Enlarge image

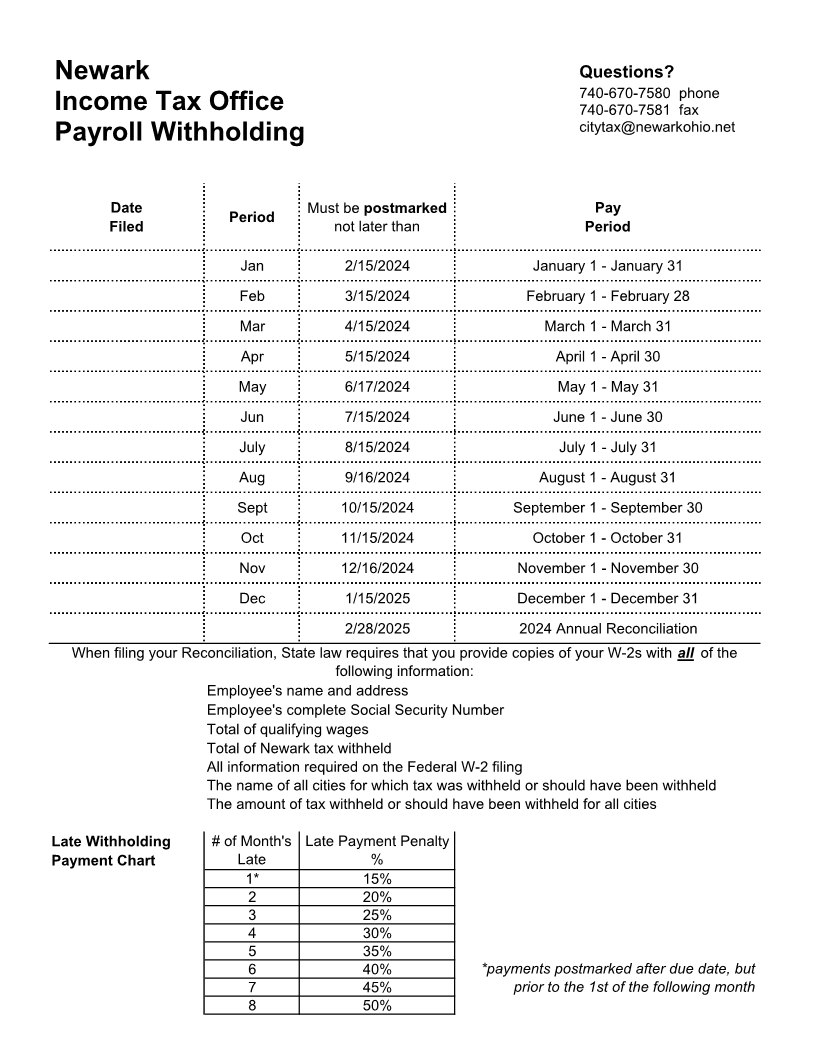

NeNewarkwark Questions?Questions?

740-670-7580 740- phone670-7580 phone

Income Tax Income Tax OfficeOffice 740-740-670-7581 fax670-7581 fax

citcitytax@newarkohio.netytax@newarkohio.net

PayPayroll Withholdingroll Withholding

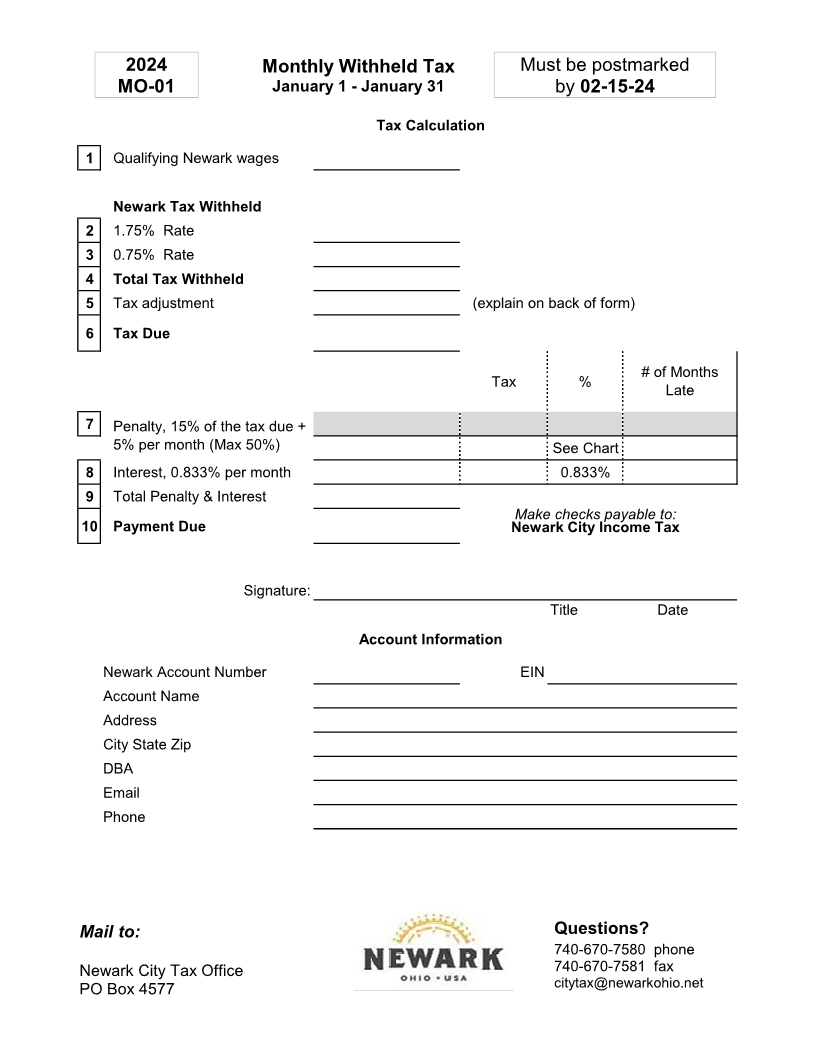

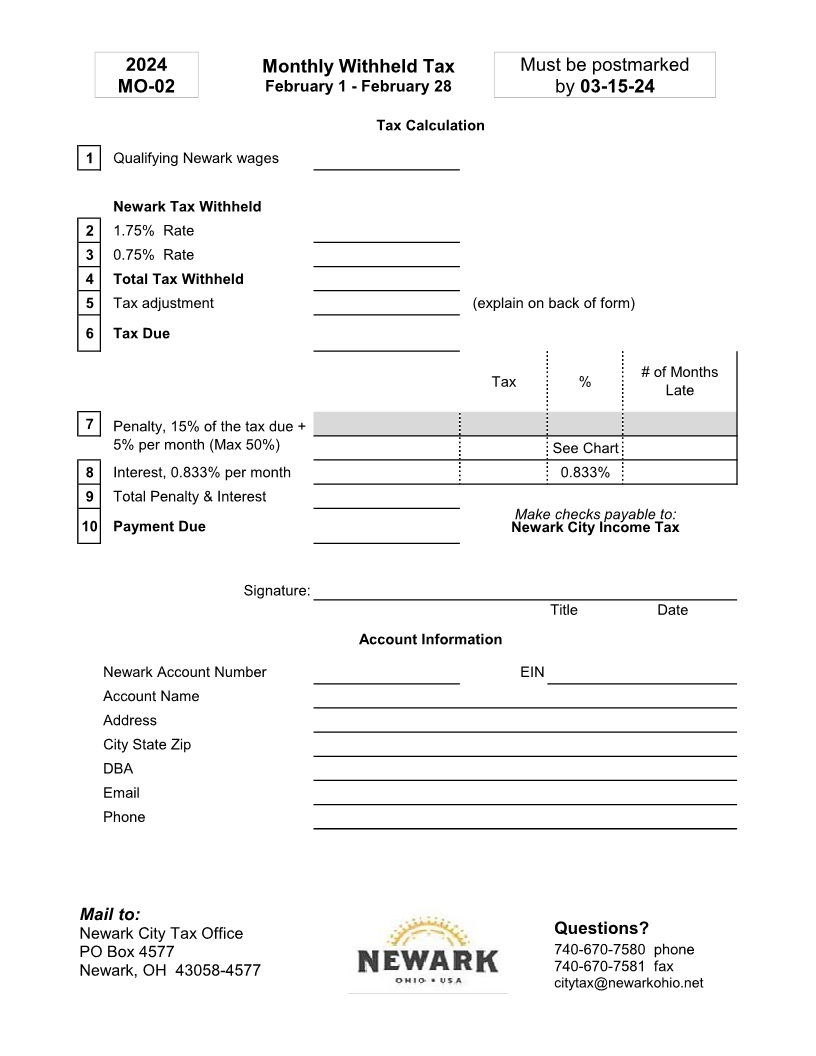

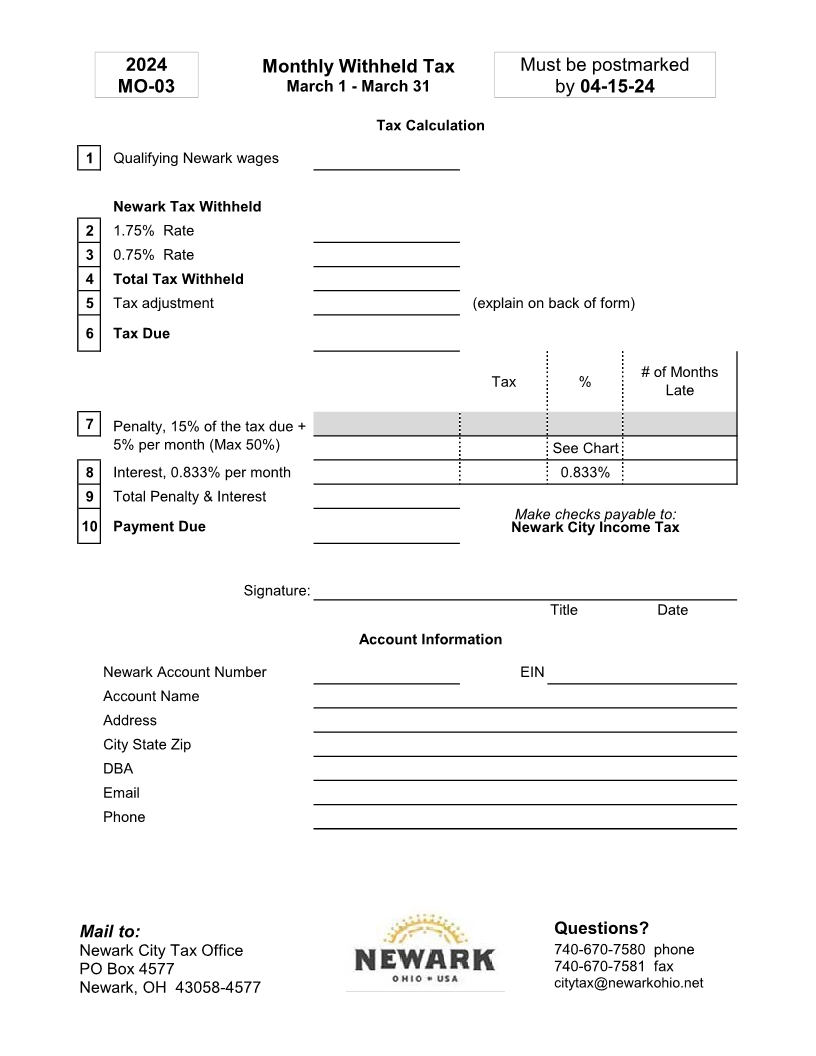

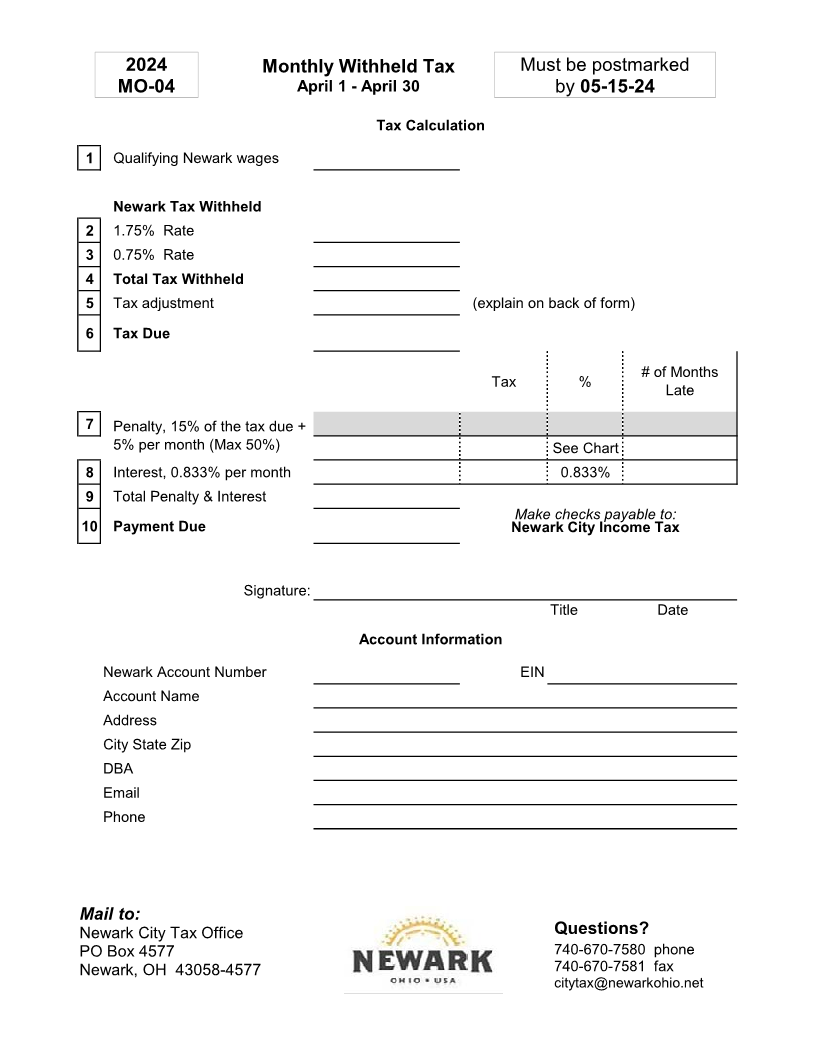

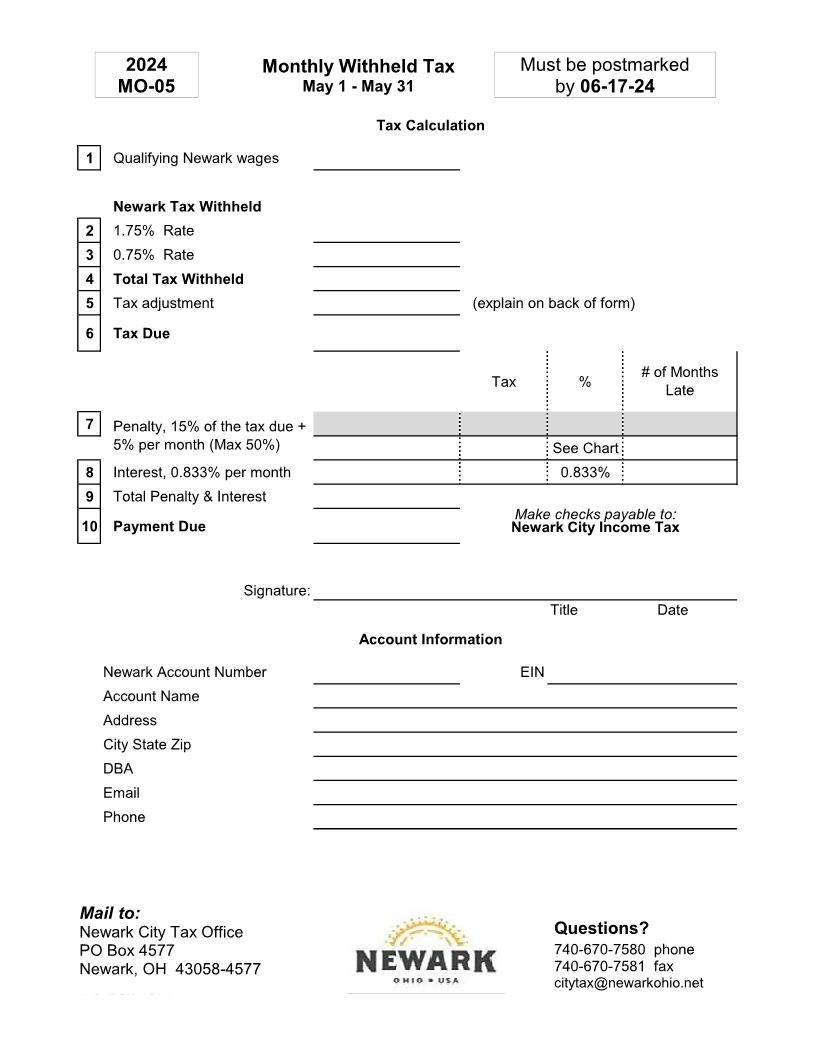

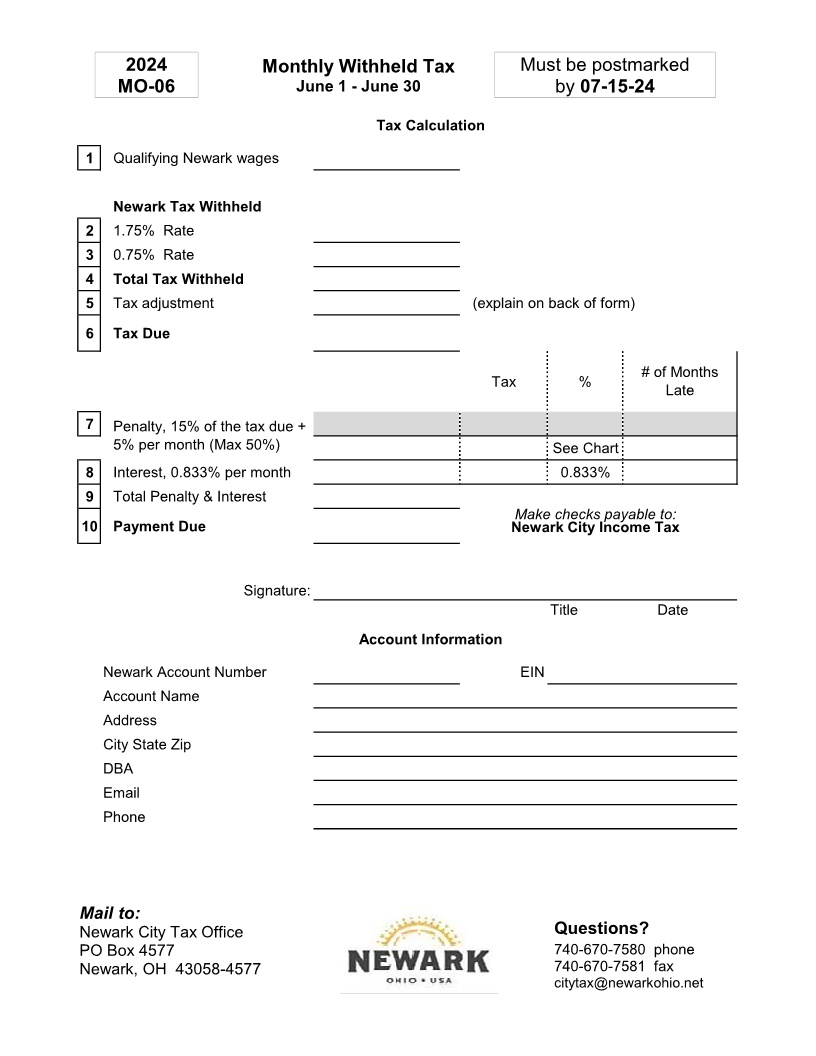

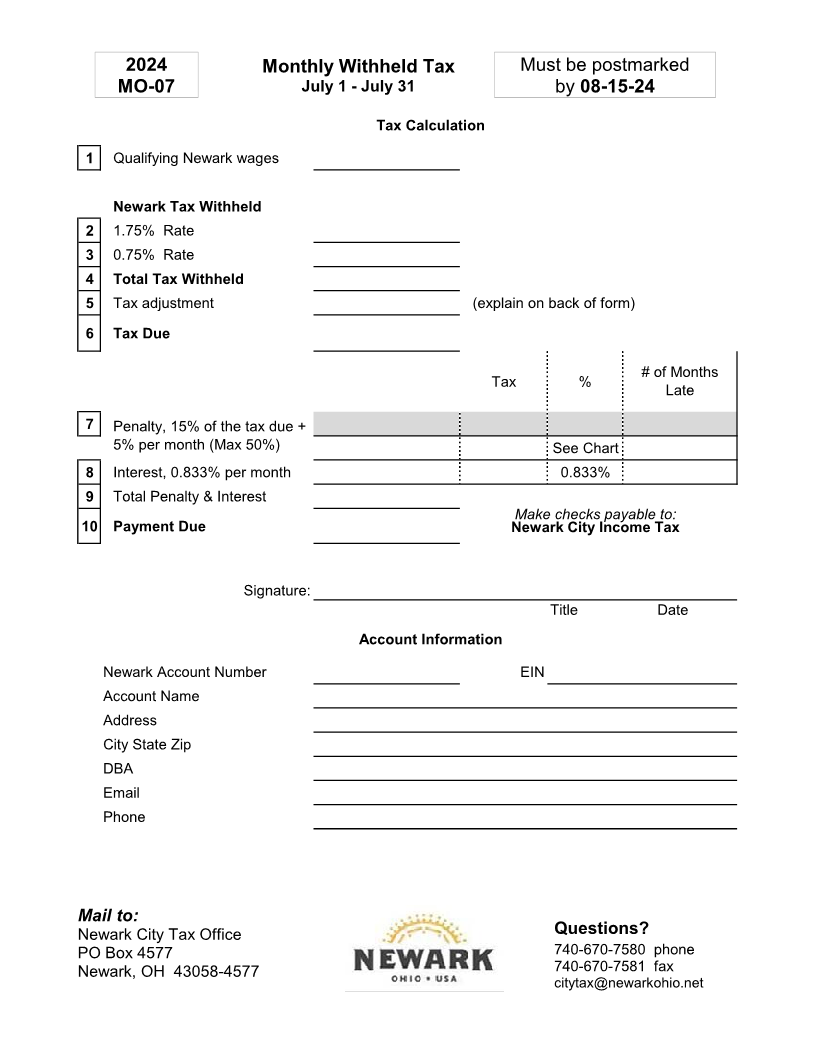

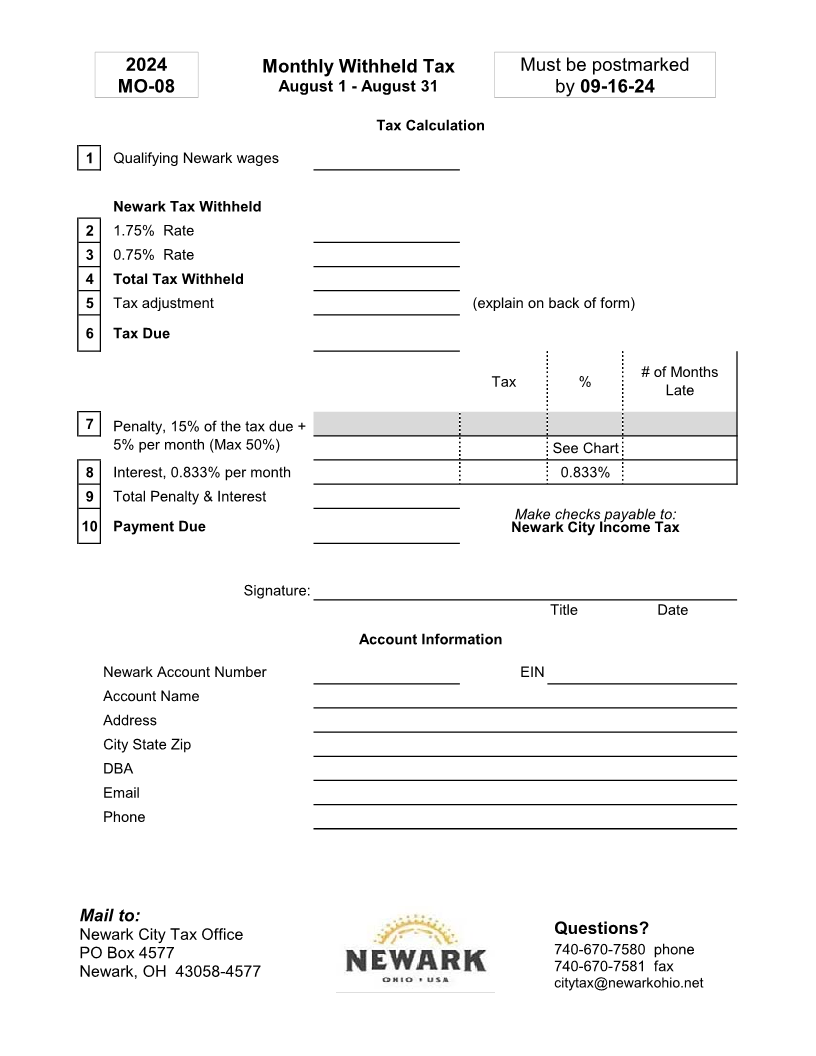

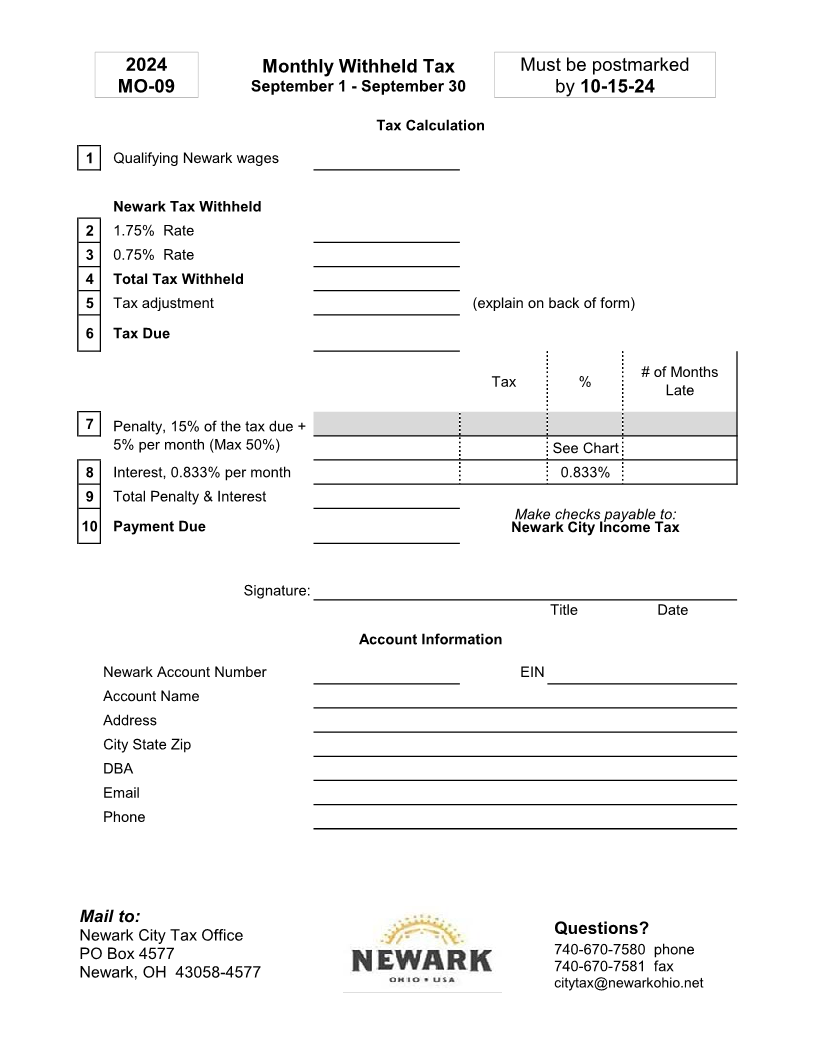

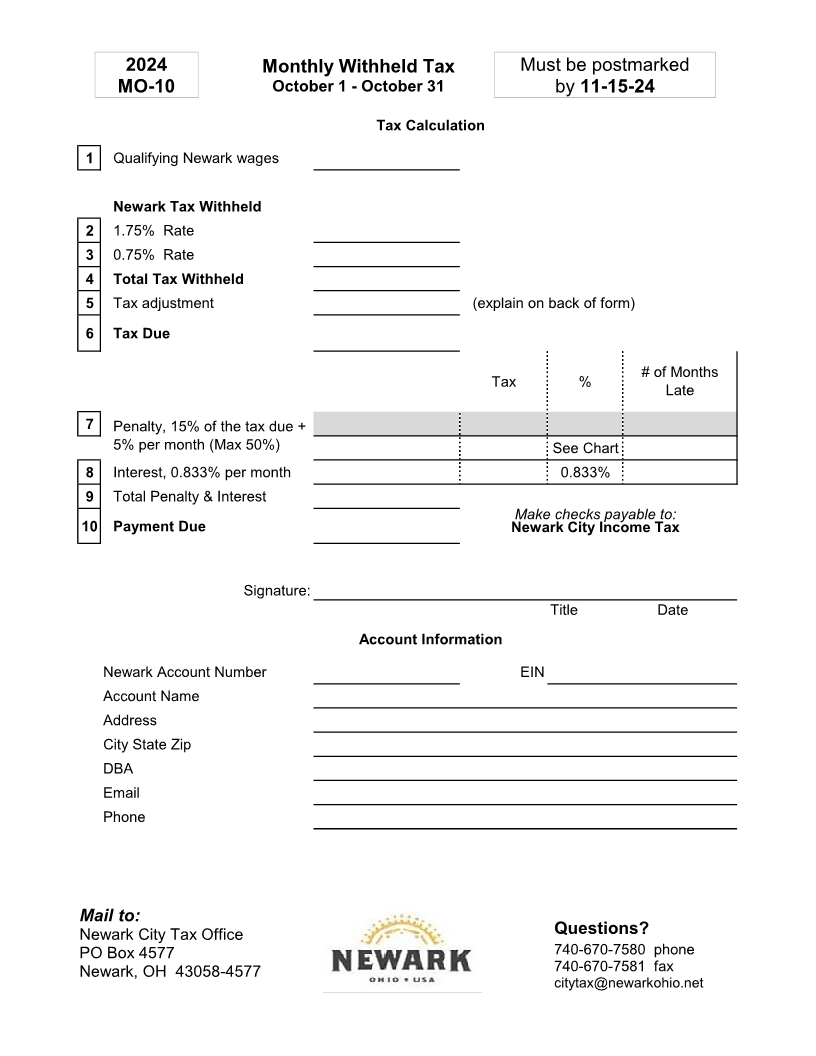

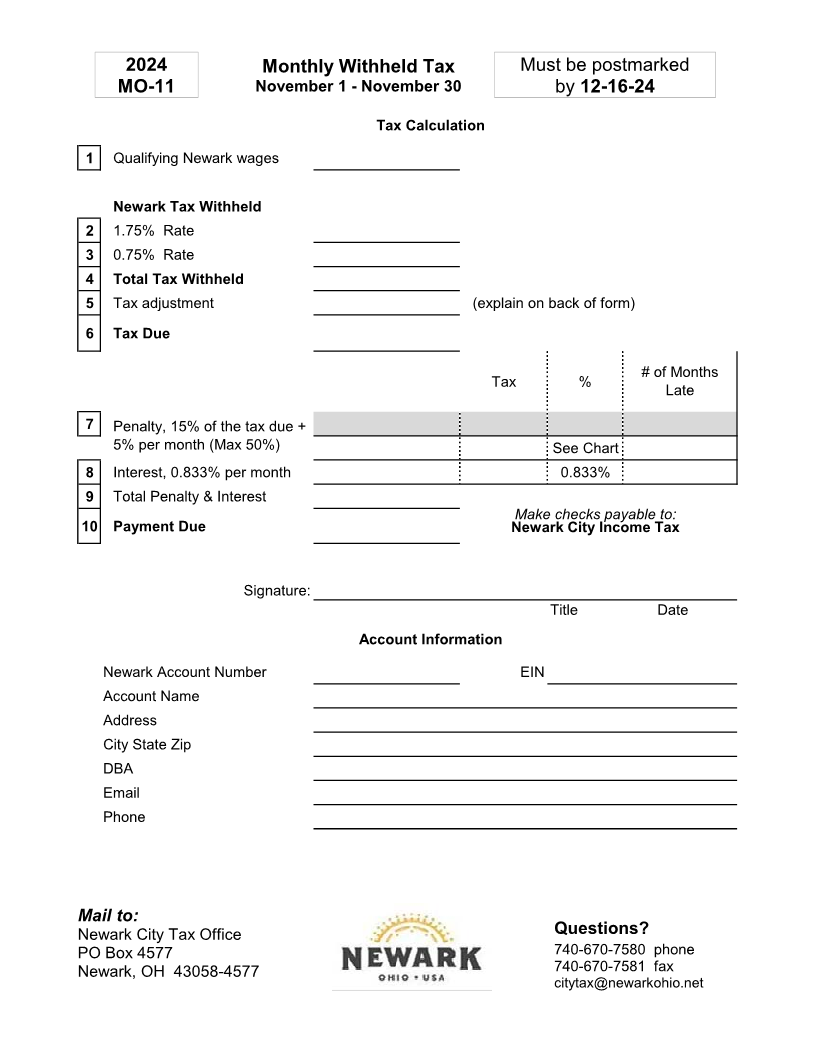

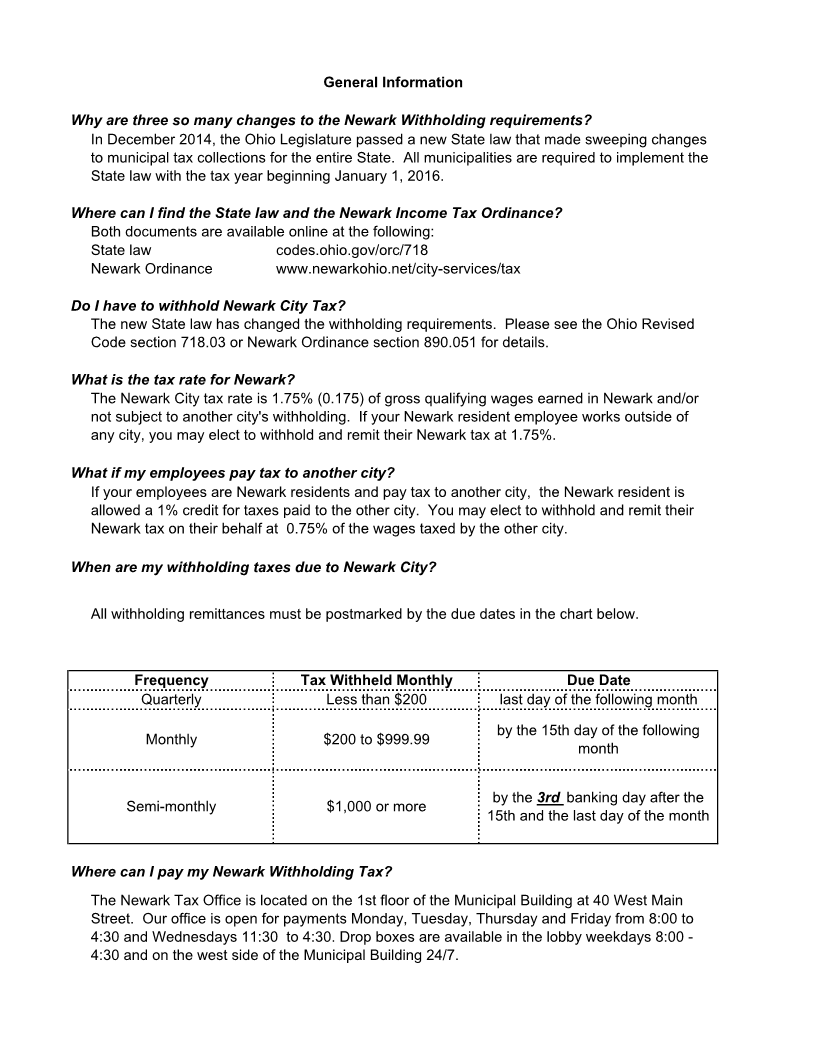

Date Must be postmarked Pay

Period

Filed not later than Period

Jan 2/15/2024 January 1 - January 31

Feb 3/15/2024 February 1 - February 28

Mar 4/15/2024 March 1 - March 31

Apr 5/15/2024 April 1 - April 30

May 6/17/2024 May 1 - May 31

Jun 7/15/2024 June 1 - June 30

July 8/15/2024 July 1 - July 31

Aug 9/16/2024 August 1 - August 31

Sept 10/15/2024 September 1 - September 30

Oct 11/15/2024 October 1 - October 31

Nov 12/16/2024 November 1 - November 30

Dec 1/15/2025 December 1 - December 31

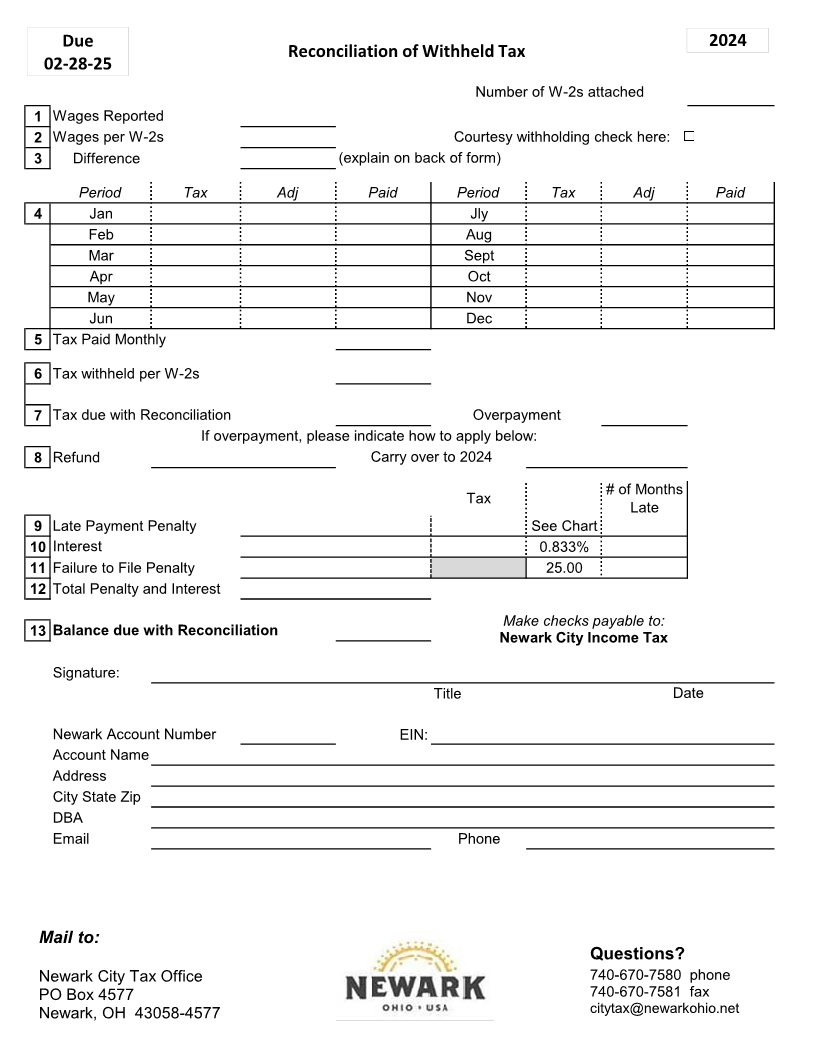

2/28/2025 2024 Annual Reconciliation

When filing your Reconciliation, State law requires that you provide copies of your W-2s with all of the

following information:

Employee's name and address

Employee's complete Social Security Number

Total of qualifying wages

Total of Newark tax withheld

All information required on the Federal W-2 filing

The name of all cities for which tax was withheld or should have been withheld

The amount of tax withheld or should have been withheld for all cities

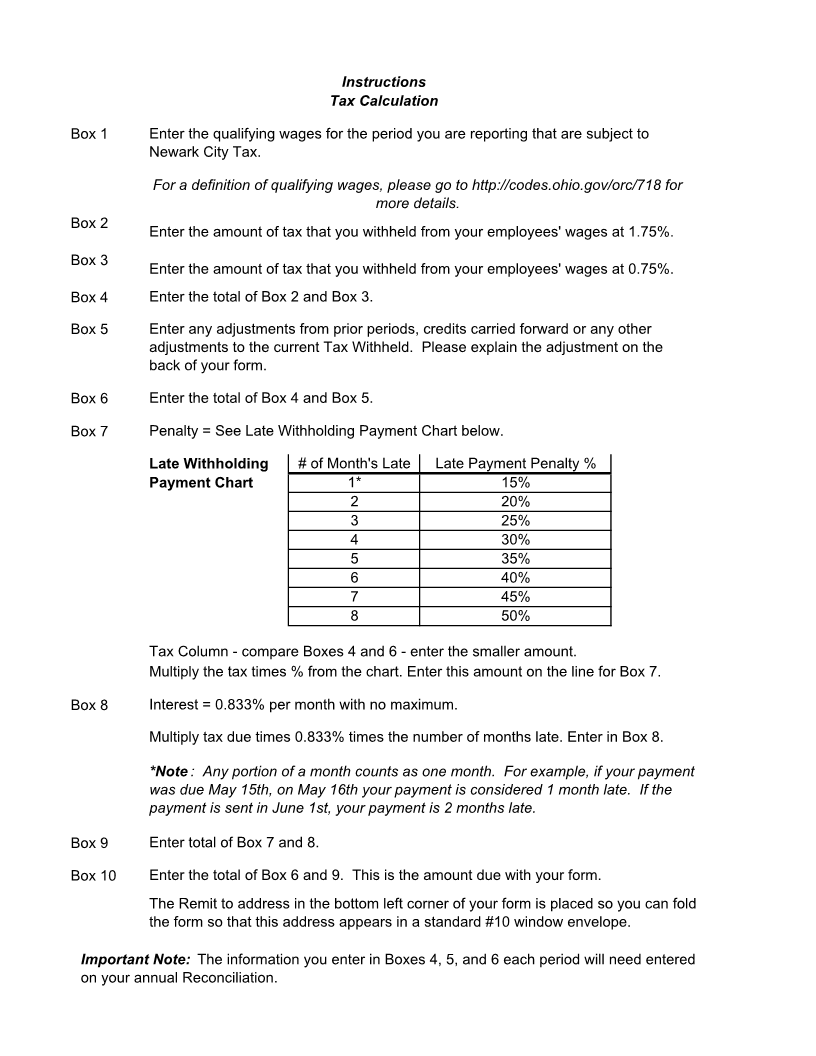

Late Withholding # of Month's Late Payment Penalty

Payment Chart Late %

1* 15%

2 20%

3 25%

4 30%

5 35%

6 40% *payments postmarked after due date, but

7 45% prior to the 1st of the following month

8 50%