- 3 -

Enlarge image

|

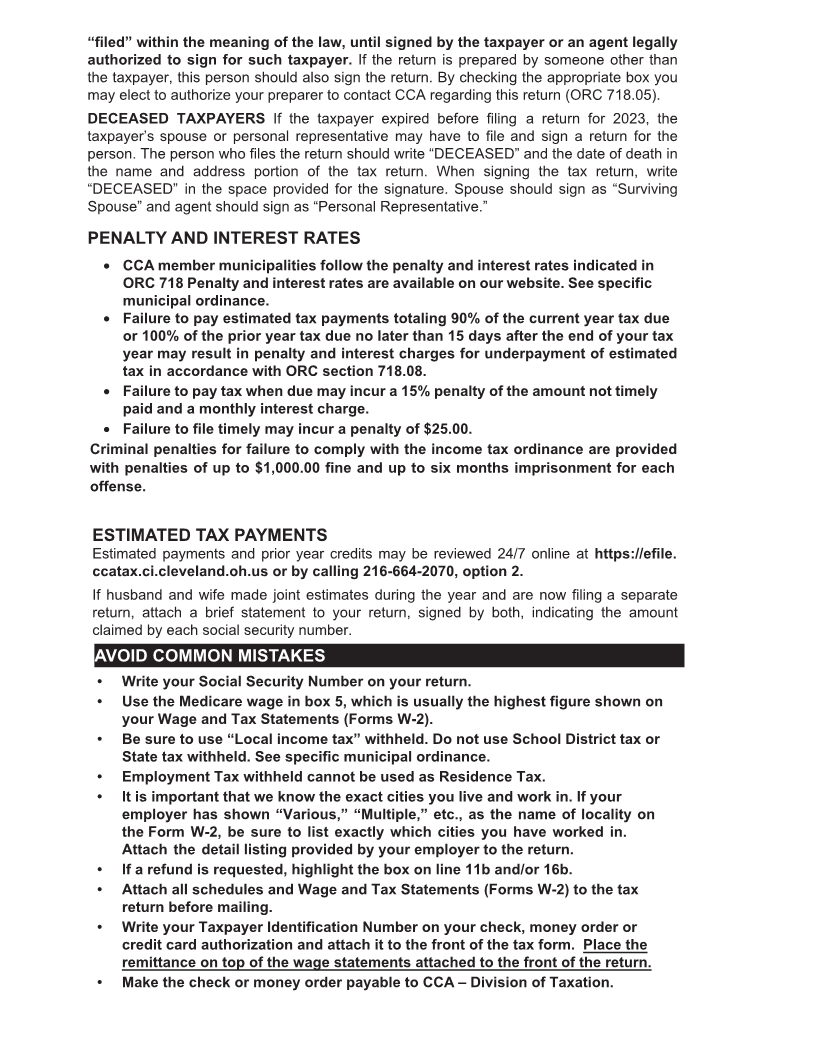

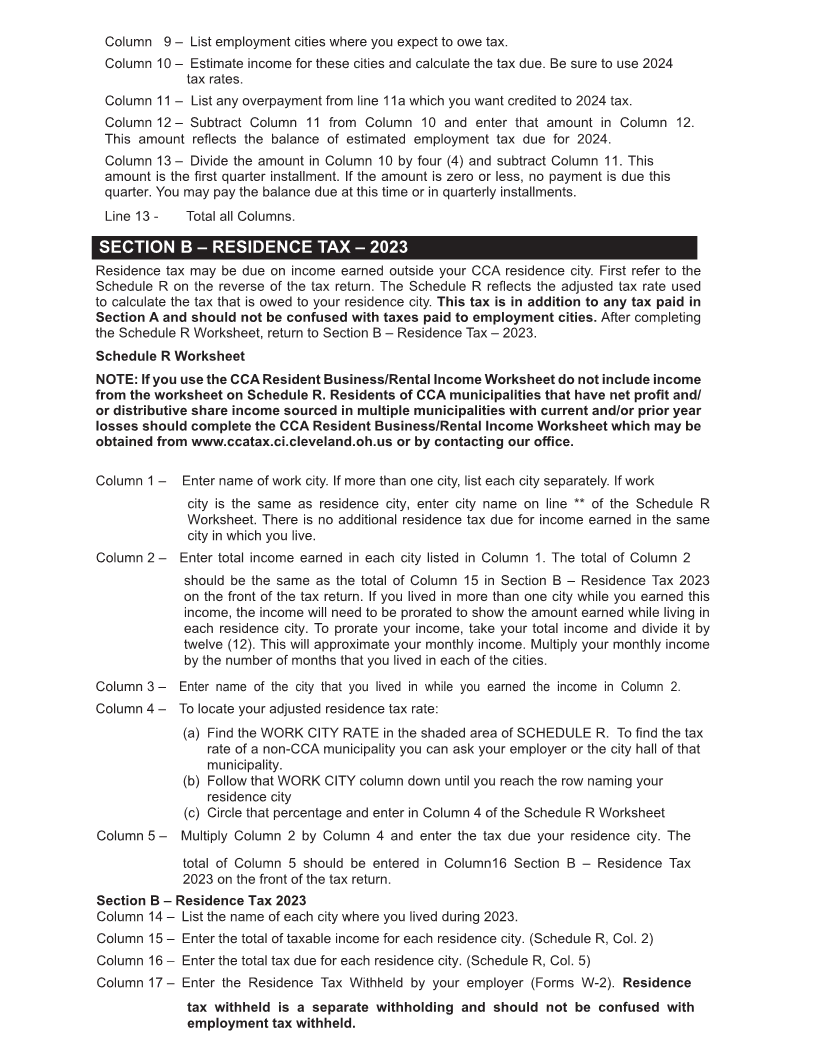

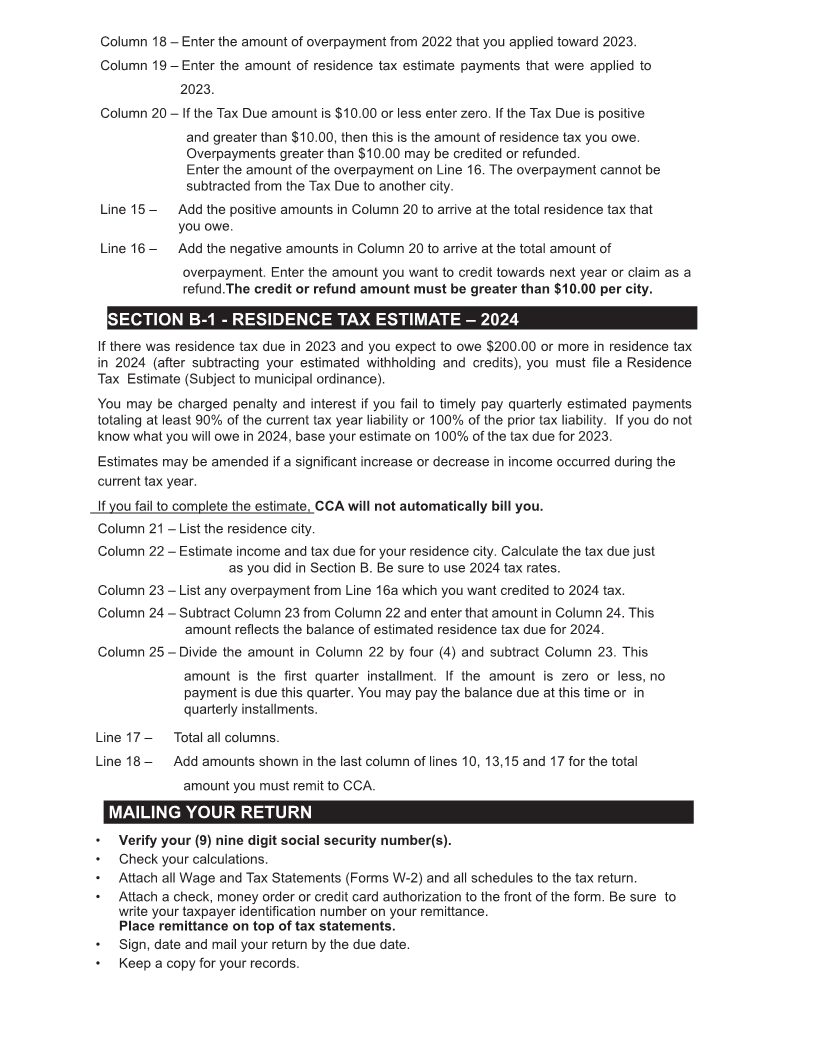

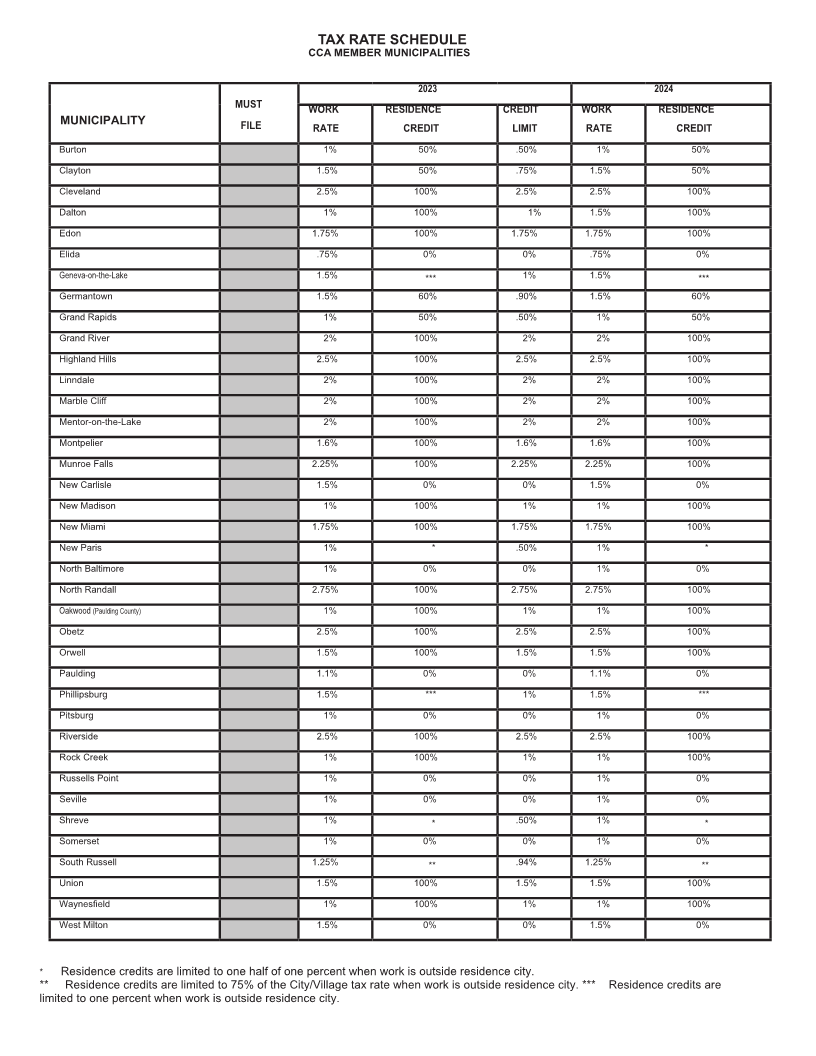

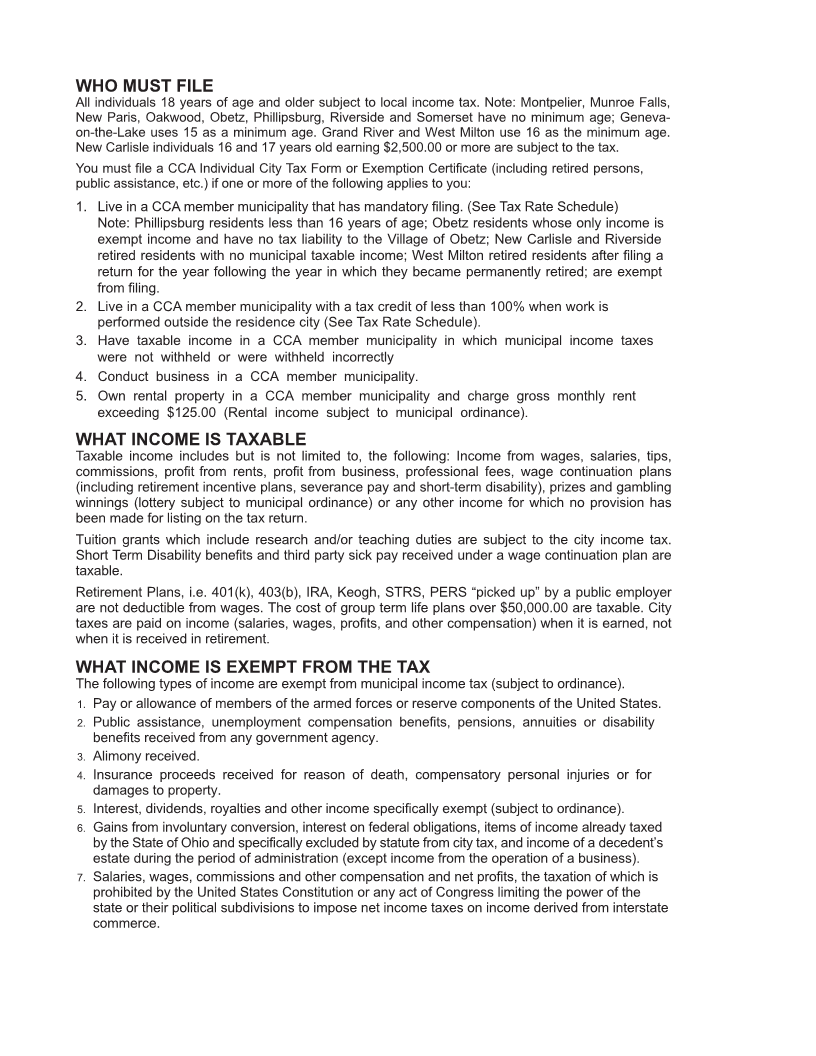

7. 6. 5. 4. 3. 2. 1. The following types of income are exempt from municipal income tax (subject to ordinance). WHAT INCOME IS EXEMPT FROM THE TAX when it is received in retirement. taxes are paid on income (salaries, wages, profits, and other compensation) when it is earned, not are not deductible from wages. The cost of group term life plans over $50,000.00 are taxable. City Retirement Plans, i.e. 401(k), 403(b), IRA, Keogh, STRS, PERS “picked up” by a public employer taxable. Short Term Disability benefits and third party sick pay received under a wage continuation plan are Tuition grants which include research and/or teaching duties are subject to the city income tax. been made for listing on the tax return. winnings (lottery subject to municipal ordinance) or any other income for which no provision has (including retirement incentive plans, severance pay and short-term disability), prizes and gambling commissions, profit from rents, profit from business, professional fees, wage continuation plans Taxable WHAT INCOME IS TAXABLE 5. 4. 3. 2. 1. public assistance, etc.) if one or more of the following applies to you: You must file a CCA Individual City Tax Form or Exemption Certificate (including retired persons, New Carlisle individuals 16 and 17 years old earning $2,500.00 or more are subject to the tax. on-the-Lake uses 15 as a minimum age. Grand River and West Milton use 16 as the minimum age. New Paris, Oakwood, Obetz, Phillipsburg, Riverside and Somerset have no minimum age; Geneva- All individuals 18 years of age and older subject to local income tax. Note: Montpelier, Munroe Falls, WHO MUST FILE

commerce. state or their political subdivisions to impose net income taxes on income derived from prohibited by the United States Constitution or any act of Congress limiting the power of the Salaries, wages, commissions and other compensation and net profits, the taxation of which is estate during the period of administration (except income from the operation of a business). by the State of Ohio and specifically excluded by statute from city tax, and income of a decedent’s Gains from involuntary conversion, interest on federal obligations, items of income already taxed Interest, dividends, royalties and other income specifically exempt (subject to ordinance). damages to property. Insurance Alimony received. benefits received from any government agency. Public Pay or allowance of members of the armed forces or reserve components of the United States. exceeding Own Conduct were Have performed outside the residence city (See Tax Rate Schedule). Live in a CCA member municipality with a tax credit of less than 100% when work is from filing. return for the year following the year in which they became permanently retired; are exempt retired residents with no municipal taxable income; West Milton retired residents after filing a exempt income and have no tax liability to the Village of Obetz; New Carlisle and Riverside Note: Phillipsburg residents less than 16 years of age; Obetz residents whose only income is Live in a CCA member municipality that has mandatory filing. (See Tax Rate Schedule)

income rental not taxable

assistance,

proceeds business withheld

$125.00

includes property

income

unemployment

received (Rental in or

but in a were in

a CCA

is a

CCA

for not income withheld CCA

member

limited member

reason compensation member

subject incorrectly

of to, municipality.

municipality

death, the municipality

to

benefits, following: municipal

compensatory

and

in

pensions, Income ordinance).

charge which

personal from municipal

annuities gross

wages,

monthly

injuries income

or salaries,

disability

rent

interstate or taxes

for

tips,

|