Enlarge image

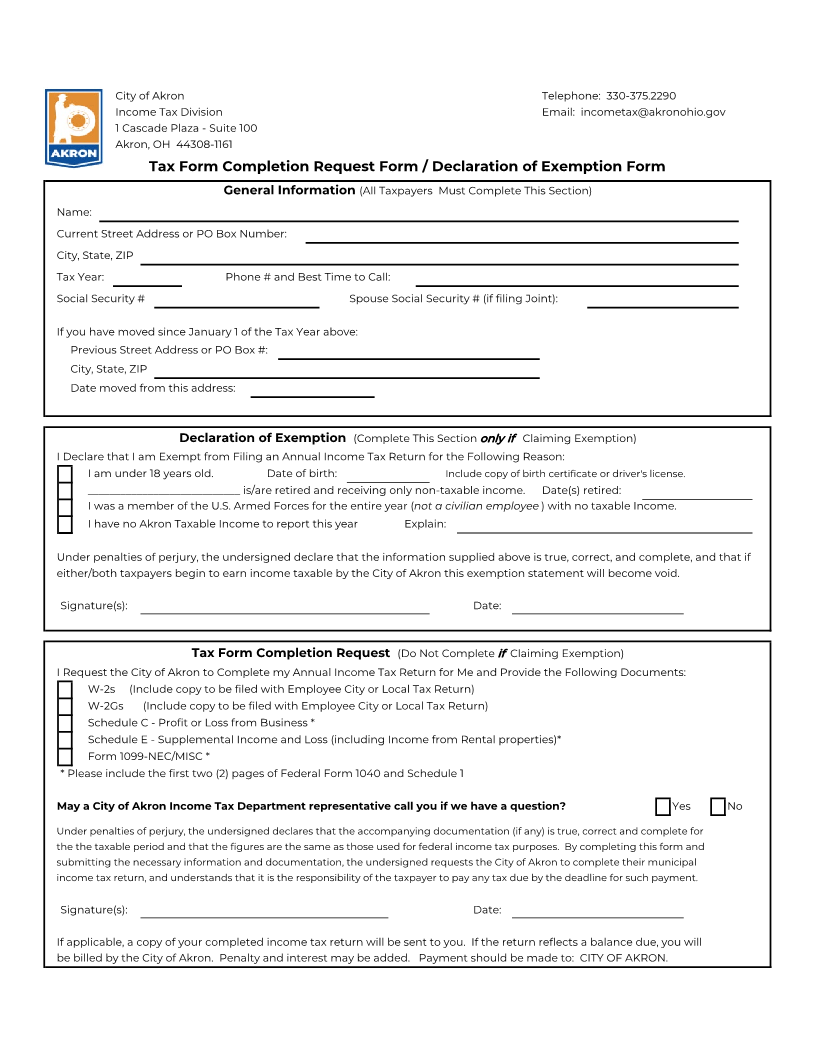

City of Akron Telephone: 330-375.2290 Income Tax Division Email: incometax@akronohio.gov 1 Cascade Plaza - Suite 100 Akron, OH 44308-1161 Tax Form Completion Request Form / Declaration of Exemption Form General Information (All Taxpayers Must Complete This Section) Name: Current Street Address or PO Box Number: City, State, ZIP Tax Year: Phone # and Best Time to Call: Social Security # Spouse Social Security # (if filing Joint): If you have moved since January 1 of the Tax Year above: Previous Street Address or PO Box #: City, State, ZIP Date moved from this address: Declaration of Exemption (Complete This Section only if Claiming Exemption) I Declare that I am Exempt from Filing an Annual Income Tax Return for the Following Reason: I am under 18 years old. Date of birth: Include copy of birth certificate or driver's license. ____________________________ is/are retired and receiving only non-taxable income. Date(s) retired: I was a member of the U.S. Armed Forces for the entire year (not a civilian employee ) with no taxable Income. I have no Akron Taxable Income to report this year Explain: Under penalties of perjury, the undersigned declare that the information supplied above is true, correct, and complete, and that if either/both taxpayers begin to earn income taxable by the City of Akron this exemption statement will become void. Signature(s): Date: Tax Form Completion Request (Do Not Complete ifClaiming Exemption) I Request the City of Akron to Complete my Annual Income Tax Return for Me and Provide the Following Documents: W-2s (Include copy to be filed with Employee City or Local Tax Return) W-2Gs (Include copy to be filed with Employee City or Local Tax Return) Schedule C - Profit or Loss from Business * Schedule E - Supplemental Income and Loss (including Income from Rental properties)* Form 1099-NEC/MISC * * Please include the first two (2) pages of Federal Form 1040 and Schedule 1 May a City of Akron Income Tax Department representative call you if we have a question? Yes No Under penalties of perjury, the undersigned declares that the accompanying documentation (if any) is true, correct and complete for the the taxable period and that the figures are the same as those used for federal income tax purposes. By completing this form and submitting the necessary information and documentation, the undersigned requests the City of Akron to complete their municipal income tax return, and understands that it is the responsibility of the taxpayer to pay any tax due by the deadline for such payment. Signature(s): Date: If applicable, a copy of your completed income tax return will be sent to you. If the return reflects a balance due, you will be billed by the City of Akron. Penalty and interest may be added. Payment should be made to: CITY OF AKRON.