Enlarge image

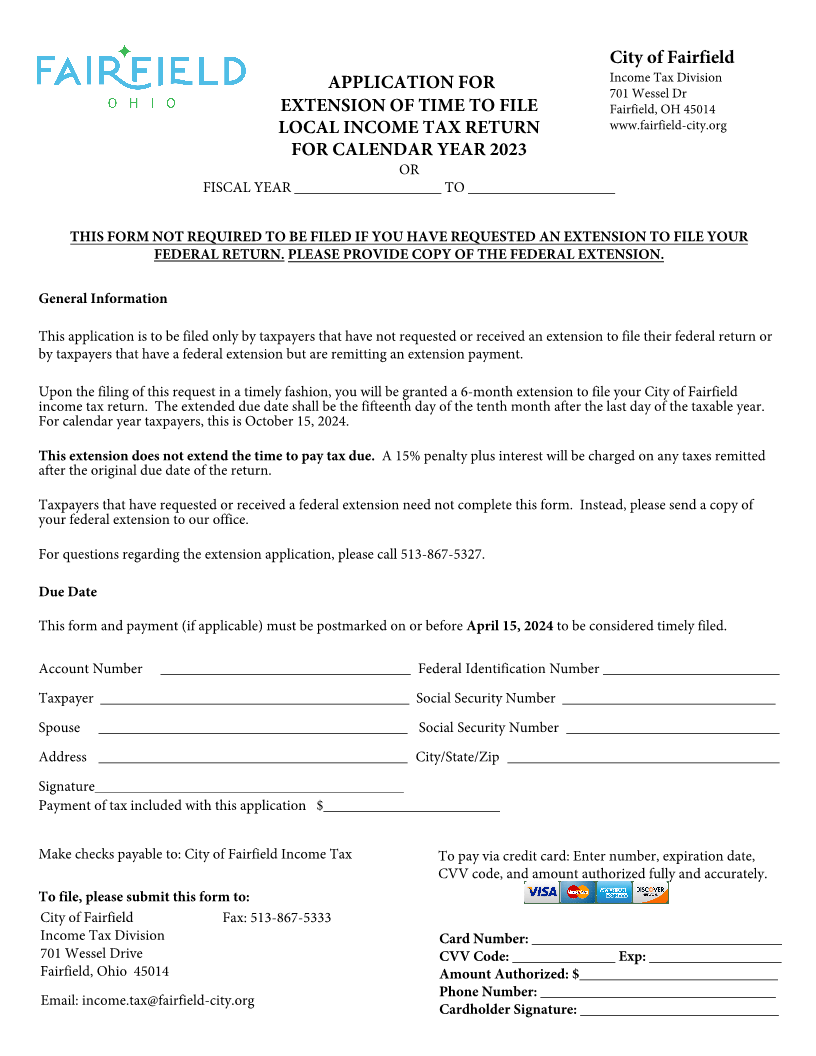

City of Fairfield

Income Tax Division

APPLICATION FOR

701 Wessel Dr

EXTENSION OF TIME TO FILE Fairfield, OH 45014

LOCAL INCOME TAX RETURN www.fairfield-city.org

FOR CALENDAR YEAR 2023

OR

FISCAL YEAR ____________________ TO ____________________

THIS FORM NOT REQUIRED TO BE FILED IF YOU HAVE REQUESTED AN EXTENSION TO FILE YOUR

FEDERAL RETURN. PLEASE PROVIDE COPY OF THE FEDERAL EXTENSION.

General Information

This application is to be filed only by taxpayers that have not requested or received an extension to file their federal return or

by taxpayers that have a federal extension but are remitting an extension payment.

Upon the filing of this request in a timely fashion, you will be granted a 6-month extension to file your City of Fairfield

income tax return. The extended due date shall be the fifteenth day of the tenth month after the last day of the taxable year.

For calendar year taxpayers, this is October 15, 2024.

This extension does not extend the time to pay tax due. A 15% penalty plus interest will be charged on any taxes remitted

after the original due date of the return.

Taxpayers that have requested or received a federal extension need not complete this form. Instead, please send a copy of

your federal extension to our office.

For questions regarding the extension application, please call 513-867-5327.

Due Date

This form and payment (if applicable) must be postmarked on or beforeApril 15, 2024 to be considered timely filed.

Account Number __________________________________ Federal Identification Number ________________________

Taxpayer __________________________________________ Social Security Number _____________________________

Spouse __________________________________________ Social Security Number _____________________________

Address __________________________________________ City/State/Zip _____________________________________

Signature__________________________________________

Payment of tax included with this application $________________________

Make checks payable to: City of Fairfield Income Tax To pay via credit card: Enter number, expiration date,

CVV code, and amount authorized fully and accurately.

To file, please submit this form to:

City of Fairfield Fax: 513-867-5333

Income Tax Division Card Number: __________________________________

701 Wessel Drive CVV Code: ______________ Exp: __________________

Fairfield, Ohio 45014 Amount Authorized: $___________________________

Phone Number: ________________________________

Email: income.tax@fairfield-city.org

Cardholder Signature: ___________________________