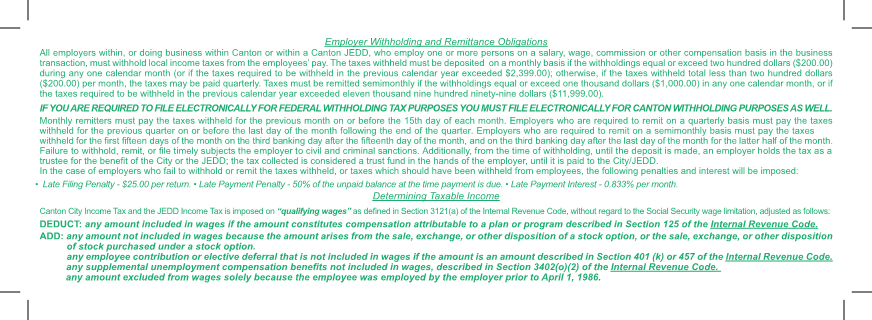

Enlarge image

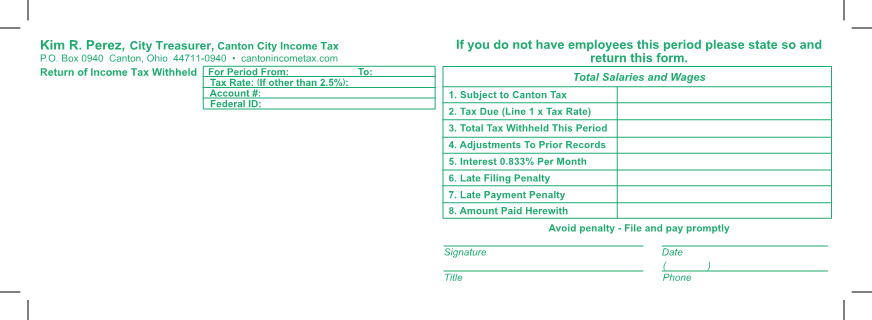

Kim R. Perez, City Treasurer, Canton City Income Tax If you do not have employees this period please state so and

P.O. Box 0940 Canton, Ohio 44711-0940 • cantonincometax.com return this form.

Return of Income Tax Withheld For Period From: To: Total Salaries and Wages

Tax Rate: (If other than 2.5%):

Account #: 1. Subject to Canton Tax

Federal ID:

2. Tax Due (Line 1 x Tax Rate)

3. Total Tax Withheld This Period

4. Adjustments To Prior Records

5. Interest 0.833% Per Month

6. Late Filing Penalty

7. Late Payment Penalty

8. Amount Paid Herewith

Avoid penalty - File and pay promptly

Signature Date

( )

Title Phone