Enlarge image

City of Fairfield

Annual

Income Tax Division Phone: 513-867-5327

Reconciliation 701 Wessel Dr Fax: 513-867-5333

Fairfield, OH 45014

Submit by

www.fairfield-city.org

February 29, 2024

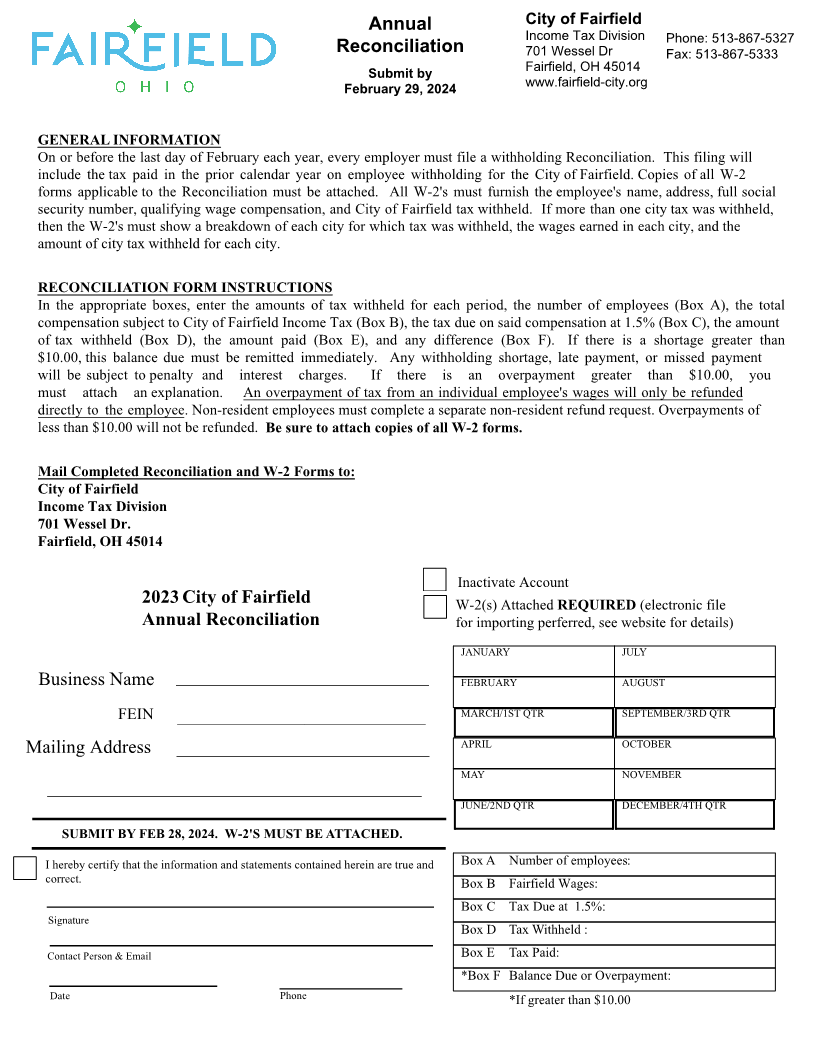

GENERAL INFORMATION

On or before the last day of February each year , every employer must file a withholding Reconciliation. This filing will

include the tax paid in the prior calendar year on employee withholding for the City of Fairfield. Copies of all W-2

forms applicable to the Reconciliation must be attached. All W-2's must furnish the employee's name, address, full social

security number, qualifying wage compensation, and City of Fairfield tax withheld. If more than one city tax was withheld,

then the W-2's must show a breakdown of each city for which tax was withheld, the wages earned in each city, and the

amount of city tax withheld for each city.

RECONCILIATION FORM INSTRUCTIONS

In the appropriate boxes, enter the amounts of tax withheld for each period, the number of employees (Box A), the total

compensation subject to City of Fairfield Income Tax (Box B), the tax due on said compensation 1.5 at % (Box C), the amount

of tax withheld (Box D), the amount paid (Box E), and any difference (Box F). If there is a shortage greater than

$10.00, this balance due must be remitted immediately. Any withholding shortage , late payment, or missed payment

will be subject to penalty and interest charges. If there is an overpayment greater than $10.00, you

must attach an explanation. An overpayment of tax from an individual employee's wages will only be refunded

directly to the employee. Non-resident employees must complete a separate non-resident refund request. Overpayments of

less than $10.00 will not be refunded. Be sure to attach copies of all W-2 forms.

Mail Completed Reconciliation and W-2 Forms to:

City of Fairfield

Income Tax Division

701 Wessel Dr.

Fairfield, OH 45014

Inactivate Account

2023 City of Fairfield W-2(s) Attached REQUIRED (electronic file

Annual Reconciliation for importing perferred, see website for details)

JANUARY JULY

Business Name ___________________________ FEBRUARY AUGUST

FEIN _____________________________________ MARCH/1ST QTR SEPTEMBER/3RD QTR

APRIL OCTOBER

Mailing Address ___________________________

MAY NOVEMBER

________________________________________

JUNE/2ND QTR DECEMBER/4TH QTR

SUBMIT BY FEB 28, 2024. W-2'S MUST BE ATTACHED.

I hereby certify that the information and statements contained herein are true and Box A Number of employees:

correct. Box B Fairfield Wages:

Box C Tax Due at 1.5%:

Signature

Box D Tax Withheld :

Contact Person & Email Box E Tax Paid:

*Box F Balance Due or Overpayment:

Date Phone *If greater than $10.00