Enlarge image

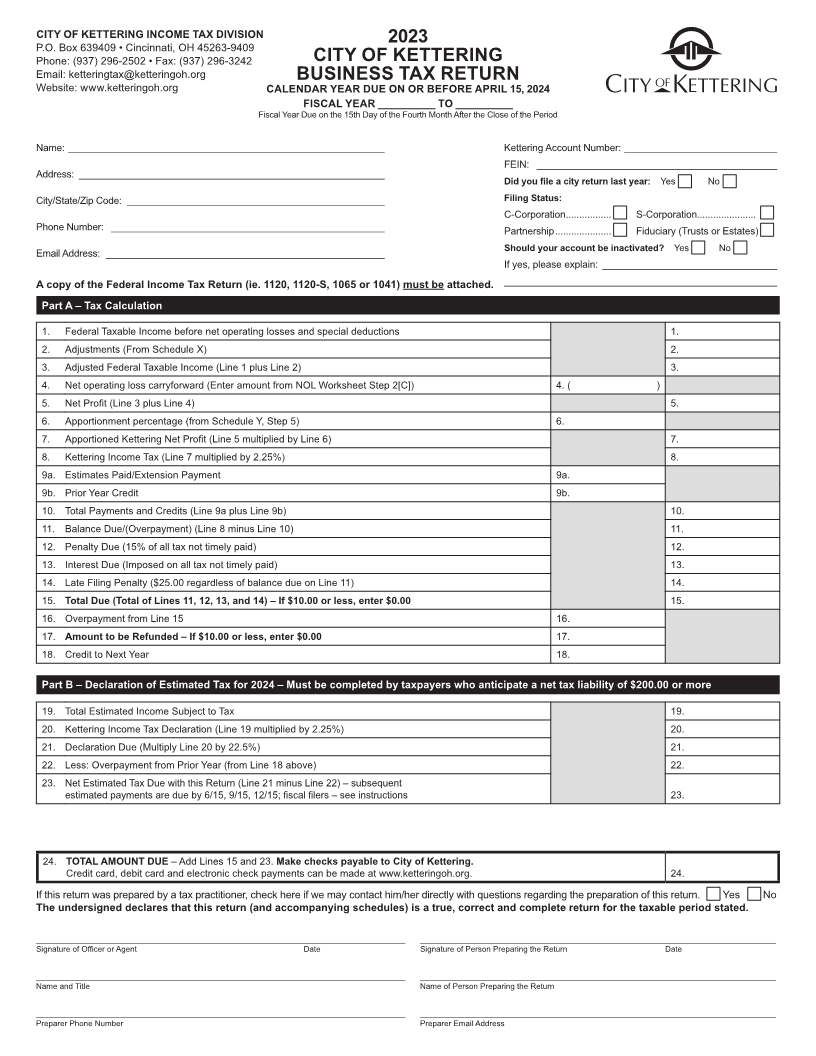

CITY OF KETTERING INCOME TAX DIVISION

P.O. Box 639409 • Cincinnati, OH 45263-9409 2023

Phone: (937) 296-2502 • Fax: (937) 296-3242 CITY OF KETTERING

Email: ketteringtax@ketteringoh.org BUSINESS TAX RETURN

Website: www.ketteringoh.org CALENDAR YEAR DUE ON OR BEFORE APRIL 15, 2024

FISCAL YEAR __________ TO __________

Fiscal Year Due on the 15th Day of the Fourth Month After the Close of the Period

Name: Kettering Account Number:

FEIN:

Address:

Did you file a city return last year: Yes No

City/State/Zip Code: Filing Status:

C-Corporation ................. S-Corporation......................

Phone Number: Partnership ..................... Fiduciary (Trusts or Estates)

Email Address: Should your account be inactivated? Yes No

If yes, please explain:

A copy of the Federal Income Tax Return (ie. 1120, 1120-S, 1065 or 1041) must be attached.

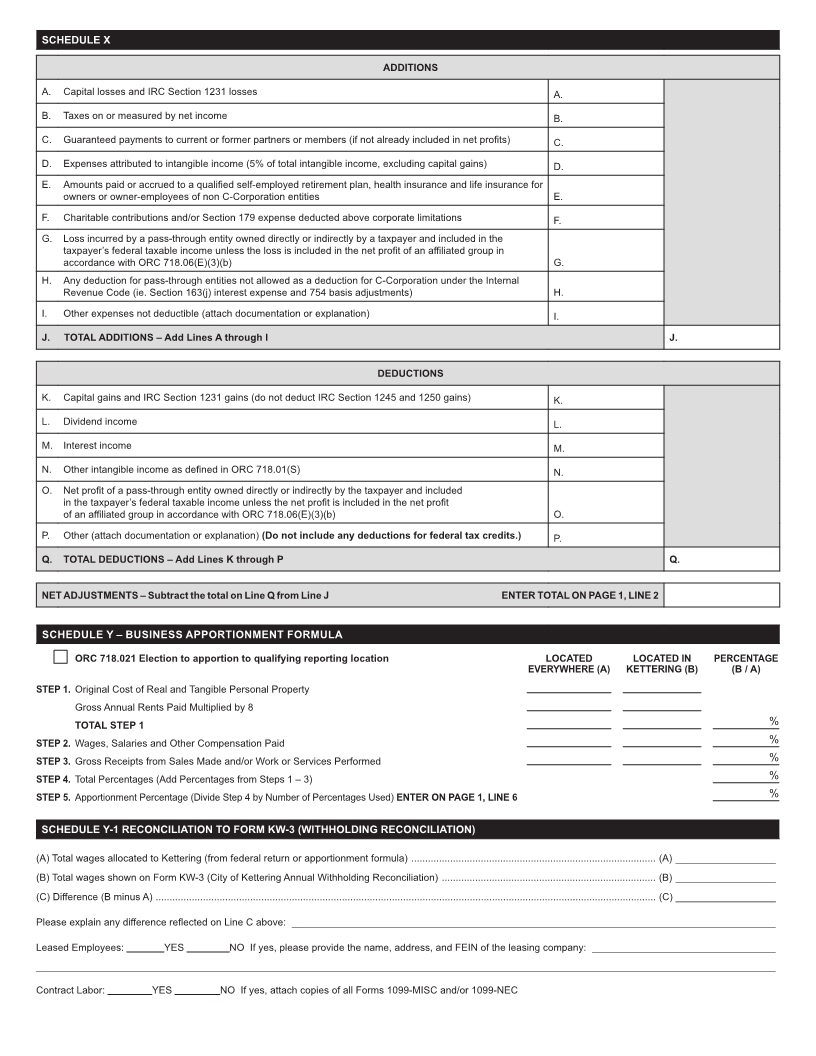

Part A – Tax Calculation

1. Federal Taxable Income before net operating losses and special deductions 1.

2. Adjustments (From Schedule X) 2.

3. Adjusted Federal Taxable Income (Line 1 plus Line 2) 3.

4. Net operating loss carryforward (Enter amount from NOL Worksheet Step 2[C]) 4. ( )

5. Net Profit (Line 3 plus Line 4) 5.

6. Apportionment percentage (from Schedule Y, Step 5) 6.

7. Apportioned Kettering Net Profit (Line 5 multiplied by Line 6) 7.

8. Kettering Income Tax (Line 7 multiplied by 2.25%) 8.

9a. Estimates Paid/Extension Payment 9a.

9b. Prior Year Credit 9b.

10. Total Payments and Credits (Line 9a plus Line 9b) 10.

11. Balance Due/(Overpayment) (Line 8 minus Line 10) 11.

12. Penalty Due (15% of all tax not timely paid) 12.

13. Interest Due (Imposed on all tax not timely paid) 13.

14. Late Filing Penalty ($25.00 regardless of balance due on Line 11) 14.

15. Total Due (Total of Lines 11, 12, 13, and 14) – If $10.00 or less, enter $0.00 15.

16. Overpayment from Line 15 16.

17. Amount to be Refunded – If $10.00 or less, enter $0.00 17.

18. Credit to Next Year 18.

Part B – Declaration of Estimated Tax for 2024 – Must be completed by taxpayers who anticipate a net tax liability of $200.00 or more

19. Total Estimated Income Subject to Tax 19.

20. Kettering Income Tax Declaration (Line 19 multiplied by 2.25%) 20.

21. Declaration Due (Multiply Line 20 by 22.5%) 21.

22. Less: Overpayment from Prior Year (from Line 18 above) 22.

23. Net Estimated Tax Due with this Return (Line 21 minus Line 22) – subsequent

estimated payments are due by 6/15, 9/15, 12/15; fiscal filers – see instructions 23.

24. TOTAL AMOUNT DUE – Add Lines 15 and 23. Make checks payable to City of Kettering.

Credit card, debit card and electronic check payments can be made at www.ketteringoh.org. 24.

If this return was prepared by a tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return. Yes No

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated.

Signature of Officer or Agent Date Signature of Person Preparing the Return Date

Name and Title Name of Person Preparing the Return

Preparer Phone Number Preparer Email Address