Enlarge image

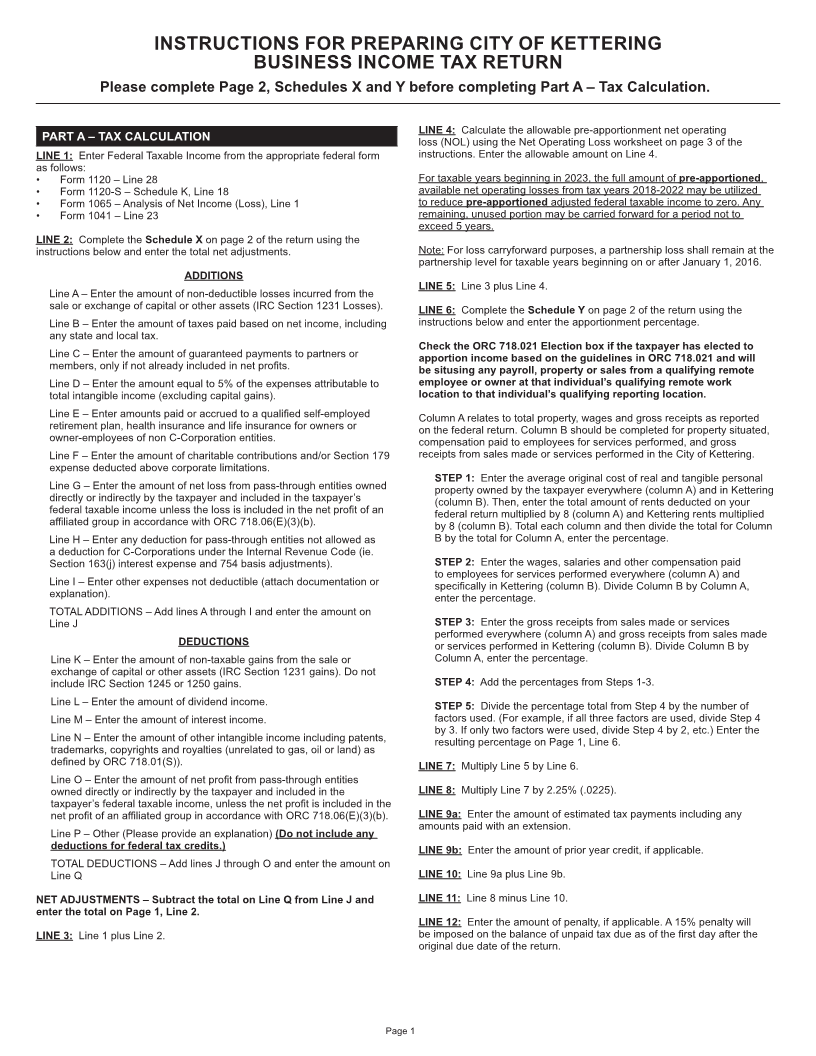

INSTRUCTIONS FOR PREPARING CITY OF KETTERING

BUSINESS INCOME TAX RETURN

Please complete Page 2, Schedules X and Y before completing Part A – Tax Calculation.

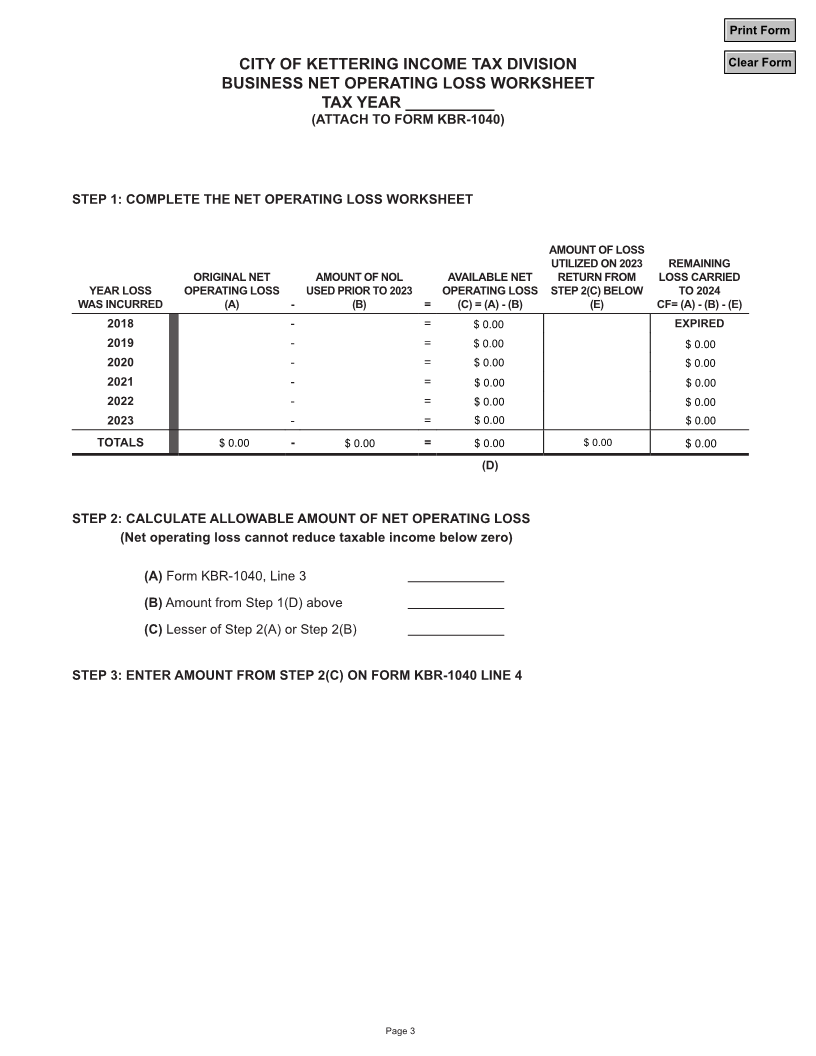

LINE 4: Calculate the allowable pre-apportionment net operating

PART A – TAX CALCULATION loss (NOL) using the Net Operating Loss worksheet on page 3 of the

LINE 1: Enter Federal Taxable Income from the appropriate federal form instructions. Enter the allowable amount on Line 4.

as follows:

• Form 1120 – Line 28 For taxable years beginning in 2023, the full amount of pre-apportioned,

• Form 1120-S – Schedule K, Line 18 available net operating losses from tax years 2018-2022 may be utilized

• Form 1065 – Analysis of Net Income (Loss), Line 1 to reduce pre-apportioned adjusted federal taxable income to zero. Any

• Form 1041 – Line 23 remaining, unused portion may be carried forward for a period not to

exceed 5 years.

LINE 2: Complete the Schedule X on page 2 of the return using the

instructions below and enter the total net adjustments. Note: For loss carryforward purposes, a partnership loss shall remain at the

partnership level for taxable years beginning on or after January 1, 2016.

ADDITIONS

LINE 5: Line 3 plus Line 4.

Line A – Enter the amount of non-deductible losses incurred from the

sale or exchange of capital or other assets (IRC Section 1231 Losses). LINE 6: Complete the Schedule Y on page 2 of the return using the

Line B – Enter the amount of taxes paid based on net income, including instructions below and enter the apportionment percentage.

any state and local tax.

Check the ORC 718.021 Election box if the taxpayer has elected to

Line C – Enter the amount of guaranteed payments to partners or apportion income based on the guidelines in ORC 718.021 and will

members, only if not already included in net profits. be situsing any payroll, property or sales from a qualifying remote

Line D – Enter the amount equal to 5% of the expenses attributable to employee or owner at that individual’s qualifying remote work

total intangible income (excluding capital gains). location to that individual’s qualifying reporting location.

Line E – Enter amounts paid or accrued to a qualified self-employed Column A relates to total property, wages and gross receipts as reported

retirement plan, health insurance and life insurance for owners or on the federal return. Column B should be completed for property situated,

owner-employees of non C-Corporation entities. compensation paid to employees for services performed, and gross

Line F – Enter the amount of charitable contributions and/or Section 179 receipts from sales made or services performed in the City of Kettering.

expense deducted above corporate limitations.

STEP 1: Enter the average original cost of real and tangible personal

Line G – Enter the amount of net loss from pass-through entities owned property owned by the taxpayer everywhere (column A) and in Kettering

directly or indirectly by the taxpayer and included in the taxpayer’s (column B). Then, enter the total amount of rents deducted on your

federal taxable income unless the loss is included in the net profit of an federal return multiplied by 8 (column A) and Kettering rents multiplied

affiliated group in accordance with ORC 718.06(E)(3)(b). by 8 (column B). Total each column and then divide the total for Column

Line H – Enter any deduction for pass-through entities not allowed as B by the total for Column A, enter the percentage.

a deduction for C-Corporations under the Internal Revenue Code (ie.

Section 163(j) interest expense and 754 basis adjustments). STEP 2: Enter the wages, salaries and other compensation paid

to employees for services performed everywhere (column A) and

Line I – Enter other expenses not deductible (attach documentation or specifically in Kettering (column B). Divide Column B by Column A,

explanation). enter the percentage.

TOTAL ADDITIONS – Add lines A through I and enter the amount on

Line J STEP 3: Enter the gross receipts from sales made or services

performed everywhere (column A) and gross receipts from sales made

DEDUCTIONS or services performed in Kettering (column B). Divide Column B by

Line K – Enter the amount of non-taxable gains from the sale or Column A, enter the percentage.

exchange of capital or other assets (IRC Section 1231 gains). Do not

include IRC Section 1245 or 1250 gains. STEP 4: Add the percentages from Steps 1-3.

Line L – Enter the amount of dividend income. STEP 5: Divide the percentage total from Step 4 by the number of

Line M – Enter the amount of interest income. factors used. (For example, if all three factors are used, divide Step 4

by 3. If only two factors were used, divide Step 4 by 2, etc.) Enter the

Line N – Enter the amount of other intangible income including patents, resulting percentage on Page 1, Line 6.

trademarks, copyrights and royalties (unrelated to gas, oil or land) as

defined by ORC 718.01(S)). LINE 7: Multiply Line 5 by Line 6.

Line O – Enter the amount of net profit from pass-through entities

owned directly or indirectly by the taxpayer and included in the LINE 8: Multiply Line 7 by 2.25% (.0225).

taxpayer’s federal taxable income, unless the net profit is included in the

net profit of an affiliated group in accordance with ORC 718.06(E)(3)(b). LINE 9a: Enter the amount of estimated tax payments including any

amounts paid with an extension.

Line P – Other (Please provide an explanation) (Do not include any

deductions for federal tax credits.) LINE 9b: Enter the amount of prior year credit, if applicable.

TOTAL DEDUCTIONS – Add lines J through O and enter the amount on

Line Q LINE 10: Line 9a plus Line 9b.

NET ADJUSTMENTS – Subtract the total on Line Q from Line J and LINE 11: Line 8 minus Line 10.

enter the total on Page 1, Line 2.

LINE 12: Enter the amount of penalty, if applicable. A 15% penalty will

LINE 3: Line 1 plus Line 2. be imposed on the balance of unpaid tax due as of the first day after the

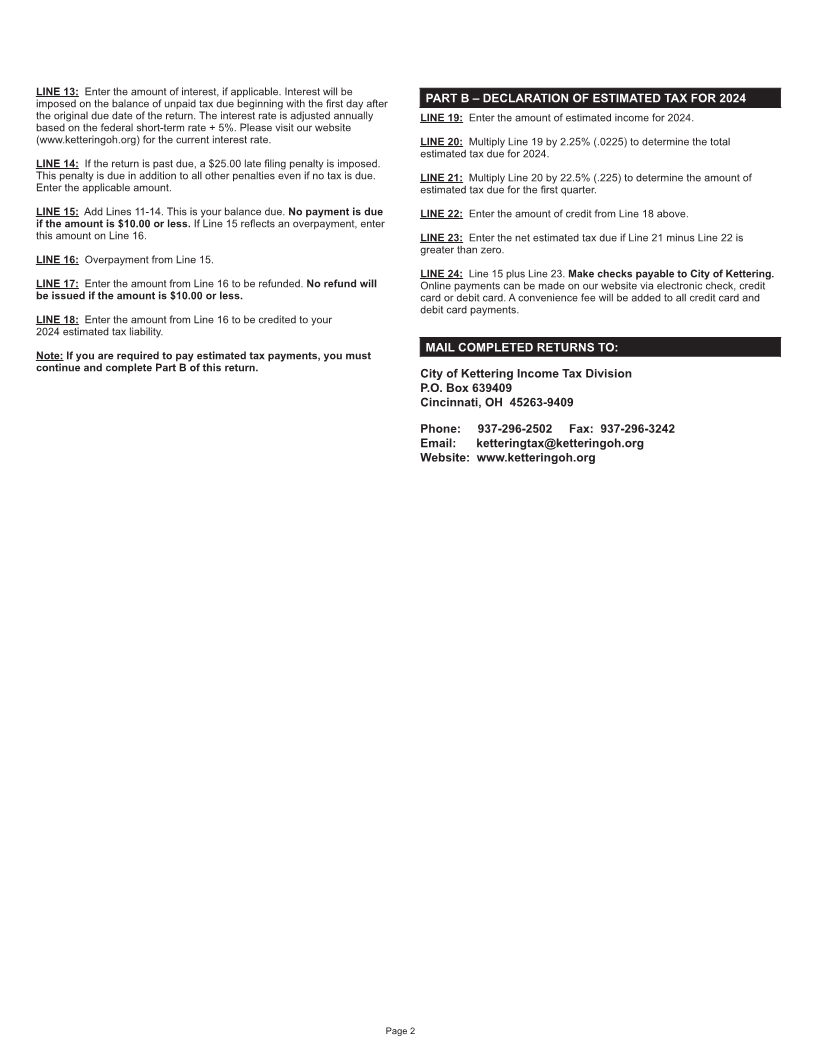

original due date of the return.

Page 1