Enlarge image

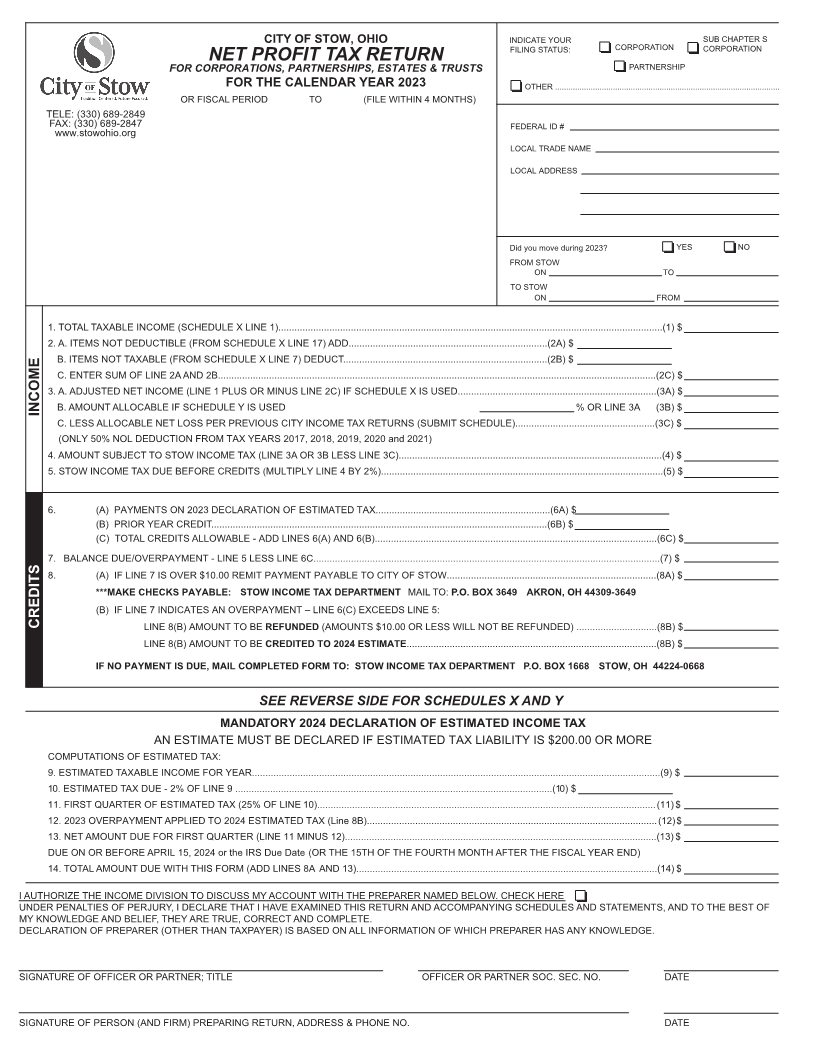

CITY OF STOW, OHIO INDICATE YOUR SUB CHAPTER S

FILING STATUS: CORPORATION CORPORATION

NET PROFITCITY OF STOW,TAXOHIORETURN INDICATE YOUR PARTNERSHIP SUB CHAPTER S

FOR CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS FILING STATUS: CORPORATION CORPORATION

TELE: (330) 689-2849 FOR CORPORATIONS,NETFORPROFITTHE CALENDARPARTNERSHIPS,TAXYEARRETURNESTATES2023 & TRUSTS OTHER .....................................................................................................PARTNERSHIP

www.stowohio.org

FAX:TELE:(330)(330)689-2847689-2849 OR FISCALFORPERIODTHE CALENDAR TO YEAR(FILE WITHIN20194 MONTHS) OTHER .....................................................................................................

FAX: (330) 689-2847 OR FISCAL PERIOD TO (FILE WITHIN 4 MONTHS) FEDERAL ID #

www.stowohio.org

LOCALFEDERALTRADEID #NAME

LOCAL ADDRESSLOCAL TRADE NAME

LOCAL ADDRESS

Did you move during 2023? YES NONO

FROM STOW

Did youONmove during 2019? TO YES NONO

TO STOWFROM STOW

ONON FROMTO

TO STOW

ON FROM

1. TOTAL TAXABLE INCOME (SCHEDULE X LINE 1)...............................................................................................................................................(1) $

2. A. ITEMS NOT DEDUCTIBLE (FROM SCHEDULE X LINE 17) ADD..........................................................................(2A) $1. TOTAL TAXABLE INCOME (SCHEDULE X LINE 1)...............................................................................................................................................(1) $

2.B.A.ITEMSITEMSNOTNOTTAXABLEDEDUCTIBLE(FROM(FROMSCHEDULESCHEDULEX LINEX LINE7) DEDUCT............................................................................(2B)17) ADD..........................................................................(2A)$$

C.B.ENTERITEMSSUMNOT TAXABLEOF LINE 2A(FROMAND 2B...................................................................................................................................................................(2C)SCHEDULE X LINE 7) DEDUCT............................................................................(2B) $$

3. A. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2C) IF SCHEDULE X IS USED..........................................................................(3A) $C. ENTER SUM OF LINE 2A AND 2B...................................................................................................................................................................(2C) $

INCOME 3.B.A.AMOUNTADJUSTEDALLOCABLENET INCOMEIF SCHEDULE(LINE 1 PLUSY ISORUSEDMINUS LINE 2C) IF SCHEDULE X IS USED..........................................................................(3A)% OR LINE 3A (3B) $$

C.B.LESSAMOUNTALLOCABLEALLOCABLENETIFLOSSSCHEDULEPER PREVIOUSY IS USEDCITY INCOME TAX RETURNS (SUBMIT SCHEDULE)....................................................(3C)% OR LINE 3A (3B)$$

INCOME (ONLY 50% NOL DEDUCTION FROM TAX YEARS 2017, 2018, 2019, 2020 and 2021)

C. LESS ALLOCABLE NET LOSS PER PREVIOUS CITY INCOME TAX RETURNS (SUBMIT SCHEDULE)....................................................(3C) $

4. AMOUNT(ONLY 50%SUBJECTNOL DEDUCTIONTO STOW INCOMEFROM TAXTAXYEARS(LINE20173A ORAND3B LESSBEYOND)LINE 3C)..................................................................................................(4) $

5. STOW INCOME TAX DUE BEFORE CREDITS (MULTIPLY LINE 4 BY 2%).........................................................................................................(5) $4. AMOUNT SUBJECT TO STOW INCOME TAX (LINE 3A OR 3B LESS LINE 3C)..................................................................................................(4) $

5. STOW INCOME TAX DUE BEFORE CREDITS (MULTIPLY LINE 4 BY 2%).........................................................................................................(5) $

6. (A) PAYMENTS ON 2023 DECLARATION OF ESTIMATED TAX.................................................................(6A) $

(B) PRIOR YEAR CREDIT.............................................................................................................................(6B) $

6. (C) (A) TOTALPAYMENTSCREDITSON 201 ALLOWABLE9DECLARATION- ADD LINESOF ESTIMATED6(A) ANDTAX.................................................................(6A)6(B).........................................................................................................(6C)$ $

(B) PRIOR YEAR CREDIT.............................................................................................................................(6B) $

7. BALANCE DUE/OVERPAYMENT - LINE 5 LESS LINE 6C.................................................................................................................................(7) $(C) TOTAL CREDITS ALLOWABLE - ADD LINES 6(A) AND 6(B).........................................................................................................(6C) $

8.7. BALANCE(A) IFDUE/OVERPAYMENTLINE 7 IS OVER $10.00- LINEREMIT5 LESSPAYMENTLINE 6C.................................................................................................................................(7)PAYABLE TO CITY OF STOW..............................................................................(8A) $$

8. ***MAKE(A) CHECKSIF LINEPAYABLE:7 IS OVERSTOW$10.00INCOMEREMITTAXPAYMENTDEPARTMENTPAYABLE TO CITY OFMAILSTOW..............................................................................(8A)TO: P.O. BOX 3649 AKRON, OH 44309-3649 $

(B)***MAKEIFCHECKSLINE 7PAYABLE:INDICATESSTOWAN OVERPAYMENTINCOME TAX DEPARTMENT– LINE 6(C) EXCEEDS LINEMAIL5:TO:P.O. BOX 3649 AKRON, OH 44309-3649

CREDITS LINE 8(B) AMOUNT TO BE REFUNDED (AMOUNTS $10.00 OR LESS WILL NOT BE REFUNDED) ..............................(8B) $

(B) IF LINE 7 INDICATES AN OVERPAYMENT – LINE 6(C) EXCEEDS LINE 5:

CREDITS LINELINE8(B)8(B)AMOUNTAMOUNTTOTOBEBECREDITEDREFUNDEDTO(AMOUNTS20 24 ESTIMATE$10.00.............................................................................................(8B)OR LESS WILL NOT BE REFUNDED) ..............................(8B)$$

IF NO PAYMENTLINEIS DUE,8(B)MAILAMOUNTCOMPLETEDTO BEFORMCREDITEDTO: STOWTOINCOME20 20 ESTIMATETAX DEPARTMENT .............................................................................................(8B)P.O. BOX 1668 STOW, OH 44224-0668 $

IF NO PAYMENT IS DUE, MAIL COMPLETED FORM TO: STOW INCOME TAX DEPARTMENT P.O. BOX 1668 STOW, OH 44224-0668

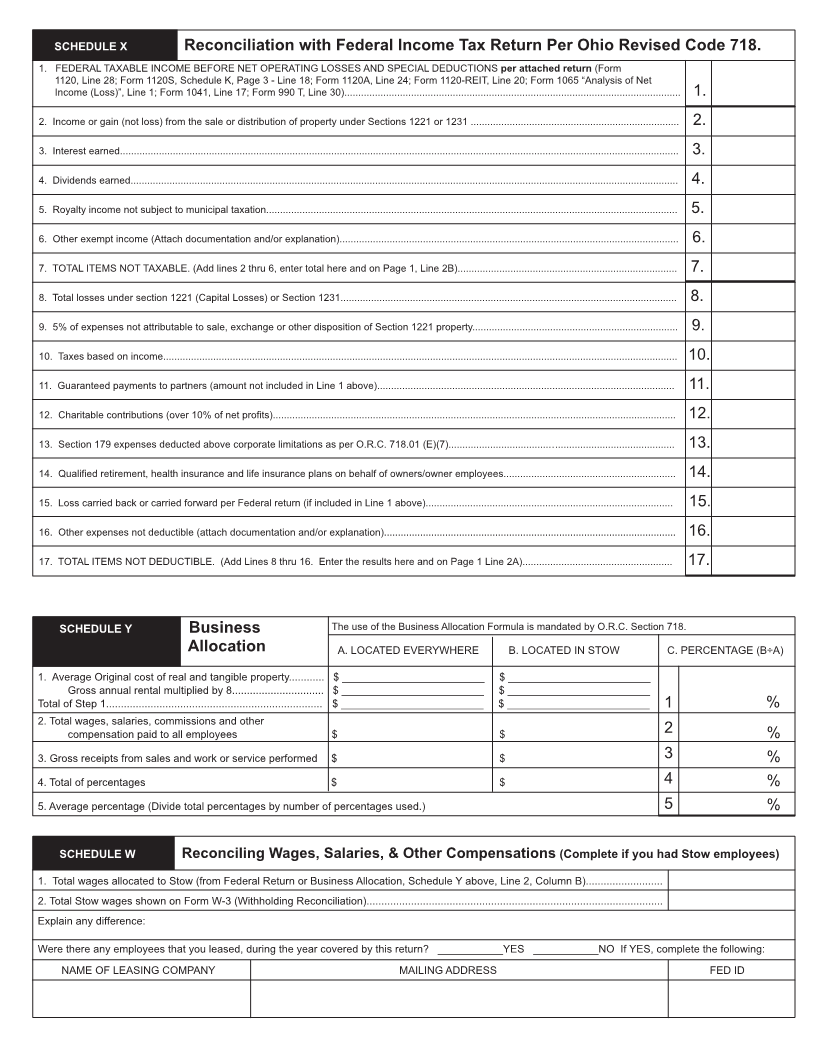

SEE REVERSE SIDE FOR SCHEDULES X AND Y

MANDA TORYSEE20 REVERSE24 DECLARATIONSIDE FOROFSCHEDULESESTIMATED INCOMEX ANDTAX Y

AN ESTIMATEMANDATORYMUST BE2019DECLAREDDECLARATIONIF ESTIMATEDOF ESTIMATEDTAXINCOMELIABILITYTAX IS $200.00 OR MORE

COMPUTATIONS OF ESTIMATED TAX:

AN ESTIMATE MUST BE DECLARED IF ESTIMATED TAX LIABILITY IS $200.00 OR MORE

9.COMPUTATIONSESTIMATED TAXABLEOF ESTIMATEDINCOME FORTAX:YEAR........................................................................................................................................................(9) $

10. ESTIMATED TAX DUE - 2% OF LINE 9 ......................................................................................................................(10) $9. ESTIMATED TAXABLE INCOME FOR YEAR........................................................................................................................................................(9) $

11.10.FIRSTESTIMATEDQUARTERTAXOFDUEESTIMATED- 2% OF LINETAX9(25%......................................................................................................................(10)OF LINE 10)..............................................................................................................................(11)$$

12.11.20FIRST23 OVERPAYMENTQUARTER OF ESTIMATEDAPPLIED TOTAX2024(25% ESTIMATEDOF LINETAX10)..............................................................................................................................(11)(Line 8B)............................................................................................................(12) $$

13.12.NET201 9AMOUNTOVERPAYMENTDUE FORAPPLIEDFIRST QUARTERTO 20 20 ESTIMATED(LINE 11 MINUSTAX (Line12)....................................................................................................................(13)8B)............................................................................................................(12)$$

DUE13. NETON ORAMOUNTBEFOREDUEAPRILFOR1FIRST5, 20 24QUARTER or the IRS(LINEDue Date11 MINUS(OR THE12)....................................................................................................................(13)15TH OF THE FOURTH MONTH AFTER THE FISCAL YEAR END) $

14.DUETOTALON ORAMOUNTBEFOREDUEAPRILWITH15,THIS2020FORM or the(ADDIRS DueLINESDate8A (ORANDTHE13)................................................................................................................(14)15TH OF THE FOURTH MONTH AFTER THE FISCAL YEAR END) $

I AUTHORIZE THE INCOME DIVISION TO DISCUSS MY ACCOUNT WITH THE PREPARER NAMED BELOW. CHECK HERE14. TOTAL AMOUNT DUE WITH THIS FORM (ADD LINES 8A AND 13)................................................................................................................(14) $

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF

MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE.I AUTHORIZE THE INCOME DIVISION TO DISCUSS MY ACCOUNT WITH THE PREPARER NAMED BELOW. CHECK HERE

DECLARATION OF PREPARER (OTHER THAN TAXPAYER) IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF

MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE.

DECLARATION OF PREPARER (OTHER THAN TAXPAYER) IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

SIGNATURE OF OFFICER OR PARTNER; TITLE OFFICER OR PARTNER SOC. SEC. NO. DATE

SIGNATURE OF OFFICER OR PARTNER; TITLE OFFICER OR PARTNER SOC. SEC. NO. DATE

SIGNATURE OF PERSON (AND FIRM) PREPARING RETURN, ADDRESS & PHONE NO. DATE

SIGNATURE OF PERSON (AND FIRM) PREPARING RETURN, ADDRESS & PHONE NO. DATE