Enlarge image

EFW2 Reporting for Municipal Income Tax – 2023

Page 1 of 4

The file submitted for municipal income tax must include all of the records that are submitted to the Social Security Administration for W2 wage

reporting in the EFW2 format. This file in the EFW2 format must meet the same requirements as the Social Security Administration. The file

must include all of the following record types:

RA - Submitter Record, RE - Employer Record, RW - Wage Record, RS - State Wage Record, (Used for City reporting), RT - Total

Record, RF - Final Record.

Instructions per the Social Security Administration Publication No. 42-007 EFW2 Tax Year 2023 V.1

3.2 File Requirements

3.2.1 RA (Submitter) Record ***REQUIRED***

• Must be the first data record on each file.

• Make the address entries specific enough to ensure proper delivery.

3.2.2 RE (Employer) Record ***REQUIRED***

• The first RE (Employer) Record must follow the RA (Submitter) Record.

• Following the last RW(Employee)/RO (Employee Optional)/RS (State) Record for the employer, create an RT (Total)/RU (Total

Optional)/RV ( State Total) Record and then create either the:

- RE (Employer) Record for the next employer in the submission; or

- RF (Final) Record if this is the last report in the submission.

• When the same employer information applies to multiple RW (Employee)/RO (Employee Optional) Records, group them together

under a single RE (Employer) Record. Unnecessary RE (Employer) Records can cause serious processing errors or delays.

3.2.3 RW (Employee) Record and RO (Employee Optional) Record ***RW REQUIRED***

• Following each RE (Employer) Record, include the RW (Employee) Record(s) for that RE (Employer) Record immediately followed by

the RO (Employee Optional) Record(s). If an RO (Employee Optional) Record is required for an employee, it must immediately follow

that employee’s RW (Employee) Record.

• The RO (Employee Optional) Record is required if one or more of the fields must be completed because the field(s) applies to an

employee. If just one field applies, the entire record must be completed.

• Do not complete an RO (Employee Optional) Record if only blanks and zeros would be entered in positions 3 - 512. Write RO

(Employee Optional) Records only for those employees who have RO (Employee Optional) Record information to report.

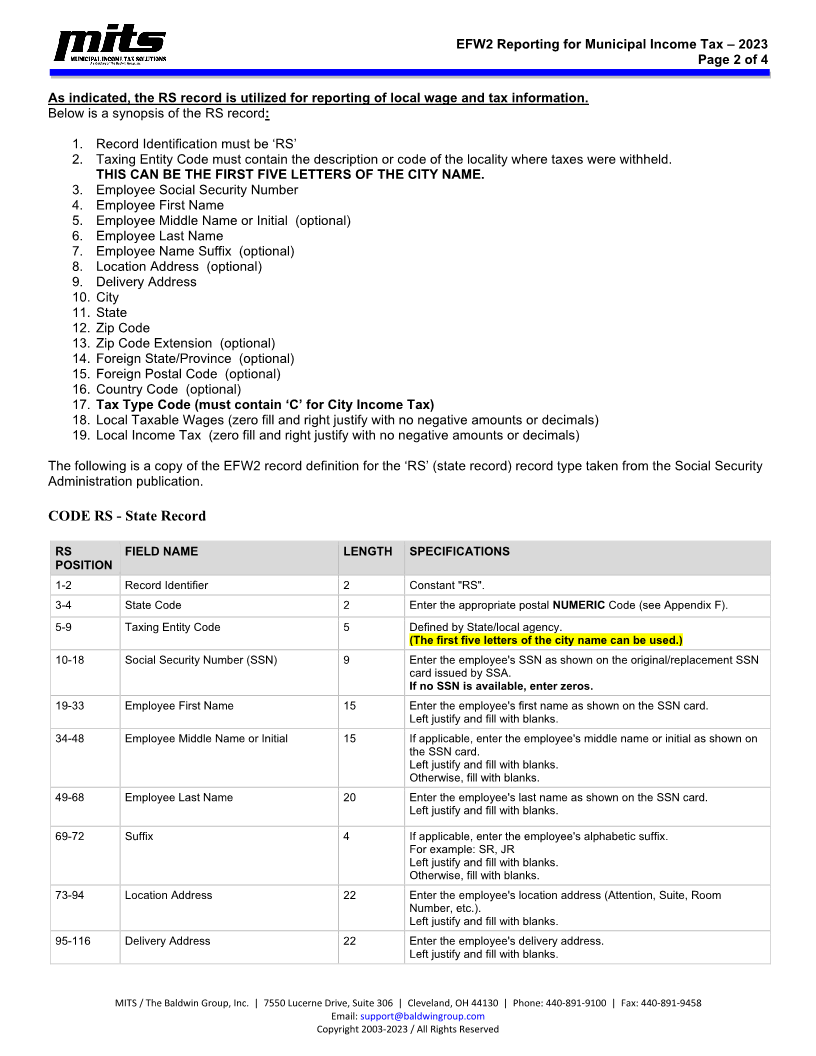

3.2.4 RS (State) Record) ***RS REQUIRED***

• The RS (State) Record is an optional record; SSA and IRS do not read or process this information.

HOWEVER, this is the record municipalities use for local wage and local income tax information!

• Contact your State Revenue Agency to confirm the use of this record format and for questions about field definitions, covering

transmittals, reporting procedures, etc. The IRS has a helpful website for State contacts at www.irs.gov/businesses/small-

businesses-self-employed/state-links-1 .

• The RS (State) Record should follow the related RW (Employee) Record (or RO (Employee Optional) Record).

• If there are multiple RS (State) Records for an employee, include all of the RS (State) Records for the employee immediately after the

related RW (Employee) or RO (Employee Optional) Record.

• Do not generate this record if only blanks would be entered after the record identifier.

3.2.5 RT (Total) Record and RU (Total Optional) Record ***RT REQUIRED***

• The RT (Total) Record must be generated for each RE (Employer) Record.

• The RU (Total Optional) Record is required if an RO (Employee Optional) Record is prepared.

• If just one field applies, the entire record must be completed.

• Do not complete an RU (Total Optional) Record if only zeros would be entered in positions 3 - 512.

3.2.6 RV (State Total) Record)

• The RV (State Total) Record is an optional record; SSA and IRS do not read or process this information.

• Contact your State Revenue Agency to confirm the use of this record format and for questions about field definitions, covering

transmittals, reporting procedures, etc.

• The RV (State Total) Record should follow the RU (Total Optional) Record. If no RU (Total Optional) Record is in the submission, then

it should follow the RT (Total) Record.

• If no RS (State) Records are prepared, do not prepare an RV (State Total) Record.

• Do not generate this record if only blanks would be entered after the record identifier.

3.2.7 RF (Final) Record ***REQUIRED***

• Must be the last record on the file.

• Must appear only once on each file.

• Do not create a file that contains any data recorded after the RF (Final) Record. Your submission will not be processed if it contains

data after the RF (Final) Record.

MITS / The Baldwin Group, Inc. | 7550 Lucerne Drive, Suite 306 | Cleveland, OH 44130 | Phone: 440-891-9100 | Fax: 440-891-9458

Email: support@baldwingroup.com

Copyright 2003-2023 / All Rights Reserved