Enlarge image

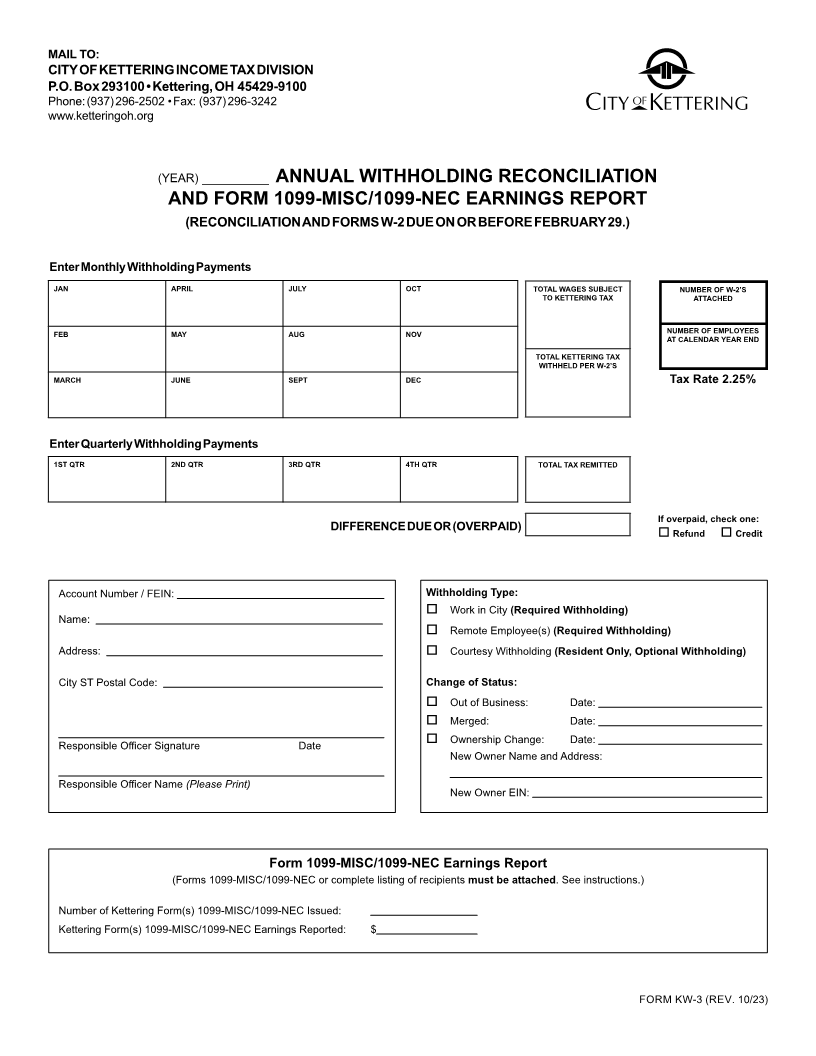

ANNUAL WITHHOLDING RECONCILIATION

AND FORM 1099-MISC/1099-NEC EARNINGS REPORT

GENERAL INFORMATION

On or before the last day of February of each year, every employer must file an Annual Withholding Reconciliation (Form KW-

3) including copies of all corresponding W-2 Forms. Each W-2 Form shall furnish employee name, address, social security

number, qualifying wages, local tax withheld, name of locality for which tax was withheld, and any other compensation

allocated or set aside for or paid to the employee. In lieu of the actual W-2 Forms, an employer may provide a listing which

furnishes the same information as contained on a W-2 Form.

Employers who are required to submit IRS Form W-2 information electronically for Federal purposes shall also submit

the wage information required by the City of Kettering in electronic format, along with the completed Annual Withholding

Reconciliation (Form KW-3). The completed Form KW-3 should be attached to the CD-Rom containing corresponding wage

records.

Your Annual Withholding Reconciliation including all corresponding Forms W-2 and/or Forms 1099-MISC/1099-

NEC shall be due on or before the last day of February of each year. Submit completed returns and corresponding

forms or magnetic media to:

City of Kettering

Income Tax Division

P.O. Box 293100

Kettering, OH 45429-9100

ANNUAL WITHHOLDING RECONCILIATION FILING INSTRUCTIONS

Enter a breakdown of all withholding payments made either on a monthly or quarterly basis in the corresponding boxes

found on this return. You must also enter the total wages subject to Kettering tax, amount of tax paid to the City of Kettering,

the amount of Kettering tax withheld (as shown on W-2 Forms), the number of W-2 Forms included with your reconciliation

and the number of employees subject to Kettering tax at calendar year end. The total amount of tax paid and tax withheld

should be equal amounts. In the event of an overpayment, please check the appropriate box to indicate whether you would

like to have the overpayment refunded to you or credited to the following year. If you have a balance due, your payment

must accompany this return.

FORM 1099-MISC/1099-NEC REPORTING INSTRUCTIONS

All taxpayers who issue Forms 1099-MISC/1099-NEC to individuals or entities for services performed shall also report such

payments to the City of Kettering when the services were performed in Kettering. The information may be submitted to the

Tax Division on a listing that includes all identifying information of the recipients and the amount of payments made to each.

Forms 1099-MISC/1099-NEC may be submitted in lieu of such listing.

FORM KW-3 (REV. 10/23)