Enlarge image

Instructions for 2023 Individual Income Tax Returns

All Sharonville residents age 18 & older, and those under 18 who have municipal taxable income, are required to file a City of

Sharonville tax return each year regardless of whether or not any tax is due. All non-residents with income taxable to the City

of Sharonville that is not fully withheld by an employer are also required to file a Sharonville tax return.

Ohio state law now requires your Sharonville tax return to include a copy of your Federal form 1040 and all W-2s. To receive all available

deductions and credits please attach all applicable federal schedules, forms, and any other filed local tax returns.

Taxable income includes:

-Qualifying wages per IRS tax code section 3121(a). It includes many different types of income, including but not limited to

wages, sick pay, vacation pay, commissions, severance pay, settlements, bonuses, fringe benefits, stock options and deferred

compensation. It is usually found in Box 5 (Medicare wages) on your W-2, however there are some exceptions.

-Other Income (generally listed within line 8 of your Federal 1040 Schedule 1) including but not limited to gambling winnings,

taxable H.S.A. distributions, jury duty pay, prizes and awards, stock options, non-business rental income, scholarship distributions,

director’s fees.

-The net of all profits and losses from profession and/or business operations.

Income which is NOT taxable includes interest, dividends, capital gains (unless considered ordinary income), alimony received, military pay and

allowances, Social Security benefits, welfare benefits, unemployment insurance benefits, workers compensation, proceeds from qualified IRS defined

retirement plans and income specifically prohibited from taxation.

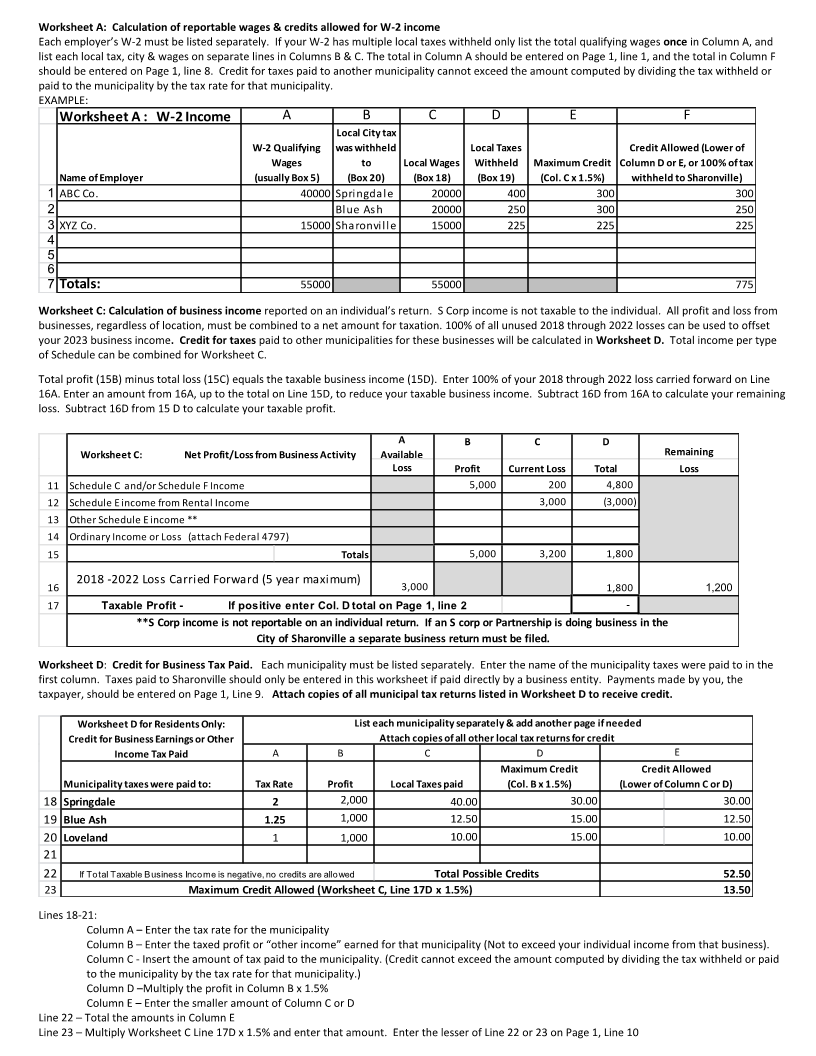

Line 1 Enter total qualifying wages from all W-2 forms for the tax year (generally located in Box 5 of each W-2). If you filled out Worksheet A on page

2 enter the amount from box 7A.

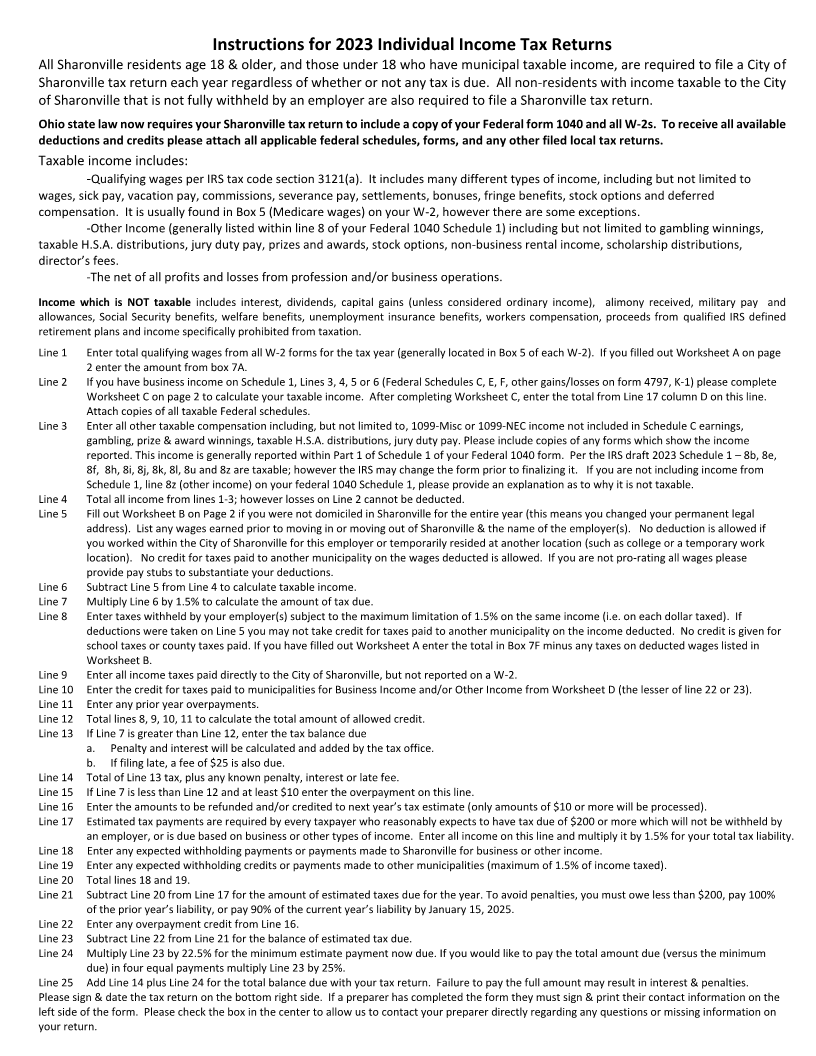

Line 2 If you have business income on Schedule 1, Lines 3, 4, 5 or 6 (Federal Schedules C, E, F, other gains/losses on form 4797, K-1) please complete

Worksheet C on page 2 to calculate your taxable income. After completing Worksheet C, enter the total from Line 17 column D on this line.

Attach copies of all taxable Federal schedules.

Line 3 Enter all other taxable compensation including, but not limited to, 1099-Misc or 1099-NEC income not included in Schedule C earnings,

gambling, prize & award winnings, taxable H.S.A. distributions, jury duty pay. Please include copies of any forms which show the income

reported. This income is generally reported within Part 1 of Schedule 1 of your Federal 1040 form. Per the IRS draft 2023 Schedule 1 –8b, 8e,

8f, 8h, 8i, 8j, 8k, 8l, 8u and 8z are taxable; however the IRS may change the form prior to finalizing it. If you are not including income from

Schedule 1, line 8z (other income) on your federal 1040 Schedule 1, please provide an explanation as to why it is not taxable.

Line 4 Total all income from lines 1-3; however losses on Line 2 cannot be deducted.

Line 5 Fill out Worksheet B on Page 2 if you were not domiciled in Sharonville for the entire year (this means you changed your permanent legal

address). List any wages earned prior to moving in or moving out of Sharonville & the name of the employer(s). No deduction is allowed if

you worked within the City of Sharonville for this employer or temporarily resided at another location (such as college or a temporary work

location). No credit for taxes paid to another municipality on the wages deducted is allowed. If you are not pro-rating all wages please

provide pay stubs to substantiate your deductions.

Line 6 Subtract Line 5 from Line 4 to calculate taxable income.

Line 7 Multiply Line 6 by 1.5% to calculate the amount of tax due.

Line 8 Enter taxes withheld by your employer(s) subject to the maximum limitation of 1.5% on the same income (i.e. on each dollar taxed). If

deductions were taken on Line 5 you may not take credit for taxes paid to another municipality on the income deducted. No credit is given for

school taxes or county taxes paid. If you have filled out Worksheet A enter the total in Box 7F minus any taxes on deducted wages listed in

Worksheet B.

Line 9 Enter all income taxes paid directly to the City of Sharonville, but not reported on a W-2.

Line 10 Enter the credit for taxes paid to municipalities for Business Income and/or Other Income from Worksheet D (the lesser of line 22 or 23).

Line 11 Enter any prior year overpayments.

Line 12 Total lines 8, 9, 10, 11 to calculate the total amount of allowed credit.

Line 13 If Line 7 is greater than Line 12, enter the tax balance due

a. Penalty and interest will be calculated and added by the tax office.

b. If filing late, a fee of $25 is also due.

Line 14 Total of Line 13 tax, plus any known penalty, interest or late fee.

Line 15 If Line 7 is less than Line 12 and at least $10 enter the overpayment on this line.

Line 16 Enter the amounts to be refunded and/or credited to next year’s tax estimate (only amounts of $10 or more will be processed).

Line 17 Estimated tax payments are required by every taxpayer who reasonably expects to have tax due of $200 or more which will not be withheld by

an employer, or is due based on business or other types of income. Enter all income on this line and multiply it by 1.5% for your total tax liability.

Line 18 Enter any expected withholding payments or payments made to Sharonville for business or other income.

Line 19 Enter any expected withholding credits or payments made to other municipalities (maximum of 1.5% of income taxed).

Line 20 Total lines 18 and 19.

Line 21 Subtract Line 20 from Line 17 for the amount of estimated taxes due for the year. To avoid penalties, you must owe less than $200, pay 100%

of the prior year’s liability, or pay 90% of the current year’s liability by January 15, 2025.

Line 22 Enter any overpayment credit from Line 16.

Line 23 Subtract Line 22 from Line 21 for the balance of estimated tax due.

Line 24 Multiply Line 23 by 22.5% for the minimum estimate payment now due. If you would like to pay the total amount due (versus the minimum

due) in four equal payments multiply Line 23 by 25%.

Line 25 Add Line 14 plus Line 24 for the total balance due with your tax return. Failure to pay the full amount may result in interest & penalties.

Please sign & date the tax return on the bottom right side. If a preparer has completed the form they must sign & print their contact information on the

left side of the form. Please check the box in the center to allow us to contact your preparer directly regarding any questions or missing information on

your return.