Enlarge image

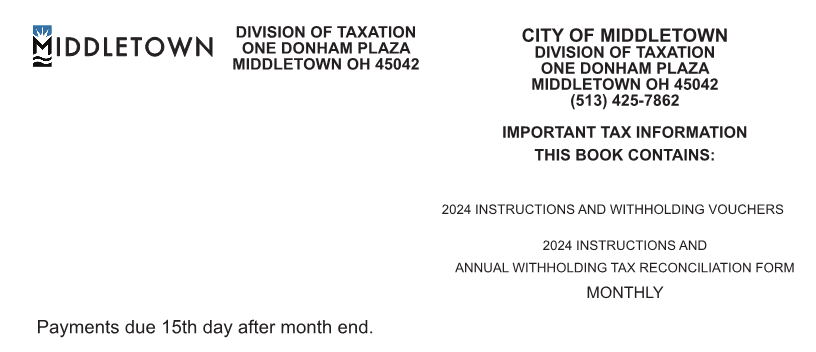

DIVISION OF TAXATION CITY OF MIDDLETOWN

IDDLETOWN ONE DONHAM PLAZA DIVISION OF TAXATION

MIDDLETOWN OH 45042 ONE DONHAM PLAZA

MIDDLETOWN OH 45042

(513) 425-7862

IMPORTANT TAX INFORMATION

THIS BOOK CONTAINS:

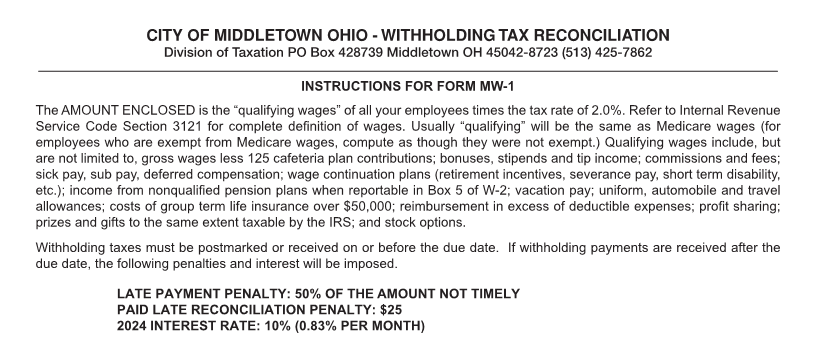

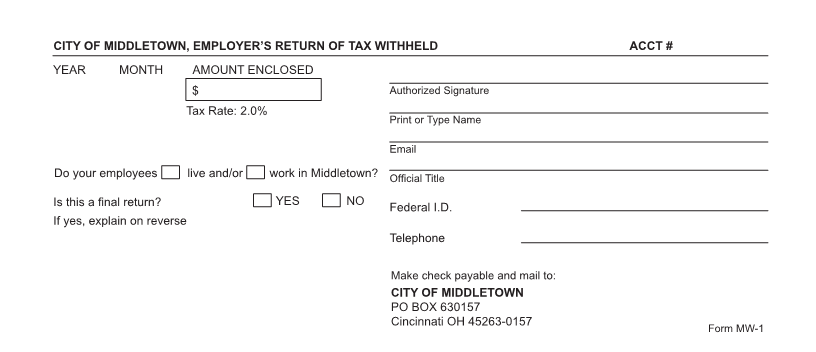

2024 INSTRUCTIONS AND WITHHOLDING VOUCHERS

2024 INSTRUCTIONS AND

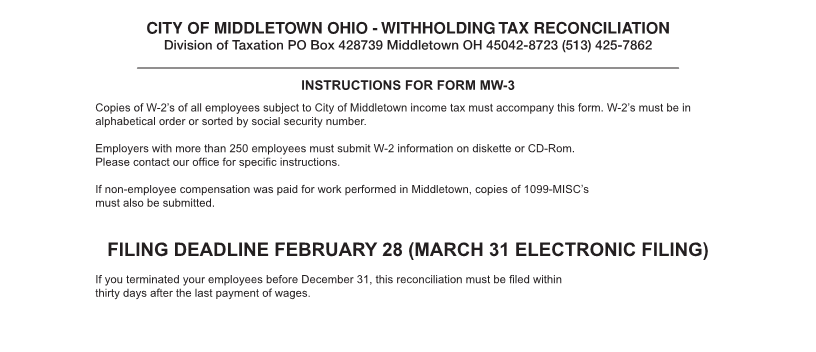

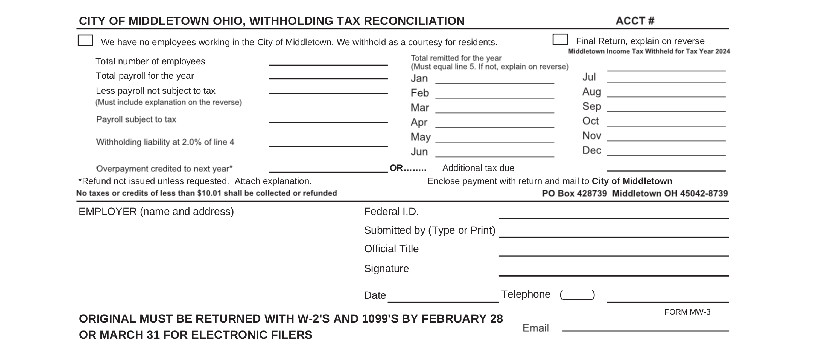

ANNUAL WITHHOLDING TAX RECONCILIATION FORM

MONTHLY

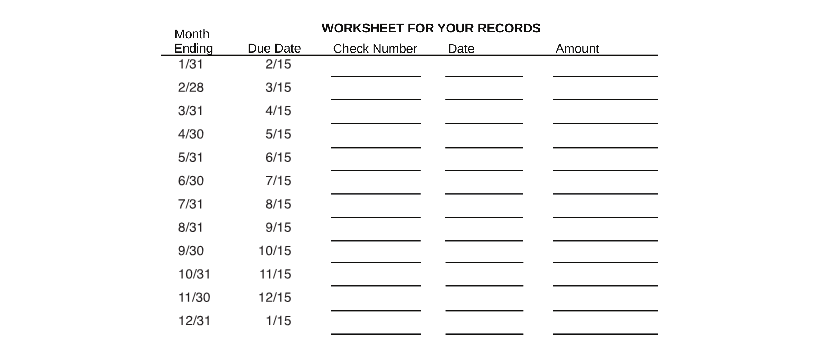

Payments due 15th day after month end.