Enlarge image

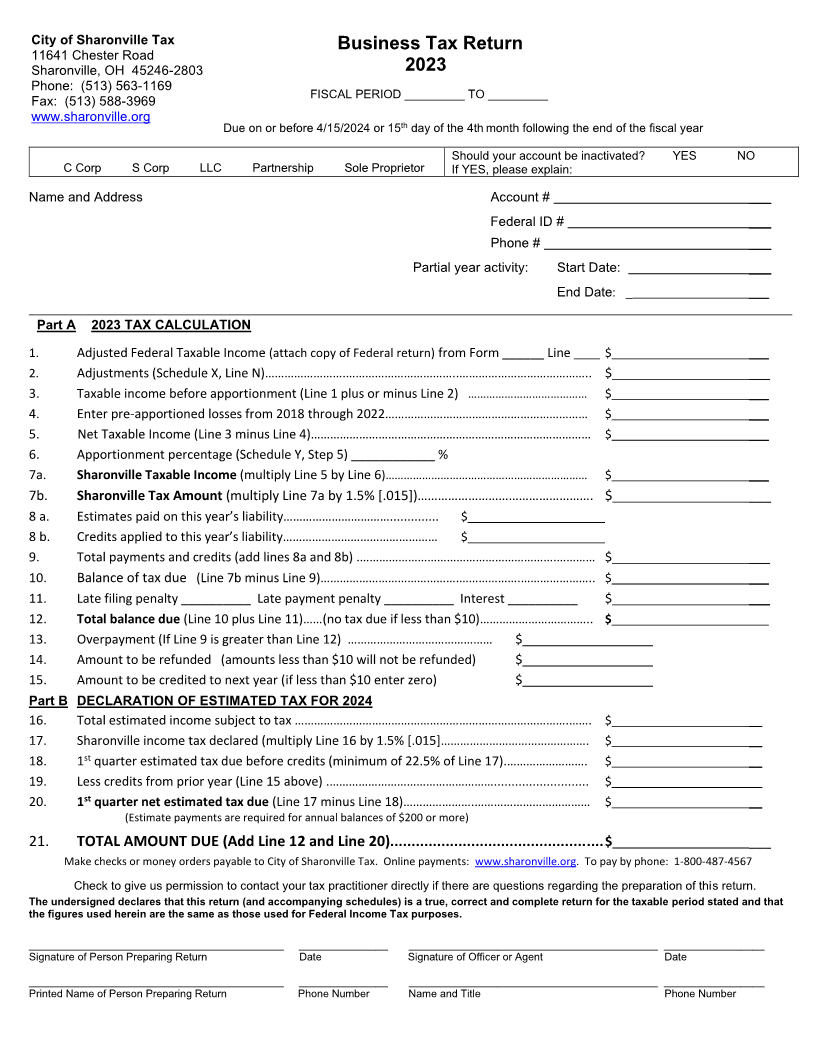

City of Sharonville Tax Business Tax Return

11641 Chester Road

Sharonville, OH 45246-2803 2023

Phone: (513) 563-1169

FISCAL PERIOD _________ TO _________

Fax: (513) 588-3969

www.sharonville.org

Due on or before 4/15/2024 or 15 thday of the 4th month following the end of the fiscal year

Should your account be inactivated? YES NO

C Corp S Corp LLC Partnership Sole Proprietor If YES, please explain:

Name and Address Account # ___

Federal ID # ___

Phone # ___

Partial year activity: Start Date: ___

End Date: _ ___

Part A 2023 TAX CALCULATION

1. Adjusted Federal Taxable Income(attach copy of Federal return) from Form ______ Line ____ $ ___

2. Adjustments (Schedule X, Line N)…………………….……………………………..………………………………….. $ ___

3. Taxable income before apportionment (Line 1 plus or minus Line 2) ………………………………… $ ___

4. Enter pre-apportioned losses from 2018 through 2022……………………………………………………… $ ___

5. Net Taxable Income (Line 3 minus Line 4)…………………………………………………………………………… $ ___

6. Apportionment percentage (Schedule Y, Step 5) ____________ %

7a. Sharonville Taxable Income (multiply Line 5 by Line 6)………………………………………………………… $ ___

7b. Sharonville Tax Amount(multiply Line 7a by 1.5% [.015])……………………………………………. $ ___

8 a. Estimates paid on this year’s liability…………………………….............. $

8 b. Credits applied to this year’s liability………………………………………… $

9. Total payments and credits (add lines 8a and 8b).…………………………………………………….………… $ ___

10. Balance of tax due (Line 7b minus Line 9)…………………………………….……………….………………….. $ ___

11. Late filing penalty __________ Late payment penalty __________ Interest __________ $ ___

12. Total balance due (Line 10 plus Line 11)…… (no tax due if less than $10)…………………………….. $ ___

13. Overpayment (If Line 9 is greater than Line 12) ……………………………………… $

14. Amount to be refunded (amounts less than $10 will not be refunded) $

15. Amount to be credited to next year (if less than $10 enter zero) $

Part B DECLARATION OF ESTIMATED TAX FOR 2024

16. Total estimated income subject to tax ………………………………………………………………………….……. $ __

17. Sharonville income tax declared (multiply Line 16 by1.5% [.015]………………………………………. $ __

18. 1 stquarter estimated tax due before credits (minimum of 22.5% of Line 17). ……………………. $ __

19. Less credits from prior year (Line 15 above) .……………………………………………........................... $ __

20. 1 stquarter net estimated tax due (Line 17 minus Line 18)………………….……………………………… $ __

(Estimate payments are required for annual balances of $200 or more)

21. TOTAL AMOUNT DUE (Add Line 12 and Line 20).................................................. $ ___

Make checks or money orders payable to City of Sharonville Tax. Online payments: www.sharonville.org. To pay by phone: 1-800-487-4567

Check to give us permission to contact your tax practitioner directly if there are questions regarding the preparation of this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that

the figures used herein are the same as those used for Federal Income Tax purposes.

___________________________________________ _______________ __________________________________________ _________________

Signature of Person Preparing Return Date Signature of Officer or Agent Date

___________________________________________ _______________ __________________________________________ _________________

Printed Name of Person Preparing Return Phone Number Name and Title Phone Number