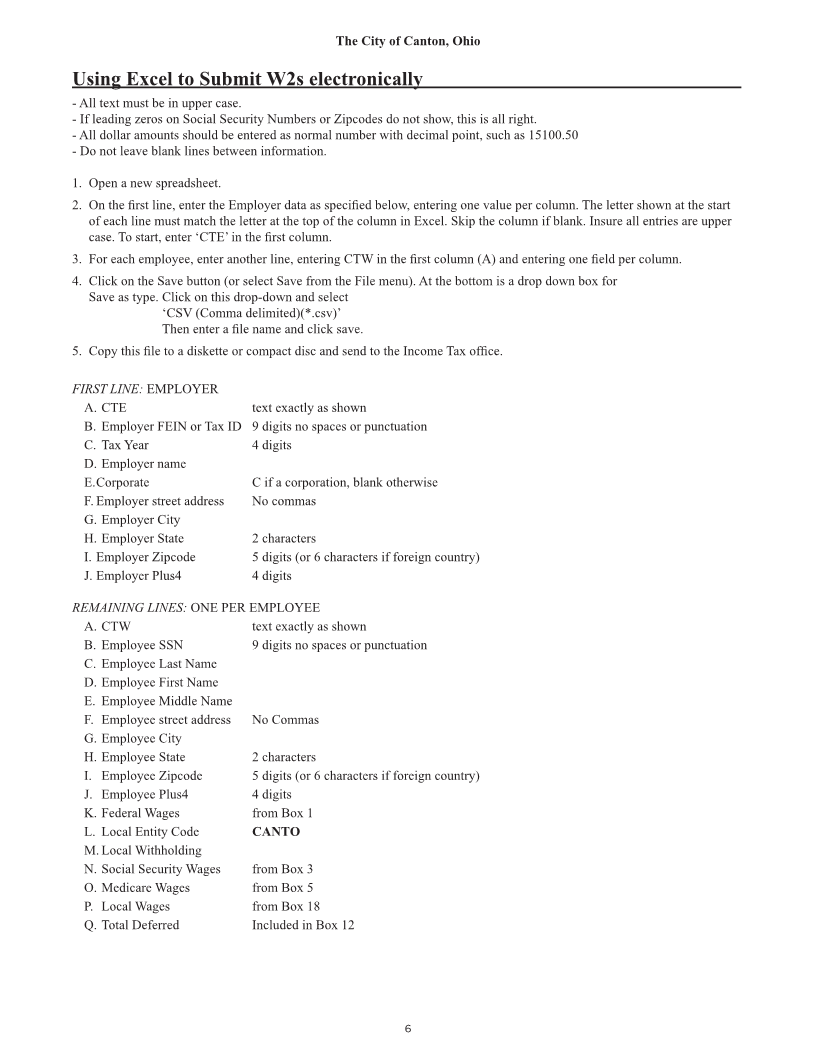

Enlarge image

KS-1338_Layout 1 12/12/13 1:41 PM Page 1

KS-1338_Layout 1 12/12/13 1:41 PM Page 1

KS-1338_Layout 1 12/12/13 1:41 PM Page 1KS-1338_Layout 1 12/12/13 1:41 PM Page 1KS-1338_Layout 1 12/12/13 1:41 PM Page 1

KS-1338_Layout 1 12/12/13 1:41 PM Page 1KS-1338_Layout 1 12/12/13 1:41 PM Page 1

KS-1338_Layout 1 12/12/13 1:41 PM Page 1KS-1338_Layout 1 12/12/13 1:41 PM Page 1KS-1338_Layout 1 12/12/13 1:41 PM Page 1

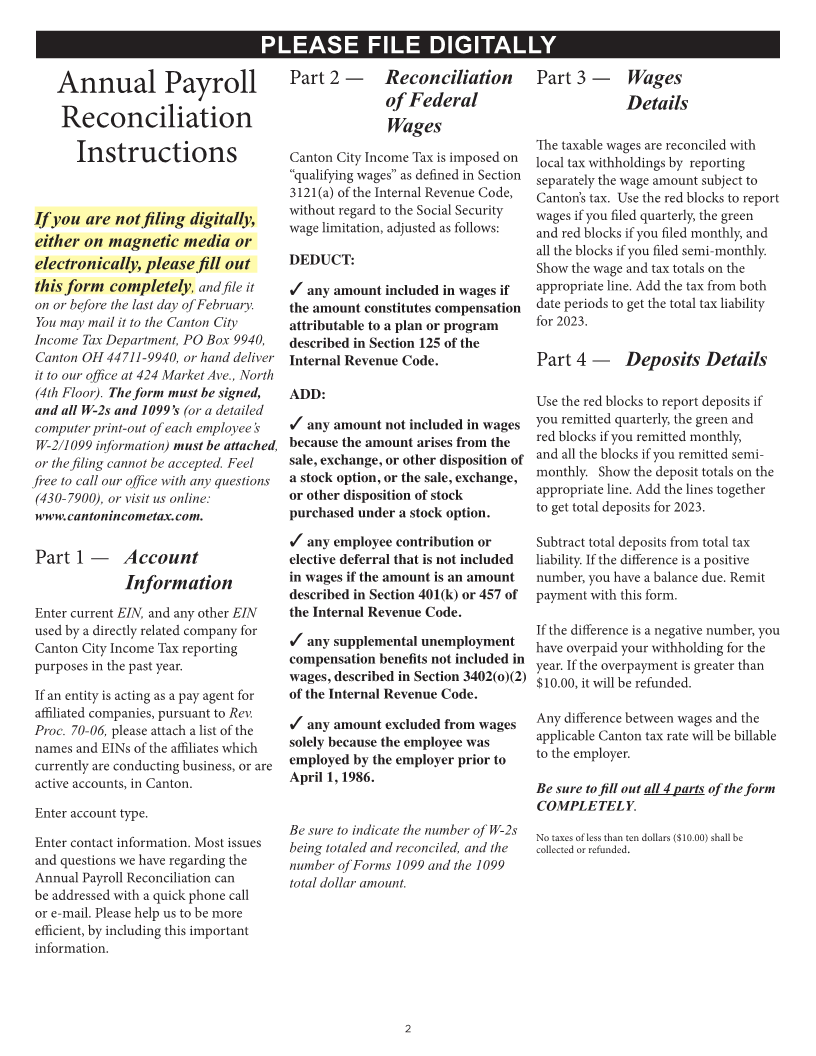

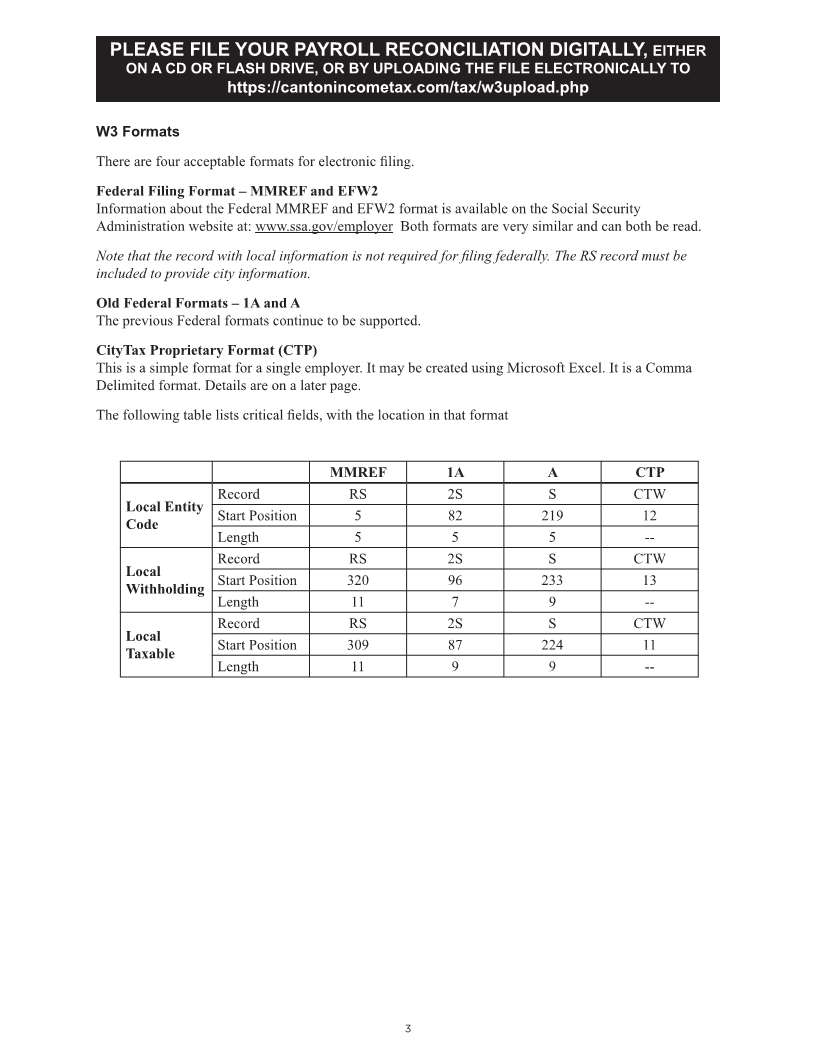

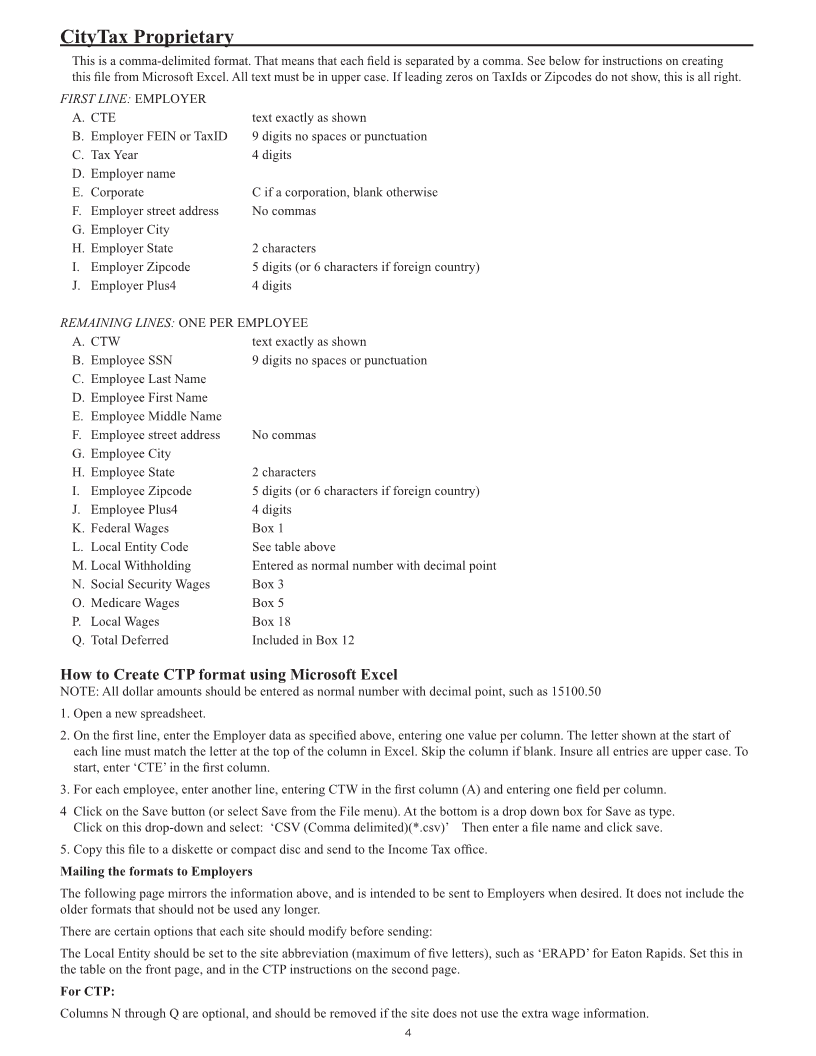

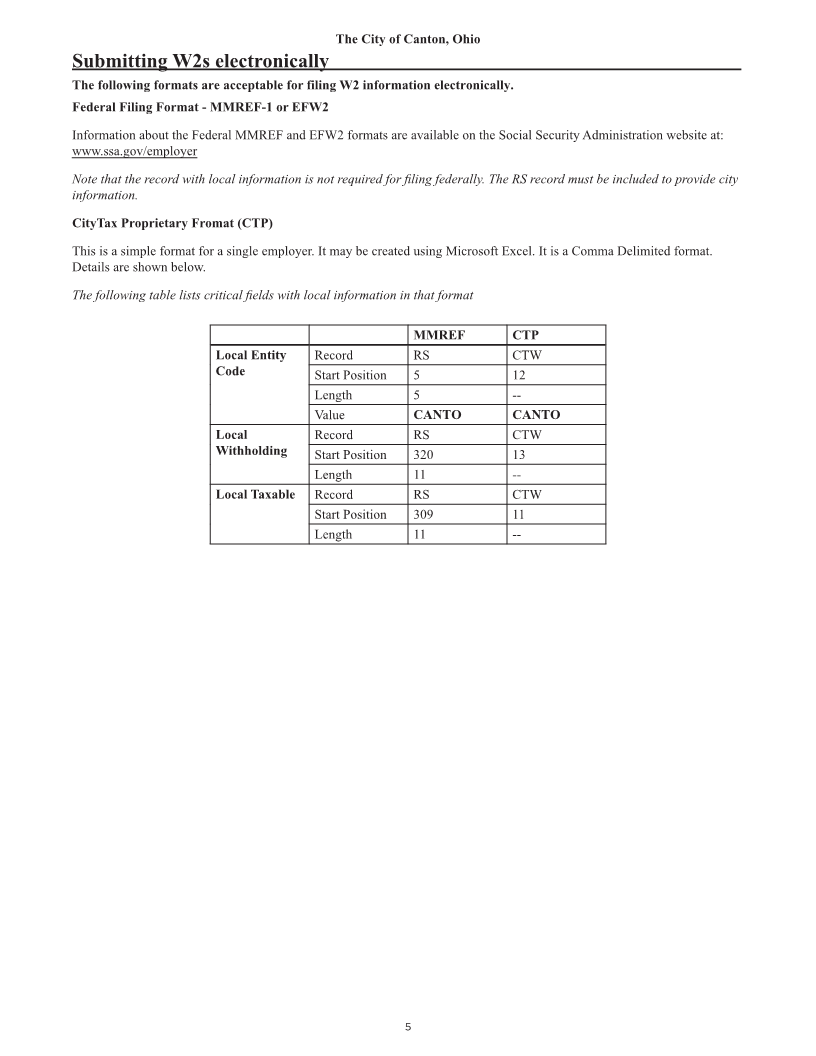

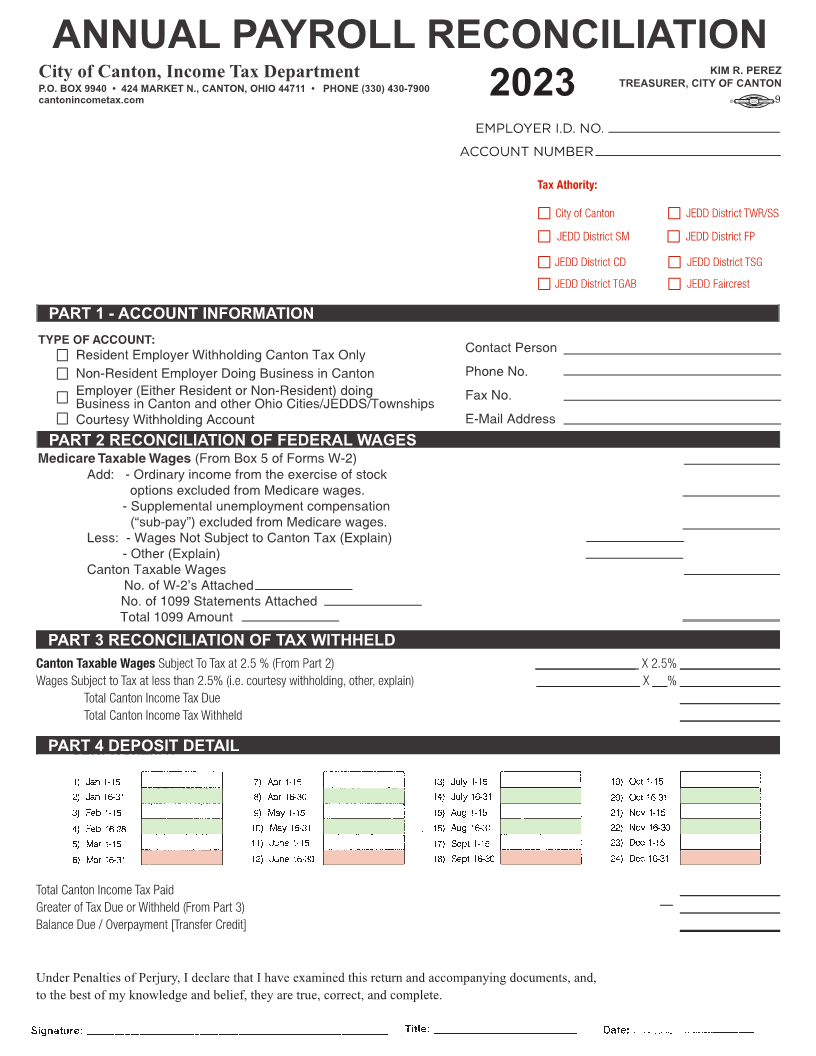

ANNUAL PAYROLL RECONCILIATION

ANNUAL PAYROLL RECONCILIATION

City of Canton, Income Tax DepartmentCity of Canton, Income Tax DepartmentANNUAL PAYROLL RECONCILIATIONANNUAL PAYROLL RECONCILIATIONANNUAL PAYROLL RECONCILIATIONKIM R. PEREZKIM R. PEREZ

KS-1338_LayoutP.O.CityP.O.CityANNUALANNUALofofBOXBOXCanton,Canton,1 9940 9940 12/12/13 IncomeIncome• • TaxTax4244241:41DepartmentDepartmentMARKETMARKETPM PAYROLLPAYROLLPageN.,N.,1CANTON,CANTON,OHIOOHIO44711 44711 • • PHONEPHONERECONCILIATIONRECONCILIATION(330)(330)430-7900430-7900 TREASURER,TREASURER,CITYCITYKIM R. PEREZKIM R. PEREZOFOFCANTONCANTON

P.O.P.O.cantonincometax.comCity ofBOXBOXCanton,9940 9940 Income• • Tax424424DepartmentMARKETMARKET N.,N., CANTON,CANTON, OHIOOHIO 44711 44711 • • PHONEPHONE (330)(330) 430-7900430-7900 TREASURER,TREASURER, CITYCITYHOURS:KIM R. PEREZOFOF8:00CANTONCANTON- 4:00

cantonincometax.comcantonincometax.comP.O.CityANNUALANNUALofBOXCanton,9940 Income• Tax424DepartmentMARKETPAYROLLPAYROLLN., CANTON, OHIO 44711 • PHONERECONCILIATIONRECONCILIATION(330) 430-7900 TREASURER,MondayCITYHOURS:HOURS:KIM R. PEREZthrough8:008:00OF CANTON--Friday4:004:00

P.O.cantonincometax.comP.O.BOXBOX9940 9940 • • 424424 MARKETMARKETN.,N.,CANTON,CANTON,OHIOOHIO44711 44711 • • PHONEPHONE(330)(330)430-7900430-7900 TREASURER,MondayMondayMondayMondayCITYHOURS:throughthroughthroughthrough8:00OF CANTON-FridayFridayFridayFriday4:00

cantonincometax.comP.O.City ofBOXCanton,9940 Income• Tax424DepartmentMARKET N., CANTON, OHIO 44711 • PHONE (330) 430-7900 TREASURER, CITYHOURS:KIM R. PEREZOF8:00CANTON- 4:00

CityCityP.O.ANNUALofofBOXCanton,Canton,9940 IncomeIncome• TaxTax424DepartmentDepartmentMARKETPAYROLLN., CANTON, OHIO 44711 • PHONERECONCILIATION(330) 430-7900 TREASURER,TREASURER,MondayMondayCITYCITYKIM R. PEREZKIM R. PEREZthroughthroughOFOF CANTONCANTONFridayFriday

CityP.O.cantonincometax.comcantonincometax.comcantonincometax.comofBOXCanton,9940 Income• Tax424DepartmentMARKET N., CANTON, OHIO 44711 • PHONE (330) 430-7900 TREASURER, CITYHOURS:HOURS:HOURS:KIM R. PEREZOF8:008:008:00CANTON--- 4:004:004:00

cantonincometax.comcantonincometax.com 2023 MondayHOURS:HOURS:through8:008:00--Friday4:004:00

Monday through FridayMonday through Friday

EMPLOYER I.D. NO.EMPLOYER I.D. NO.

ANNUAL PAYROLL RECONCILIATIONEMPLOYER I.D. NO.

City of Canton, Income Tax Department ACCOUNT NUMBEREMPLOYER I.D. NO.EMPLOYER I.D. NO.EMPLOYER I.D. NO. KIM R. PEREZ

OTHER EIN USEDEMPLOYER I.D. NO.

P.O. BOX 9940 • 424 MARKET N., CANTON, OHIO 44711 • PHONE (330) 430-7900 OTHER EIN USEDEMPLOYER I.D. NO. TREASURER, CITY OF CANTON

cantonincometax.com OTHEROTHEREMPLOYEREMPLOYEREINEIN USEDUSEDI.D.I.D.NO.NO. HOURS: 8:00 - 4:00

OTHER EIN USED

EMPLOYEROTHER EINTaxUSEDI.D.Athority:NO. Monday through Friday

OTHER EIN USED

All W-2’s, or a computer printout or magneticOTHER EINmediaUSED

All W-2’s, or a computer printout or magneticOTHER EINmediaUSEDCity of Canton JEDD District TWR/SS

AllcontainingW-2’s,W-2or adatacomputerMUST BEprintoutENCLOSED.or magnetic media

AllAllcontainingW-2’s,W-2’s,W-2oror aadatacomputercomputerMUSTprintoutprintoutBE ENCLOSED.oror magneticmagneticOTHER EINmediamediaUSEDJEDD District SM JEDD District FP

AllAllcontainingcontainingW-2’s,W-2’s,W-2W-2oror aadatadatacomputercomputerMUSTMUST BEBEprintoutprintoutENCLOSED.ENCLOSED.oror magneticmagnetic mediamedia

containing W-2 data MUST BE ENCLOSED.

PART 1 - ACCOUNT INFORMATIONAllAllAllcontainingcontainingW-2’s,W-2’s,W-2’s,W-2W-2orororaaadatadatacomputercomputercomputerMUSTMUSTprintoutBEBEprintoutprintoutENCLOSED.diaENCLOSED.diaororormagneticmagneticmagneticEMPLOYERmememediaI.D.JEDDNO.District CD JEDD District TSG

PART 1 - ACCOUNT INFORMATIONcontaining W-2 data MUST BE ENCLOSED.

PART 1 - ACCOUNT INFORMATIONcontaining W-2 data MUST BE ENCLOSED.JEDD District TGAB JEDD Faircrest

TYPE OF ACCOUNT:PART 1 - ACCOUNT INFORMATIONPART 1 - ACCOUNT INFORMATIONcontaining W-2 data MUST BE ENCLOSED.OTHER EIN USED

TYPE OF ACCOUNT:PART 1 - ACCOUNT INFORMATIONPART 1 - ACCOUNT INFORMATION

TYPE OF ACCOUNT: Contact Person

TYPE OF ACCOUNT:TYPE OF ACCOUNT:TYPE OF ACCOUNT:TYPE OF ACCOUNT:PART 1 - ACCOUNT INFORMATIONPART 1 - ACCOUNT INFORMATIONPART 1 - ACCOUNT INFORMATIONResident Employer Withholding Canton Tax Only

Resident Employer Withholding Canton Tax Only Contact Person

Contact Person

Resident Employer Withholding Canton Tax Only Contact PersonContact Person

TYPE OFNon-ResidentResidentResidentACCOUNT:EmployerEmployerEmployerWithholdingWithholdingDoing BusinessCantonCantonAllinW-2’s,TaxTaxCantonOnlyOnlyor a computer printout orPhonemagneticNo. media

TYPE OF ACCOUNT:Non-Resident Employer Doing Business in Canton Phone No.Contact Person

Contact Person

ResidentResident EmployerEmployer WithholdingWithholding CantonCanton TaxTax OnlynOnly

TYPE OFEmployerResidentNon-ResidentEmployerNon-ResidentResidentNon-ResidentACCOUNT:Employer(EitherEmployer(EitherEmployerEmployerEmployerResidentResidentWithholdingWithholdingDoingDoingDoingororBusinessBusinessBusinessNon-Resident)Non-Resident)CantonCantoncontaininginininTaxTaxCantoCantonCantonW-2OnlygOnlydoingdoingdata MUST BE ENCLOSED.FaxPhoneFaxPhonePhonePhoneNo.No.No.No.No.No.

Non-Resident Employer Doing Business in Canton Contact PersonContact Person

BusinessNon-Residentin CantonEmployerand otherDoingOhioBusinessCities/JEDDS/Townshipsin Canton

BusinessEmployerEmployerin(Either(EitherCanton andResidentResidentotherororOhioNon-Resident)Non-Resident)Cities/JEDDS/Townshipsdoingdoin FaxFaxContactPhoneNo.No.No.Person

Courtesy Withholding AccountBusiness in Canton and other Ohio Cities/JEDDS/Townships

PARTResidentBusinessNon-ResidentBusinessEmployerEmployerNon-Resident1 -ininEmployerACCOUNT(Either(EitherCantonCantonEmployerEmployerandandResidentResidentWithholdingINFORMATIONotherotherDoingDoingororOhioOhioBusinessBusinessNon-Resident)Non-Resident)CantonCities/JEDDS/TownshipsCities/JEDDS/TownshipsininCantonTaxCantondoingdoingOnly PhoneE-MailFaxFaxPhoneNo.No.No.No.Address

Business in Canton and other Ohio Cities/JEDDS/Townships

CourtesyCourtesyNon-ResidentCourtesyEmployerEmployerBusiness inWithholdingWithholdingWithholding(Either(EitherCantonEmployerandResidentResidentAccountAccountAccountotherDoingororOhioBusinessNon-Resident)Non-Resident)Cities/JEDDS/Townshipsin Cantondoingdoing E-MailE-MailPhoneE-MailE-MailFaxFax No.No.No.AddressAddressAddressAddress

PARTCourtesyEmployerEmployerBusinessCourtesy2 RECONCILIATIONinWithholdingWithholding(Either(EitherCanton andResidentResidentAccountAccountotherororOhioNon-Resident)Non-Resident)OFCities/JEDDS/TownshipsFEDERALdoingdoingWAGES FaxFaxE-MailE-MailNo.No. AddressAddress

TYPEPARTOFBusinessCourtesyACCOUNT:2 RECONCILIATIONinWithholdingCanton andAccountother OhioOFCities/JEDDS/TownshipsFEDERAL WAGES

PARTCourtesy2 RECONCILIATIONWithholding AccountOF FEDERAL WAGES E-Mail Address

MedicareMedicarePARTPARTCourtesyBusinessCourtesy22TaxableTaxableRECONCILIATIONRECONCILIATIONinWithholdingWithholdingCantonWagesWagesand(From(FromAccountAccountotherBoxBoxOhio55OFOFofofCities/JEDDS/TownshipsFormsFormsFEDERALFEDERALW-2)W-2) WAGESWAGES ContactE-MailE-MailAddressAddressPerson

Resident Employer Withholding Canton Tax Only

MedicareMedicarePARTPARTAdd: 22TaxableTaxableRECONCILIATIONRECONCILIATION-WagesWagesOrdinary(From(FromincomeBoxBoxfrom55OFOFofoftheFormsFormsFEDERALFEDERALexerciseW-2)W-2) WAGESWAGESof stock

MedicareAdd: Taxable- OrdinaryWages (FromincomeBoxfrom5 oftheFormsexerciseW-2) of stock

MedicareMedicarePARTPARTNon-Resident22TaxableTaxableRECONCILIATIONRECONCILIATIONoptionsWagesWagesEmployerexcluded(From(FromDoingBoxBoxfromBusiness55OFOFMedicareofof FormsFormsFEDERALFEDERALin CantonW-2)W-2)wages.WAGESWAGES Phone No.

Add: - Ordinary income from the exercise of stock

MedicarePARTAdd: Add: 2TaxableRECONCILIATIONoptions--OrdinaryOrdinaryWagesexcluded(FromincomeincomeBoxfromfromfrom5OFMedicareofthetheFormsFEDERALexerciseexerciseW-2)wages.WAGESofofstockstock

Employer (Either Resident or Non-Resident) doing- Supplemental unemployment compensation Fax No.

options excluded from Medicare wages.

MedicareMedicareBusinessAdd: Add: TaxableTaxablein-optionsoptionsSupplemental--CantonWagesWagesOrdinaryOrdinaryexcludedexcludedand(From(FromincomeincomeotherunemploymentBoxBoxfromfromOhiofromfrom55MedicareMedicareofofCities/JEDDS/TownshipsthetheFormsFormsexerciseexerciseW-2)W-2)compensationwageswages.. ofof stockstock

Add: Add: --(“sub-pay”)optionsoptions-SupplementalSupplemental-OrdinaryOrdinaryexcludedexcludedincomeincomeexcludedunemploymentunemploymentfromfromfromfromMedicareMedicarefromthetheMedicareexerciseexercisecompensationcompensationwages.wages.ockofwages.ofststock

-(“sub-pay”)Supplementalexcludedunemploymentfrom Medicarecompensationwages.

CourtesyAdd: Less: --Withholdingoptions(“sub-pay”)(“sub-pay”)options--SupplementalSupplementalWagesOrdinaryexcludedexcludedNotincomeAccountexcludedexcludedSubjectunemploymentunemploymentfromfromfromMedicareMedicarefromfromtotheCantonMedicareMedicareexercisecompensationcompensationwages.wages.Taxwages.wages.of(Explain)stock E-Mail Address

Less: (“sub-pay”)- Wages NotexcludedSubjectfromto CantonMedicareTaxwages.(Explain)

Less: Less: ---options(“sub-pay”)(“sub-pay”)--SupplementalOtherSupplementalWagesWages(Explain)excludedNotNotexcludedexcludedSubjectSubjectunemploymentunemploymentfrom Medicarefromfromtoto CantonCantonMedicareMedicarecompensationcompensationwages.TaxTaxwages.wages.(Explain)(Explain)

PARTLess: 2 RECONCILIATION--OtherWages(Explain)Not SubjectOFtoFEDERALCanton TaxWAGES(Explain)

CantonLess: Less: ---(“sub-pay”)(“sub-pay”)TaxableOtherOther--SupplementalWagesWages(Explain)(Explain)NotNotWagesexcludedexcludedSubjectSubjectunemploymentfromfromtoto CantonCantonMedicareMedicarecompensationTaxTaxwages.wages.(Explain)(Explain)

MedicareCantonTaxable-TaxableOtherWages(Explain)Wages

Less: CantonCantonAdd:NLess: --No.(“sub-pay”)TaxableTaxable--OtherOtherofWagesWagesW-2’s(Explain)(Explain)NotNot(FromWagesWages AttachedexcludedSubjectSubjectBox 5fromtooftoCantonCantonFormsMedicareW-2)TaxTaxwages.(Explain)(Explain)

Add:NCanton Taxable Wages No. of W-2’s Attached

Less: Add: Add:NAdd:NCantonCantonNo.--No.No.TaxableTaxable--OtherOtherofofofWagesOrdinary1099W-2’sW-2’s(Explain)(Explain)StatementsNotWagesWages incomeAttachedAttachedSubjectfromAttachedtheto CantonexerciseTaxof(Explain)stock

Add:NNo.No.ofof1099W-2’sStatementsAttached Attached

CantonCantonAdd:NAdd:NTotalNo.No.-No.No.optionsTaxableTaxableOtherofofofof109910991099W-2’sW-2’s(Explain)excludedAmountStatementsStatementsWages WagesAttachedAttachedfromAttachedAttachedMedicare wages.

Total 1099 AmountNo. of 1099 Statements Attached

CantonAdd:NAdd:NTotalTotalNo.No.-No.No.TaxableSupplementalofofofof1099109910991099W-2’sW-2’sAmountAmountStatementsStatementsWagesAttachedAttachedunemploymentAttachedAttachedcompensation

PART 3 RECONCILIATIONTotal 1099 Amount OF TAX WITHHELD

PART 3 RECONCILIATION OF TAX WITHHELD

PARTPARTAdd:N33RECONCILIATIONRECONCILIATIONNo.TotalTotalNo.No.(“sub-pay”)ofofof1099109910991099W-2’sAmountAmountStatementsStatementsAttachedexcludedAttachedAttachedOFOFfromTAXTAXMedicareWITHHELDWITHHELDwages.

CantonPARTPARTTaxable33RECONCILIATIONRECONCILIATIONTotalNo.TotalWagesof109910991099SubjectAmountAmountStatementsTo TaxAttachedFromOFOFatTAXTAX2% (WITHHELDWITHHELDPart 2) X 2%

PARTPARTAdd:Less: 33TotalRECONCILIATIONRECONCILIATION- Wages1099 AmountWagesNot SubjectSubjectOFOFto CantonTAXTAXToWITHHELDWITHHELDTaxTax(Explain)At Less Than 2% X___%

Canton Taxable Wages Subject To Tax at 2% (From Part 2) X 2%

CantonCantonTaxableTaxableWagesWages SubjectSubjectTo Tax at 2.5To%Tax(FromatPart2%2)(From Part 2) _______________ X 2% X 2.5% _______________

CantonCantonPARTPARTAdd:TaxableTaxable33(i.e.RECONCILIATIONWagesRECONCILIATION- OtherWagesWagescourtesySubject(Explain)SubjectSubjectwithholding,To TaxToToTaxTaxother,AtOFOFatatLessexplain)TAXTAX2%2%Than(From(FromWITHHELDWITHHELD2%PartPart2)2) XX___%X2%2%

WagesCantonCantonSubjectAdd:Add:CantonTaxableTaxableto(i.e.WagesWagesTaxTaxableWagesWagesatcourtesylessSubjectSubjectthanSubjectSubjectwithholding,Wages2.5%ToTo(i.e.TaxTaxcourtesyToToother,TaxTaxAtAtwithholding,atatLessLessexplain)2%2%ThanThan(From(Fromother,2%2%PartPartexplain) 2)2) _______________ X___%X___%XX 2%2% X __% _______________

Add: (i.e. courtesy withholding, other, explain)Wages Subject To Tax At Less Than 2% X___%

CantonCantonPARTTotalAdd:TaxableAdd:NAdd:Taxable3Canton(i.e.(i.e.RECONCILIATIONTotalWagesNo.WagesWagesofIncomecourtesycourtesyCantonSubjectW-2’sSubjectSubjectTaxwithholding,withholding,AttachedDue IncomeTo TaxToToTaxother,Taxother,TaxAtOFDueatatLessexplain)explain)TAX2%2%Than(From(FromWITHHELD2%PartPart2)2) XXX___%2%2% _______________

Add: Add: Total Canton Income Tax DueWages Subject To Tax At Less Than 2% X___%

Add: Total Canton Income Tax Due

CantonTotalAdd:Add:Add:TaxableAdd:Canton(i.e.(i.e.TotalTotalTotalNo.WagesWagesofIncomecourtesycourtesyCantonCantonCantonSubject1099SubjectTaxStatementswithholding,withholding,Withheld IncomeIncomeIncomeTo TaxToTaxTaxTaxTaxother,other,AttachedAtDueDueWithheldatLessexplain)explain)2%Than(From2%Part 2) XX___%2% _______________

Add: Total Canton Income Tax Withheld

Add:Add:Add:Add:Add:Add:(i.e.WagesWagesTotalTotalTotalTotalcourtesyCantonCantonCantonCantonSubjectSubjectwithholding,IncomeIncomeIncomeIncomeToToTaxTaxTaxTaxTaxTaxother,AtAtWithheldWithheldDueDueLessLessexplain)ThanThan2%2% X___%X___%

Add: (i.e. courtesy withholding, other, explain)Total Canton Income Tax Withheld

PARTWAGES:Add:Add:Add:Add:4(i.e.RECONCILIATIONTotalTotalTotalTotalTotal Entercourtesyon1099CantonCantonCantonCantonlinesAmountwithholding,1 throughIncomeIncomeIncomeIncome24TaxTaxTaxTaxtheother,OFamountDueDueWithheldWithheldexplain)DEPOSITSpaid for each Semi-Monthly filling period.

PARTPARTAdd:Add:44RECONCILIATIONDEPOSITTotalTotalCantonCantonDETAILIncomeIncome TaxTaxOFWithheldDueDEPOSITS

QuarterPARTPARTPARTPARTAdd:Ended4443RECONCILIATIONRECONCILIATIONRECONCILIATIONRECONCILIATIONTotal03/31 Canton Income TaxOFOFOFOFWithheldDEPOSITSDEPOSITSDEPOSITSTAX WITHHELD

PARTAdd:4 RECONCILIATIONTotal Canton Income TaxOFWithheldDEPOSITS

Quarter Ended 03/31

CantonQuarterQuarterPARTTaxableEndedEnded4 RECONCILIATION03/3106/30Wages OF DEPOSITS

Quarter Ended 03/31Quarter Ended 09/30Quarter Ended 03/31Quarter Ended 03/31Quarter Ended 03/31PART 4 RECONCILIATION OF DEPOSITSPART 4 RECONCILIATION OF DEPOSITSPART 4 RECONCILIATION OF DEPOSITSSubject To Tax at 2% (From Part 2) X 2%

QuarterAdd:EndedWages06/30 Subject To Tax At Less Than 2% X___%

Quarter Ended 06/30

Quarter Ended 09/30Quarter Ended 06/30Quarter Ended 06/30(i.e. courtesy withholding, other, explain)

Quarter Ended 12/31Quarter Ended 09/30

QuarterQuarterQuarterQuarterQuarterQuarterQuarterAdd:EndedEndedEndedEndedEndedEndedEndedTotal03/3109/3009/3012/3106/3003/3106/30 Canton Income Tax Due

TotalQuarterCantonEndedIncome12/31 Tax Paid

QuarterQuarterQuarterQuarterTotalQuarterQuarterQuarterCantonAdd:EndedEndedEndedEndedEndedEndedEndedTotal06/3012/3112/3103/31Income06/3009/3009/30CantonTaxIncomePaid Tax Withheld

GreaterTotalQuarterTotalQuarterQuarterQuarterQuarterCantonCantonofEndedEndedEndedEndedEndedTax09/30IncomeIncome06/3012/3112/3109/30DueTaxor WithheldTaxPaidPaid (From Part 3)

GreaterTotal Cantonof TaxIncomeDue or WithheldTax Paid (From Part 3)

BalanceQuarterQuarterGreaterGreaterTotalQuarterTotal CantonCantonofofEndedEndedEndedDueTaxTax/12/31r09/3012/31rIncomeIncomeDueDueOverpayment ooWithheldWithheldTaxTax PaidPaid[Transfer(From(FromPartPartCredit]3)3)

BalanceGreaterPARTof4DueTaxRECONCILIATION/DueOverpayment or Withheld[Transfer(FromOFPartCredit]DEPOSITS3)

BalanceBalanceTotalQuarterGreaterGreaterTotalCantonCantonofofEndedDueDueTaxTax//Income12/31IncomeDueDueOverpayment Overpayment oror WithheldWithheldTaxTaxPaidPaid[Transfer[Transfer(From(From PartPartCredit]Credit]3)3)

TotalBalanceCantonDueIncome/TaxOverpayment Paid [Transfer Credit] _______________

QuarterGreaterTotalUnderBalanceBalanceGreaterPenaltiesCantonofofEndedDueDueTaxTax//of03/31IncomeDueDueOverpayment Overpayment perjury,ororWithheldWithheldTaxIPaiddeclare[Transfer[Transfer(From(FromthatPartPartCredit]Credit]I have3)3) examined this return and accompanying documents, and,

Under Penalties of perjury, I declare that I have examined this return and accompanying documents, and,

GreaterBalanceGreaterQuartertoUnderUnderBalancethePenaltiesPenaltiesofbestofTaxEndedDueDueofTaxDue//ofof06/30myorDueWithheldOverpayment Overpayment perjury,perjury,knowledgeor Withheld(FromIIanddeclaredeclarePart[Transfer[Transferbelief,3) (FromthatthatParttheyCredit]Credit]II havehaveare3)examinedexaminedtrue, correct,thisthis returnreturnandandandcomplete.accompanyingaccompanying documents,documents, and,and, _______________

BalancetoBalanceQuartertotoUnderUnderthethethePenaltiesPenaltiesbestbestbestDueEndedDue/ofofofOverpayment/ofof09/30mymymyOverpayment perjury,perjury,knowledgeknowledgeknowledge[TransferIIandandanddeclaredeclareCredit] belief,belief,[Transferbelief,thatthattheytheytheyCredit]IIhavehaveareareareexaminedexaminedtrue,true,true,correct,correct,correct,thisthisreturnreturnandandandcomplete.complete.complete.andandaccompanyingaccompanyingdocuments,documents,and,and, _______________

to the best of my knowledge and belief, they are true, correct, and complete.Under Penalties of perjury, I declare that I have examined this return and accompanying documents, and,

QuarterSignaturetotoUnderthethePenaltiesbestbestEndedofofof12/31mymyperjury,knowledgeknowledgeIandanddeclarebelief,belief,thattheytheyI haveareareexaminedtrue,true, correct,correct,thisTitlereturnandand complete.complete.and accompanying documents,Date and,

Under Penalties of perjury, I declare that I have examined this return and accompanying documents, and,

SignatureTotaltoUndertothethePenaltiesbestbestCantonofofofIncomemymyperjury,knowledgeknowledgeTaxIandandPaiddeclarebelief,belief,thattheytheyI haveareareexaminedtrue,true,correct,correct,thisTitlereturnandandcomplete.complete.and accompanying documents,Date and,

Signature Title Date

UnderGreatertoSignatureSignatureSignaturethePenaltiesbestofofTaxofmyPerjury,DueknowledgeorIWithhelddeclareandthatbelief,(FromI haveParttheyexaminedare3) true,thiscorrect,returnTitleTitleTitleandandaccompanyingcomplete. documents, and, DateDateDate

Signature Title Date

toBalanceSignatureSignaturethe bestDueof my/knowledgeOverpayment and belief,[TransfertheyCredit]are true, correct, andTitleTitlecomplete. DateDate

SignatureSignature TitleTitle DateDate

Under Penalties of perjury, I declare that I have examined this return and accompanying documents, and,

to the best of my knowledge and belief, they are true, correct, and complete.