Enlarge image

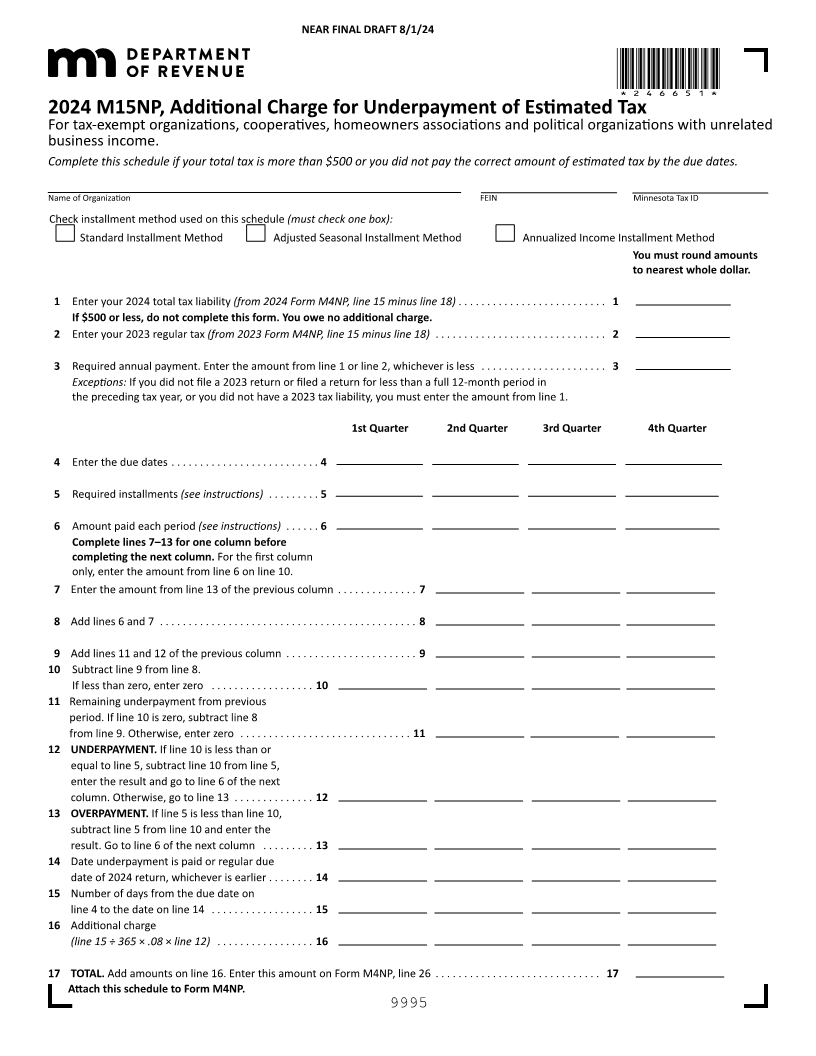

NEAR FINAL DRAFT 8/1/24

*246651*

2024 M15NP, Additional Charge for Underpayment of Estimated Tax

For tax-exempt organizations, cooperatives, homeowners associations and political organizations with unrelated

business income.

Complete this schedule if your total tax is more than $500 or you did not pay the correct amount of estimated tax by the due dates.

Name of Organization FEIN Minnesota Tax ID

Check installment method used on this schedule (must check one box):

Standard Installment Method Adjusted Seasonal Installment Method Annualized Income Installment Method

You must round amounts

to nearest whole dollar.

1 Enter your 2024 total tax liability (from 2024 Form M4NP, line 15 minus line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . 1

If $500 or less, do not complete this form. You owe no additional charge.

2 Enter your 2023 regular tax (from 2023 Form M4NP, line 15 minus line 18) .. ..... ...... ...... ..... ...... 2

3 Required annual payment. Enter the amount from line 1 or line 2, whichever is less . ..... ...... ..... ..... 3

Exceptions: If you did not file a 2023 return or filed a return for less than a full 12-month period in

the preceding tax year, or you did not have a 2023 tax liability, you must enter the amount from line 1.

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

4 Enter the due dates ... ...... ..... ....... ..... 4

5 Required installments (see instructions) ..... .... 5

6 Amount paid each period (see instructions) . . . . . . 6

Complete lines 7–13 for one column before

completing the next column. For the first column

only, enter the amount from line 6 on line 10.

7 Enter the amount from line 13 of the previous column ... ...... ..... 7

8 Add lines 6 and 7 .. ...... ...... ..... ...... ...... ..... ...... ... 8

9 Add lines 11 and 12 of the previous column ... ...... ..... ...... ... 9

10 Subtract line 9 from line 8.

If less than zero, enter zero .. ...... ...... .... 10

11 Remaining underpayment from previous

period. If line 10 is zero, subtract line 8

from line 9. Otherwise, enter zero ... ..... ...... ..... ...... ..... 11

12 UNDERPAYMENT. If line 10 is less than or

equal to line 5, subtract line 10 from line 5,

enter the result and go to line 6 of the next

column. Otherwise, go to line 13 . . . . . . . . . . . . . . 12

13 OVERPAYMENT. If line 5 is less than line 10,

subtract line 5 from line 10 and enter the

result. Go to line 6 of the next column . ..... ... 13

14 Date underpayment is paid or regular due

date of 2024 return, whichever is earlier .... .... 14

15 Number of days from the due date on

line 4 to the date on line 14 ..... ..... ...... .. 15

16 Additional charge

(line 15 ÷ 365 × .08 × line 12) .. ..... ...... .... 16

17 TOTAL. Add amounts on line 16. Enter this amount on Form M4NP, line 26 ... ...... ..... ....... ..... ... 17

Attach this schedule to Form M4NP.

9995