Enlarge image

OIC-101

(03/2022)

Offer In Compromise

Instruction Booklet

State of North Carolina

Department of Revenue

Help Preparing an Offer In What is an Offer in Compromise?

Compromise The North Carolina Offer In Compromise purpose of delaying collection or otherwise

This Booklet provides program allows qualifying, financially dis- jeopardizing the Department’s ability to

instructions for taxpay- tressed taxpayers the opportunity to put collect the tax debt.

overwhelming tax liabilities behind them by

ers preparing an Offer In Forced collection actions, such as garnish-

paying a lump sum amount in exchange for

Compromise. ments, in effect at the time you submit your

the liability being settled in full. The law pro-

Additional instructions offer, will not automatically be suspended

vides specific requirements for accepting an

during the review period. Interest and penal-

and web-fill versions of offer. The goal of the Offer In Compromise

ty will continue to accrue on any unpaid tax

forms are available on program is to resolve a liability in a manner

debt while the offer is being considered.

the Department’s web- that is in the best interest of both the State

site at www.ncdor.gov. and the taxpayer. This booklet provides the basic instructions,

forms and other materials you will need to

You are required to provide reasonable doc-

Contact a Customer submit a request for an Offer In Compromise.

Service agent at 1-877- umentation, as outlined below, with your

request for an Offer In Compromise. If you have questions, or need additional

252-3052 for assis-

assistance, please contact the Department

tance with specific ques- An offer will not be considered if it is

at 1-877-252-3052 or visit our website at:

determined that the offer was filed for the

tions. www.ncdor.gov .

Contents

Statutory Basis for an Offer in Compromise and Basic Qualifications 2

What Do I Send with My Offer? 3

Determining the Amount of Your Offer & Required Down Payment

4

How Does the Department Calculate the RCP?

Does Offering the RCP Guarantee Acceptance of My Offer?

5

Will Offers for My Interest Only in a Joint Income Tax Liability Be Considered?

What Happens After My Offer Is Submitted?

Will Collection Actions Stop?

6

If Your Offer Is Accepted

If Your Offer Is Denied

OIC Checklist 7

Form OIC-100 Offer In Compromise 8 9 -

Form OIC 101-A for Individuals: Calculating the RCP and Down Payment - Individuals 10

Form OIC 101-B for Businesses: Calculating the RCP and Down Payment - Business Entities 11

Form OIC 101-C for Self-Employed Individuals: Calculating the RCP and Down Payment - Self-Employed Individuals & Proprietorships 12

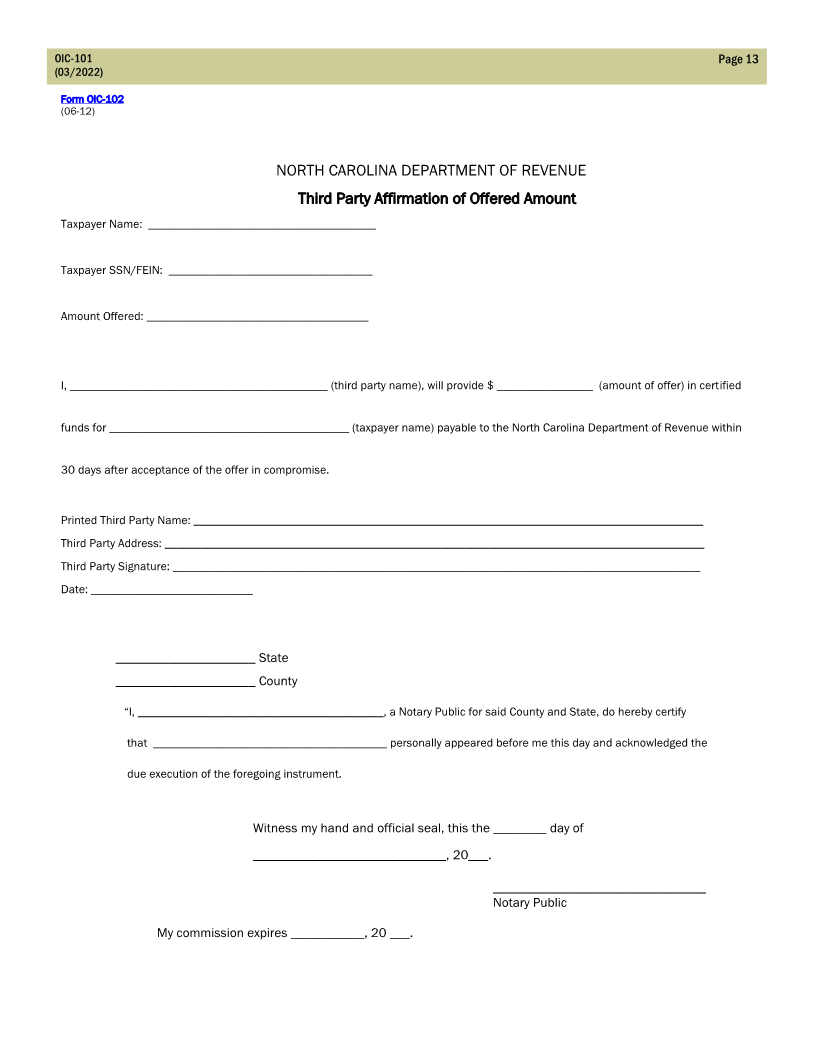

Form OIC-102 Third Party Affirmation 13