Enlarge image

Acct Amt Chk #

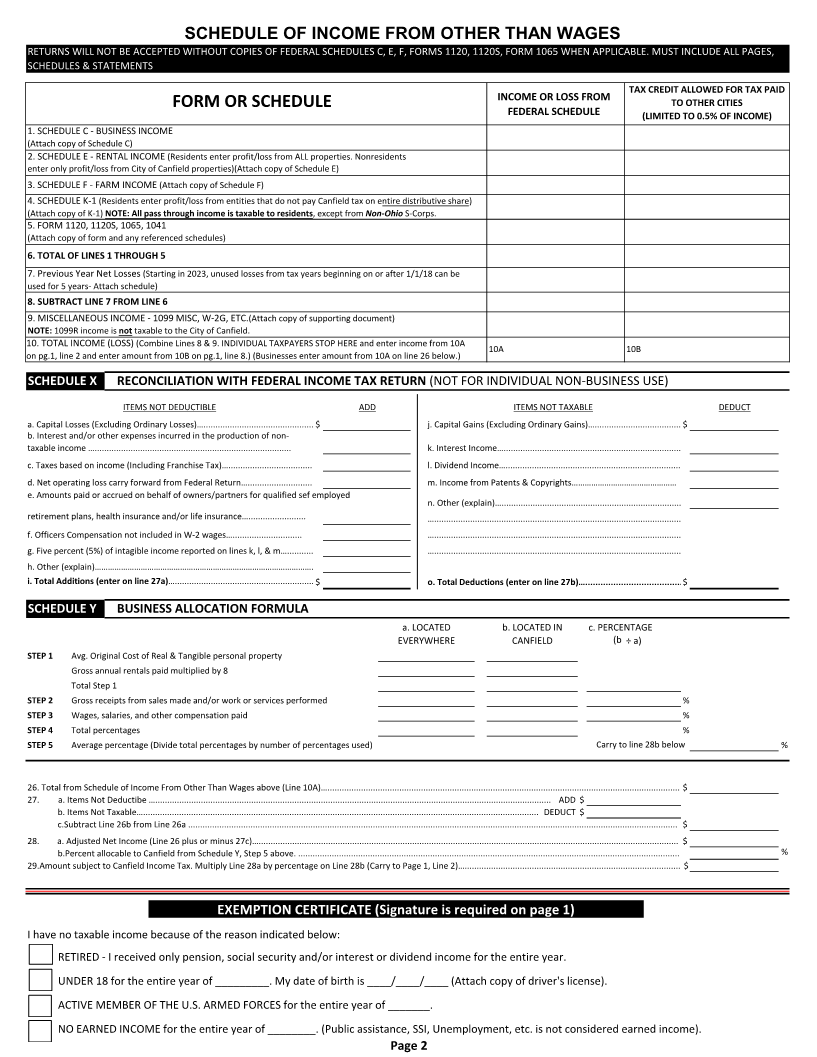

2023 CITY OF CANFIELD INCOME TAX RETURN

FOR CALENDAR YEAR 2023 OR FISCAL PERIOD ______________ TO ________________

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15 , 20 24 FISCAL FILERS FILE WITHIN 105 DAYS OF PERIOD END

Mail To: City of Canfield

DECLARING EXEMPTION: Please fill out exemption **FILING REQUIRED EVEN IF NO TAX IS DUE** Income Tax Department

certificate on page 2 and sign on this page 104 Lisbon Street

Canfield, OH 44406

TAXPAYER(S) NAME AND ADDRESS PHONE: PH: 330-533-1101

FAX: 330-533-2668

NAME: IF YOU MOVED OR HAD ANY CHANGE IN STATUS DURING 202,3COMPLETE THE FOLLOWING:

Date moved into City of Canfield______________________________________

ADDRESS: Previous Address __________________________________________________

Date moved out of City of Canfield____________________________________

CITY: STATE: ZIP: If name change, give previous name___________________________________

SOCIAL SECURITY # OR FEDERAL ID #:___________________ SPOUSE SOCIAL SECURITY #:_________________________

W-2/W-2G WORKSHEET 1 2 3 4 5 6

Dates wages were QUALIFYING WAGES CREDIT ALLOWED FOR

Earned OTHER CITIES

(Month/Day) ON W-2/W-2G (if other city tax was withheld,

CITY WHERE (greater of Box 5 or 18 CANFIELD TAX OTHER CITY TAX max credit = wages in Box 18

W-2/W-2G From To PRINT EMPLOYER'S NAME EMPLOYED on W2 ) WITHHELD WITHHELD on W2 x 0.005)

COPIES

MUST BE

ATTACHED

TOTALS

ATTACH A COPY OF 1040, ALL APPLICABLE W-2s/W-2Gs, FEDERAL SCHEDULES, 1099s, EXPLANATIONS, ETC…

1.Total W-2 wages from column 3 ………….……….…………….……………………......……….….…………………………………..……..…..…….……… 1 $

INCOME 2. Income other than wages (from pg. 2, line 29)(Attach applicable schedules) NOTE: NO LOSS CAN OFFSET W2 WAGES.… 2 $

3. TOTAL CANFIELD INCOME: ADD LINES 1 AND 2 ……..……….….……….….…………………………………….…….……………………...………... 3 $

TAX 4. CITY OF CANFIELD INCOME TAX- MULTIPLY LINE 3 BY 1.0% (0.01) ……..…………...………………………………….....…...................... 4 $

5. CANFIELD income tax withheld fromcolumn 4 …………………………..………….………..….…………………..5 $

TAX WITHHELD, 6. Prior year credits carried forward………………………………...…………………...…..…….…………..……….… 6 $

PAYMENTS 7. Estimated payments paid for 2023 income tax………………………………………..………….………………… 7 $

AND CREDITS 8. Credits for taxes withheld to other cities fromcolumn 6 above and pg. 2, line 10B …….….….… 8 $

9. TOTAL PAYMENTS AND CREDITS: ADD LINES 5 THROUGH 8 ……….….…………….….....……………… 9 $

10. BALANCE DUE. If line 4 is greater than line 9, enter balance here, otherwiseleave blank or write "0" …………....…………..… 10 $

11. Late filing and late payment penalty (see instructions) …………………………………...………………..…...………………………………………11 $

BALANCE DUE, 12. Interest (see instructions) …………………………………………………………………….…..……………..……………….………..……………………………12 $

REFUND, 13. TOTAL DUE. Add lines 10 through 12. Carry to line 24 below (No tax due if $10.00 or less) …..………….............................. 13$

OR CREDIT 14. OVERPAYMENT. If line 4 is less than line 9, enter overpayment here …………..……………………… 14 $

15. AMOUNT FROM LINE 14 TO BE REFUNDED (no refund if $10 or less) ….....………………………… 15 $

16. AMOUNT FROM LINE 14 TO BECREDITED TO 20 2(no3 credit if $10 or less) ……………………… 16 $

DECLARATION OF ESTIMATED TAX - TAXPAYERS OWING MORE THAN $200.00 ARE REQUIRED TO SET UP AND PAY

17. Total estimated income subject to tax $________________________ Multiply by tax rate of 1.0% (0.01)………..…………… 17 $

18. Estimated taxes to be withheld for Canfield ……………………………..…..……….………………………….. 18 $

ESTIMATE 19. Estimated taxes to be withheld for other cities (limited to 0.5%(0.005) of wages)…… …...…... 19 $

FOR NEXT YEAR 20. Balance of city income tax declared. Subtract lines 18 & 19 from line 17……………………………….……...…………………………………20 $

21. 1st Quarter estimated taxes due. Multiply line 20 by52 % (0.25)..…......………………….…………………...….……………………………… 21$

22. Less credit for2023 overpayment. Enter line 16 ...……… …………………………………………………..………….…………………………………. 22 $

23. Net estimated tax due with return - subtract line 22 from line 21 (If less than zero, enter $0.00) …….………………………………23 $

24. Enter balance due from line 13 above (No tax due if $10.00 or less) …………………..………….…....………...………………………………24 $

TAX DUE 25. TOTAL TAX DUE. ADD LINES 23 & 24. PLEASE MAKE CHECKS PAYABLE TO "CITY OF CANFIELD" ……………..…………………… 25 $

If this return was prepared by a tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return.

The undersigned declares under penalty of perjury that this return (and accompanying schedules) is true, correct and complete for the taxable period stated and that the figures used herein are the same as

used for Federal Income Tax purposes.

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER DATE SIGNATURE OF TAXPAYER DATE

NAME AND ADDRESS OF PREPARER (PLEASE PRINT) TELEPHONE NUMBER SIGNATURE OF SPOUSE (IF JOINT RETURN) DATE

Page 1