Enlarge image

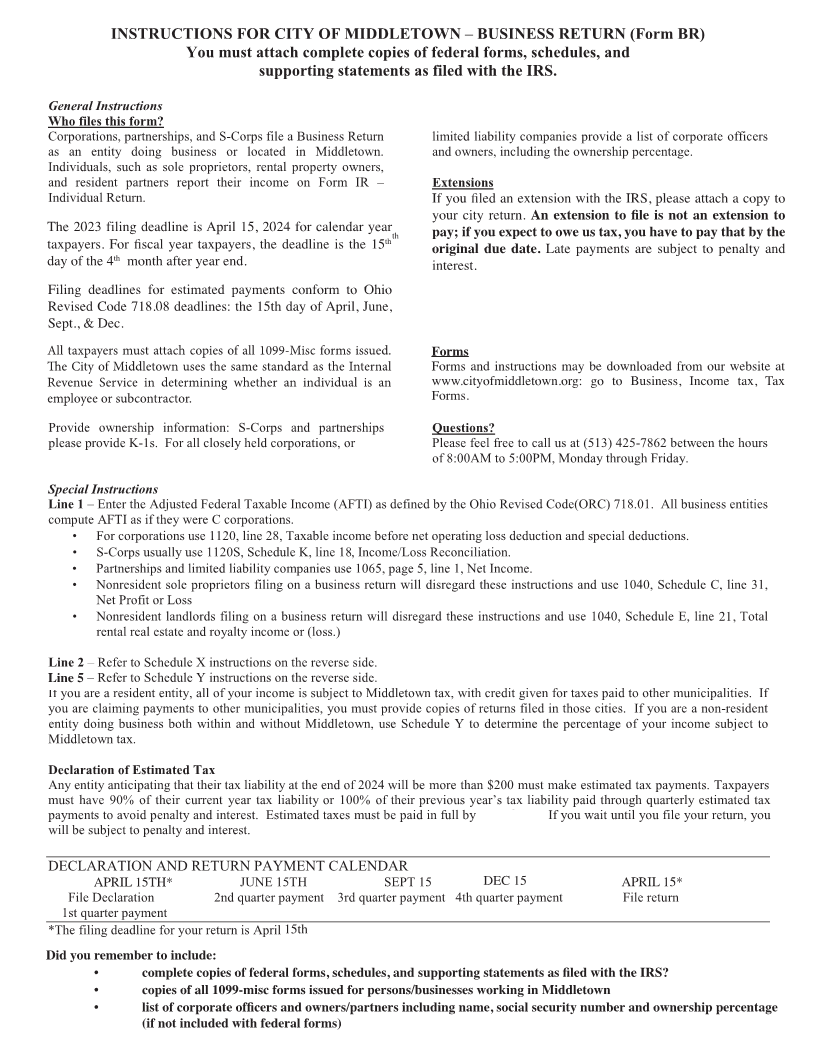

INSTRUCTIONS FOR CITY OF MIDDLETOWN – BUSINESS RETURN (Form BR)

You must attach complete copies of federal forms, schedules, and

supporting statements as filed with the IRS.

General Instructions

Who files this form?

Corporations, partnerships, and S-Corps file a Business Return limited liability companies provide a list of corporate officers

as an entity doing business or located in Middletown. and owners, including the ownership percentage.

Individuals, such as sole proprietors, rental property owners,

and resident partners report their income on Form IR – Extensions

Individual Return. If you need an extension to file, you must request it directly If you filed an extension with the IRS, please attach a copy to

your city return. with the City of Middletown. Extension requests must be An extension to file is not an extension to

th

The 2023 filing deadline is April 1 ,5 2024 for calendar yearth th pay;postmarkedif youonexpector beforeto oweAprilus15tax,foryoucalendarhaveyearto paytaxpayersthat by the

th th

taxpayers.taxpayers. ForForfiscalfiscal yearyeartaxpayers,taxpayers,thethedeadlinedeadlineisisthethe1515 originaland by thedue15 daydate.of Latethe 4paymentsmonth forarefiscalsubjectyear taxpayers.to penalty and

thth

dayday ofofthethe44 monthmonthafterafteryearyearend.end. interest.You may use a copy of the Federal Extension Request or any

written format. An extension to file is not an extension to pay;

Filing Filing deadlines deadlines for for estimated estimated payments payments conform conform to to IRSOhio if you expect to owe us tax, you have to pay that by the

th th th th th

Reviseddeadlines:Codethe 15718.08day ofdeadlines:the 4 , 6 , 9the, and15th12daymonthof April,after June, original due date. Late payments are subject to penalty and

Sept., & Dec.the beginning of the taxable year. interest.

AllAll taxpayerstaxpayers mustmust attachattach copiescopies of allof 1099-Miscall 1099-Misc formsformsissued. FormsForms

Theissued Cityto ofOhio Middletownresidents.usesThe theCity sameof standardMiddletown as theuses Internalthe FormsFormsandandinstructionsinstructions maymaybebedownloadeddownloadedfromfromourourwebsitewebsite at

Revenuesame standardServiceasinthedeterminingInternal RevenuewhetherServicean individualin determiningis an www.cityofmiddletown.org: at www.cityofmiddletown.org:go goto toBusiness, Business,Income then Middletowntax, Tax

employee or subcontractor.whether an individual is an employee or subcontractor. Forms.income tax, then download forms.

Provide ownership information: S-Corps and partnerships Questions?

please provide K-1s. For all closely held corporations, or Please feel free to call us at (513) 425-7862 between the hours

of 8:00AM to 5:00PM, Monday through Friday.

Special Instructions

Line 1 – Enter the Adjusted Federal Taxable Income (AFTI) as defined by the Ohio Revised Code(ORC) 718.01. All business entities

compute AFTI as if they were C corporations.

• For corporations use 1120, line 28, Taxable income before net operating loss deduction and special deductions.

• S-Corps usually use 1120S, Schedule K, line 18, Income/Loss Reconciliation.

• Partnerships and limited liability companies use 1065, page 5, line 1, Net Income.

• Nonresident sole proprietors filing on a business return will disregard these instructions and use 1040, Schedule C, line 31,

Net Profit or Loss

• Nonresident landlords filing on a business return will disregard these instructions and use 1040, Schedule E, line 26, Total21,

rental real estate and royalty income or (loss.)

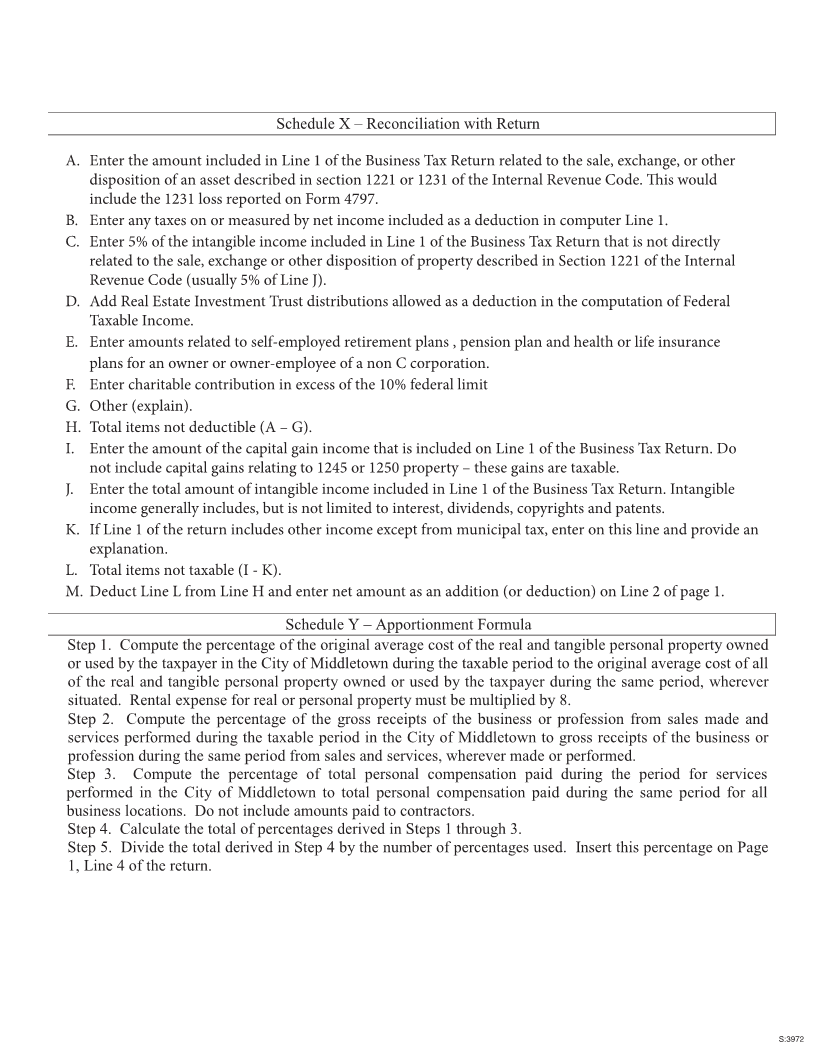

Line 2 – Refer to Schedule X instructions on the reverse side.

Line 5Line 4 – Refer to Schedule Y instructions on the reverse side.

If you are a resident entity, all of your income is subject to Middletown tax, with credit given for taxes paid to other municipalities. If

you are claiming payments to other municipalities, you must provide copies of returns filed in those cities. If you are a non-resident

entity doing business both within and without Middletown, use Schedule Y to determine the percentage of your income subject to

Middletown tax.

Declaration of Estimated Tax

Any entity anticipating that their tax liability at the end of 202 4 will be more than $200 must make estimated tax payments. Taxpayers

must have 90% of their current year tax liability or 100% of their previous year’s tax liability paid through quarterly estimated tax

payments to avoid penalty and interest. Estimated taxes must be paid in full by DecemberDecember 15.15.If you wait until you file your return, you

will be subject to penalty and interest.

DECLARATION AND RETURN PAYMENT CALENDAR

APRIL 15TH*APRIL 15TH* JUNE 15TH SEPT 15 DEC 15DEC 15 APRIL 15*APRIL 15*

File Declaration 2nd quarter payment 3rd quarter payment 4th quarter payment File return

1st quarter payment

*The filing deadline for your return is April 1515th 15th

Did you remember to include:Did you remember to include:

• • complete copies of federal forms, schedules, and supporting statements as filed with the IRS?complete copies of federal forms, schedules, and supporting statements as filed with the IRS?

• • copies of all 1099-misc forms issued to Ohio residentscopies of all 1099-misc forms issued for persons/businesses working in Middletown

• • list of corporate officers and owners/partners including name, social security number and ownership percentage (if list of corporate officers and owners/partners including name, social security number and ownership percentage

not included with federal forms) (if not included with federal forms)