Enlarge image

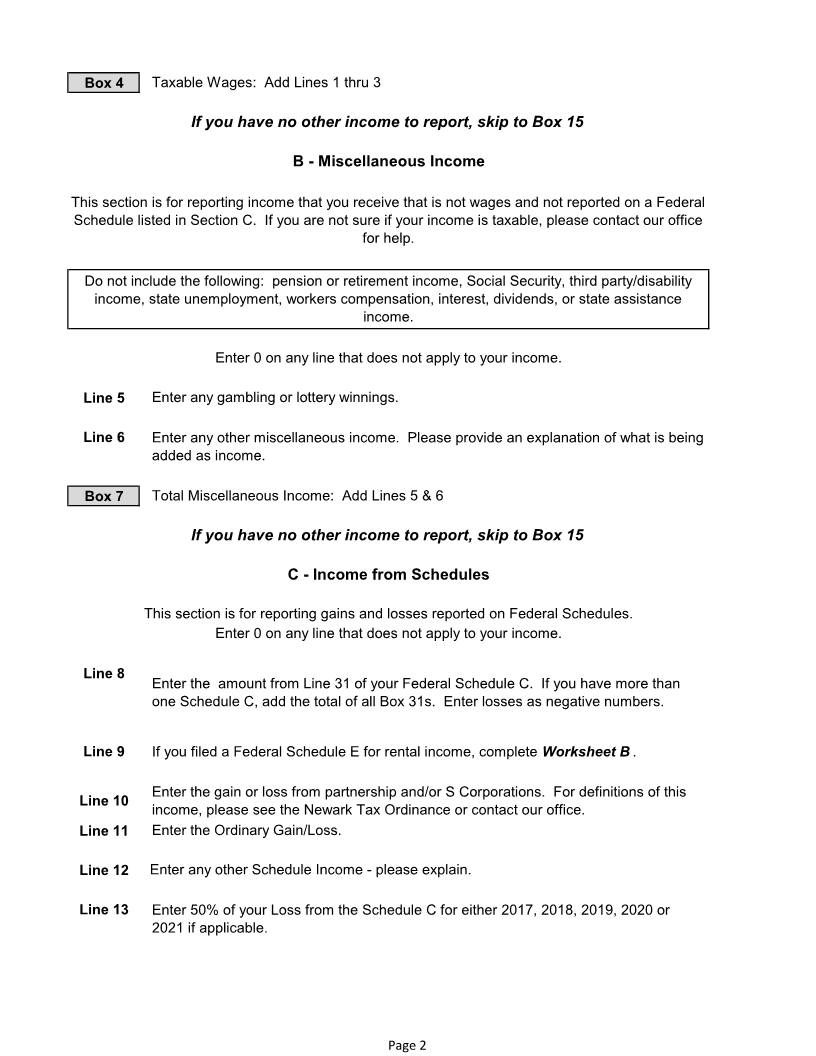

2023LF Instructions Part 1 - Account Information Account Enter your Newark Tax Account Number. If unknown, leave blank. Enter your full Social Security Number. If filing jointly, enter your spouse's full number. SSN State law now requires this information. Name Enter your name. If filing joint, enter spouse's name. Resident Enter your street address including city, state and zip code. Address Mailing Enter your mailing address if it is different from your street address. Address Phone Please enter a number where we can reach you if we have any questions. Email Please enter your Email address. Date If you moved into or out of Newark in 2023, please provide the dates. Filing Please place an X in the box beside your filing status. Status Part 2 - Taxable Income & Tax Calculation Please round all amounts to the nearest whole dollar. A - W-2 Income Line 1 Enter the total wages from Box 5 of all of your W-2s. If Box 5 is blank, use the higher of Box 1 or Box 18. Do not include: pension income, state unemployment, third party/disability pay or work study wages. Line 2 You may qualify to make adjustments to the wages reported on Line 1 under the following circumstances: 1 . you were a full year resident and turned 18 in 2023. 2 . you were a partial year resident in 2023. Complete Worksheet A . Line 3 BLANK Page 1