Enlarge image

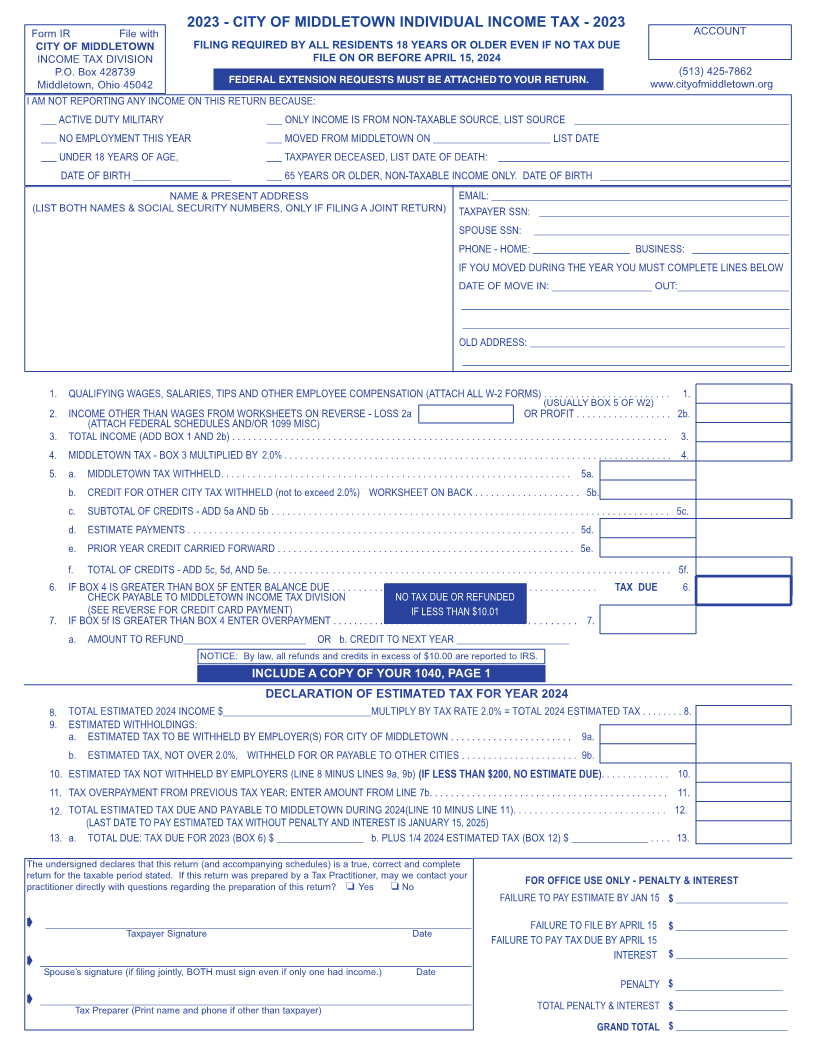

2023 - CITY OF MIDDLETOWN INDIVIDUAL INCOME TAX - 2023

Form IR File with ACCOUNT

CITY OF MIDDLETOWN FILING REQUIRED BY ALL RESIDENTS 18 YEARS OR OLDER EVEN IF NO TAX DUE

INCOME TAX DIVISION FILE ON OR BEFORE APRIL 15, 2024

P.O. Box 428739 FEDERAL EXTENSION REQUESTS MUST BE ATTACHED TO YOUR RETURN. (513) 425-7862

Middletown, Ohio 45042 EXTENSION REQUESTS MUST BE RECEIVED BEFORE APRIL 15,52016 www.cityofmiddletown.org

I AM NOT REPORTING ANY INCOME ON THIS RETURN BECAUSE:

___ ACTIVE DUTY MILITARY ___ ONLY INCOME IS FROM NON-TAXABLE SOURCE, LIST SOURCE __________________________________________

___ NO EMPLOYMENT THIS YEAR ___ MOVED FROM MIDDLETOWN ON _______________________ LIST DATE

___ UNDER 1618YEARS OF AGE, ___ TAXPAYER DECEASED, LIST DATE OF DEATH: _________________________________________________________

DATE OF BIRTH ___________________ ___ 65 YEARS OR OLDER, NON-TAXABLE INCOME ONLY. DATE OF BIRTH _____________________________________

IF NAME OR ADDRESSNAMEIS INCORRECT& PRESENTMAKEADDRESSNECESSARY CHANGES EMAIL: __________________________________________________________

(LIST BOTH(LIST BOTHNAMESNAMES& SOCIAL& SOCIALSECURITYSECURITYNUMBERS,NUMBERS IFONLYFILINGIFAFILINGJOINT RETURN)A JOINT RETURN) TAXPAYER SSN: _________________________________________________

SPOUSE SSN: __________________________________________________

PHONE - HOME: ___________________ BUSINESS: ___________________

IF YOU MOVED DURING THE YEAR YOU MUST COMPLETE LINES BELOW

DATE OF MOVE IN: __________________ OUT:____________________DATE OF MOVE: _________________________________________________

___________________________________________________________PRESENT ADDRESS: _____________________________________________

________________________________________________________________

OLD ADDRESS: __________________________________________________

________________________________________________________________

1. QUALIFYING WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (ATTACH ALL W-2 FORMS) . . . . . . . . . . . . . . . . . . . . . . . . 1.

(USUALLY BOX 5 OF W2)

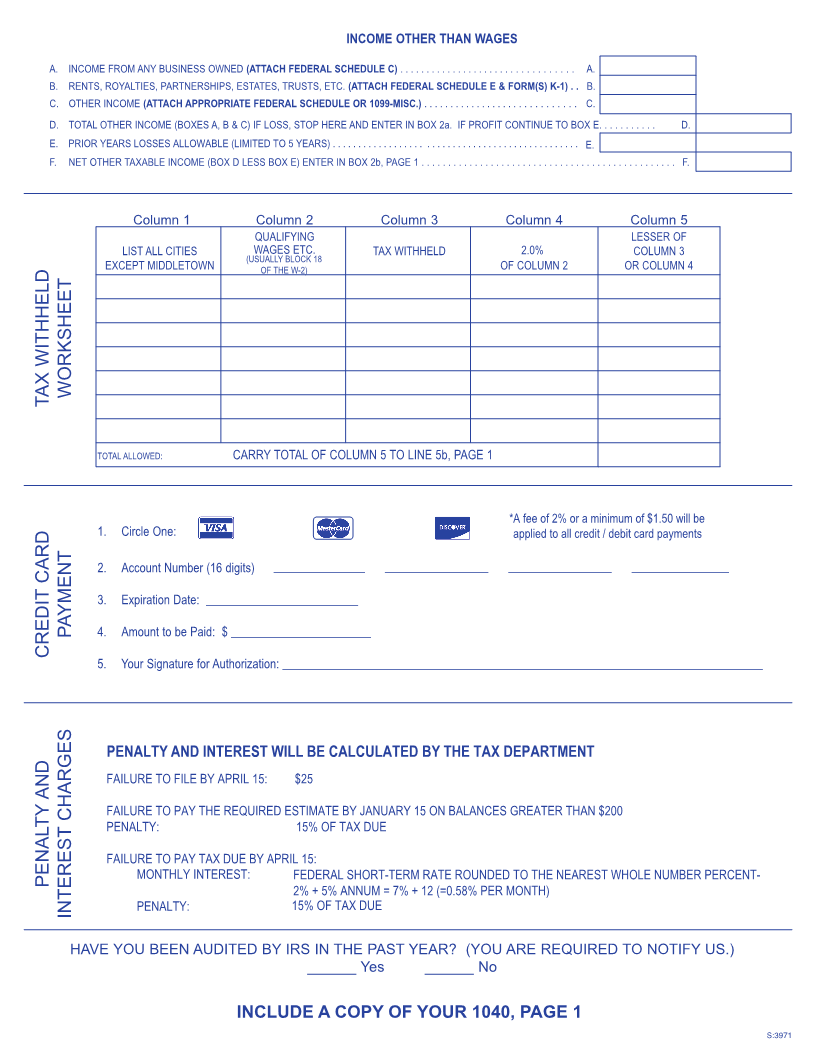

2. INCOME OTHER THAN WAGES FROM WORKSHEETS ON REVERSE - LOSS 2a OR PROFIT . . . . . . . . . . . . . . . . . . 2b.

(ATTACH FEDERAL SCHEDULES AND/OR 1099 MISC)

3. TOTAL INCOME (ADD BOX 1 AND 2b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. MIDDLETOWN TAX - BOX 3 MULTIPLIED BY 1.75%2.0%. ... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. a. MIDDLETOWN TAX WITHHELD. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5a.

b. CREDIT FOR OTHER CITY TAX WITHHELD (not to exceed 1.75%)2.0%)WORKSHEET ON BACK . . . . . . . . . . . . . . . . . . . . 5b.

c. SUBTOTAL OF CREDITS - ADD 5a AND 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5c.

d. ESTIMATE PAYMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5d.

e. PRIOR YEAR CREDIT CARRIED FORWARD . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5e.

f. TOTAL OF CREDITS - ADD 5c, 5d, AND 5e. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5f.

6. IF BOX 4 IS GREATER THAN BOX 5F ENTER BALANCE DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

CHECK PAYABLE TO MIDDLETOWN INCOME TAX DIVISION NONOTAXTAXDUEDUEOROR REFUNDEDREFUNDED

(SEE REVERSE FOR CREDIT CARD PAYMENT) IFIF LESSLESSTHANTHAN$10.01$3.00

7. IF BOX 5f IS GREATER THAN BOX 4 ENTER OVERPAYMENT .............................. . . . . . . . . . . . . . . . . 7.

a. AMOUNT TO REFUND________________________ OR b. CREDIT TO NEXT YEAR ______________________

NOTICE: By law, all refunds and credits in excess of $10.00 are reported to IRS.

INCLUDE A COPY OF YOUR 1040, PAGE 1INCLUDE A COPY OF YOUR 1040, PAGE 1

DECLARATION OF ESTIMATED TAX FOR YEAR 2024

8. TOTAL ESTIMATED 2024 INCOME $_____________________________MULTIPLY BY TAX RATE 2.0% = TOTAL 2024 ESTIMATED TAX . . . . . . . . 8.

9. ESTIMATED WITHHOLDINGS:

a. ESTIMATED TAX TO BE WITHHELD BY EMPLOYER(S) FOR CITY OF MIDDLETOWN . . . . . . . . . . . . . . . . . . . . . . . 9a.

b. ESTIMATED TAX, NOT OVER 1.75%,2.0%, WITHHELD FOR OR PAYABLE TO OTHER CITIES . . . . . . . . . . . . . . . . . . . . . . 9b.

10. ESTIMATED TAX NOT WITHHELD BY EMPLOYERS (LINE 8 MINUS LINES 9a, 9b) (IF LESS(IF LESSTHANTHAN$200, NO$200,ESTIMATENO ESTIMATEDUE) . .DUE). . . . . . . . . . . 10.

11. TAX OVERPAYMENT FROM PREVIOUS TAX YEAR: ENTER AMOUNT FROM LINE 7b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. TOTAL ESTIMATED TAX DUE AND PAYABLE TO MIDDLETOWN DURING 2024(LINE 10 MINUS LINE 11). . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

(LAST DATE TO PAY ESTIMATED TAX WITHOUT PENALTY AND INTEREST IS JANUARY 15, 2025)

13. a. TOTAL DUE: TAX DUE FOR 2023(BOX 6) $ _________________ b. PLUS 1/4 2024 ESTIMATED TAX (BOX 12) $ _______________ . . . . 13.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete

return for the taxable period stated. If this return was prepared by a Tax Practitioner, may we contact your

practitioner directly with questions regarding the preparation of this return? Yes No

FAILURE TO PAY ESTIMATE BY JAN 15 $ _______________________

__________________________________________________________________________________ FAILURE TO FILE BY APRIL 15 $ _______________________

Taxpayer Signature Date ______________________

FAILURE TO PAY TAX DUE BY APRIL 15

___________________________________________________________________________________ INTEREST $_____________________________________________

Spouse’s signature (if filing jointly, BOTH must sign even if only one had income.) Date

PENALTYTEREST $ _____________________

___________________________________________________________________________________ TOTAL PENALTY & INTEREST $ _______________________

Tax Preparer (Print name and phone if other than taxpayer)

GRAND TOTAL $ _______________________