Enlarge image

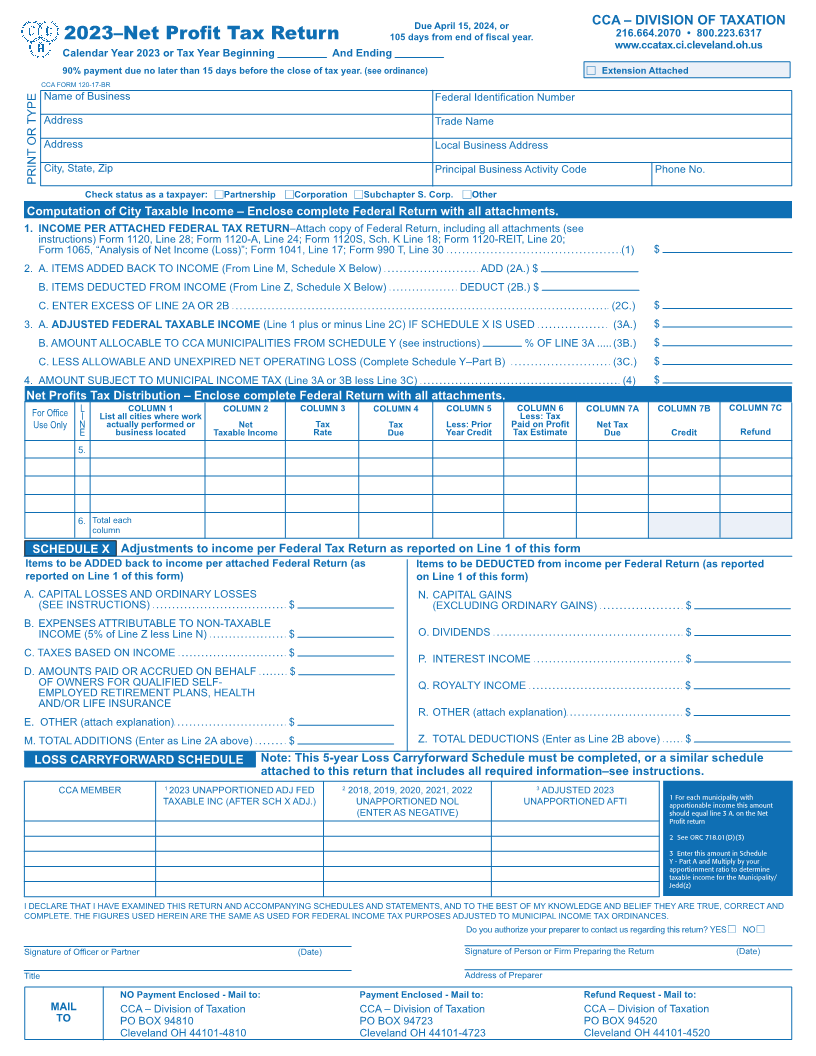

Due April 15, 2024, or CCA – DIVISION OF TAXATION

2023–Net Profit Tax Return 105 days from end of fiscal year. 216.664.2070 • 800.223.6317

www.ccatax.ci.cleveland.oh.us

Calendar Year 2023 or Tax Year Beginning And Ending

90% payment due no later than 15 days before the close of tax year. (see ordinance) Extension Attached

CCA FORM 120-17-BR @

Name of Business Federal Identification Number

Address Trade Name

Address Local Business Address

City, State, Zip Principal Business Activity Code Phone No.

PRINT OR TYPE

Check status as a taxpayer: Partnership Corporation Subchapter S. Corp. Other

Computation of City Taxable Income@ – Enclose@ complete@ Federal Return with@all attachments.

1. INCOME PER ATTACHED FEDERAL TAX RETURN–Attach copy of Federal Return, including all attachments (see

instructions) Form 1120, Line 28; Form 1120-A, Line 24; Form 1120S, Sch. K Line 18; Form 1120-REIT, Line 20;

Form 1065, “Analysis of Net Income (Loss)”; Form 1041, Line 17; Form 990 T, Line 30 (1) $

2. A. ITEMS ADDED BACK TO INCOME (From Line M, Schedule X Below) ADD (2A.) $

B. ITEMS DEDUCTED FROM INCOME (From Line Z, Schedule X Below) DEDUCT (2B.) $

C. ENTER EXCESS OF LINE 2A OR 2B (2C.) $

3. A. ADJUSTED FEDERAL TAXABLE INCOME (Line 1 plus or minus Line 2C) IF SCHEDULE X IS USED (3A.) $

B. AMOUNT ALLOCABLE TO CCA MUNICIPALITIES FROM SCHEDULE Y (see instructions) % OF LINE 3A ..... (3B.) $

C. LESS ALLOWABLE AND UNEXPIRED NET OPERATING LOSS (Complete Schedule Y–Part B) (3C.) $

4. AMOUNT SUBJECT TO MUNICIPAL INCOME TAX (Line 3A or 3B less Line 3C) (4) $

Net Profits Tax Distribution – Enclose complete Federal Return with all attachments.

For Office L COLUMN 1 COLUMN 2 COLUMN 3 COLUMN 4 COLUMN 5 COLUMN 6 COLUMN 7A COLUMN 7B COLUMN 7C

I List all cities where work Less: Tax

Use Only N actually performed or Net Tax Tax Less: Prior Paid on Profit Net Tax

E business located Taxable Income Rate Due Year Credit Tax Estimate Due Credit Refund

5.

6. Total each

column

SCHEDULE X Adjustments to income per Federal Tax Return as reported on Line 1 of this form

Items to be ADDED back to income per attached Federal Return (as Items to be DEDUCTED from income per Federal Return (as reported

reported on Line 1 of this form) on Line 1 of this form)

A. CAPITAL LOSSES AND ORDINARY LOSSES N. CAPITAL GAINS

(SEE INSTRUCTIONS) $ (EXCLUDING ORDINARY GAINS) $

B. EXPENSES ATTRIBUTABLE TO NON-TAXABLE

INCOME (5% of Line Z less Line N) $ O. DIVIDENDS $

C. TAXES BASED ON INCOME $ P. INTEREST INCOME $

D. AMOUNTS PAID OR ACCRUED ON BEHALF $

OF OWNERS FOR QUALIFIED SELF- Q. ROYALTY INCOME $

EMPLOYED RETIREMENT PLANS, HEALTH

AND/OR LIFE INSURANCE

R. OTHER (attach explanation) $

E. OTHER (attach explanation) $

M. TOTAL ADDITIONS (Enter as Line 2A above) $ Z. TOTAL DEDUCTIONS (Enter as Line 2B above) $

LOSS CARRYFORWARD SCHEDULE Note: This 5-year Loss Carryforward Schedule must be completed, or a similar schedule

attached to this return that includes all required information–see instructions.

CCA MEMBER 1 2023 UNAPPORTIONED ADJ FED 2 2018, 2019, 2020, 2021, 2022 3 ADJUSTED 2023 1 For each municipality with

TAXABLE INC (AFTER SCH X ADJ.) UNAPPORTIONED NOL UNAPPORTIONED AFTI apportionable income this amount

(ENTER AS NEGATIVE) should equal line 3 A. on the Net

Profit return

2 See ORC 718.01(D)(3)

3 Enter this amount in Schedule

Y - Part A and Multiply by your

apportionment ratio to determine

taxable income for the Municipality/

Jedd(z)

I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF THEY ARE TRUE, CORRECT AND

COMPLETE. THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES ADJUSTED TO MUNICIPAL INCOME TAX ORDINANCES.

Do you authorize your preparer to contact us regarding this return? YES NO

@ @

Signature of Officer or Partner (Date) Signature of Person or Firm Preparing the Return (Date)

Title Address of Preparer

NO Payment Enclosed - Mail to: Payment Enclosed - Mail to: Refund Request - Mail to:

MAIL CCA – Division of Taxation CCA – Division of Taxation CCA – Division of Taxation

TO PO BOX 94810 PO BOX 94723 PO BOX 94520

Cleveland OH 44101-4810 Cleveland OH 44101-4723 Cleveland OH 44101-4520