Enlarge image

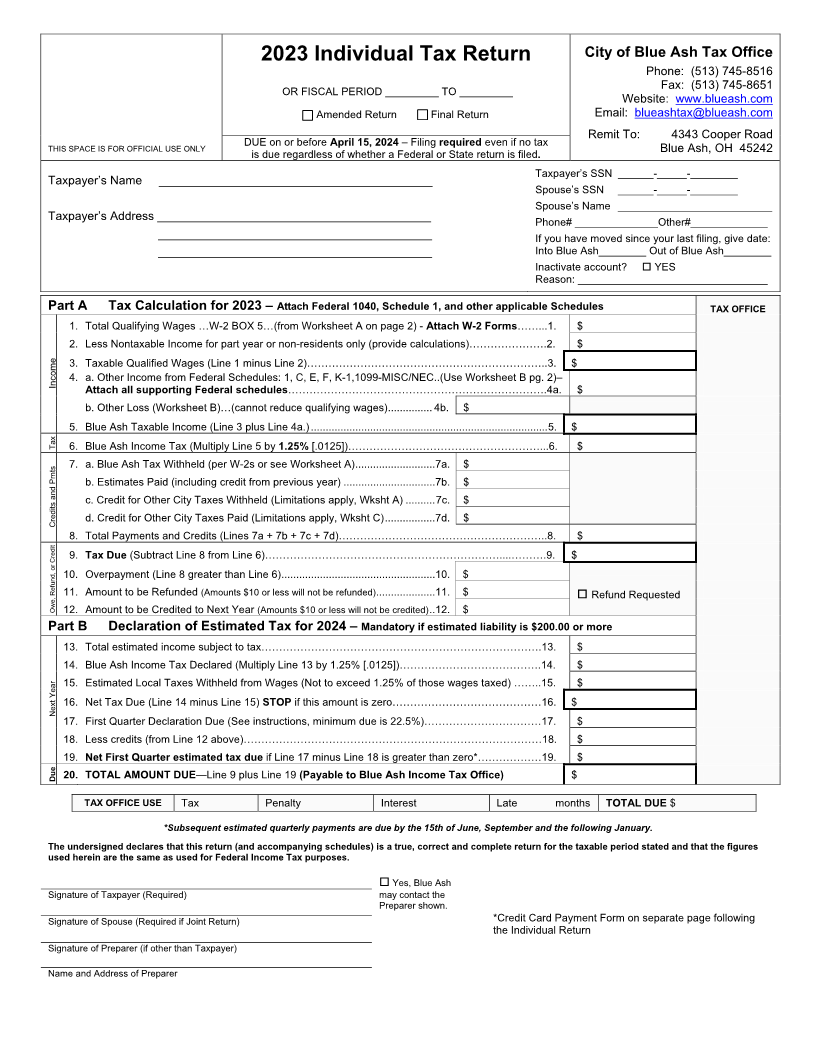

2023 Individual Tax Return City of Blue Ash Tax Office

Phone: (513) 745-8516

OR FISCAL PERIOD _________ TO _________ Fax: (513) 745-8651

Website: www.blueash.com

Amended Return Final Return Email: blueashtax@blueash.com

Remit To: 4343 Cooper Road

DUE on or before April 1 , 202

THIS SPACE IS FOR OFFICIAL USE ONLY 5 4 – Filing required even if no tax Blue Ash, OH 45242

is due regardless of whether a Federal or State return is filed.

Taxpayer’s SSN ______-_____-________

Taxpayer’s Name _________________________________________

Spouse’s SSN ______-_____-________

Spouse’s Name __________________________

Taxpayer’s Address _________________________________________ Phone# ______________Other#_____________

_________________________________________ If you have moved since your last filing, give date:

_________________________________________ Into Blue Ash________ Out of Blue Ash________

Inactivate account? YES

Reason: ________________________________

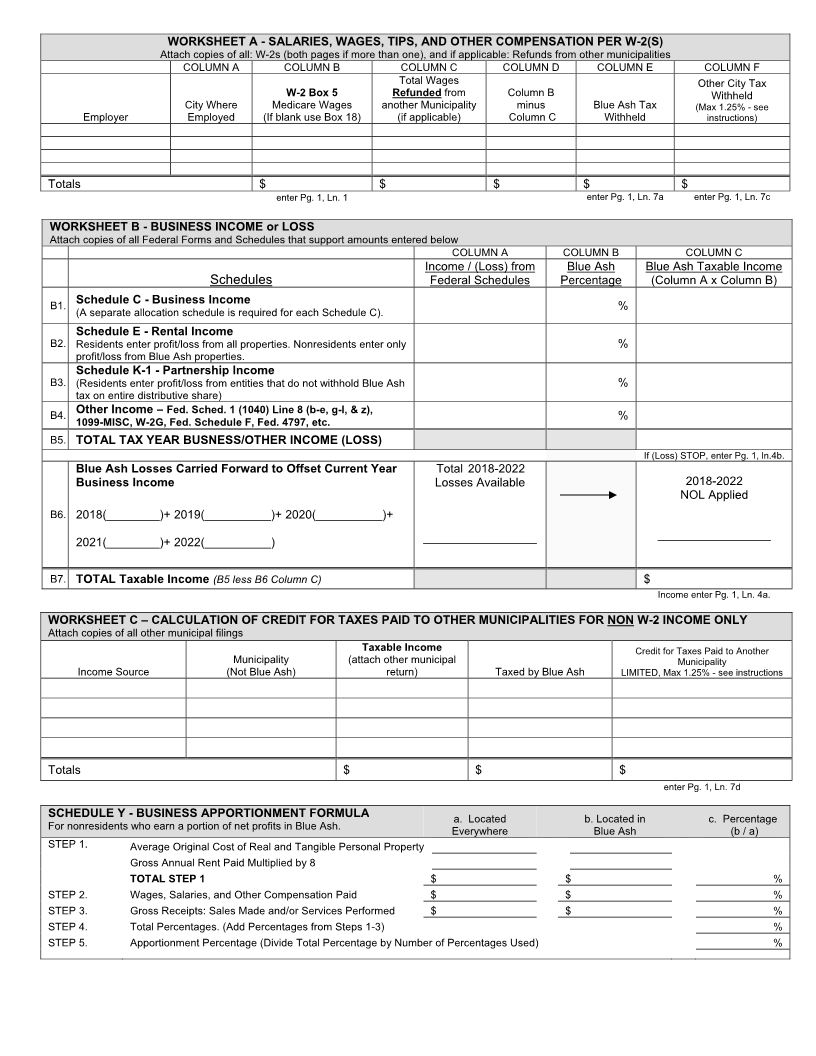

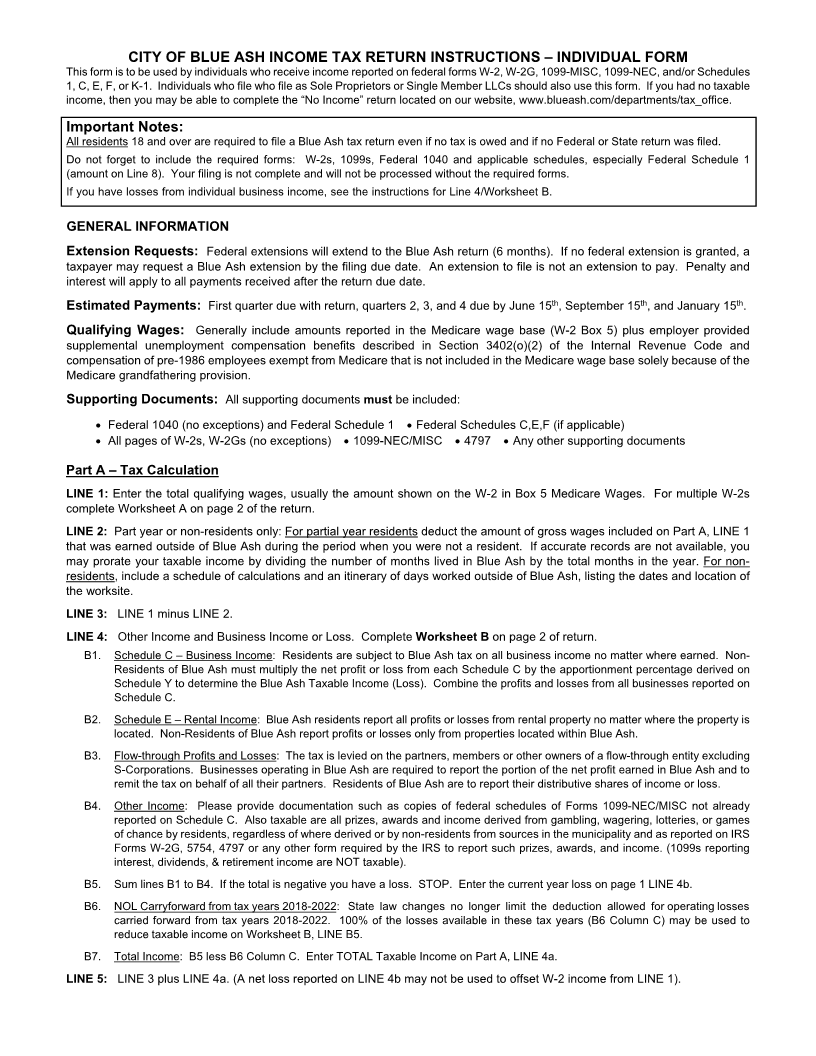

Part A Tax Calculation for 202 3– Attach Federal 1040, Schedule 1, and other applicable Schedules TAX OFFICE

1. Total Qualifying Wages …W-2 BOX 5…(from Worksheet A on page 2) - Attach W-2 Forms……...1. $

2. Less Nontaxable Income for part year or non-residents only (provide calculations)………………….2. $

3. Taxable Qualified Wages (Line 1 minus Line 2)…………………………………………………………..3. $

Income 4. a. Other Income from Federal Schedules: 1, C, E, F, K-1,1099-MISC/NEC..(Use Worksheet B pg. 2)–

Attach all supporting Federal schedules……………………………………………………………….4a. $

b. Other Loss (Worksheet B)…(cannot reduce qualifying wages) ............... 4b. $

5. Blue Ash Taxable Income (Line 3 plus Line 4a.) ................................................................................ 5. $

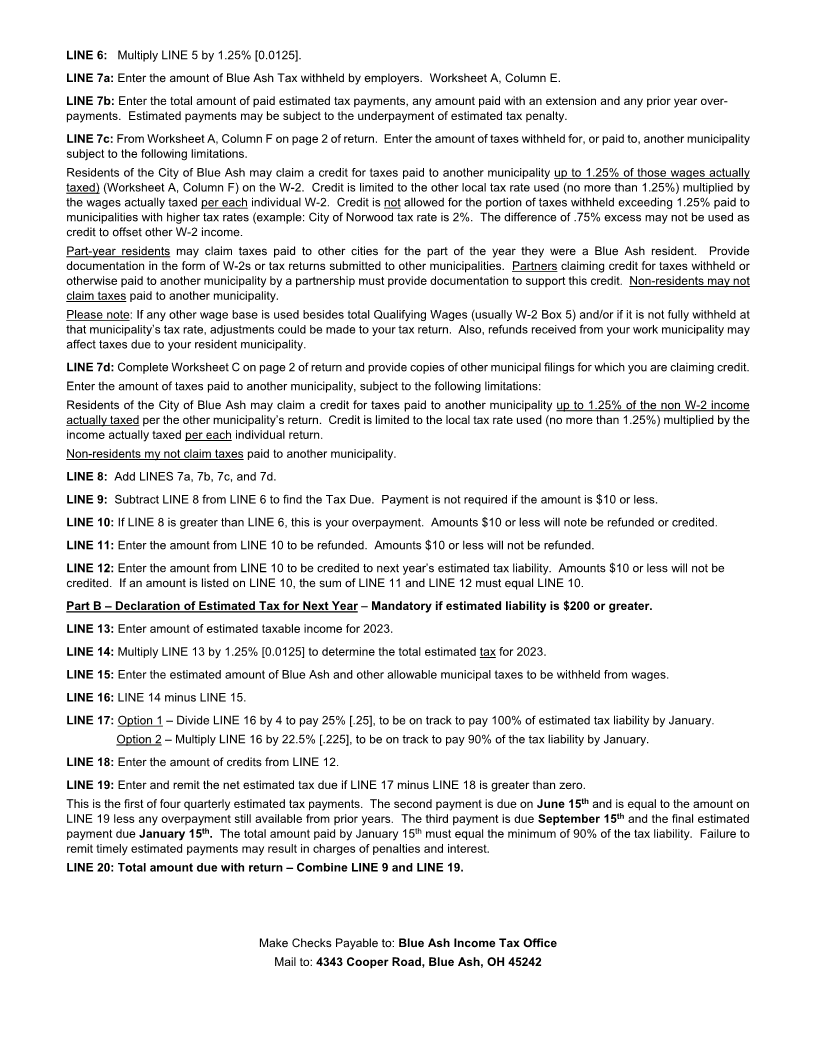

Tax 6. Blue Ash Income Tax (Multiply Line 5 by 1.25% [.0125])………………………………………………...6. $

7. a. Blue Ash Tax Withheld (per W-2s or see Worksheet A) ........................... 7a. $

b. Estimates Paid (including credit from previous year) ............................... 7b. $

c. Credit for Other City Taxes Withheld (Limitations apply, Wksht A) .......... 7c. $

Credits and Pmts d. Credit for Other City Taxes Paid (Limitations apply, Wksht C) ................. 7d. $

8. Total Payments and Credits (Lines 7a + 7b + 7c + 7d)…………………………………………………..8. $

9. Tax Due (Subtract Line 8 from Line 6)…………………………………………………………....……….9. $

10. Overpayment (Line 8 greater than Line 6) .................................................... 10. $

11. Amount to be Refunded (Amounts $10 or less will not be refunded) .................... 11. $ Refund Requested

Owe, Refund, or Credit 12. Amount to be Credited to Next Year (Amounts $10 or less will not be credited) .. 12. $

Part B Declaration of Estimated Tax for 202 4– Mandatory if estimated liability is $200.00 or more

13. Total estimated income subject to tax…………………………………………………………………….13. $

14. Blue Ash Income Tax Declared (Multiply Line 13 by 1.25% [.0125])………………………………….14. $

15. Estimated Local Taxes Withheld from Wages (Not to exceed 1.25% of those wages taxed) ……..15. $

16. Net Tax Due (Line 14 minus Line 15) STOP if this amount is zero……………………………………16. $

Next Year

17. First Quarter Declaration Due (See instructions, minimum due is 22.5%)……………………………17. $

18. Less credits (from Line 12 above)…………………………………………………………………………18. $

19. Net First Quarter estimated tax due if Line 17 minus Line 18 is greater than zero*………………19. $

Due 20. TOTAL AMOUNT DUE—Line 9 plus Line 19 (Payable to Blue Ash Income Tax Office) $

TAX OFFICE USE Tax Penalty Interest Late months TOTAL DUE $

*Subsequent estimated quarterly payments are due by the 15th of June, September and the following January.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures

used herein are the same as used for Federal Income Tax purposes.

Yes, Blue Ash

Signature of Taxpayer (Required) may contact the

Preparer shown.

Signature of Spouse (Required if Joint Return) *Credit Card Payment Form on separate page following

the Individual Return

Signature of Preparer (if other than Taxpayer)

Name and Address of Preparer