Enlarge image

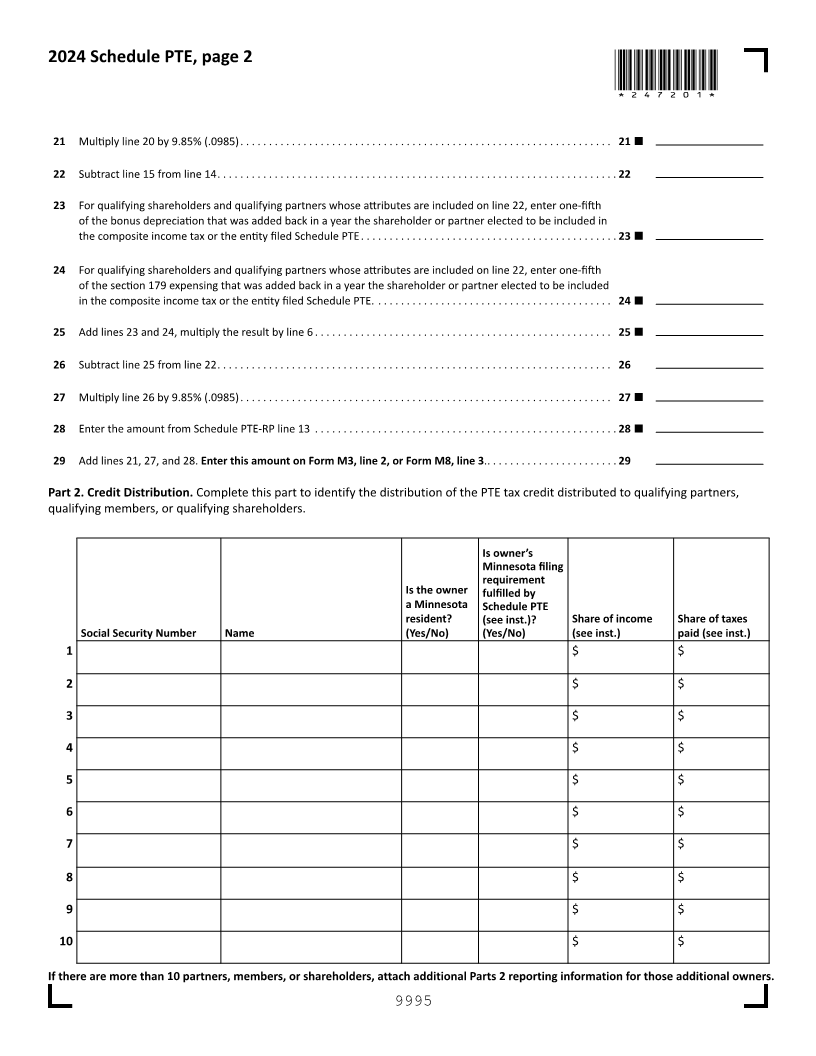

NEAR FINAL DRAFT 8/1/24

*247101*

2024 Schedule PTE, Pass-through Entity Tax

Partnerships, Limited Liability Companies (LLCs), and S-Corporations: Complete Schedule PTE and file with Form M3 or M8 if you

are electing to file and pay tax at the entity level.

Name of LLC, Partnership, or S corporation FEIN Minnesota Tax ID Number

Entity is a Partnership LLC S corporation

Part 1. Tax Calculation. Complete this part to determine the pass-through entity tax due from the entity for qualifying owners. Complete lines 1

through 27 with amounts attributable to shareholders and nonresident partners.

1 80% of federal bonus depreciation (see instructions)... ...... ..... ....... ..... ...... ..... ..... ...... .. 1

2 Additions for foreign-derived intangible income (FDII) deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 This line intentionally left blank . ..... ...... ...... ..... ..... ...... ...... ..... ...... ...... ..... ..... 3

4 State income taxes deducted by the entity to determine net income (see instructions) .... ...... ....... .... 4

5 Add lines 1 through 4... ...... ..... ...... ...... ..... ...... ..... ...... ...... ..... ...... ...... ..... 5

6 Minnesota apportionment factor (from line 5, column C, of Form M3A or Form M8A) .. ..... ....... ..... ... 6

7 Multiply line 5 by line 6 ... ...... ...... ...... ..... ...... ..... ...... ..... ...... ...... ...... ..... ... 7

8 Minnesota portion of amounts from Schedules K-1 (see instructions) ..... ...... ...... ...... ..... ...... .. 8

9 Add lines 7 and 8 . ...... ...... ...... .... ...... ...... ...... ..... ...... ..... ...... ...... ...... ... 9

10 Subtractions: Deferred foreign income (sec. 965) and delayed business interest . ...... ..... ...... ..... ... 10

11 State income tax refund included in income (see instructions) ...... ...... ..... ...... ..... ...... ...... . 11

12 Add lines 10 and 11 ... ...... ..... ...... ..... ...... ...... ...... ..... ...... ..... ...... ...... ..... 12

13 Multiply line 12 by line 6 ..... ..... ...... ...... ..... ....... ..... ..... ...... ..... ...... ...... .... 13

14 Subtract line 13 from line 9... ...... ..... ....... ..... ..... ...... ..... ...... ...... ...... ..... ..... 14

15 Amount on line 14 attributable to resident qualifying shareholders, nonresident qualifying shareholders,

and nonresident qualifying partners whose Minnesota income tax liability is not satisfied by this entity

level tax. ... ...... ..... ....... ..... ...... ..... ...... ..... ...... ...... ...... ..... ...... ..... .... 15

16 For qualifying shareholders and qualifying partners whose attributes are included on line 15, enter one-fifth

of the bonus depreciation that was added back in a year the shareholder or partner elected to be included

in the composite income tax or the entity filed Schedule PTE. ... ...... ..... ...... ...... ..... ...... ..... 16

17 For qualifying shareholders and qualifying partners whose attributes are included on line 15, enter one-fifth

of the section 179 expensing that was added back in a year the shareholder or partner elected to be included

in the composite income tax or the entity filed Schedule PTE... ...... ..... ....... ..... ...... ..... ..... 17

18 Add lines 16 and 17 ... ...... ..... ...... ..... ...... ...... ...... ..... ...... ..... ...... ...... ..... . 18

19 Multiply line 18 by line 6 ... ...... ..... ....... ..... ...... ..... ..... ...... ...... ...... ..... ...... . 19

20 Subtract line 19 from line 15... ...... ..... ....... ..... ...... ..... ...... ..... ...... ...... ...... ... 20

9995