Enlarge image

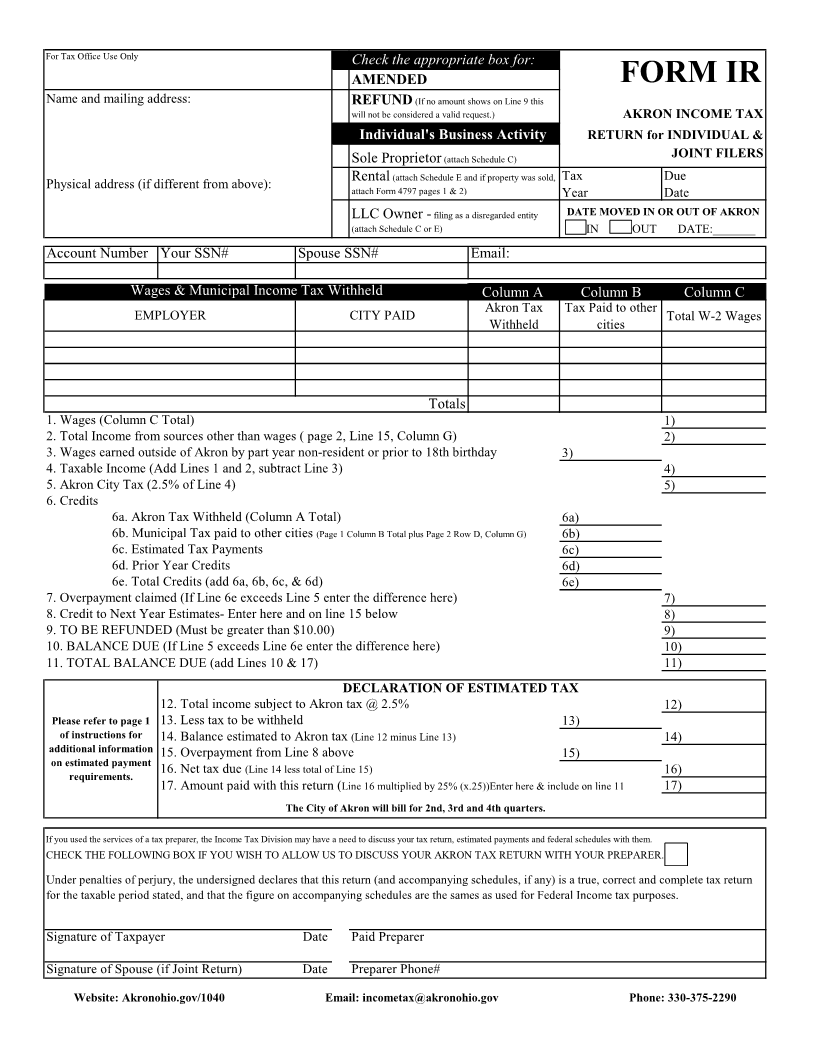

For Tax Office Use Only Check the appropriate box for:

AMENDED FORM IR

Name and mailing address: REFUND (If no amount shows on Line 9 this

will not be considered a valid request.) AKRON INCOME TAX

Individual's Business Activity RETURN for INDIVIDUAL &

Sole Proprietor (attach Schedule C) JOINT FILERS

Rental (attach Schedule E and if property was sold, Tax Due

Physical address (if different from above): attach Form 4797 pages 1 & 2)

Year Date

LLC Owner - filing as a disregarded entity DATE MOVED IN OR OUT OF AKRON

(attach Schedule C or E) IN OUT DATE:_______

Account Number Your SSN# Spouse SSN# Email:

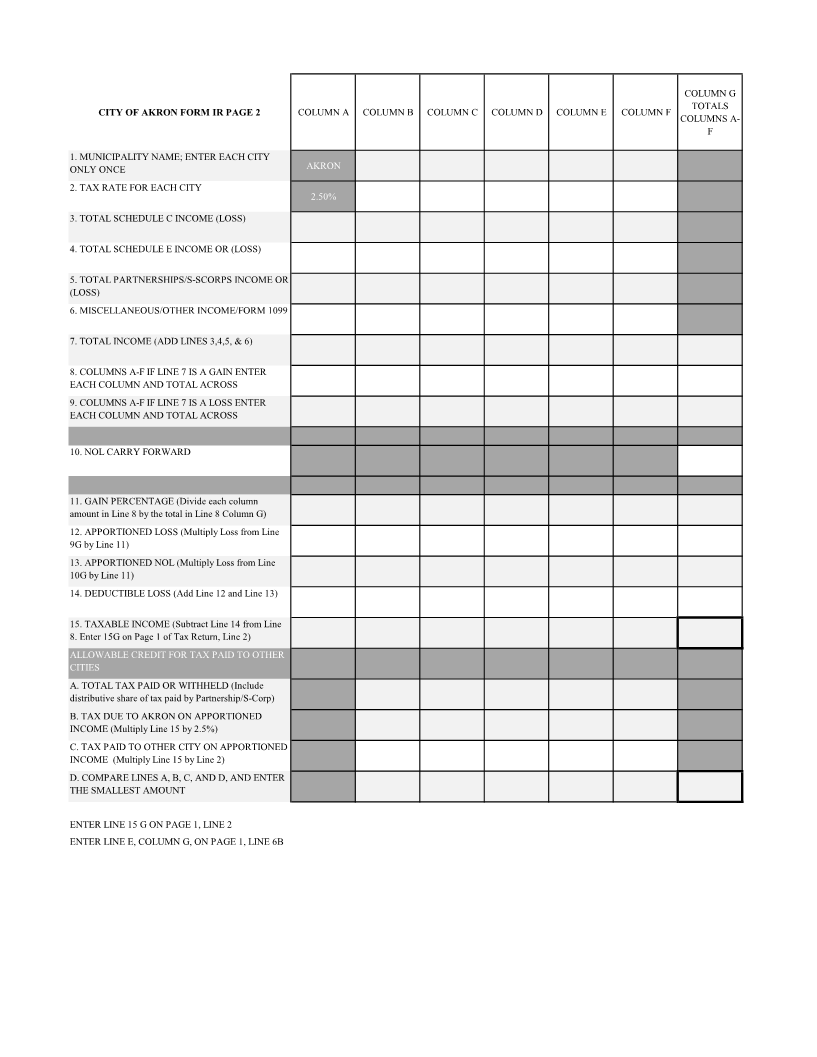

Wages & Municipal Income Tax Withheld Column A Column B Column C

Akron Tax Tax Paid to other

EMPLOYER CITY PAID Total W-2 Wages

Withheld cities

Totals

1. Wages (Column C Total) 1)

2. Total Income from sources other than wages ( page 2, Line 15, Column G) 2)

3. Wages earned outside of Akron by part year non-resident or prior to 18th birthday 3)

4. Taxable Income (Add Lines 1 and 2, subtract Line 3) 4)

5. Akron City Tax (2.5% of Line 4) 5)

6. Credits

6a. Akron Tax Withheld (Column A Total) 6a)

6b. Municipal Tax paid to other cities (Page 1 Column B Total plus Page 2 Row D, Column G) 6b)

6c. Estimated Tax Payments 6c)

6d. Prior Year Credits 6d)

6e. Total Credits (add 6a, 6b, c,6& d)6 6e)

7. Overpayment claimed (If Line 6e exceeds Line 5 enter the difference here) 7)

8. Credit to Next Year Estimates- Enter here and on line 15 below 8)

9. TO BE REFUNDED (Must be greater than $10.00) 9)

10. BALANCE DUE (If Line 5 exceeds Line 6e enter the difference here) 10)

11. TOTAL BALANCE DUE (add Lines 10 & 17) 11)

DECLARATION OF ESTIMATED TAX

12. Total income subject to Akron tax @ 2.5% 12)

Please refer to page 1 13. Less tax to be withheld 13)

of instructions for 14. Balance estimated to Akron tax (Line 12 minus Line 13) 14)

additional information 15. Overpayment from Line 8 above 15)

on estimated payment 16. Net tax due (Line 14 less total of Line 15) 16)

requirements.

17. Amount paid with this return (Line 16 multiplied by 25% (x.25))Enter here & include on line 11 17)

The City of Akron will bill for 2nd, 3rd and 4th quarters.

If you used the services of a tax preparer, the Income Tax Division may have a need to discuss your tax return, estimated payments and federal schedules with them.

CHECK THE FOLLOWING BOX IF YOU WISH TO ALLOW US TO DISCUSS YOUR AKRON TAX RETURN WITH YOUR PREPARER.

Under penalties of perjury, the undersigned declares that this return (and accompanying schedules, if any) is a true, correct and complete tax return

for the taxable period stated, and that the figure on accompanying schedules are the sames as used for Federal Income tax purposes.

Signature of Taxpayer Date Paid Preparer

Signature of Spouse (if Joint Return) Date Preparer Phone#

Website: Akronohio.gov/1040 Email: incometax@akronohio.gov Phone: 330-375-2290