Enlarge image

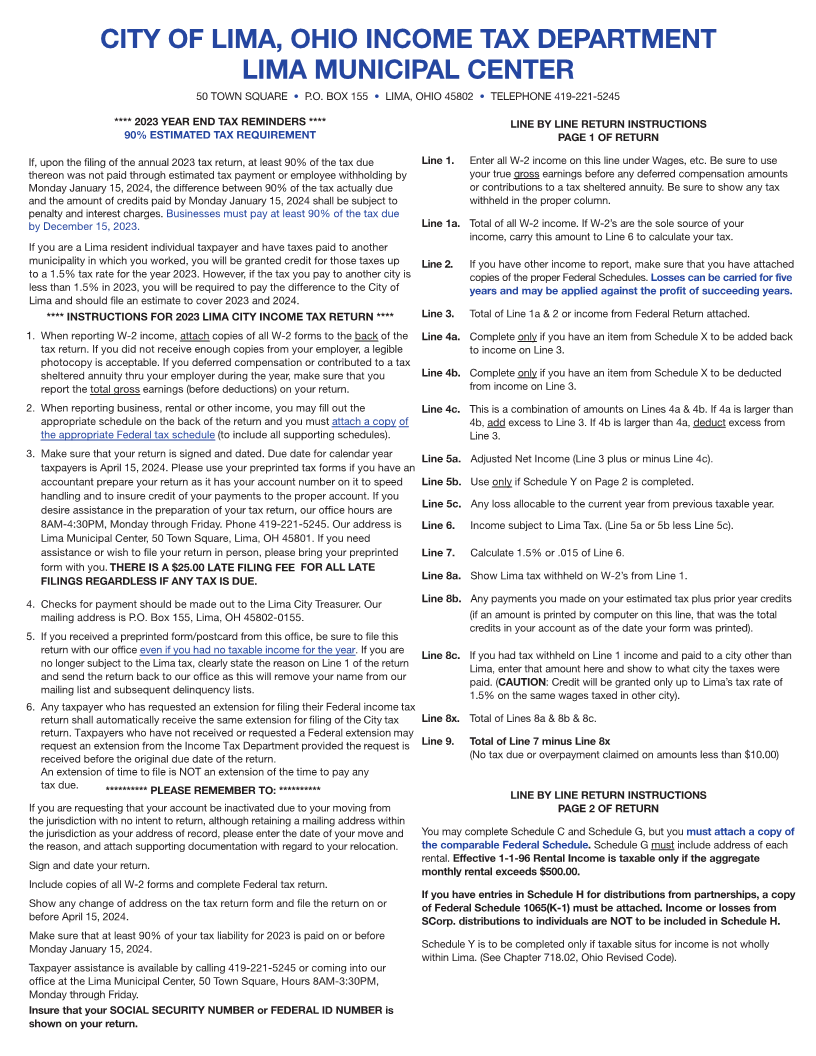

CITY OF LIMA, OHIO INCOME TAX DEPARTMENT

LIMA MUNICIPAL CENTER

50 TOWN SQUARE • P.O. BOX 155 • LIMA, OHIO 45802 • TELEPHONE 419-221-5245

**** 2023 YEAR END TAX REMINDERS **** LINE BY LINE RETURN INSTRUCTIONS

90% ESTIMATED TAX REQUIREMENT PAGE 1 OF RETURN

If, upon the filing of the annual 2023 tax return, at least 90% of the tax due Line 1. Enter all W-2 income on this line under Wages, etc. Be sure to use

thereon was not paid through estimated tax payment or employee withholding by your true gross earnings before any deferred compensation amounts

Monday January 15, 2024, the difference between 90% of the tax actually due or contributions to a tax sheltered annuity. Be sure to show any tax

and the amount of credits paid byMonday January 15, 2024 shall be subject to withheld in the proper column.

penalty and interest charges. Businesses must pay at least 90% of the tax due

by December 15, 2023. Line 1a. Total of all W-2 income. If W-2’s are the sole source of your

income, carry this amount to Line 6 to calculate your tax.

If you are a Lima resident individual taxpayer and have taxes paid to another

municipality in which you worked, you will be granted credit for those taxes up Line 2. If you have other income to report, make sure that you have attached

to a 1.5% tax rate for the year 2023. However, if the tax you pay to another city is copies of the proper Federal Schedules.Losses can be carried for five

less than 1.5% in 2023, you will be required to pay the difference to the City of years and may be applied against the profit of succeeding years.

Lima and should file an estimate to cover 2023 and 2024.

**** INSTRUCTIONS FOR 2023 LIMA CITY INCOME TAX RETURN **** Line 3. Total of Line 1a & 2 or income from Federal Return attached.

1. When reporting W-2 income, attach copies of all W-2 forms to the back of the Line 4a. Complete only if you have an item from Schedule X to be added back

tax return. If you did not receive enough copies from your employer, a legible to income on Line 3.

photocopy is acceptable. If you deferred compensation or contributed to a tax

sheltered annuity thru your employer during the year, make sure that you Line 4b. Complete only if you have an item from Schedule X to be deducted

report the total gross earnings (before deductions) on your return. from income on Line 3.

2. When reporting business, rental or other income, you may fill out the Line 4c. This is a combination of amounts on Lines 4a & 4b. If 4a is larger than

appropriate schedule on the back of the return and you mustattach a copy of 4b, add excess to Line 3. If 4b is larger than 4a, deduct excess from

the appropriate Federal tax schedule (to include all supporting schedules). Line 3.

3. Make sure that your return is signed and dated. Due date for calendar year Adjusted Net Income (Line 3 plus or minus Line 4c).

Line 5a.

taxpayers is April 1 5,2024. Please use your preprinted tax forms if you have an

accountant prepare your return as it has your account number on it to speed Line 5b. Use only if Schedule Y on Page 2 is completed.

handling and to insure credit of your payments to the proper account. If you

desire assistance in the preparation of your tax return, our office hours are Line 5c. Any loss allocable to the current year from previous taxable year.

8AM-4:30PM, Monday through Friday. Phone 419-221-5245. Our address is Line 6. Income subject to Lima Tax. (Line 5a or 5b less Line 5c).

Lima Municipal Center, 50 Town Square, Lima, OH 45801. If you need

assistance or wish to file your return in person, please bring your preprinted Line 7. Calculate 1.5% or .015 of Line 6.

form with you. THERE IS A $25.00 LATE FILING FEE FOR ALL LATE Show Lima tax withheld on W-2’s from Line 1.

FILINGS REGARDLESS IF ANY TAX IS DUE. Line 8a.

4. Checks for payment should be made out to the Lima City Treasurer. Our Line 8b. Any payments you made on your estimated tax plus prior year credits

mailing address is P.O. Box 155, Lima, OH 45802-0155. (if an amount is printed by computer on this line, that was the total

credits in your account as of the date your form was printed).

5. If you received a preprinted form/postcard from this office, be sure to file this

return with our office even if you had no taxable income for the year. If you are Line 8c. If you had tax withheld on Line 1 income and paid to a city other than

no longer subject to the Lima tax, clearly state the reason on Line 1 of the return Lima, enter that amount here and show to what city the taxes were

and send the return back to our office as this will remove your name from our paid. (CAUTION: Credit will be granted only up to Lima’s tax rate of

mailing list and subsequent delinquency lists. 1.5% on the same wages taxed in other city).

6. Any taxpayer who has requested an extension for filing their Federal income tax

return shall automatically receive the same extension for filingof the City tax Line 8x. Total of Lines 8a & 8b & 8c.

return. Taxpayers who have not received or requested a Federal extension may

request an extension from the Income Tax Department provided the request is Line 9. Total of Line 7 minus Line 8x

received before the original due date of the return. (No tax due or overpayment claimed on amounts less than $10.00)

An extension of time to file is NOT an extension of the time to pay any

tax due.

********** PLEASE REMEMBER TO: ********** LINE BY LINE RETURN INSTRUCTIONS

If you are requesting that your account be inactivated due to your moving from PAGE 2 OF RETURN

the jurisdiction with no intent to return, although retaining a mailing address within

the jurisdiction as your address of record, please enter the date of your move and You may complete Schedule C and Schedule G, but you must attach a copy of

the reason, and attach supporting documentation with regard to your relocation. the comparable Federal Schedule. Schedule G must include address of each

Sign and date your return. rental. Effective 1-1-96 Rental Income is taxable only if the aggregate

monthly rental exceeds $500.00.

Include copies of all W-2 forms and complete Federal tax return.

If you have entries in Schedule H for distributions from partnerships, a copy

Show any change of address on the tax return form and file the return on or of Federal Schedule 1065(K-1) must be attached. Income or losses from

before April 15, 2024. SCorp. distributions to individuals are NOT to be included in Schedule H.

Make sure that at least 90% of your tax liability for 2023 is paid on or before

Monday January 15, 20 24. Schedule Y is to be completed only if taxable situs for income is not wholly

within Lima. (See Chapter 718.02, Ohio Revised Code).

Taxpayer assistance is available by calling 419-221-5245 or coming into our

office at the Lima Municipal Center, 50 Town Square, Hours 8AM-3:30PM,

Monday through Friday.

Insure that your SOCIAL SECURITY NUMBER or FEDERAL ID NUMBER is

shown on your return.