Enlarge image

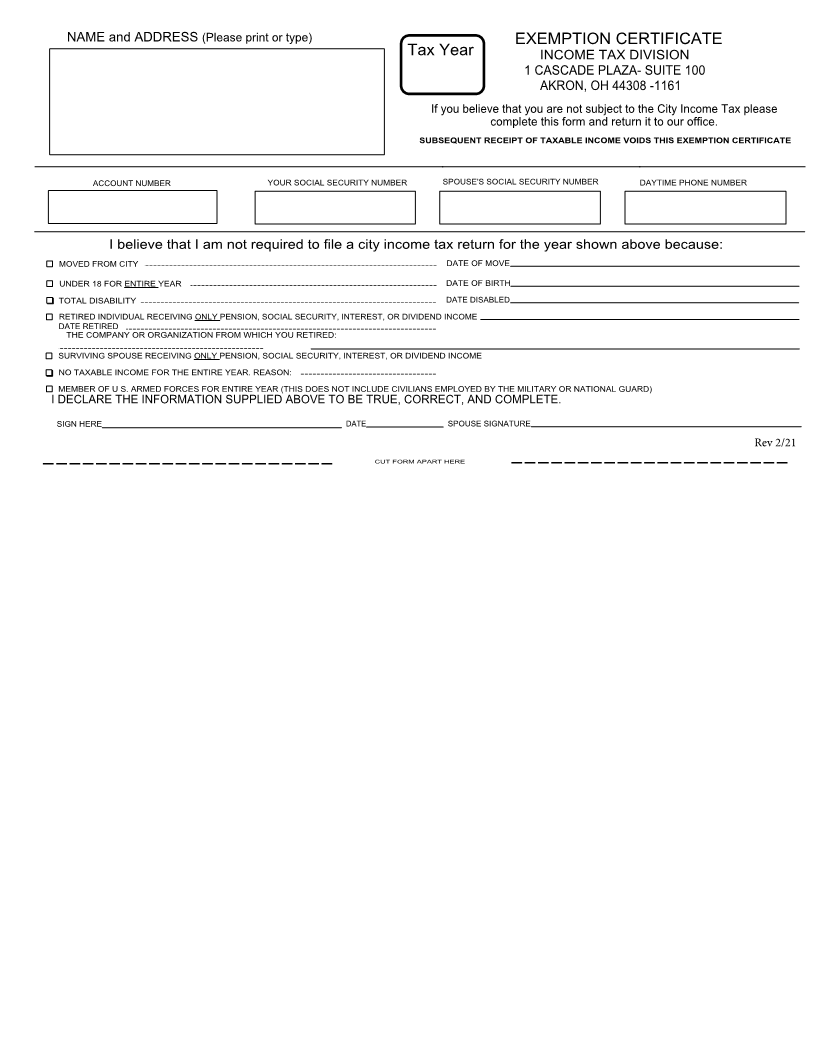

NAME and ADDRESS (Please print or type) EXEMPTION CERTIFICATE

Tax Year INCOME TAX DIVISION

1 CASCADE PLAZA- SUITE 100

AKRON, OH 44308 -1161

If you believe that you are not subject to the City Income Tax please

complete this form and return it to our office.

SUBSEQUENT RECEIPT OF TAXABLE INCOME VOIDS THIS EXEMPTION CERTIFICATE

ACCOUNT NUMBER YOUR SOCIAL SECURITY NUMBER SPOUSE'S SOCIAL SECURITY NUMBER DAYTIME PHONE NUMBER

I believe that I am not required to file a city income tax return for the year shown above because:

MOVED FROM CITY DATE OF MOVE

UNDER 18 FOR ENTIRE YEAR DATE OF BIRTH

TOTAL DISABILITY DATE DISABLED

RETIRED INDIVIDUAL RECEIVING ONLY PENSION, SOCIAL SECURITY, INTEREST, OR DIVIDEND INCOME

DATE RETIRED

THE COMPANY OR ORGANIZATION FROM WHICH YOU RETIRED:

SURVIVING SPOUSE RECEIVING ONLY PENSION, SOCIAL SECURITY, INTEREST, OR DIVIDEND INCOME

NO TAXABLE INCOME FOR THE ENTIRE YEAR. REASON:

MEMBER OF U S. ARMED FORCES FOR ENTIRE YEAR (THIS DOES NOT INCLUDE CIVILIANS EMPLOYED BY THE MILITARY OR NATIONAL GUARD)

I DECLARE THE INFORMATION SUPPLIED ABOVE TO BE TRUE, CORRECT, AND COMPLETE.

SIGN HERE DATE SPOUSE SIGNATURE

Rev 2/21

---------------------- CUT FORM APART HERE ---------------------