Enlarge image

losses from work done, services performed or

rendered, or business conducted in Columbus.

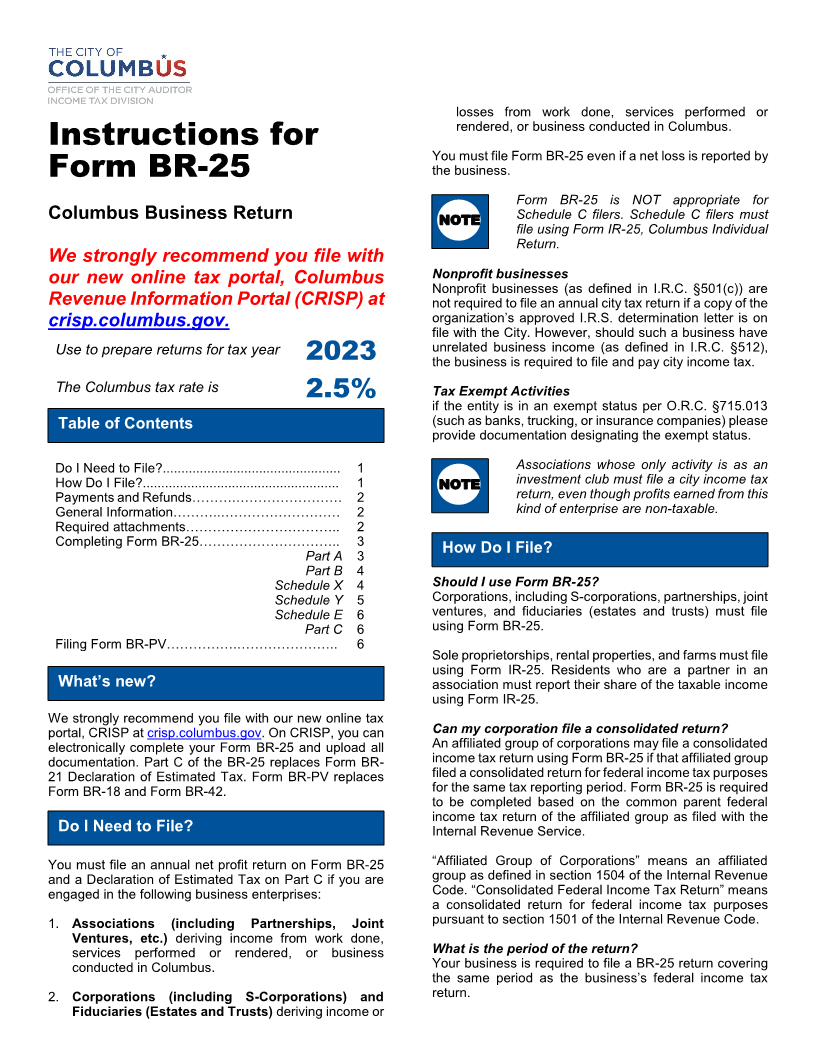

Instructions for

You must file Form BR-25 even if a net loss is reported by

Form BR-25 the business.

Form BR-25 is NOT appropriate for

Columbus Business Return NOTE Schedule C filers. Schedule C filers must

file using Form IR-25, Columbus Individual

Return.

We strongly recommend you file with

our new online tax portal, Columbus Nonprofit businesses

Nonprofit businesses (as defined in I.R.C. §501(c)) are

Revenue Information Portal (CRISP) at not required to file an annual city tax return if a copy of the

crisp.columbus.gov. organization’s approved I.R.S. determination letter is on

file with the City. However, should such a business have

Use to prepare returns for tax year unrelated business income (as defined in I.R.C. §512),

2023 the business is required to file and pay city income tax.

The Columbus tax rate is Tax Exempt Activities

2.5%

if the entity is in an exempt status per O.R.C. §715.013

Table of Contents (such as banks, trucking, or insurance companies) please

provide documentation designating the exempt status.

Do I Need to File?................................................ 1 Associations whose only activity is as an

How Do I File?..................................................... 1 NOTE investment club must file a city income tax

Payments and Refunds……….…………………… 2 return, even though profits earned from this

General Information………..……………………… 2 kind of enterprise are non-taxable.

Required attachments…………………………….. 2

Completing Form BR-25………………………….. 3

Part A 3 How Do I File?

Part B 4

Schedule X 4 Should I use Form BR-25?

Schedule Y 5 Corporations, including S-corporations, partnerships, joint

Schedule E 6 ventures, and fiduciaries (estates and trusts) must file

Part C 6 using Form BR-25.

Filing Form BR-PV…………….………………….. 6

Sole proprietorships, rental properties, and farms must file

using Form IR-25. Residents who are a partner in an

What’s new? association must report their share of the taxable income

using Form IR-25.

We strongly recommend you file with our new online tax

portal, CRISP at crisp.columbus.gov. On CRISP, you can Can my corporation file a consolidated return?

electronically complete your Form BR-25 and upload all An affiliated group of corporations may file a consolidated

documentation. Part C of the BR-25 replaces Form BR- income tax return using Form BR-25 if that affiliated group

21 Declaration of Estimated Tax. Form BR-PV replaces filed a consolidated return for federal income tax purposes

Form BR-18 and Form BR-42. for the same tax reporting period. Form BR-25 is required

to be completed based on the common parent federal

income tax return of the affiliated group as filed with the

Do I Need to File? Internal Revenue Service.

You must file an annual net profit return on Form BR-25 “Affiliated Group of Corporations” means an affiliated

and a Declaration of Estimated Tax on Part C if you are group as defined in section 1504 of the Internal Revenue

engaged in the following business enterprises: Code. “Consolidated Federal Income Tax Return” means

a consolidated return for federal income tax purposes

1. Associations (including Partnerships, Joint pursuant to section 1501 of the Internal Revenue Code.

Ventures, etc.) deriving income from work done,

services performed or rendered, or business What is the period of the return?

conducted in Columbus. Your business is required to file a BR-25 return covering

the same period as the business’s federal income tax

2. Corporations (including S-Corporations) and return.

Fiduciaries (Estates and Trusts) deriving income or