5. Adjusted net income subject to Toledo income tax (add Lines 1 & 4) 5. $__________________0.00

0.00

AX 6. Toledo Income Tax – Enter 2.5% of Line 5 6. $__________________

T

7. Toledo Income Tax withheld by employers (add Box 2 from Worksheet A and Box 4B from Worksheet B) 7. $__________________

TAX 8. Tax withheld to other municipalities or JEDDs – Do not exceed 2.5% (Box 3 from Worksheet A) 8. $__________________

WITHHELD , 9. Tax paid to other municipalities or JEDDs (Attach other city/JEDD tax return). 9. $__________________

PAYMENTS

& C REDITS If you worked remotely, attach a copy of tax returns for other municipalities for which you are claiming credit.

The taxpayer declares that, I did not work remote during 2023. (signature required)________________________________

0.00

10. Estimated payments 10a $_________ and Credit from 2022 10b $______________ …………………. Total 10a + 10b = 10c. $__________________

11. Total allowable credits (add 7, 8, 9 and 10c) 11. $__________________0.00

BALANCE 12. Balance due (subtract Line 11 from Line 6) PAYMENT IS REQUIRED WITH RETURN if more than $10 12. $__________________0.00

D UE

13. Add 2210 assessment for Underpayment of Estimated Tax (see instructions) 13. $__________________

14. Add Penalty & Interest for Late Payment (see instructions) 14. $__________________

15. Balance due to include penalty & interest (add Lines 12 + 13 + 14) 15. $__________________0.00

CREDIT

FOR NEXT 16. If Line 11 is greater than Line 6, enter the difference here, if more than $10 16. $__________________

YEAR OR Disburse as follows: 17. CREDIT APPLIED TO NEXT YEAR (Check box at top of form) 17. $__________________

REFUND 18. REFUND (Check box at top of form) 18. $__________________

Important: This return is NOT considered filed until IF YOU OWE MORE THAN $200, QUARTERLY ESTIMATE PAYMENTS ARE REQUIRED

Signature signed by taxpayer and spouse (if applicable). and you may be subject to penalties and interest due to lack of estimated payments. Further you may

need to make estimate payments for 2024 if you expect to owe the same or greater amount next year.

The undersigned declares that this return (and accompanying schedules) is a Payment must accompany return. Make payable to “COMMISSIONER OF TAXATION” & MAIL TO:

true, correct and complete return for the taxable period stated, and that the

figures used are the same as used for federal income tax purposes and REFUND: PAYMENT ENCLOSED NO PAYMENT ENCLOSED

CITY OF TOLEDO INCOME TAX CITY OF TOLEDO INCOME TAX CITY OF TOLEDO INCOME TAX

understands that the information may be released to the tax administration PO BOX 902 PO BOX 993 PO BOX 929

of the city of residence and the I.R.S. Toledo, OH 43697-0902 Toledo, OH 43697-0993 Toledo, OH 43697-0929

Sign Your Paid Your

Here Signature______________________________Date____________ Preparer’s Signature_______________________________Date_______________

Use Only Print

If a joint return Spouse Name __________________________________PTIN______________

both must sign Signature ______________________________Date____________

CHECK BOX IF CITY MAY DISCUSS YOUR RETURN WITH YOUR TAX PREPARER Phone Number ____________________________________________