Enlarge image

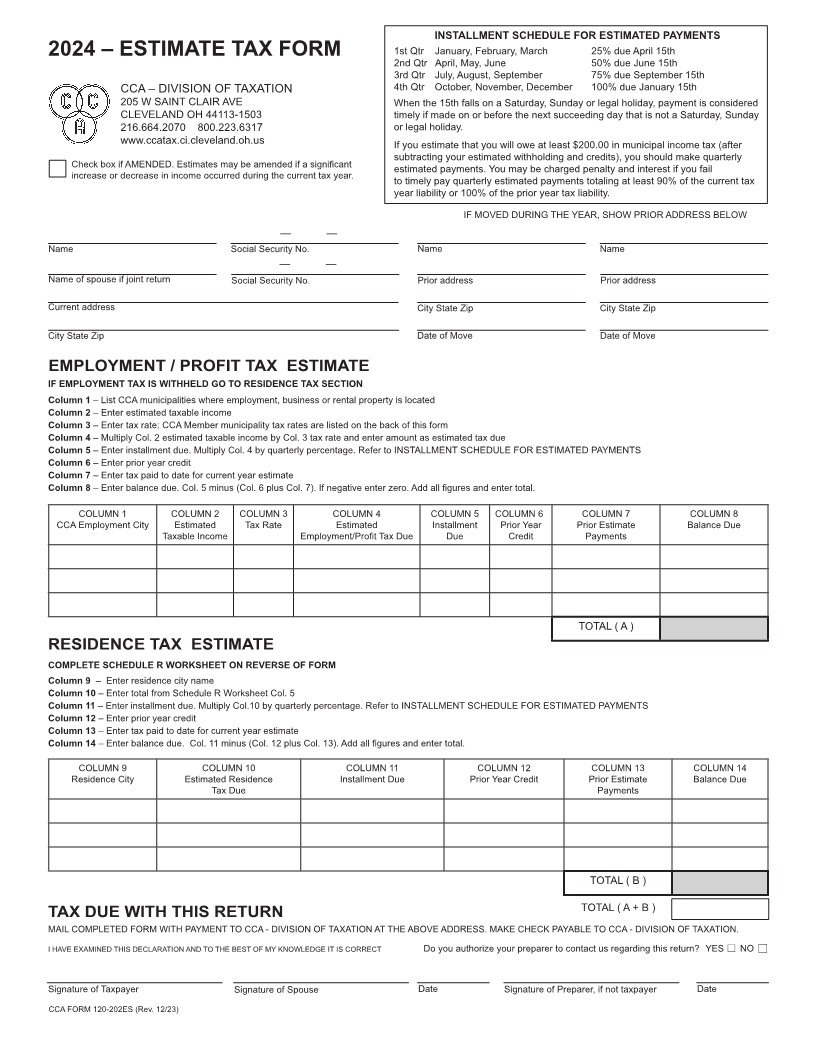

INSTALLMENT SCHEDULE FOR ESTIMATED PAYMENTS

2024 – ESTIMATE TAX FORM 1st Qtr January, February, March 25% due April 15th

2nd Qtr April, May, June 50% due June 15th

3rd Qtr July, August, September 75% due September 15th

CCA – DIVISION OF TAXATION 4th Qtr October, November, December 100% due January 15th

205 W SAINT CLAIR AVE When the 15th falls on a Saturday, Sunday or legal holiday, payment is considered

CLEVELAND OH 44113-1503 timely if made on or before the next succeeding day that is not a Saturday, Sunday

216.664.2070 800.223.6317 or legal holiday.

www.ccatax.ci.cleveland.oh.us If you estimate that you will owe at least $200.00 in municipal income tax (after

subtracting your estimated withholding and credits), you should make quarterly

Check box if AMENDED. Estimates may be amended if a significant estimated payments. You may be charged penalty and interest if you fail

increase or decrease in income occurred during the current tax year. to timely pay quarterly estimated payments totaling at least 90% of the current tax

year liability or 100% of the prior year tax liability.

IF MOVED DURING THE YEAR, SHOW PRIOR ADDRESS BELOW

— —

Name Social Security No. Name Name

— —

Name of spouse if joint return Social Security No. Prior address Prior address

Current address City State Zip City State Zip

City State Zip Date of Move Date of Move

EMPLOYMENT / PROFIT TAX ESTIMATE

IF EMPLOYMENT TAX IS WITHHELD GO TO RESIDENCE TAX SECTION

Column 1 – List CCA municipalities where employment, business or rental property is located

Column 2 – Enter estimated taxable income

Column 3 – Enter tax rate: CCA Member municipality tax rates are listed on the back of this form

Column 4 – Multiply Col. 2 estimated taxable income by Col. 3 tax rate and enter amount as estimated tax due

Column 5 – Enter installment due. Multiply Col. 4 by quarterly percentage. Refer to INSTALLMENT SCHEDULE FOR ESTIMATED PAYMENTS

Column 6 – Enter prior year credit

Column 7 – Enter tax paid to date for current year estimate

Column 8 – Enter balance due. Col. 5 minus (Col. 6 plus Col. 7). If negative enter zero. Add all figures and enter total.

COLUMN 1 COLUMN 2 COLUMN 3 COLUMN 4 COLUMN 5 COLUMN 6 COLUMN 7 COLUMN 8

CCA Employment City Estimated Tax Rate Estimated Installment Prior Year Prior Estimate Balance Due

Taxable Income Employment/Profit Tax Due Due Credit Payments

TOTAL ( A )

RESIDENCE TAX ESTIMATE

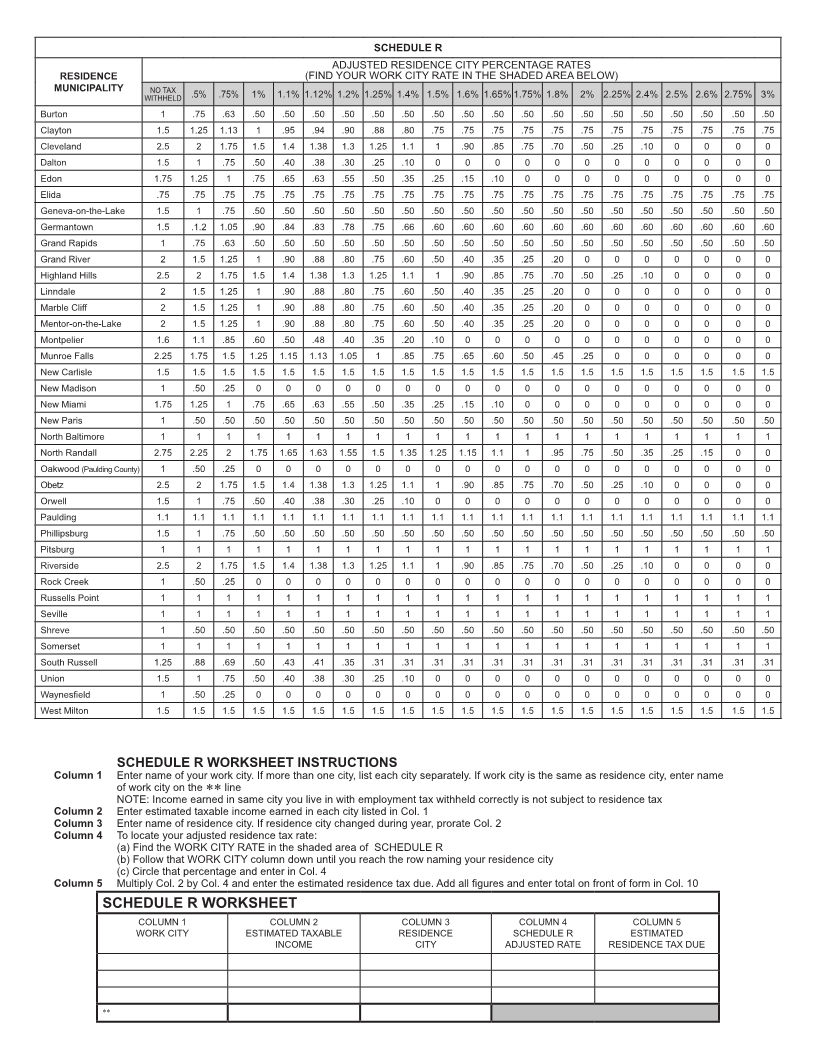

COMPLETE SCHEDULE R WORKSHEET ON REVERSE OF FORM

Column 9 – Enter residence city name

Column 10 – Enter total from Schedule R Worksheet Col. 5

Column 11 – Enter installment due. Multiply Col.10 by quarterly percentage. Refer to INSTALLMENT SCHEDULE FOR ESTIMATED PAYMENTS

Column 12 – Enter prior year credit

Column 13 – Enter tax paid to date for current year estimate

Column 14 – Enter balance due. Col. 11 minus (Col. 12 plus Col. 13). Add all figures and enter total.

COLUMN 9 COLUMN 10 COLUMN 11 COLUMN 12 COLUMN 13 COLUMN 14

Residence City Estimated Residence Installment Due Prior Year Credit Prior Estimate Balance Due

Tax Due Payments

TOTAL ( B )

TOTAL ( A + B )

TAX DUE WITH THIS RETURN

MAIL COMPLETED FORM WITH PAYMENT TO CCA - DIVISION OF TAXATION AT THE ABOVE ADDRESS. MAKE CHECK PAYABLE TO CCA - DIVISION OF TAXATION.

I HAVE EXAMINED THIS DECLARATION AND TO THE BEST OF MY KNOWLEDGE IT IS CORRECT Do you authorize your preparer to contact us regarding this return? YES NO

@ @

Signature of Taxpayer Signature of Spouse Date Signature of Preparer, if not taxpayer Date

CCA FORM 120-202ES (Rev. 12/23)