Enlarge image

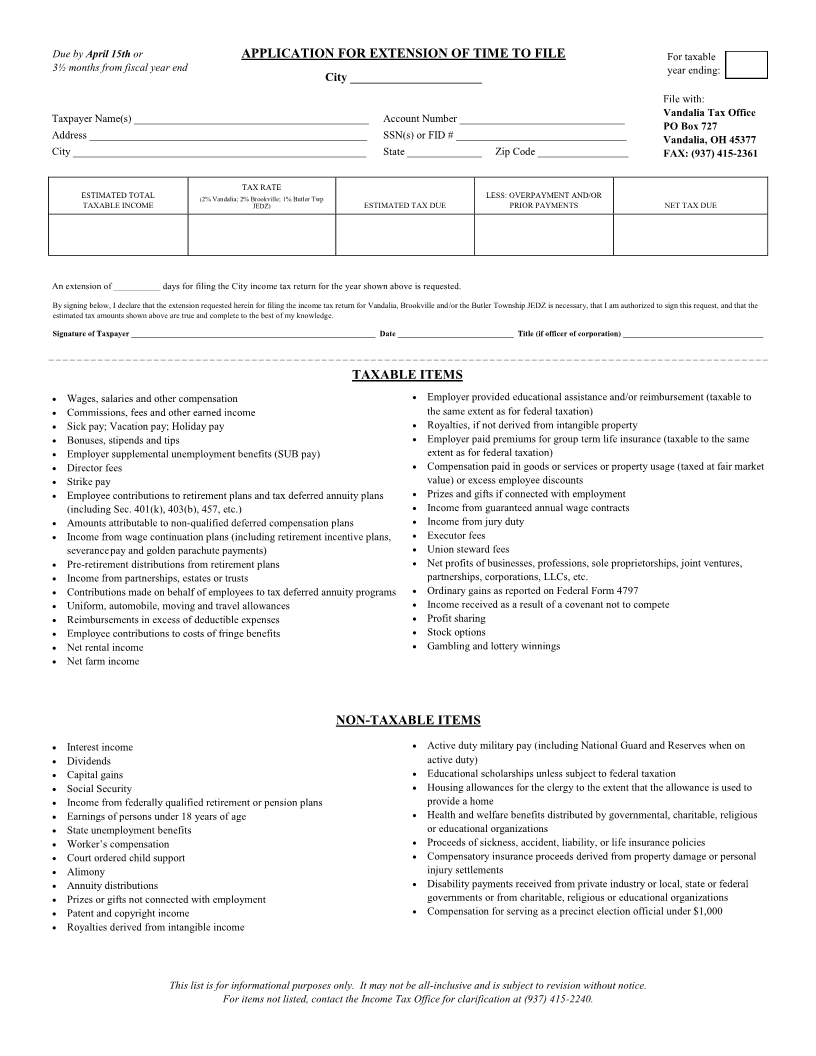

Due by April 15th or APPLICATION FOR EXTENSION OF TIME TO FILE For taxable

3½ months from fiscal year end year ending:

City ______________________

File with:

Taxpayer Name(s) ____________________________________________ Account Number _______________________________ Vandalia Tax Office

PO Box 727

Address ____________________________________________________ SSN(s) or FID # ________________________________ Vandalia, OH 45377

City _______________________________________________________ State ______________ Zip Code _________________ FAX: (937) 415-2361

TAX RATE

ESTIMATED TOTAL (2% Vandalia; 2% Brookville; 1% Butler Twp LESS: OVERPAYMENT AND/OR

TAXABLE INCOME JEDZ) ESTIMATED TAX DUE PRIOR PAYMENTS NET TAX DUE

An extension of __________ days for filing the City income tax return for the year shown above is requested.

By signing below, I declare that the extension requested herein for filing the income tax return for Vandalia, Brookville and/or the Butler Township JEDZ is necessary, that I am authorized to sign this request, and that the

estimated tax amounts shown above are true and complete to the best of my knowledge.

Signature of Taxpayer _____________________________________________________________ Date _____________________________ Title (if officer of corporation) ___________________________________

TAXABLE ITEMS

• Wages, salaries and other compensation • Employer provided educational assistance and/or reimbursement (taxable to

• Commissions, fees and other earned income the same extent as for federal taxation)

• Sick pay; Vacation pay; Holiday pay • Royalties, if not derived from intangible property

• Bonuses, stipends and tips • Employer paid premiums for group term life insurance (taxable to the same

• Employer supplemental unemployment benefits (SUB pay) extent as for federal taxation)

• Director fees • Compensation paid in goods or services or property usage (taxed at fair market

• Strike pay value) or excess employee discounts

• Employee contributions to retirement plans and tax deferred annuity plans • Prizes and gifts if connected with employment

(including Sec. 401(k), 403(b), 457, etc.) • Income from guaranteed annual wage contracts

• Amounts attributable to non-qualified deferred compensation plans • Income from jury duty

• Income from wage continuation plans (including retirement incentive plans, • Executor fees

severancepay and golden parachute payments) • Union steward fees

• Pre-retirement distributions from retirement plans • Net profits of businesses, professions, sole proprietorships, joint ventures,

• Income from partnerships, estates or trusts partnerships, corporations, LLCs, etc.

• Contributions made on behalf of employees to tax deferred annuity programs • Ordinary gains as reported on Federal Form 4797

• Uniform, automobile, moving and travel allowances • Income received as a result of a covenant not to compete

• Reimbursements in excess of deductible expenses • Profit sharing

• Employee contributions to costs of fringe benefits • Stock options

• Net rental income • Gambling and lottery winnings

• Net farm income

NON-TAXABLE ITEMS

• Interest income • Active duty military pay (including National Guard and Reserves when on

• Dividends active duty)

• Capital gains • Educational scholarships unless subject to federal taxation

• Social Security • Housing allowances for the clergy to the extent that the allowance is used to

• Income from federally qualified retirement or pension plans provide a home

• Earnings of persons under 18 years of age • Health and welfare benefits distributed by governmental, charitable, religious

• State unemployment benefits or educational organizations

• Worker’s compensation • Proceeds of sickness, accident, liability, or life insurance policies

• Court ordered child support • Compensatory insurance proceeds derived from property damage or personal

• Alimony injury settlements

• Annuity distributions • Disability payments received from private industry or local, state or federal

• Prizes or gifts not connected with employment governments or from charitable, religious or educational organizations

• Patent and copyright income • Compensation for serving as a precinct election official under $1,000

• Royalties derived from intangible income

This list is for informational purposes only. It may not be all-inclusive and is subject to revision without notice.

For items not listed, contact the Income Tax Office for clarification at (937) 415-2240.