Enlarge image

PRINT FORM RESET FORM

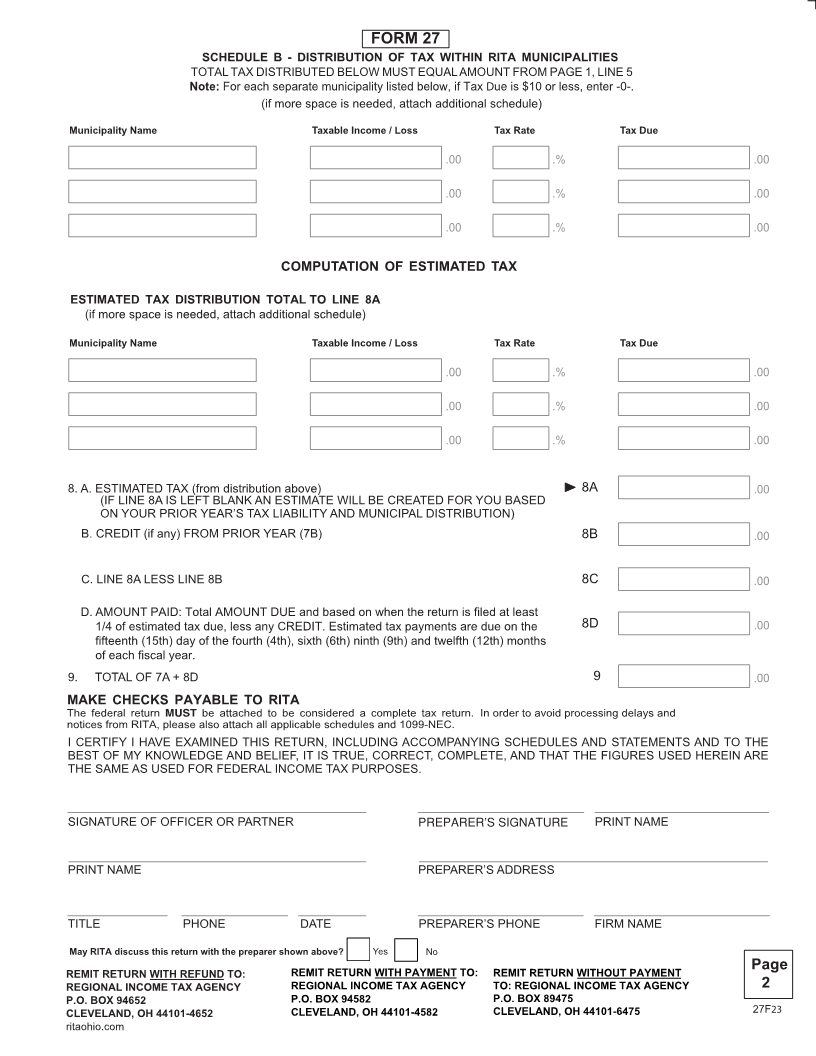

Regional Income Tax Agency

Form

27 RITA Net Profit Tax Return 2023

FOR CALENDAR YEAR OR FISCAL YEAR BEGINNING AND ENDING

The federal return MUST be attached to be considered a complete tax return. Please also attach all applicable schedules and 1099-NEC to avoid delays.

Check if: Initial RITA Return No longer in RITA Extension

Amended Return Out of Business

Federal Business Activity Code #

Consolidated Return (Attach Form 851) Alternate Method

Consolidated filer with 80% ownership of a Pass-Through Entity (see Instructions, Page 3) Business

Activity

BUSINESS: C CORPORATION PARTNERSHIP LLC SMALL EMPLOYER: ORC 718.021 ELECTION:

S CORPORATION ESTATE TRUST

Company Name Federal Identification Number:

Address # Street Suite #

City State Zip Code

1. INCOME PER ATTACHED FEDERAL RETURN

(per attached Federal Form 1120 (Line 28), 1120S (Sch. K - Line 18), 990T (Line 30), 1 .00

1065 (Sch. K - Analysis of Net Income (Loss), Page 5 - Line 1), 1041 (Line 17) or the equivalent)

2. A. ITEMS NOT DEDUCTIBLE (from Page 3, Schedule X, Line G) Add 2A .00

B. ITEMS NOT TAXABLE (from Page 3, Schedule X, Line Q) Deduct 2B .00

C. ENTER EXCESS OF LINE 2A OR 2B 2C .00

3. A. ADJUSTED FEDERAL TAXABLE INCOME (Line 1 plus or minus Line 2C) 3A .00

B. CHECK THE BOX WHEN USING DIFFERENT NET OPERATING LOSS AMOUNTS FOR

DIFFERENT MUNICIPALITIES AND ATTACH YOUR NET OPERATING LOSSES WORKSHEET. 3B

SEE FORM 27 INSTRUCTIONS FOR 3Bii THROUGH LINE 4.

i. THIS LINE INTENTIONALLY LEFT BLANK

ii. PRE-APPORTIONED LOSSES FROM TAX YEARS BEGINNING ON OR AFTER 1/1/18 3B(ii) .00

UTILIZED IN THIS TAX YEAR

iii. Income/Loss Subject to Apportionment (Line 3A less Line 3B(ii)) 3B(iii) .00

C. PERCENTAGE ALLOCABLE TO RITA 3C %

If Schedule Y, Page 4 is used

4. AMOUNT SUBJECT TO MUNICIPAL INCOME TAX

(Line 3b(iii) multiplied by 3C (%)) 4 .00

5. MUNICIPAL INCOME TAX DUE(see Instructions)

NOTE: Must equal Schedule B on Page 2 5 .00

6. A. PAYMENTS ON DECLARATIONS OF ESTIMATED MUNICIPAL INCOME TAX 6A .00

B. AMOUNT OF PREVIOUS YEAR CREDIT 6B .00

C. TOTAL CREDITS ALLOWABLE (Line 6A + 6B) 6C .00

7. A. BALANCE DUE (Line 5 less Line 6C) AMOUNT PAYABLE TO RITA MUST ACCOMPANY THIS FORM 7A .00

B. OVERPAYMENT CLAIMED (If Line 6C exceeds Line 5 enter difference here and check the 7B .00

desired box)

(Cannot be split between refund and credit) Refund................... Credit...................