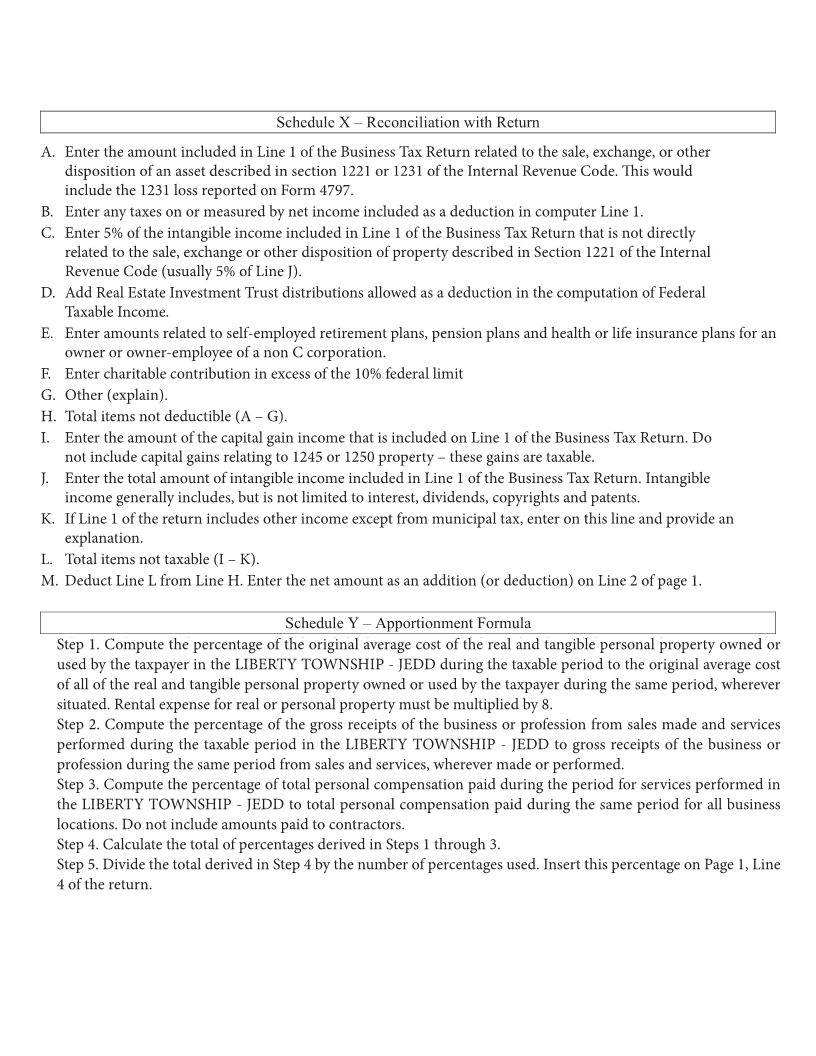

Enlarge image

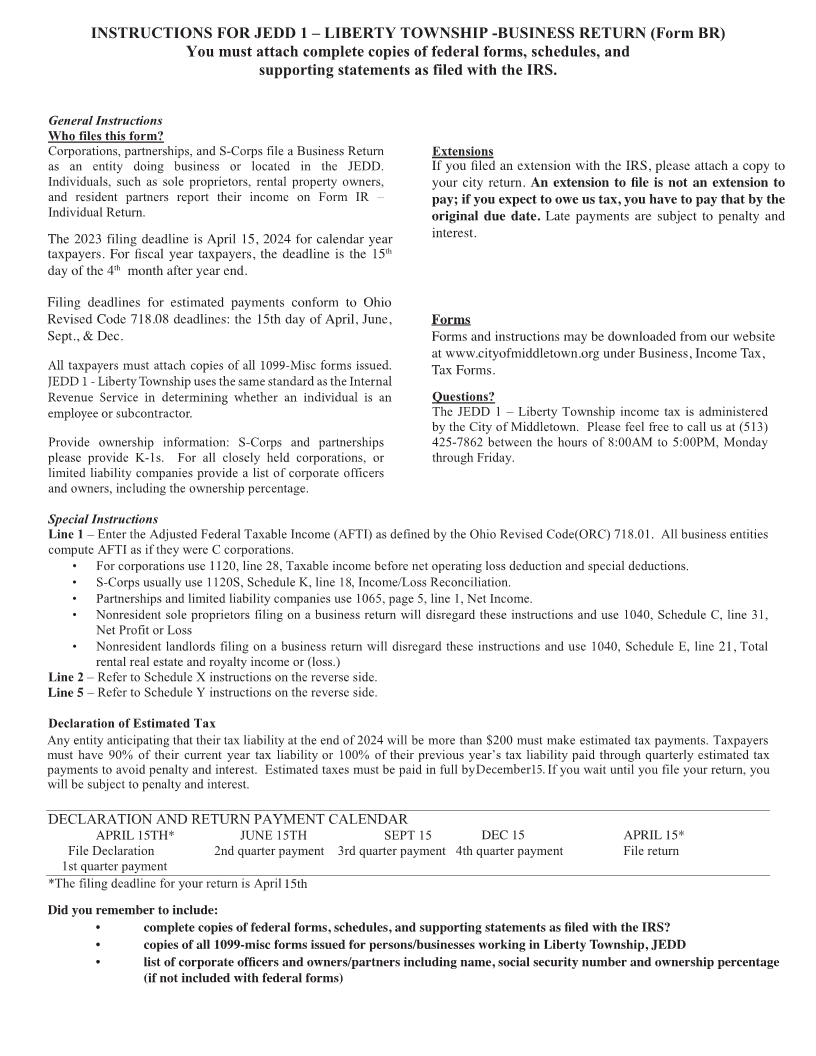

INSTRUCTIONS FOR JEDD 1 – LIBERTY TOWNSHIP -BUSINESS RETURN (Form BR)

You must attach complete copies of federal forms, schedules, and

supporting statements as filed with the IRS.

INSTRUCTIONS FOR JEDD 1 – LIBERTY TOWNSHIP -BUSINESS RETURN (Form BR)

INSTRUCTIONSYouFORmustJEDDattach1complete– LIBERTYcopiesTOWNSHIPof federal forms,-BUSINESSschedules,RETURNand (Form BR)

General Instructions

Who files this form? You must attachsupportingcompletestatementscopies ofasfederalfiled withforms,the IRS.schedules, and

Corporations, partnerships, and S-Corpssupportingfile a BusinessstatementsReturn asExtensionsfiled with the IRS.

General Instructionsas an entity doing business or located in the JEDD. If you need an extension to file, you must request it directly

WhoGeneralIndividuals,filesInstructionsthissuchform?as sole proprietors, rental property owners, with the City of Middletown. Extension requests must be

th

WhoCorporations,and residentfiles thispartnerspartnerships,form?report andtheirS-CorpsincomefileonaFormBusinessIR –Return Extensionspostmarked on or before April 15 for calendar year taxpayers

th th

Corporations,asIndividualan entityReturn.partnerships,doing businessand S-Corpsor locatedfile ainBusinessthe JEDD.Return IfandExtensionsyoubyneedthe 15andayextensionof the 4tomonthfile, youformustfiscalrequestyear taxpayers.it directly

as Individuals,an entity suchdoing as solebusiness proprietors,or located rentalin propertythe JEDD.owners, IfIfwithYouyouyoumaytheneedfiledCityuseananofaextensioncopyextensionMiddletown.of thetowithFederalfile,ExtensiontheyouExtensionIRS,mustrequestspleaserequestRequestattachmustit directlyora copyany beto

th

Individuals,andTheresident2015 filingsuchpartnersdeadlineas solereport proprietors,is Apriltheir15,income2016rentalonforpropertyFormcalendarIRowners, year – yourwith postmarkedwrittencitythe format.City return.on orof AnbeforeAnMiddletown. extensionextensionAprilto15filetoforExtension isfilecalendarnotisannotextensionrequests yearan extensiontaxpayersmust to pay;beto

th th th th

and Individualtaxpayers.resident ForReturn.partners fiscal yearreport taxpayers,their income the deadlineon Form is theIR 15 – pay;andpostmarkedif youbyifexpect theyou15onexpectdaytoorowebeforeoftotheusowetax,4Aprilmonthusyou15 tax,haveforforyoufiscalcalendartohavepayyearthat toyeartaxpayers.paybytaxpayersthethat by the

th th th

dayIndividualof the 4Return.mont h after year end. originaloriginalandYoubymaytheduedueuse15 date.adate.daycopyLateof Lateofthepaymentsthe4 paymentsFederalmonthareforExtensionsubjectarefiscalsubjectyeartoRequestpenaltytotaxpayers. penaltyorandanyand

The 2015 filing deadline is April 15, 2016 for calendar year Youinterest.format.writtenmay use a copyAn extensionof the Federalto fileExtensionis not an extensionRequest ortoanypay;

TheFilingThe 2015202deadlines3filing filingdeadlinefordeadlineestimatedisisAprilAprilpayments15,12016,5 202conformfor4 forcalendartocalendarIRSyear yearth interest.written format. An extension to file is not an extension to pay;

taxpayers. For fiscal year taxpayers, the deadline is the 15 if you expect to owe us tax, you have to pay that by the

th th th th th th thth

taxpayers.daydeadlines:taxpayers. of the 4theForFormonth15fiscalfiscaldayafteryearofyeartheyeartaxpayers,taxpayers,4end., 6 , 9 ,theandthedeadline12deadlinemonthisafteristhethe15 15 originalFormsif you expect due date.to Lateowe paymentsus tax, you are subjecthave to topay penaltythat andby the

thth

daydaythe beginningofofthethe4 4 monthofmonththeaftertaxableafteryearyearyear.end.end. originalFormsinterest.anddueinstructionsdate. Latemaypaymentsbe downloadedare subjectfromto penalty our websiteand

Filing deadlines for estimated payments conform to IRS at www.interest. cityofmiddletown.org under Middletown Income Tax,

th th th th th

Filing Filing Alldeadlines:taxpayersdeadlines deadlines themust 15 dayfor for attachofestimated estimated thecopies4 , 6payments ,of9payments ,all and1099-Misc12conform monthconform formsafterto to IRSOhio Forms then download forms.

th th th th th

Revisedthedeadlines:issuedbeginningtoCodeOhiotheof15 residents.718.08thedaytaxableofdeadlines:theJEDDyear.4 , 61,-the9Liberty, and15th12 Townshipdaymonthof April,afterusesJune,the FormsFormsFormsand instructions may be downloaded from our website

Sept.,thesamebeginningstandard& Dec. ofasthethetaxableInternalyear.Revenue Service in determining FormsFormsatQuestions?www.cityofmiddletown.organdandinstructionsinstructionsmaymaybebeunderdownloadeddownloadedMiddletownfromfromourIncomeourwebsitewebsiteTax,

All whethertaxpayersan individualmust attachis ancopiesemployeeof all or1099-Miscsubcontractor. forms atTheatthenwww.cityofmiddletown.org www.cityofmiddletown.orgJEDDdownload1 – Libertyforms.TownshipunderunderincomeMiddletownBusiness,tax is administeredIncomeIncomeTax,Tax,

AllAll issuedtaxpayerstaxpayers to Ohiomustresidents.must attachattach JEDDcopiescopies 1of- Libertyallof 1099-Miscall Township1099-Misc formsusesformsissued.the bythenthedownloadCity of Middleforms.town. Please feel free to call us at (513)

Tax Forms.

JEDDissuedsameProvidestandard1to-ownershipOhioLibertyasresidents. Townshiptheinformation: InternalJEDDusesRevenue1theS-Corps- LibertysameServiceandstandardTownshippartnershipsin determiningas theusesInternalthe Questions? 425-7862 between the hours of 8:00AM to 5:00PM, Monday

RevenuepleasesamewhetherstandardprovideanServiceindividualasK-1s.inthedeterminingForInternalis anall employeecloselyRevenuewhetherheldorServicesubcontractor.ancorporations,individualin determining is an or ThethroughQuestions?JEDDFriday.1 – Liberty Township income tax is administered

employeelimitedwhetherliabilityanorindividualsubcontractor.companiesis anprovideemployeea listor subcontractor.of corporate officers Theby theJEDDCity1of–Middletown.Liberty TownshipPleaseincomefeel freetaxtoiscalladministeredus at (513)

Provide and owners,ownershipincludinginformation: the ownershipS-Corpspercentage.and partnerships by425-7862the Citybetweenof Middletown. the hoursPleaseof 8:00AMfeel freeto 5:00PM,to call usMondayat (513)

pleaseProvide provideownership K-1s.information: For all closelyS-Corps held corporations,and partnershipsor 425-7862through Friday.between the hours of 8:00AM to 5:00PM, Monday

please limitedSpecialprovide liabilityInstructionscompaniesK-1s. For provideall closely a list ofheld corporatecorporations, officersor through Friday.

limitedLineand owners,1–liabilityEnterincludingthecompaniesAdjustedthe ownershipprovideFederalaTaxablelistpercentage.of corporateIncome (AFTI)officers as defined by the Ohio Revised Code(ORC) 718.01. All business entities

andcomputeowners,AFTIincludingas if theythewereownershipC corporations.percentage.

Special• ForInstructionscorporations use 1120, line 28, Taxable income before net operating loss deduction and special deductions.

LineSpecial• –1 EnterInstructionsS-Corpsthe Adjustedusually useFederal1120S,TaxableScheduleIncomeK, line(AFTI)18, Income/Lossas defined byReconciliation.the Ohio Revised Code(ORC) 718.01. All business entities

Linecompute•1 –PartnershipsAFTIEnter theas ifAdjustedtheyandwerelimitedFederalC corporations.liabilityTaxablecompaniesIncome (AFTI)use 1065,aspagedefined5, lineby the1, NetOhioIncome.Revised Code(ORC) 718.01. All business entities

compute•• NonresidentForAFTIcorporationsas if theysolewereuseproprietors1120,C corporations. linefiling28, on aTaxablebusinessincomereturnbeforewill disregardnet operatingtheselossinstructionsdeductionandandusespecial1040,deductions.Schedule C, line 31,

• • S-CorpsForNetcorporationsProfitusuallyor Lossuseuse1120,1120S,lineSchedule28, TaxableK, lineincome18, Income/Lossbefore net operatingReconciliation.loss deduction and special deductions.

• •• S-Corps usually use 1120S, Schedule K, line 18, Income/Loss Reconciliation. Partnerships and limited liability companies use 1065, page 5, line 1, Net Income.Nonresident landlords filing on a business return will disregard these instructions and use 1040, Schedule E, line 26, Total

• • rental real estate and royalty income or (loss.)Partnerships and limited liability companies use 1065, page 5, line 1, Net Income. Nonresident sole proprietors filing on a business return will disregard these instructions and use 1040, Schedule C, line 31,

Line• –2 ReferNonresidentNettoProfitScheduleorsoleLossXproprietorsinstructionsfilingon theonreversea businessside.return will disregard these instructions and use 1040, Schedule C, line 31,

Line•4 –NonresidentNetReferProfitto ScheduleorlandlordsLoss Y instructionsfiling on aonbusinessthe reversereturnside. will disregard these instructions and use 1040, Schedule E, line 26, Total

If you• arerentalNonresidenta residentreal estateentity,landlordsandallroyaltyoffilingyouronincomeincomea businessoris(loss.)subjectreturntowillJEDDdisregardtax, withthesecreditinstructionsgiven forandtaxesusepaid1040,to otherSchedulemunicipalities.E, line 26,IfTotal21,you are

Lineclaiming2 –rentalReferpaymentsrealto ScheduletoestateotherandXmunicipalities,instructionsroyalty incomeonyoutheormust(loss.)reversprovidee side.copies of returns filed in those cities. If you are a non-resident entity doing

LineLinebusiness2 4––bothReferReferwithintotoScheduleScheduleand withoutXYinstructionsinstructionsJEDD-LibertyononthetheTownship,reversereverseside.side.use Schedule Y to determine the percentage of your income subject to JEDD

LineLineIftax.you54 are– Refera residentto Scheduleentity, allY instructionsof your incomeon theis subjectreversetoside.JEDD tax, with credit given for taxes paid to other municipalities. If you are

claimingIf you arepaymentsa residenttoentity,otherallmunicipalities,of your incomeyouismustsubjectprovideto JEDDcopiestax,ofwithreturnscreditfiledgivenin thosefor taxescities.paidIf youto otherare amunicipalities.non-resident entityIf youdoingare

Declaration of Estimated Tax business both within and without JEDD-Liberty Township, use Schedule Y to determine the percentage of your income subject to JEDD claiming payments to other municipalities, you must provide copies of returns filed in those cities. If you are a non-resident entity doing

Anytax.businessentitybothanticipatingwithin andthatwithouttheir taxJEDD-Libertyliability at theTownship,end of 20 use24willSchedulebe moreYthanto determine$200 mustthemakepercentageestimatedof yourtax payments.income subjectTaxpayersto JEDD

must tax. have 90% of their current year tax liability or 100% of their previous year’s tax liability paid through quarterly estimated tax

paymentsDeclarationto avoidof Estimatedpenalty andTaxinterest. Estimated taxes must be paid in full by DecemberDecember 15.15. If you wait until you file your return, you

AnywillDeclarationbeentitysubjectanticipatingoftoEstimatedpenaltythatandTaxtheirinterest. tax liability at the end of 2016 will be more than $200 must make estimated tax payments. Taxpayers

Anymustentityhave 90%anticipatingof theirthatcurrent theiryeartax liabilitytax liabilityat theorend100%of 2016of theirwillpreviousbe moreyear’sthan $200tax liabilitymust makepaidestimatedthrough quarterlytax payments.estimatedTaxpayerstax

mustpaymentsDECLARATIONhaveto90%avoidof theirpenaltyANDcurrent andRETURNinterest.year taxPAYMENTEstimatedliability ortaxes100%CALENDARmustof theirbe paidpreviousin fullyear’sby Decembertax liability15.Ifpaidyouthroughwait untilquarterlyyou fileestimatedyour return,tax you

will be subject to penalty and interest.

payments APRILAPRILto avoid15TH*15TH* penalty and interest.JUNEEstimated15TH taxes must beSEPTpaid in15 full by December DECDEC1531 15.If you wait untilAPRILAPRILyou file15*15*your return, you

will be subject to penalty and interest. File Declaration 2nd quarter payment 3rd quarter payment 4th quarter payment File return

DECLARATION 1st quarter payment AND RETURN PAYMENT CALENDAR

*TheDECLARATIONfilingAPRILdeadline15TH*ANDfor yourRETURNreturnJUNEis AprilPAYMENT15TH115th5th CALENDARSEPT 15 DEC 31 APRIL 15*

File DeclarationAPRIL 15TH* 2nd quarterJUNE 15THentpaym 3rd quarterSEPTpayment 15 4th quarterDEC 31 payment FileAPRILreturn15*

DidDid1stFileyouyouquarterDeclarationrememberrememberpaymenttotoinclude:include:2nd quarter payment 3rd quarter payment 4th quarter payment File return

*The1st• filing quarter• completedeadlinepayment completecopiesforofyourcopiesfederalreturnofforms,federalis Aprilschedules,forms,15th schedules,and supportingand supportingstatementsstatementsas filed withas filedthewithIRS?the IRS?

*The• filing• copiesdeadlineofcopiesallfor1099-miscyourof allreturn1099-miscformsis Aprilissuedforms15thtoissuedOhio residentsfor persons/businesses working in Liberty Township, JEDD

Did you• • rememberlist of corporatelisttoofinclude:corporateofficers andofficersowners/partnersand owners/partnersincludingincludingname, socialname,securitysocialnumbersecurityandnumberownershipand ownershippercentagepercentage(if

Did you• remembercompletenot included(ifcopiestonotwithinclude:includedoffederalfederalwithforms) forms,federalschedules,forms) and supporting statements as filed with the IRS?

• • completecopies of allcopies1099-miscof federalformsforms,issuedschedules,to Ohioandresidentssupporting statements as filed with the IRS?

• • copies of all 1099-misc forms issued to Ohio residentslist of corporate officers and owners/partners including name, social security number and ownership percentage (if

• not included with federal forms)list of corporate officers and owners/partners including name, social security number and ownership percentage (if

not included with federal forms)