Enlarge image

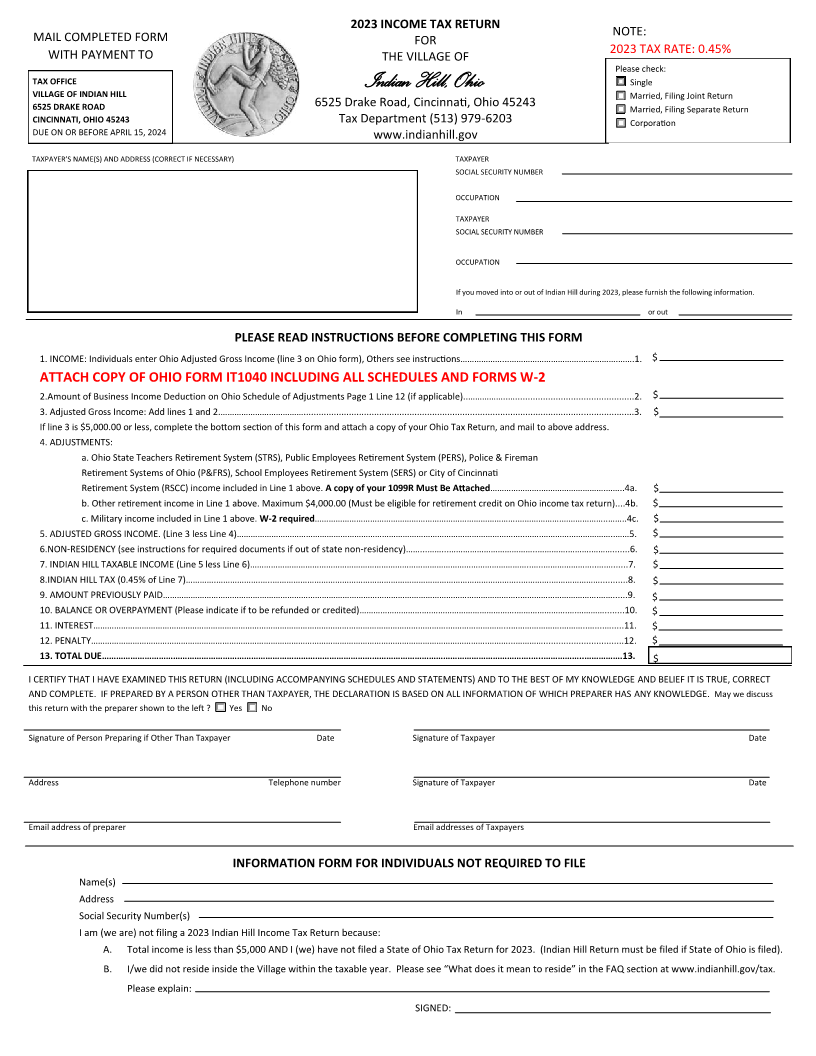

202 3 INCOME TAX RETURN

NOTE:

MAIL COMPLETED FORM FOR

202 3 TAX RATE: 0.45%

WITH PAYMENT TO THE VILLAGE OF

Please check:

TAX OFFICE Indian Hill, Ohio Single

VILLAGE OF INDIAN HILL Married, Filing Joint Return

6525 DRAKE ROAD 6525 Drake Road, Cincinnati, Ohio 45243 Married, Filing Separate Return

CINCINNATI, OHIO 45243 Tax Department (513) 979- 6203 Corporation

DUE ON OR BEFORE APRIL 1 ,5 202 4 www.indianhill.gov

TAXPAYER’ S NAME(S) AND ADDRESS (CORRECT IF NECESSARY) TAXPAYER

SOCIAL SECURITY NUMBER

OCCUPATION

TAXPAYER

SOCIAL SECURITY NUMBER

OCCUPATION

If you moved into or out of Indian Hill during 2023 , please furnish the following information.

In or out

PLEASE READ INSTRUCTIONS BEFORE COMPLETING THIS FORM

1. INCOME: Individuals enter Ohio Adjusted Gross Income (line 3 on Ohio form), Others see instructions………………...………………………….…………….…….1. $

ATTACH COPY OF OHIO FORM IT1040 INCLUDING ALL SCHEDULES AND FORMS W 2 -

2. Amount of Business Income Deduction on Ohio Schedule of Adjustments Page 1 Line 1 2 (if applicable).. ……………..…...............................................2. $

3. Adjusted Gross Income: Add lines 1 and 2.………………………………...................................................................................................................................3. $

If line 3 is $5,000.00 or less, complete the bottom section of this form and attach a copy of your Ohio Tax Return, and mail to above address.

4. ADJUSTMENTS:

a. Ohio State Teachers Retirement System (STRS), Public Employees Retirement System (PERS), Police & Fireman

Retirement Systems of Ohio (P&FRS), School Employees Retirement System (SERS) or City of Cincinnati

Retirement System (RSCC) income included in Line 1 above. A copy of your 1099R Must Be Attached………………….……………………….……..4a. $

b. Other retirement income in Line 1 above. Maximum $4,000.00 (Must be eligible for retirement credit on Ohio income tax return)....4b. $

c. Military income included in Line 1 above.W- 2 required…………………………………………………………………………….……………….………………..……..4c. $

5. ADJUSTED GROSS INCOME. (Line 3 less Line 4)……………………………………………………………………………………………………………..…….…………………………..……5. $

6. NON-RESIDENCY (see instructions for required documents if out of state non-residency)……...……...………………………………..………….……….……….......6. $

7. INDIAN HILL TAXABLE INCOME (Line 5 less Line 6)…………………………………………………………………………………………………………..…..…………………..….…......7. $

8. INDIAN HILL TAX (0.45% of Line7)………… ……………….…..……………………………………………………………………………………………..………….…………………...........8.. $

9. AMOUNT PREVIOUSLY PAID………………………………………………………………………………………………………………………………………..…………………………….……......9. $

10. BALANCE OR OVERPAYMENT (Please indicate if to be refunded or credited)………………………….……………………………….………………….….…………........10. $

11. INTEREST……………………………………………………………………………………………………………………………………….……………………...………………….………..…....….....11. $

12. PENALTY……………………………………………………………………………………………………………………………………………………….………...…………................................12. $

13. TOTAL DUE……………………………………………………………………………………………………………………………………………………………….…..……………..…………….13. $

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT

AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE. May we discuss

this return with the preparer shown to the left ? Yes No

Signature of Person Preparing if Other Than Taxpayer Date Signature of Taxpayer Date

Address Telephone number Signature of Taxpayer Date

Email address of preparer Email addresses of Taxpayers

INFORMATIONINFORMATIONFORMFORMFORFORINDIVIDUALSINDIVIDUALSNOTNOTREQUIREDREQUIREDTOTOFILEFILE

Name(s)

Address

Social Security Number(s)

I am (we are) not filing a 202 3 Indian Hill Income Tax Return because:

A. Total income is less than $5,000 AND I (we) have not filed a State of Ohio Tax Return for 2023. (Indian Hill Return must be filed if State of Ohio is filed).

B. I/we did not reside inside the Village within the taxable year. Please see “ What does it mean to reside” in the FAQ section at www.indianhill.gov/tax.

Please explain:

SIGNED: